The New Buzz Word – Populist

Last week was a bad week for the Stock Market – it has the Heebie-Jeebies, i.e, the Jitters are very apparent and of 2008 proportions with a 500 point drop in the DOW. This week can add fuel to the demise of the 10 month rally we have enjoyed since March 2009 or give us a renewed boost to the rally. It stands to reason that Politics more so than Earnings will be front and center as we look forward to the vote on the Fed Chairman, Ben Bernanke, and the State of the Union Address by President Obama on Wednesday. The REACTION by Wall Street to both may seal the fate of the rally and bring about the Intermediate Correction that so many have touted for so long, or find a fresh move to the upside to continue the rally and keep the Golden Cross alive.

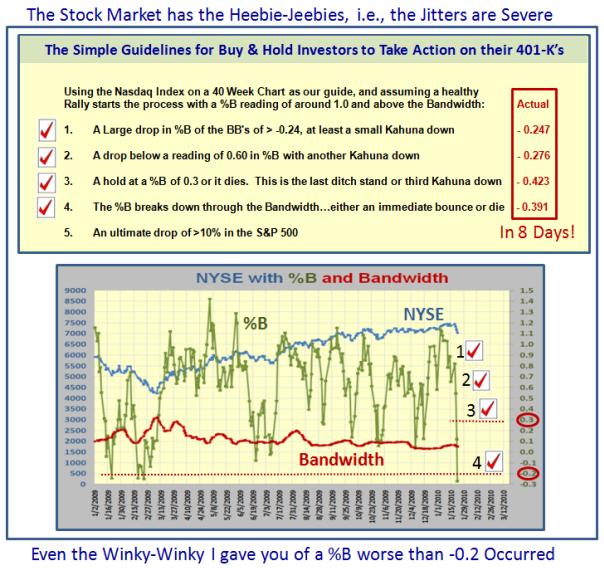

The Internet seemed to enjoy the Custer’s Last Stand blog note last week as I laid out the simple process steps that would cause Long Term Buy and Hold Investors pause for concern. Sad to say the resulting action happened inside three days flat with successive %B 1-Day Down Kahunas driving it down through the Bandwidth to finish with a negative reading of – 0.27, a number not seen since the Gloom and Doom days of 2008 and early 2009. Here is the updated chart:

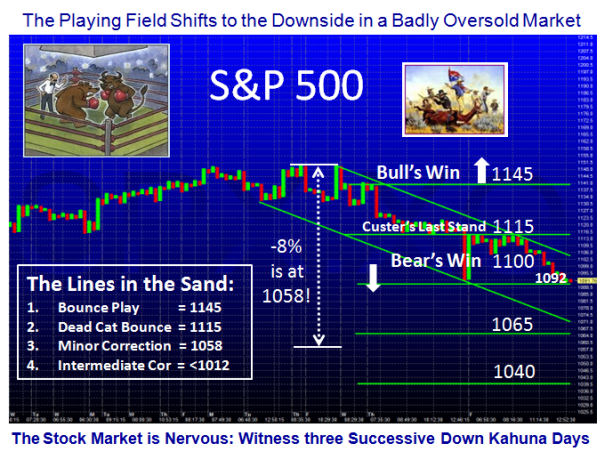

As a result, the Playing Field for the Ball Game next week has shifted heavily in the Bear’s favor. The chart below shows the various Lines in the Sand for either a reasonable Bounce Play back above Custer’s Last Stand and beyond, a Dead Cat Bounce to the obvious resistance at 1115; this would then lead to a Bear Feast of a Minor Correction of -8%, or something deeper that would end in an Intermediate Correction of -10% or worse.

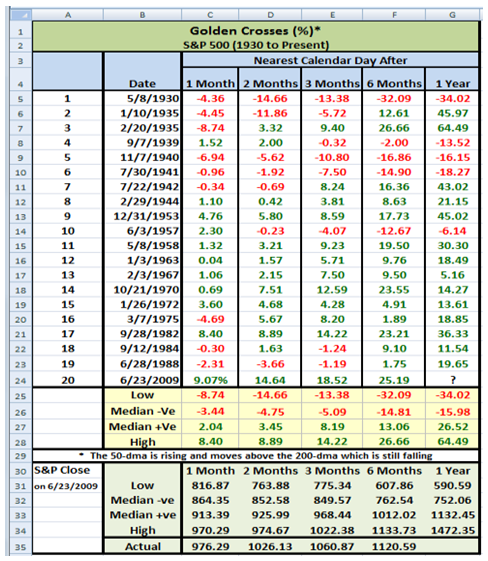

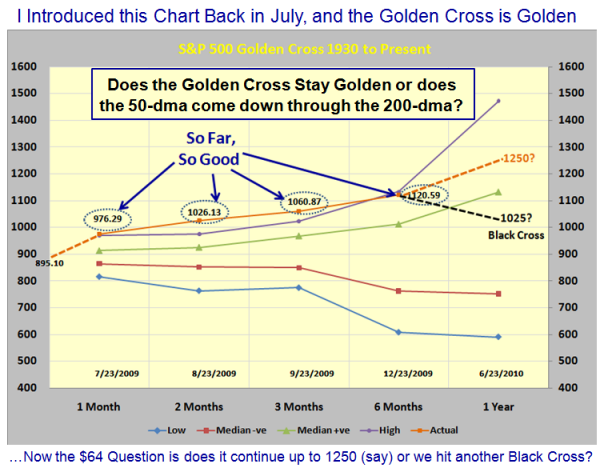

It hardly seems that six months have gone by since I first discussed the Golden Cross in the July 19th 2009 Blog Note, but I felt it worth showing you the progress that the Stock Market Rally has made since then to cheer you up! You will note that the results have been every bit to the High Side relative to past history, and projecting its progress for the next six months to mid-2010 would put the S&P 500 at around 1250. The alternative is a downside swing which could lead to a Black Cross where the 50-dma crosses down once again through the 200-dma at an estimate of about 1025. Here are the results:

Next week should be an interesting week one way or another.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog