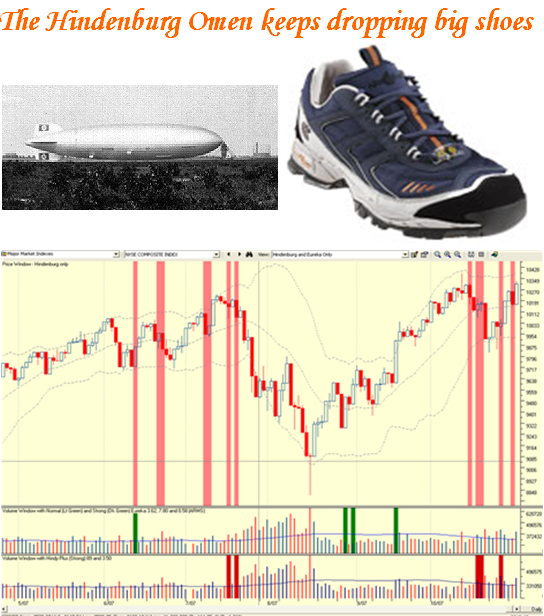

The Hindenburg Omen Keeps Dropping Big Shoes!

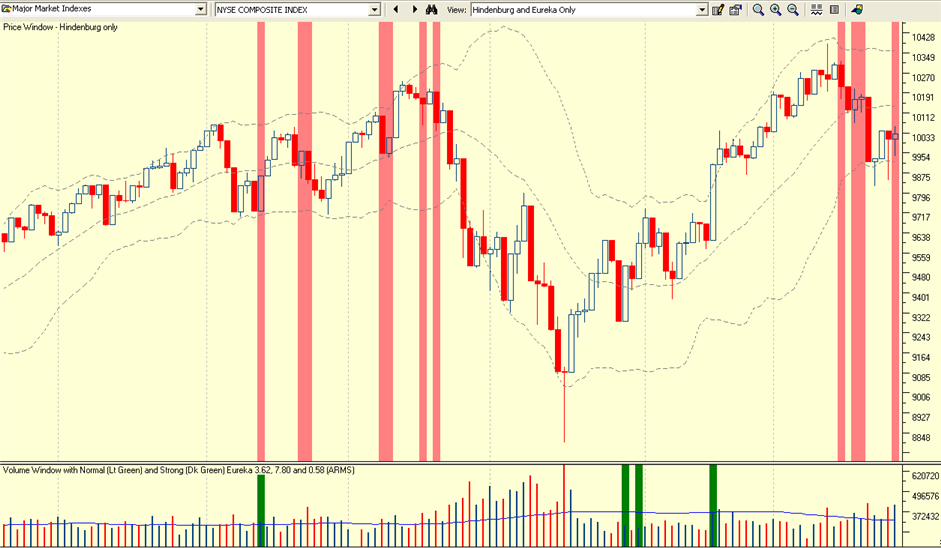

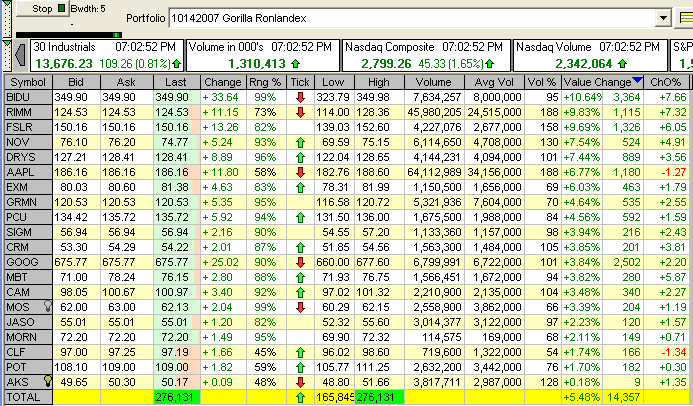

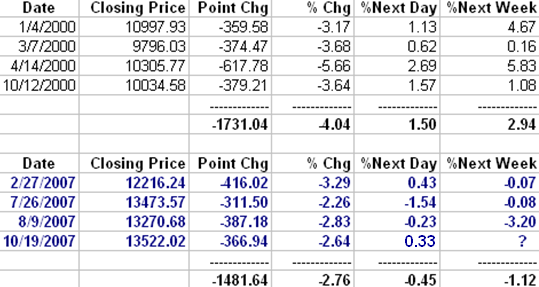

Thursday, November 1st, 2007Here is a bonus blog for you tonight…there is another one right behind this one! We have had five Hindenburg Omen signals trigger in the last two weeks so be warned that we can expect at least a 5% correction in the S&P 500. Three of these signals were “Strong” as shown by the dark red lines in the lower window of the HGSI stock chart. Now the only question is how far can the drop go? We may be lucky to get a Santa Claus Rally in which case the downdraft of yet another 362 point down day is just a blip due to Citigroup downgrading and credit fears. On the other hand, there is more than usual hits being made on the Leaders, though the really solid Gorillas as I gave you in the RonIandex Gorilla Index a few weeks ago still seems intact.

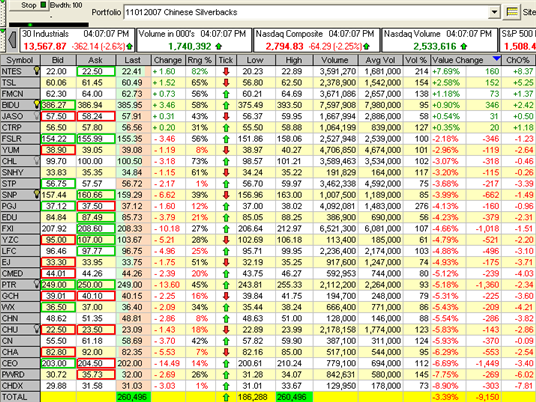

Since we are having a good deal of success in milking the process I developed over 15 years ago of having an Index of really strong leaders act as a surrogate as to when the market will topple, Ron and I have built on work the participants did at the stock seminar to identify Chinese Silverbacks! The claim to fame for these stocks is that they were selected from the list of ~ 75 stocks we identified at the Seminar, but we have pruned them to consist of stocks over $20 and are still above their 4-dma as of last night. In addition to all the work we did on suitable Wolf Packs at the seminar, this gives us a further dimension in embracing the very hot Chinese Market. Ron and I strongly suggest you put this Chinese Silverbacks list in your User Groups and keep a beady eye on them as our Winky-Winky to you for whatever you wish to do with it. It’s always “Your Call”!

Have fun and keep your powder dry! Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog