The Party’s Over, It’s Time to call it a Day

Over the weekend I mentioned that “the Chinese Silverbacks I gave you the other day have collectively given up 9.15% in a week”. Well I have news for you that the same group is down 19% and if you were keeping tabs on these, then you might have been a star performer if you picked up on my other statement which said “Late breaking news says there is now an Ultra Short Chinese ETF called FXP, which came out today.” Here is its one-day performance:

I concluded by saying “Net-net, I can’t make a silk purse out of a sow’s ear. The prudent approach is to wait and see till the dust settles and sit on the sidelines, UNLESS you enjoy volatility and know how to use your trump card which is “Nimble”. If you do, then sharpen your pencils for both sides of the coin, shorts and longs and you will do extremely well if you make the right calls quickly. You judge for yourself where the odds are right now with the picture below. There is more to go on the downside before it gets to the OK Corral again. Just watch the Red Line in the Sand.” Well they cut through the red line like a hot knife going through butter and the Bulls are sitting at the 25 yard line as all spectators rush for the exits singing the same swan song “The Party’s Over”. I also gave you the Measuring Rods.

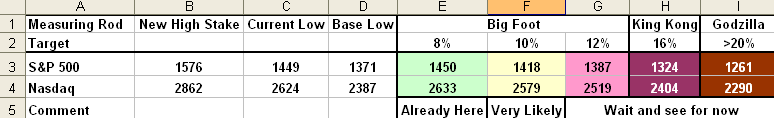

The Measuring Rods:

As you can see from the above picture, we are practically at the 10% level on both Indexes, with the S&P 500 finishing at 1439.18 and the Nasdaq at 2584.13. Those who made big money today were in the ETF’s Ultra Shorts and especially FXP, followed by QID, SDS and TWM, but the first two have been the big winners. I’m sure there are plenty of others, but you get the gist of the message. Complacency is over, buying the dips on the favorite Silverbacks are over and now we have to wait and see if we can spot the rotation, or whether eventually they will come charging back into these beaten down warriors. We can expect the gurus will tout the big horsemen like “GOOG, RIMM, AAPL and GRMN” and of course one should look for a safe entry point on these and other favorites. At some point these would be a worthwhile gift for long term buy and hold types, but wait till the dust settles…they have lost 15 to 30% from the top.

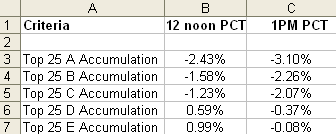

For now the Technology Leadership is lost and you can rest assured that the bottom fishing value types will be patiently rubbing their hands and are already making some hay. Why do I say that? Well after the dismal performance of those 15 stocks I gave you last night to watch first thing this morning, we quickly got our answer and it certainly was not to buy any of those stocks. To get an insight on the fly of where the action was today, I took a list of some 635 stocks which have already had their Earnings Reports out since August, 2007. I then split them into five groups with accumulation “A” through “E” and ranked them using the Gorilla Fundamental Combo which you should all have if you have downloaded Ron’s latest files, and took the top 25 stocks from each Group. Here is the snapshot of their performance at two points in time, around 12 noon Pacific Coast Time and at the close an hour later:

It looks like nobody won at the end of the day, but the bottom fishers were out looking for value. I happened to see the beaten down Fallen Angel VDSI made 14.56% today, and some of the Home Builders were up. Different strokes for different folks. Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog