A long term follower and supporter of my work wrote me a note about the January Effect and here is my response which I felt I should share with you all to explain our different definitions, especially to help new readers:

Ian – always appreciated. However, please straighten me out.

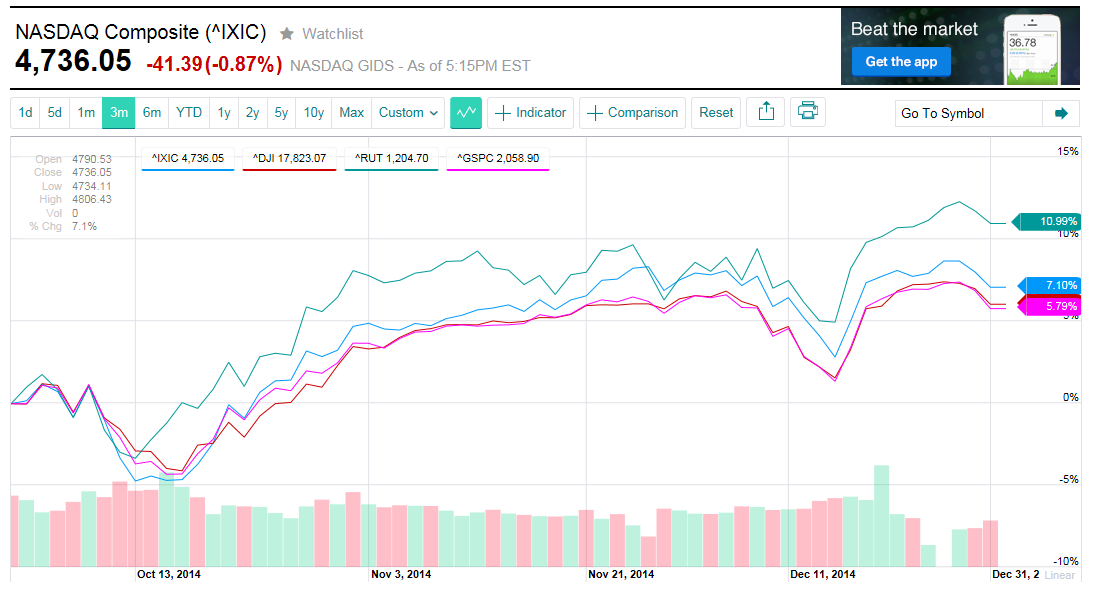

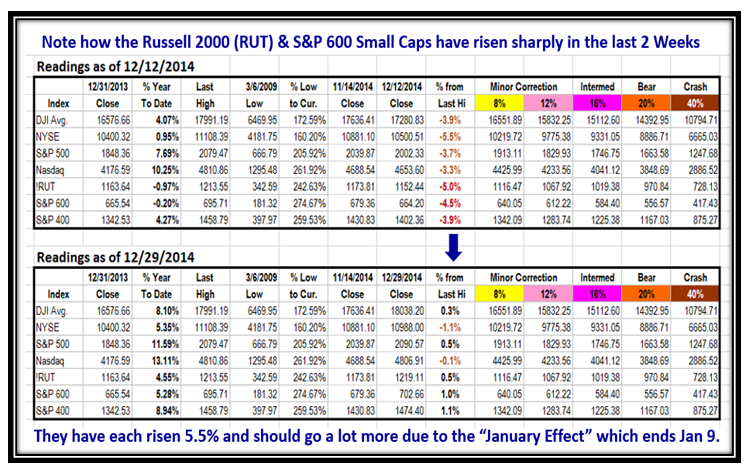

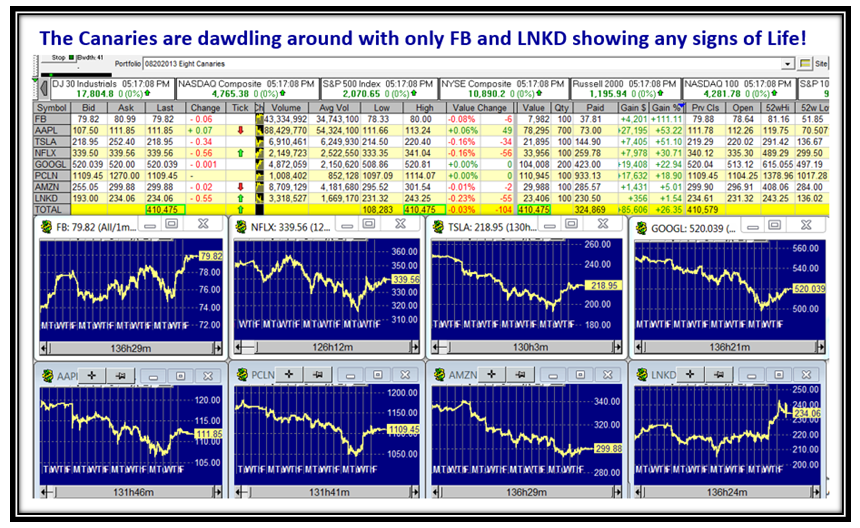

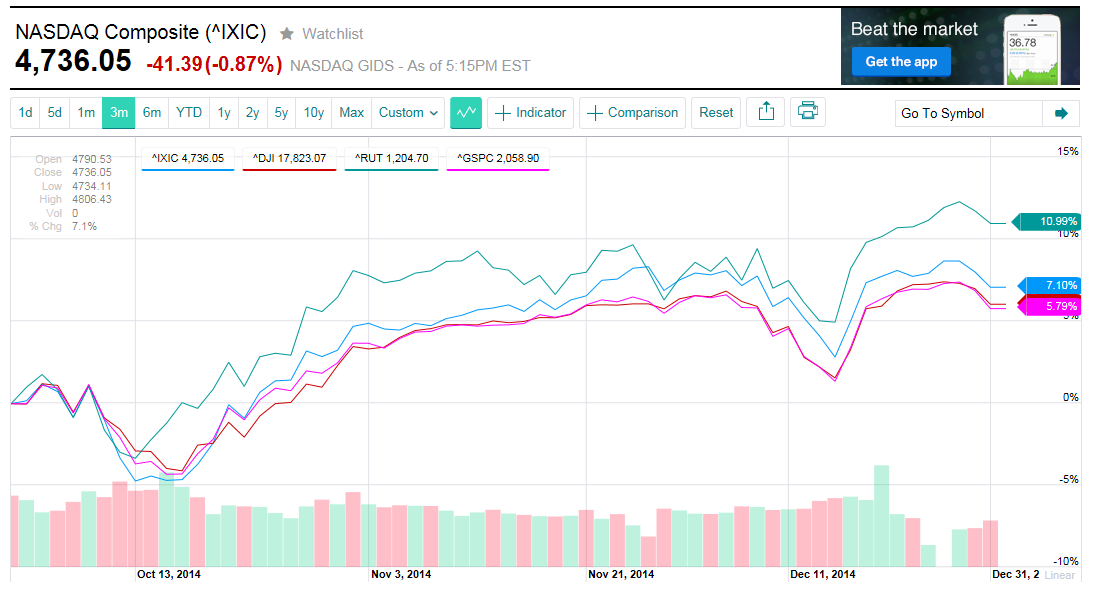

I have worked on the definition of January Effect of small cap buying years ago starting in first to middle of December and then buying started running earlier into November and even October. If you look at the 3 month chart the Russ 2k outperformed the other 3 main indexes and the same if you go from 1 December. Here is the link to the 3 mo chart (+ 11%) and can easily be read for 1 month with the same comparison.

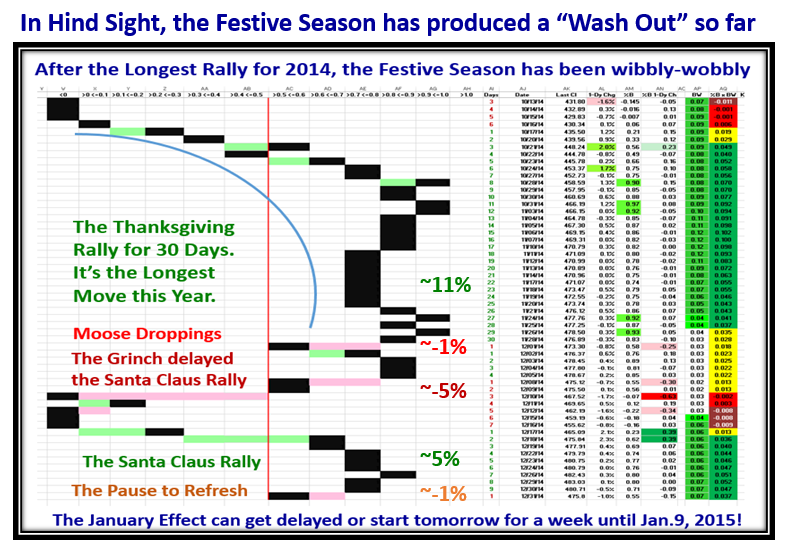

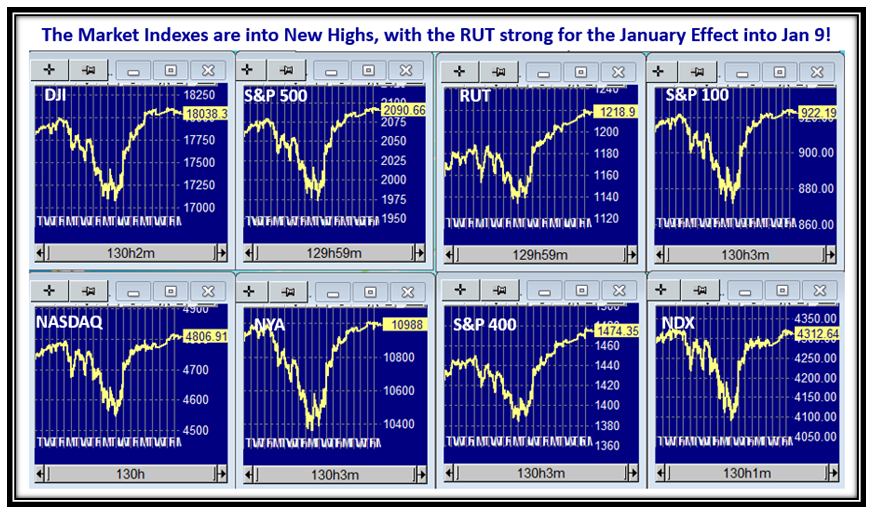

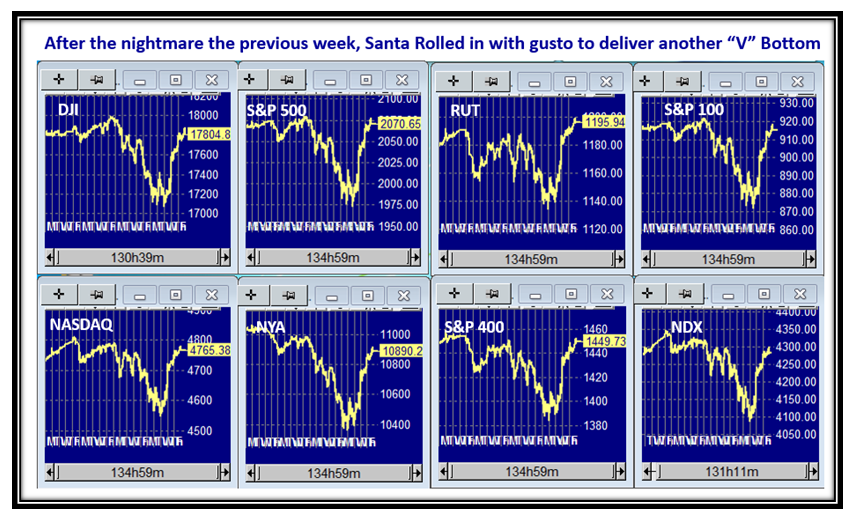

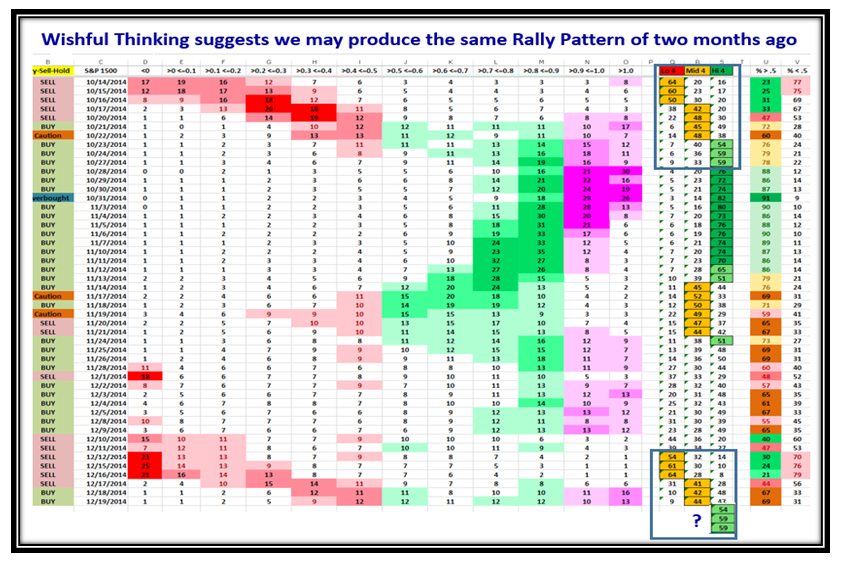

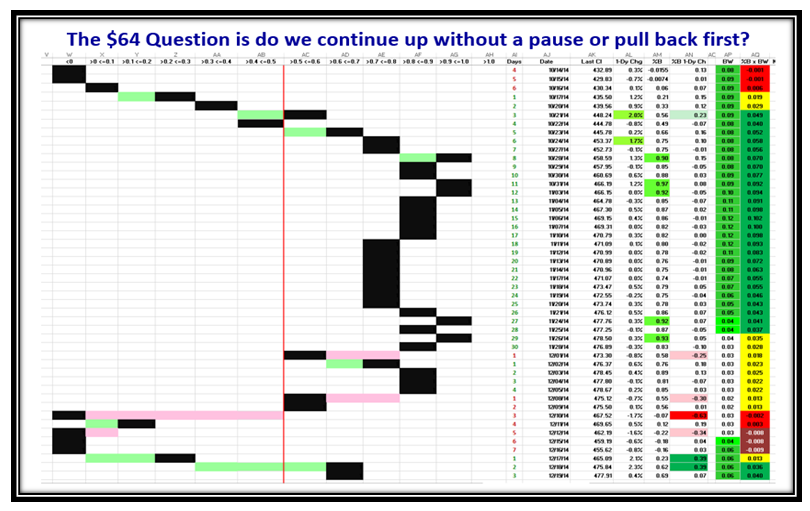

I have never subscribed to Santa (folks said he didn’t exist when I was a kid) as some of my best gains have been after 12/25. However, the market then usually sells the January effect the first week (sometimes the first trading day but more like end of the first week) and then January is positive by the end of the month. Tell me where I have been going wrong all these years?

Thanks, Bruce

Thank you Bruce and for your contributions to this bb over time. We go back almost 25 years, and you have always been the “guru” of small cap stock investing, so your insights are always valuable, and you are not wrong over these many years…only different.

As you well know in my book, our audience consists of 4 Types of Investor. Types 1&2 are essentially short term Traders, while Types 3&4 are longer term Investors. The majority of our clientele are Type 3 who look for opportunities over a few weeks to a few months. I’m assuming your bias is towards Type 4 and therefore longer than most. So your comments are very well put.

As time has passed us by since 20 years ago with the progress of the Internet in real time and High Frequency Traders (HFTs), they have also seen that until there is a Clean Out ala March 2003 and 2009 when a Fresh Rally truly begins, many have also realized that they must dabble as Type 2 shorter term traders if they are to engage the market

My comments around the festive season are always with this in mind and I use the standard definition of the first week in the New Year as the January Effect. It’s aimed at trying to accommodate the Types 1 and 2’s at such times. My Blog Notes over the years reflect that.

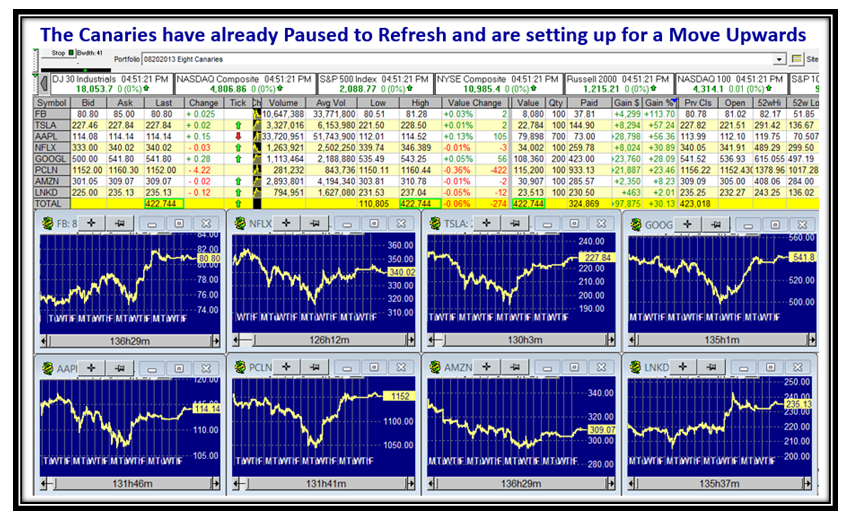

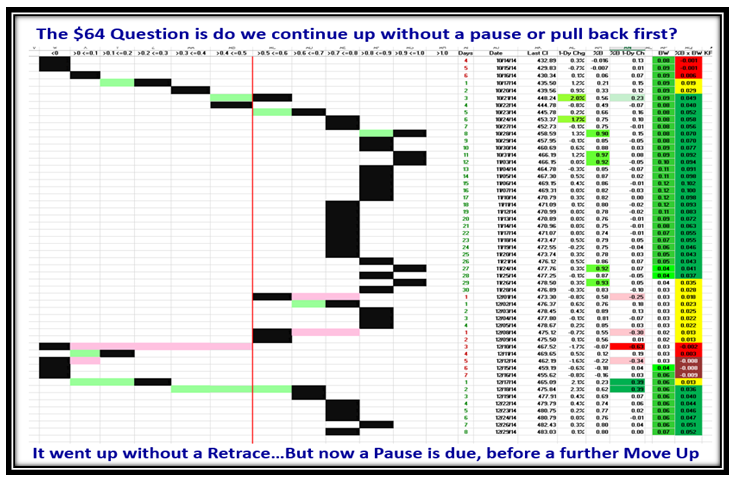

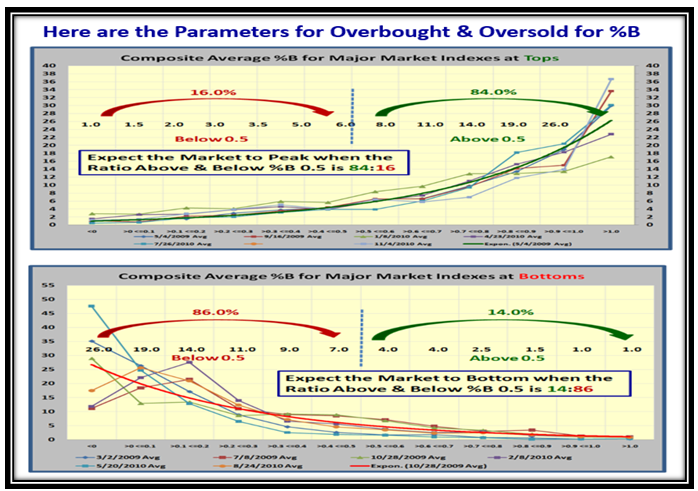

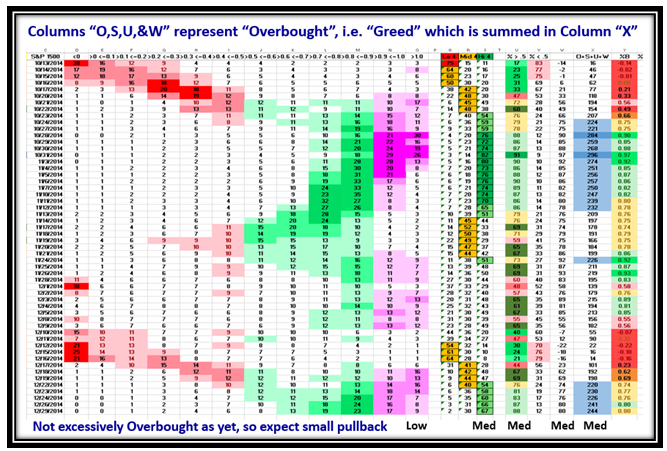

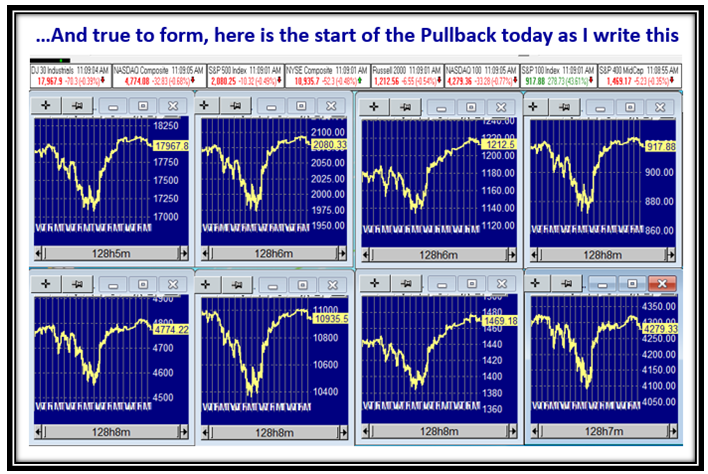

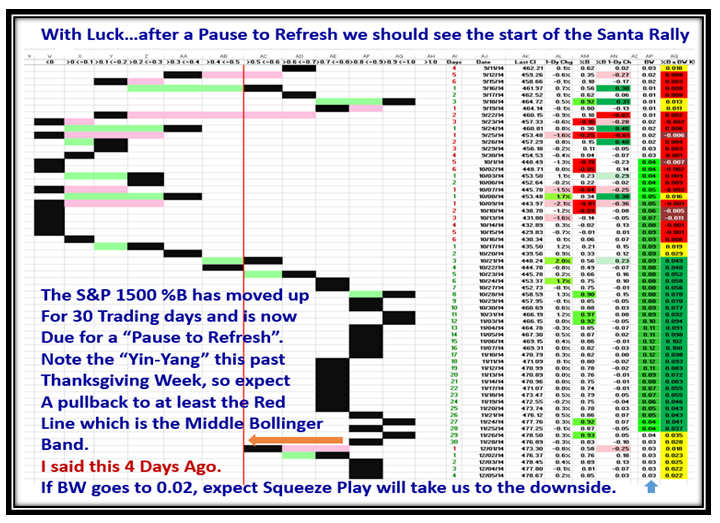

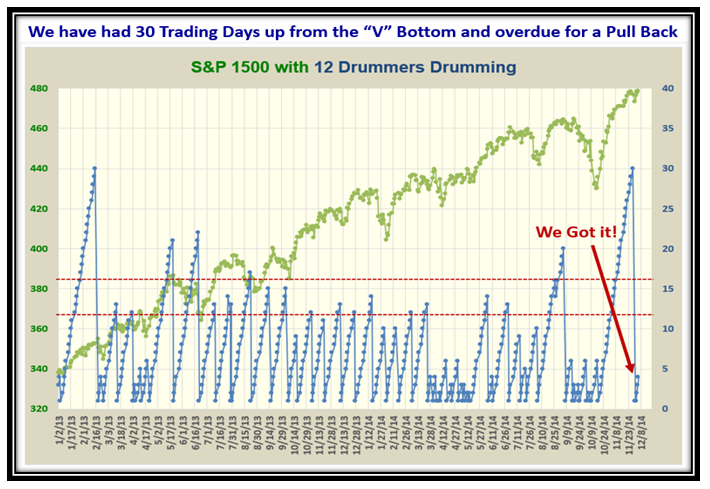

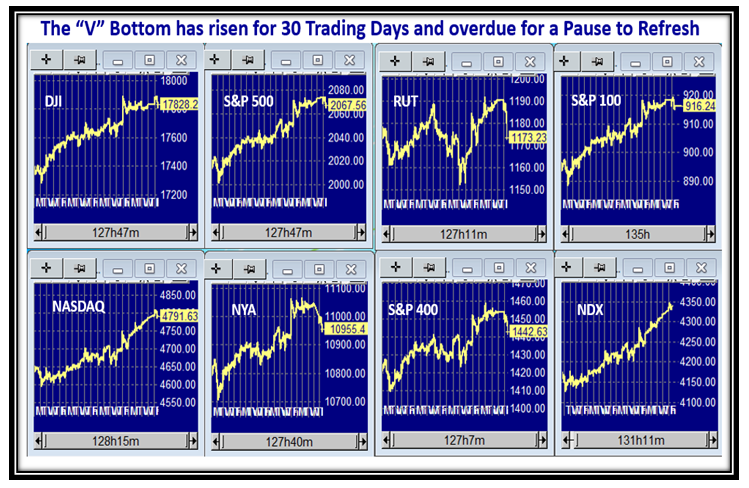

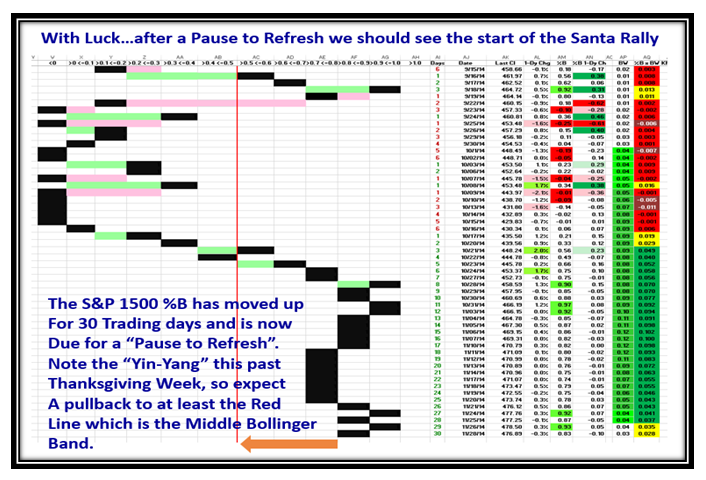

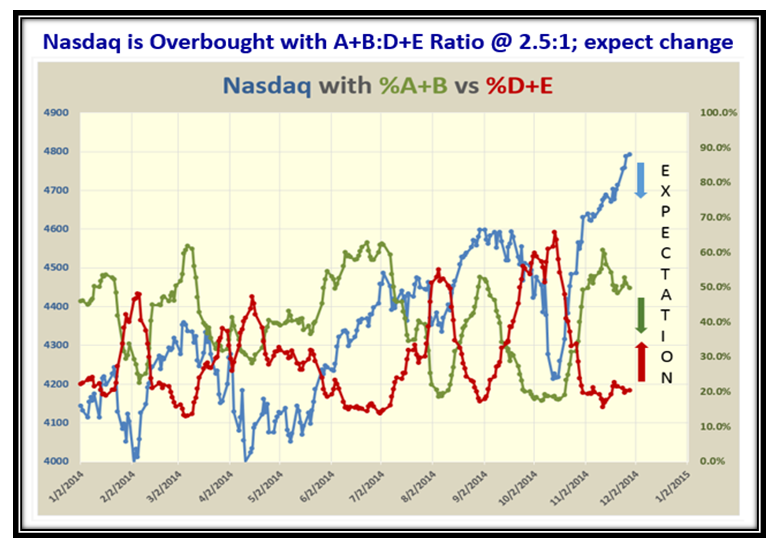

Here then in a nutshell is what I have suggested with my recent Blog Notes. Some 35 new supporters from Vietnam have found some nuggets in the last couple of posts, and I wish you all a Happy New Year with the following gift to you all:

Best Regards, and Happy New Year to you all.

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog