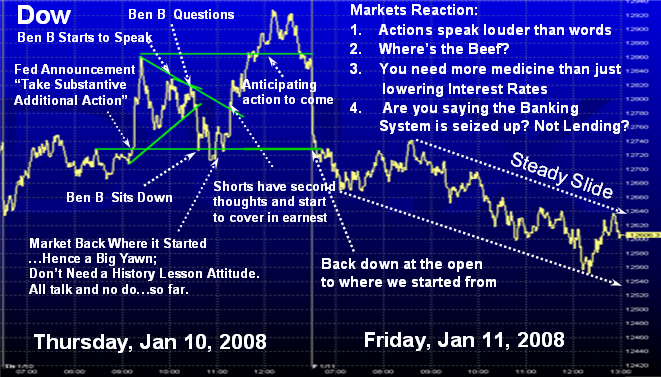

Fed Chairman Ben Bernanke indicated in a much anticipated speech Thursday that more rate cuts are on the way. “In light of recent changes in the outlook for and the risks to growth, additional policy easing may be necessary,” Bernanke said in a speech to a business group. Bernanke added the central bankers “stand ready to take substantive additional action as needed to support growth and to provide adequate insurance against downside risks.” Bernanke said the Fed has seen evidence that banks are cutting back on lending to consumers and businesses as a result of the financial market turmoil. He said the December unemployment report was disappointing. In recent days, the outlook for growth has worsened.

As you can see from the minute by minute reaction, Bob Pisani of CNBC summed it up nicely in that “The Market doesn’t want a history lesson”. However, the Bears had second thoughts and began to cover in anticipation of the next “Big Shoe to Drop!” as shown below:

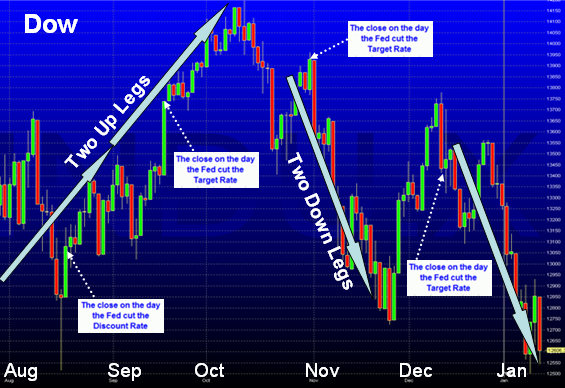

My purpose in going through all this detail is to focus us on the psychology of how markets turn on a dime and react to the Fed speak and then the actions that follow…”Walk the Talk”. This now sets up a very interesting situation and let me try to piece together the potential scenarios at play. I really hope my spending the morning recording all this detail gives you insight in what to do in your own investments. Some of you are in your foxholes waiting patiently for a Bingo on the NYSE Index. Some are buying established Fallen Angels like AAPL either for the short term or for an intermediate play. Others are on the short side and were licking their chops, but now are in a quandary. They either covered quickly or are waiting for more shoes to fall. I strongly suggest you review once more the thoughts I expressed on “Big Foot is Back and Others are Looming” in combination with what I now offer. I felt sure something would be cooking when I asked “What tricks will the FOMC and Administration have up their sleeves in advance of the next Fed meeting towards the end of this month?” Be sure to read the others as they still apply.

The entire strategy from here to the next FOMC Meeting at the end of this month is centered on the two questions at the top of the second picture. Nobody in the audience asked “Bennie and the Feds” as to what he meant by “Substantial”, so there will be a lot of second guessing on that. In any event, Uncle Ben has signaled:

-

A reaffirmation that he is prepared to cut interest rates. Whatever he meant, it is obvious that the Market will begin to bake in a 50 basis point cut. Anything less will be a disaster.

-

It will be done sooner rather than later so that the anticipation is that it will be done before the next meeting around the end of the month. Patience can soon run out. Likewise, some of this action today was the news that the Bank of America will bail out Countrywide Credit.

-

The Fed, although caught between a rock and hard place, leans to cutting rates at the expense of inflation, a weaker dollar and all the other baggage that goes with that scenario. They are prepared to bet that although the economy is slowing, and the common or garden man in the street is hurting, we are not yet showing signs that we are into a recession. Of course a recession can only be established long after we are already in it, but they feel they can pull off a soft landing instead of a hard fall in the economy.

Who said that investing in the stock market was easy? There are several schools of thought:

-

We are already in a Bear Market of which this is just the first leg. There will be rallies along the way, but be rest assured it heads on down for another leg or two. Not only are we in a bear market, but we are heading into a recession.

-

We have had yet another correction, which is over 11% for three such corrections in the past six months and once we retest this low, we will trot on up again with a fresh bull rally.

-

We have had a third correction in six months, the market is so oversold that we will now have a V bottom and head on back up to new highs.

Take your pick, but I would be very leery of betting on the last one. The odds are that any MAJOR downside are in favor of being postponed until Uncle Ben shows how big his shoe is and really provides the action to back up his words. Since the Blue Pencil Line I taught you a good few notes ago says the trend is down, the extent of the medicine the Fed hands out will determine if they can stem the tide long enough to right the ship and change the direction of the market. In any event, the odds are that we should at least retest the lows for a “W” bottom. What has changed after today’s events is that the Bears are now caught between two stools, but will only postpone their efforts until any rally peters out.

Lastly, one thing is certain. UNTIL we see sustained New Highs greater than 150 per day, any hopes of a strong rally are a pipedream. Today’s action should convince anyone that they cannot participate unless they can turn on a dime and are short term oriented to go either way.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog