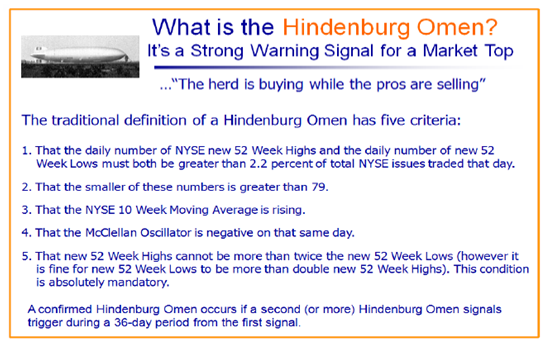

Now that the buzz is slowly subsiding regarding the Hub-hub of the spurious Hindenburg Omen sighting on August 12th, which our Reuters feed did not give us, it is time to review the bidding of where we stand at this notoriously dull time in the market. I am pleased to mention that Robert Moreno, a RealMoney Contributor of The Street.com provided a thorough balanced and objective review of this subject, in which he cited my work, along with others on the subject.

I appreciate Charley Willey giving me feedback that I have attempted to clear the muddy waters in the Comments Section of the previous blog. Although I am a strong advocate of finding rare Impulse signals at the extremes of the Normal Distribution curve, the “Fat Tails” end as John Bollinger has dubbed this phenomenon, I am frankly amazed at the reaction that this Hindenburg Omen has created around the world where blogs from the Far East, Europe, and the U.S.A. have gone gaga for any bit of information pro or con.

With all the cross currents in the World as well as the Stock Market where every bit of news drives the Indexes from Moment to Moment, any insight that gives us an edge of which way the wind is blowing other than the obvious is where I try to ferret for nuggets, and so this particular blog will focus on what might be in store for us from what I have gleaned.

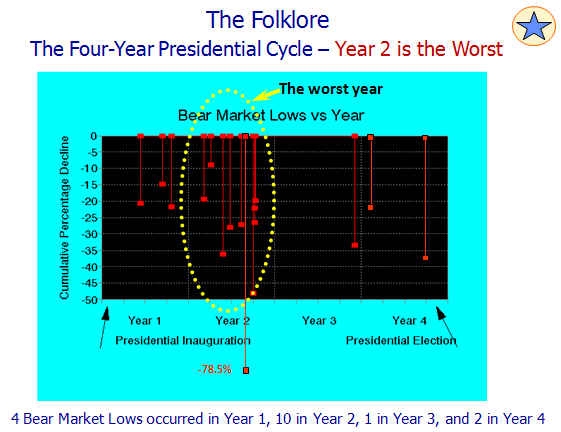

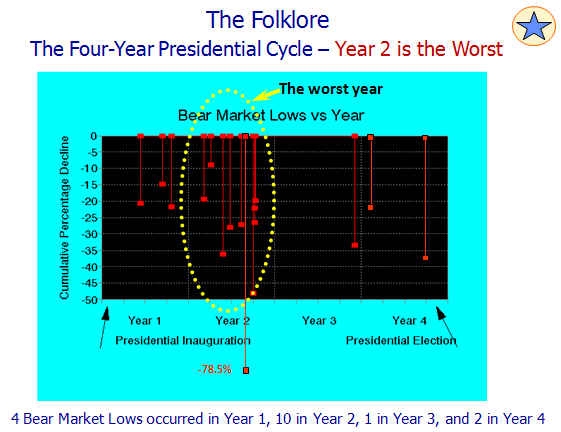

Let’s start at the beginning which is a favorite Chart of mine showing the “folklore” of the Four-Year Presidential Cycle, and it doesn’t take but two minutes to see that the second year is by far the worst. Note that the majority of these market drops occur in the latter half of the year:

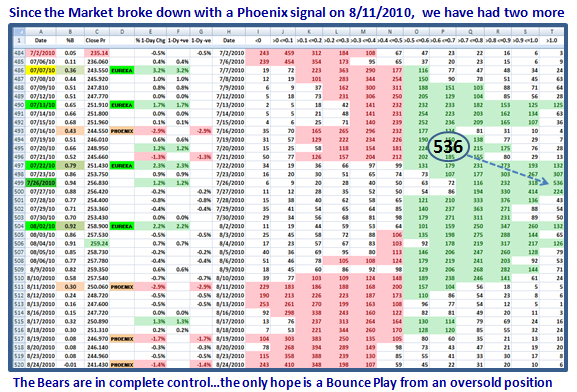

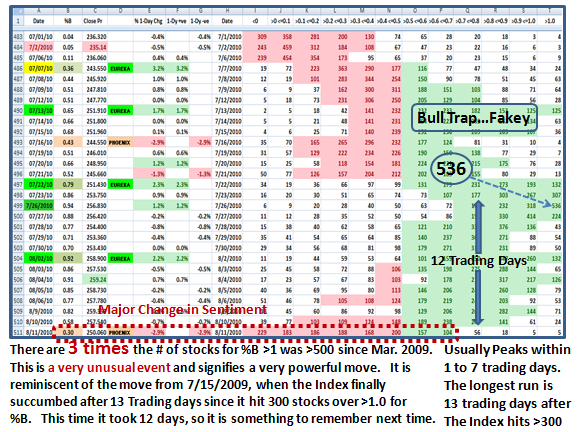

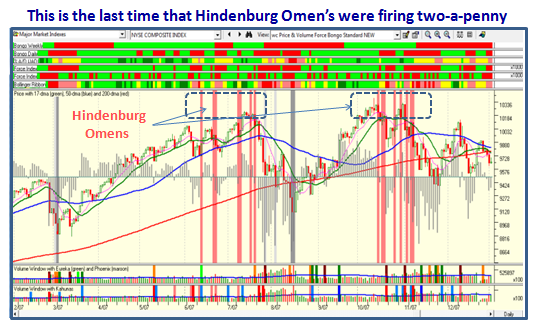

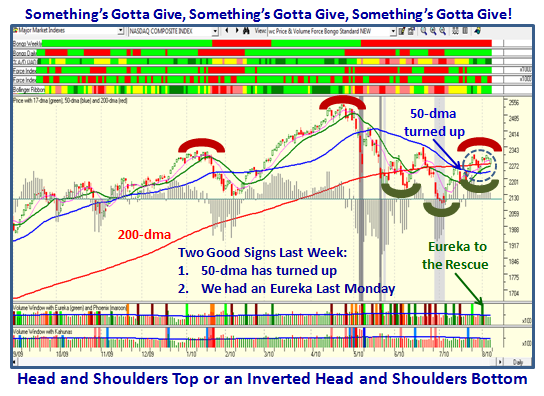

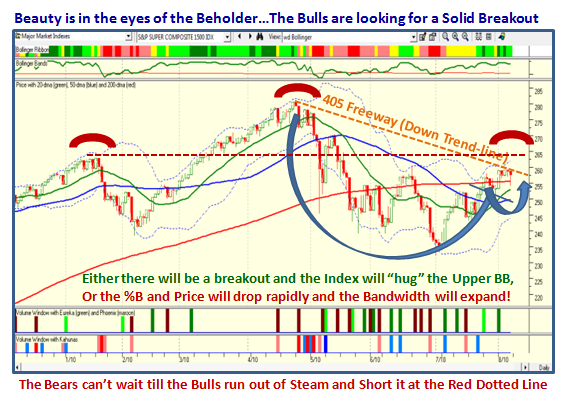

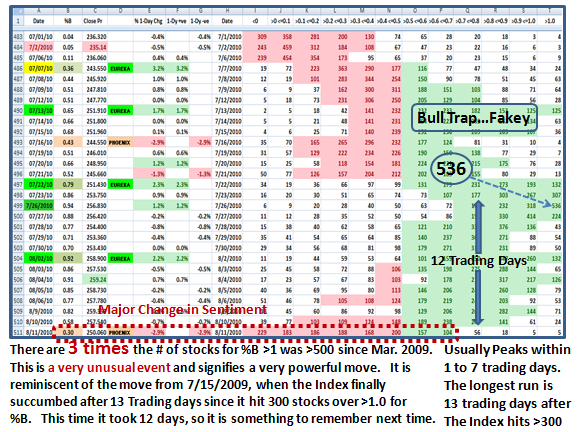

We have had a >17% Correction on most Market Indexes this year, but as yet no Bear Market. Here is a a snapshot which shows the ups and downs of the past eight months in one chart. The Heat Map gives us a quick view of how the Market has behaved, where at a glance we can see that the Market has been a highly volatile state in the past four months, where Eurekas and Phoenix’ have fired with reckless abandon. Newbies reading this blog need only know that a Eureka is triggered by Irrational Exuberance by the Bulls, usually with an Index One-Day gain of >2%. The same applies to a Phoenix which as you have guessed by now is a comparable rare Impulse signal by the Bears. Net-net, this is an extremely UNSTABLE Market, and we don’t need an Hindenburg Omen to tell us that. It has come down to trading intra-day only, and even then most lose money unless extremely nimble:

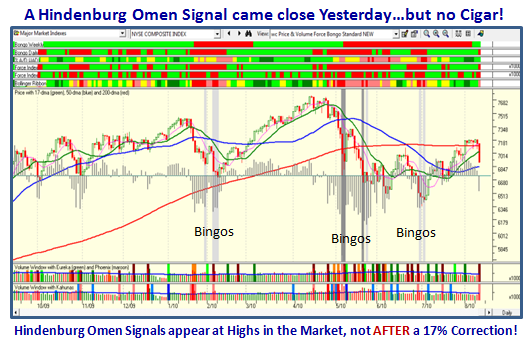

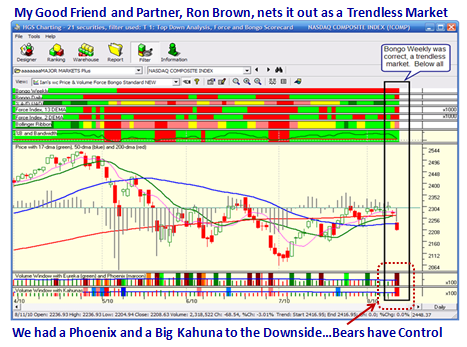

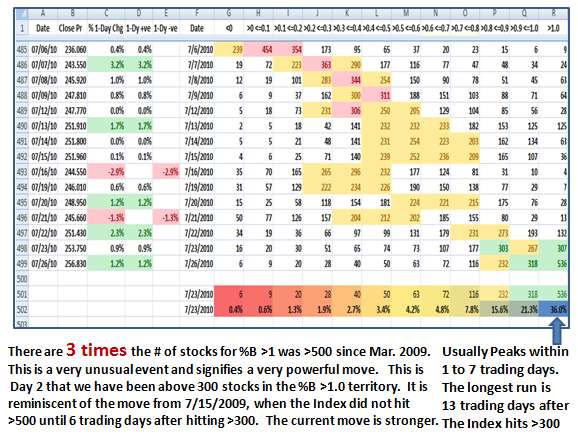

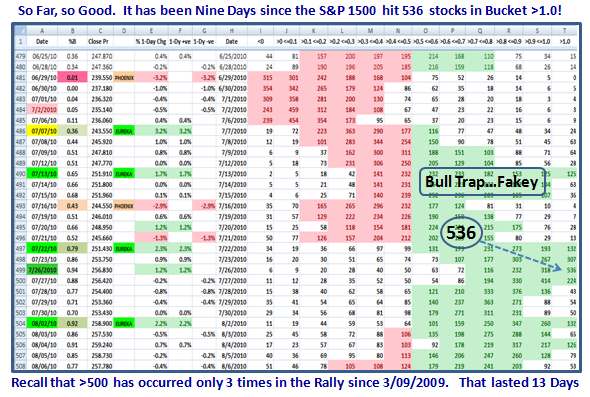

Over the course of the last month I have shown you on this blog my recent findings with regard to an unusual move in %B of 536 stocks of the S&P 1500 >1.0, above the Upper Bollinger Band. That’s ~36%. There has been an unusual flight to Bonds, ETFs and Inverse ETFs, which caused this one day jump from 307 to 536 stocks in the S&P 1500 to extremely ovesbought status. Based on past History the expectation was that within 13 days there would be a downturn. Now that this has occurred again, the warning gave us 12 days of an impending collapse. It happened one day before the supposed Hindenburg Omen triggered on the 12th August, after that drop of -2.9% registered with a Phoenix as shown below, and a Big Kahuna to the downside:

Since then, the Market is trying to struggle back, but so far it continues to meander sideways to all intents and purposes. Today was another shot across the bow, so the Bull Elephants need to weigh in heavily to prevent the inevitable trend which is setting up to the downside, given that we have the usual gloom and doom months ahead of us, this time leading into the November Elections.

The latest news on this score is that Helicopter Ben has started up a modest effort on POMO again, after a hiatus of 10 months. You have forgotten all about Private Open Market Operations (POMO)…well it is back and may be the first signs of trying to prop up the Market in these uncertain times. Don’t take this lightly as there is little doubt that this infusion of cash by the Fed did help to bolster the long Bull Rally in the early part of 2009. This bolstering may last a few weeks as word gets out to give a perception of the idea that Uncle Ben’s dollar leaflets will get equities to rise again. You and I both know that the last thing the Administration needs is a collapse prior to the mid-term elections in November.

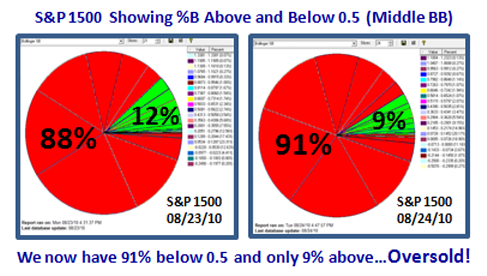

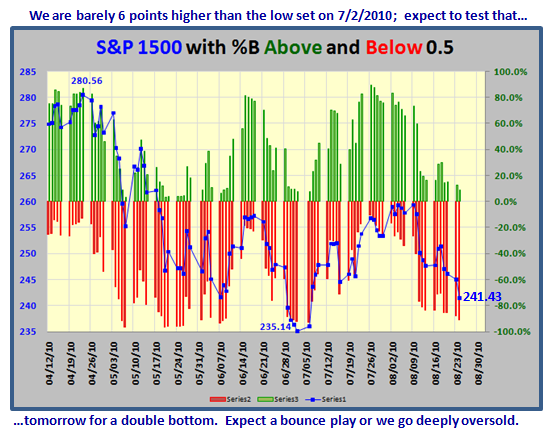

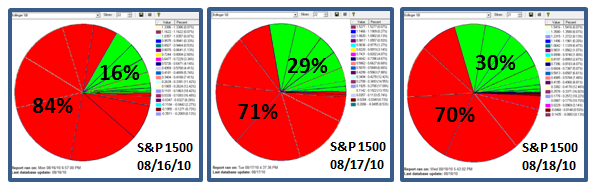

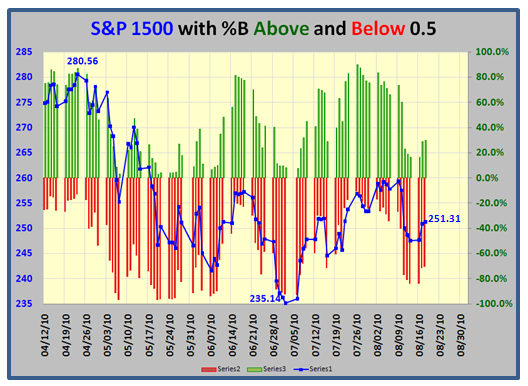

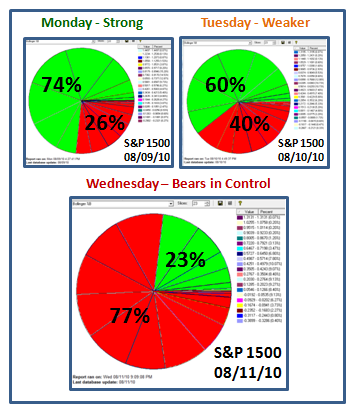

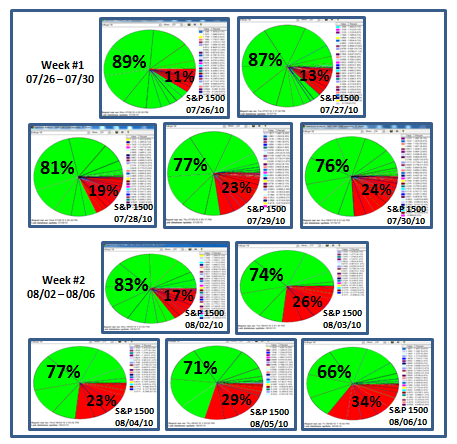

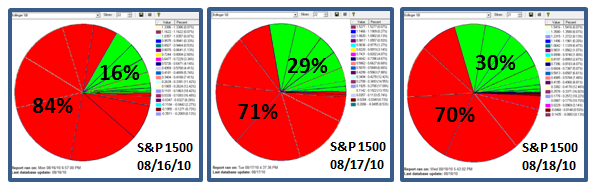

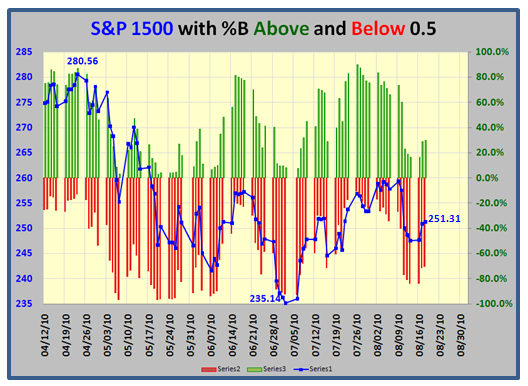

So where do the Internals of the S&P 1500 sit with regard to %B above and below 0.5…Flat with the Bears still in control. Today’s action will take things down further in favor of the Bears, and clean this rally out altogether before we start all over again:

…And here is another view of the same thing, which shows the Bulls have a ways to go to have any hope of renewing the rally, and today’s results makes that worse (not updated):

So let’s summarize the key points:

1. The second year of the four-year Presidential Cycle produces the most Bear Markets

2. We have already had a 17% correction, recovered half of that and sitting vulnerable at present

3. A Strong Warning Flag of an intermediate top occurs with >500 Stocks in the S&P 1500 over %B 1.0. One has about 12 days before the rally fades. I didn’t say die, but corrects.

4. It may be a coincidence that we had a Hindenburg Signal by some accounts one day after the Internals of the S&P 1500 collapsed and 12 days after the S&P 1500 Peaked with 536 stocks above the Upper Bollinger Band.

5. The Administration cannot afford to have a Market Collapse before the November Election, and Uncle Ben has started to prop things up with his POMO once again. Whether that is enough to stave off the Bears driving the market down remains to be seen during the recognized doldrum months of the stock market season.

6. The Bounce back has been tepid so far and the Bears are still in control. Today’s further drop proves that in spades. The market will soon be oversold once again. Most are fleeing to Bonds and this area is hot, but that game is fast becoming overbought and vulnerable.

7. Only Intra-day players have a chance to make money and they too have to be extremely nimble. The rest would be well advised to take a vacation until this very unstable market settles down. The tug-o-war between Bulls and Bears has become a farce, and mostly driven by HFT players…in my humble opinion.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog