Stock Market: Where Next?

Thursday, August 23rd, 2012It’s Thursday afternoon, the Markets are closed and there was a mild shot across the bow, so I see my followers in Australia, Canada, Belgium and Egypt to name a few along with the US Contingent who signed in today are looking for more fodder.

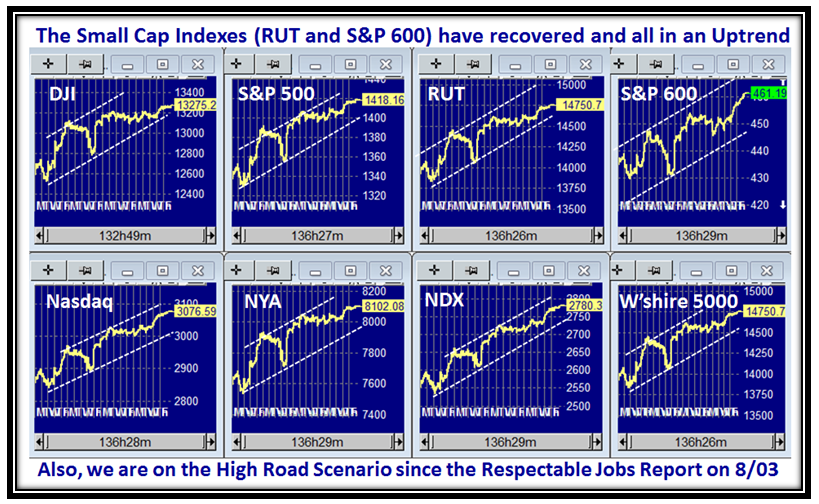

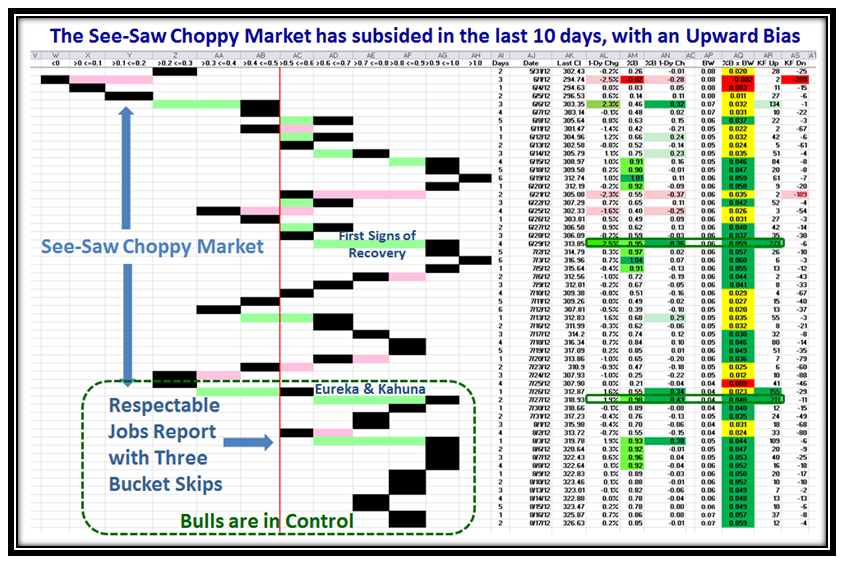

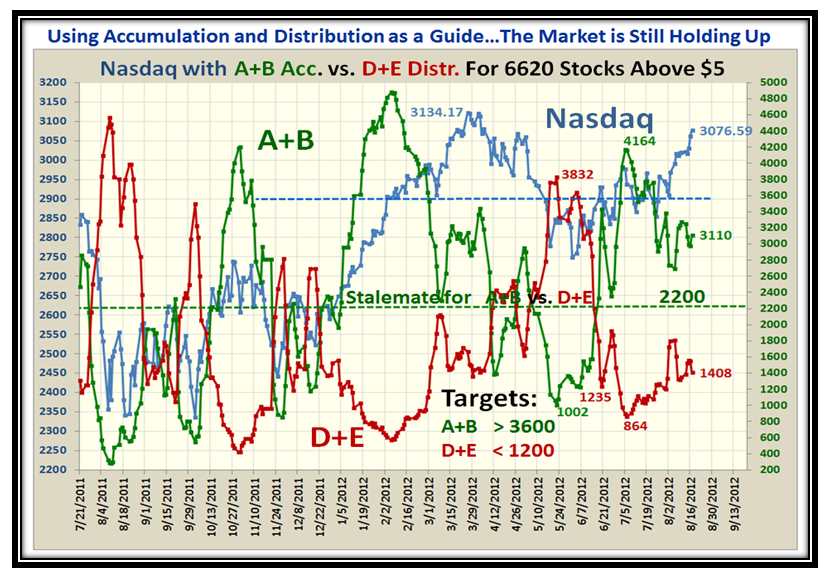

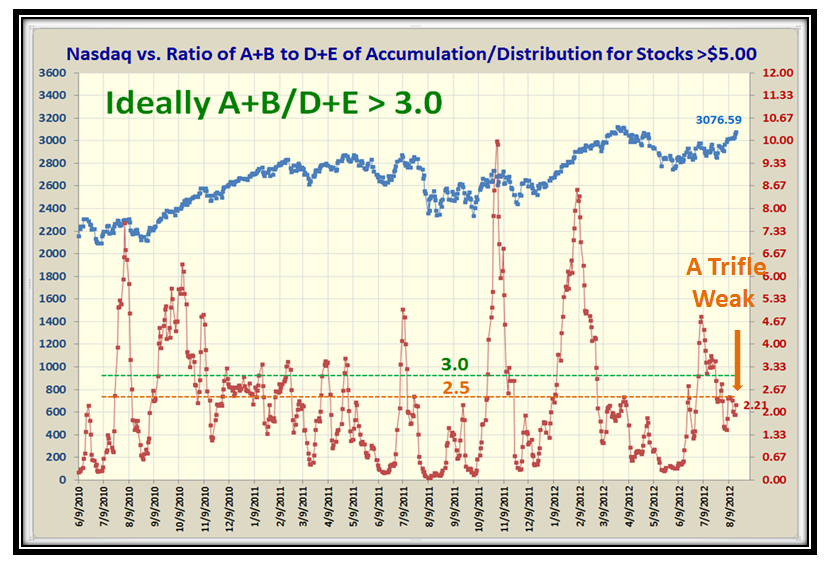

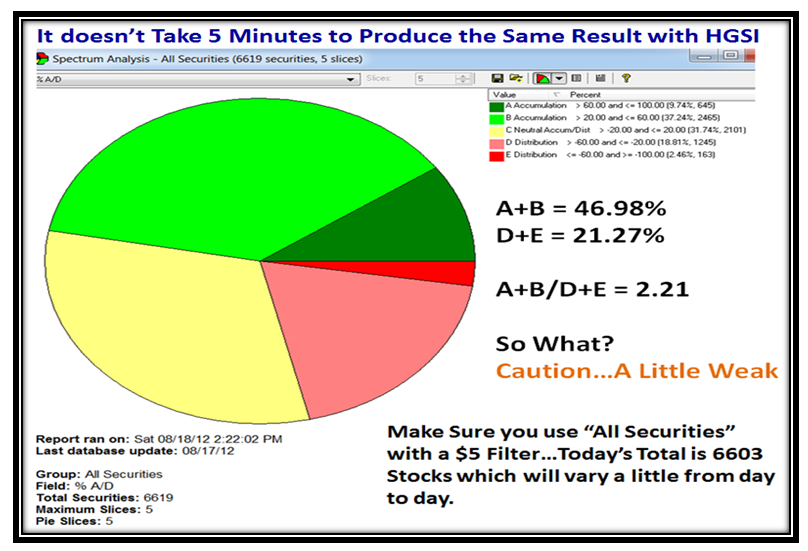

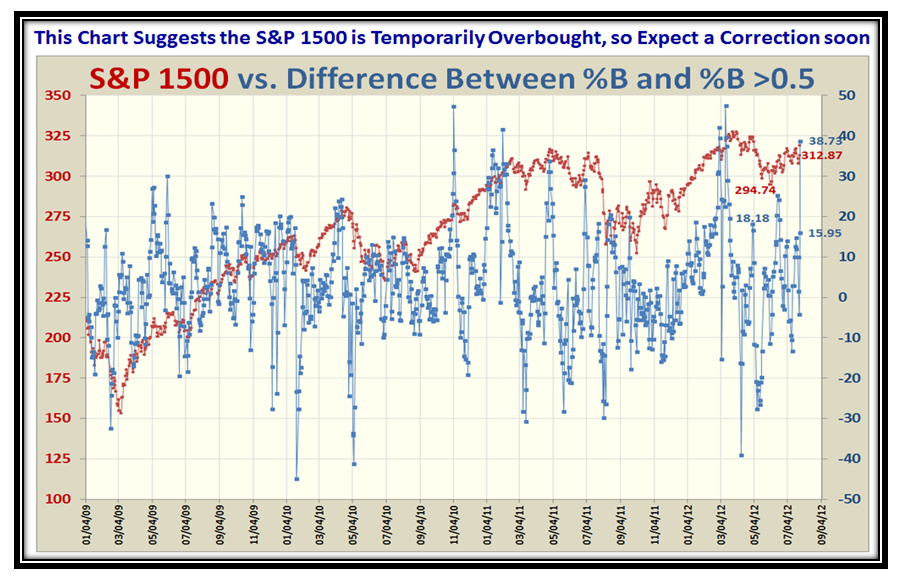

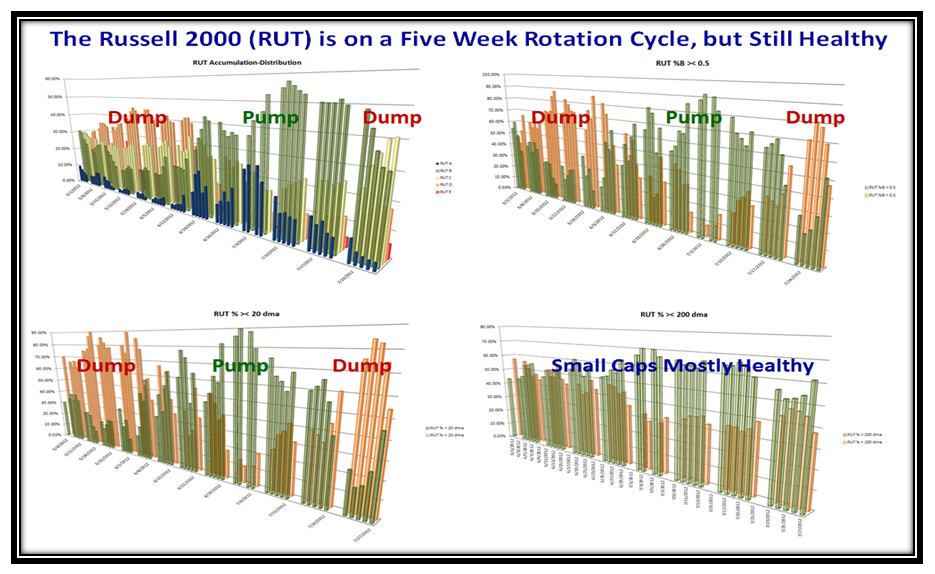

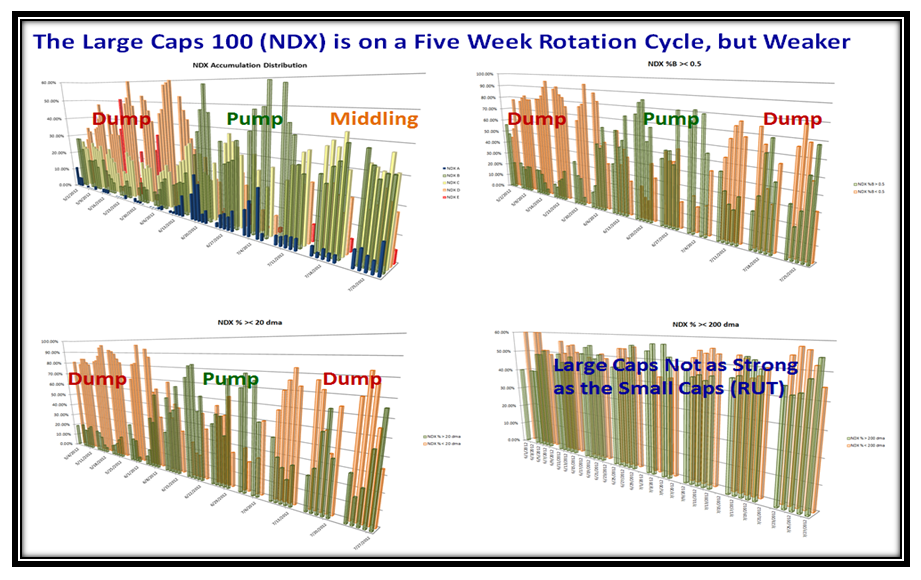

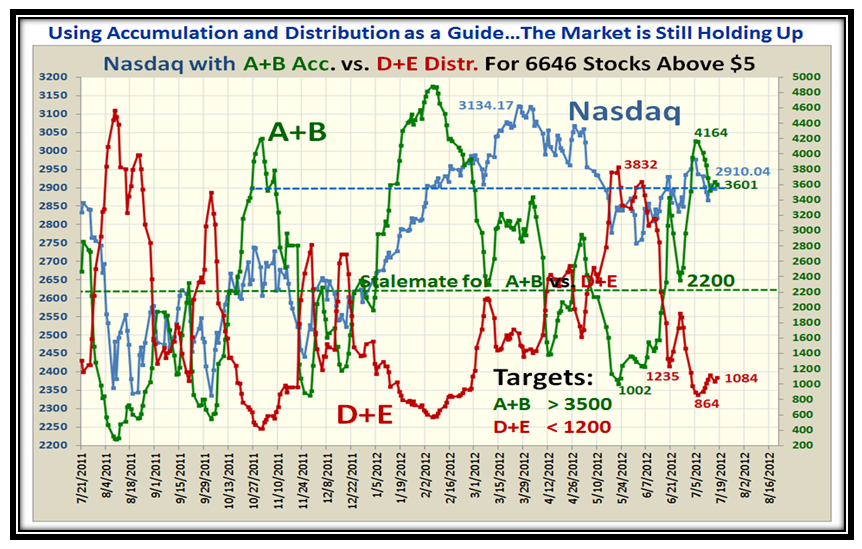

So here we have the latest pulse of the Market hot off the press:

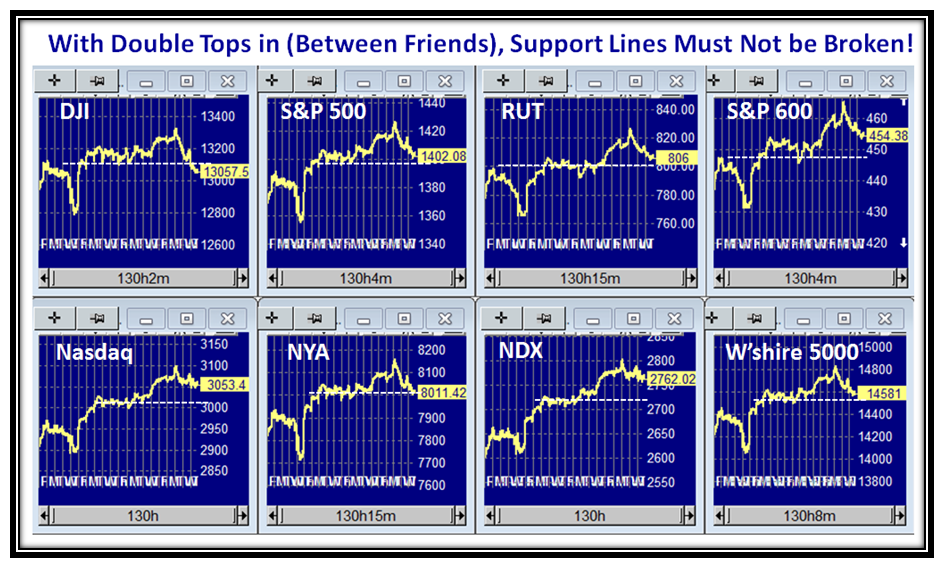

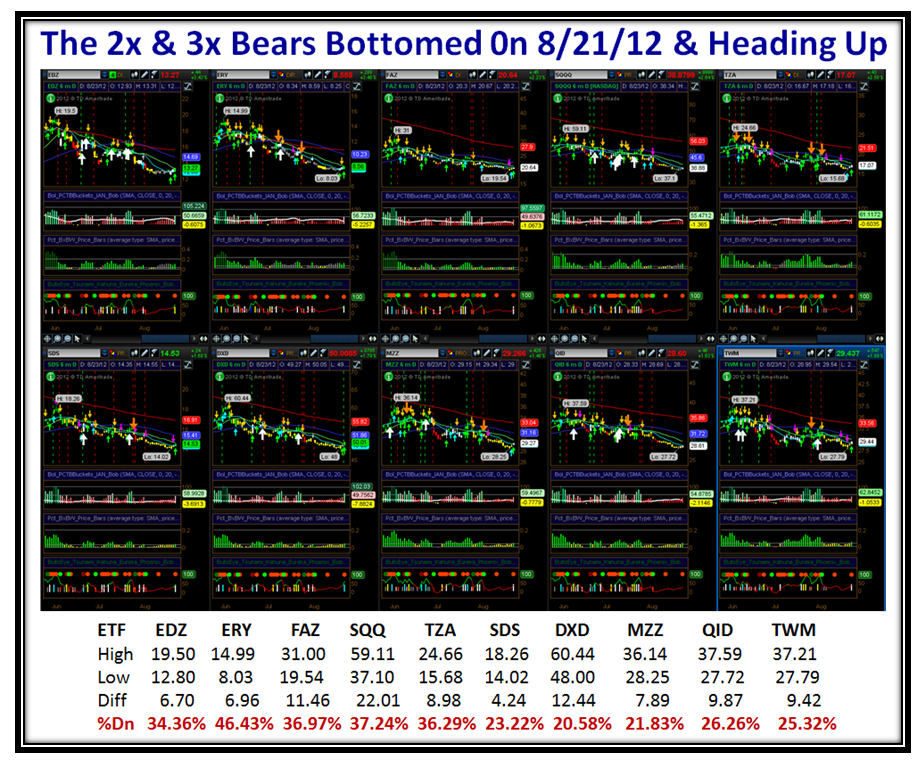

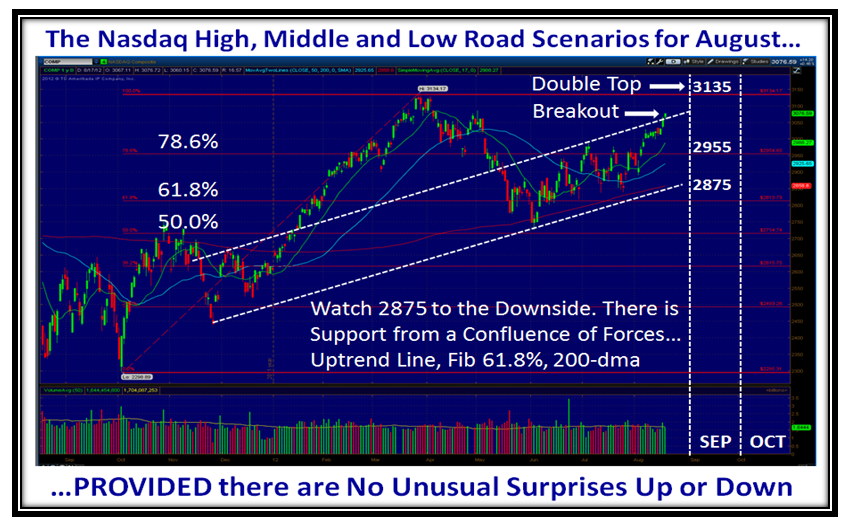

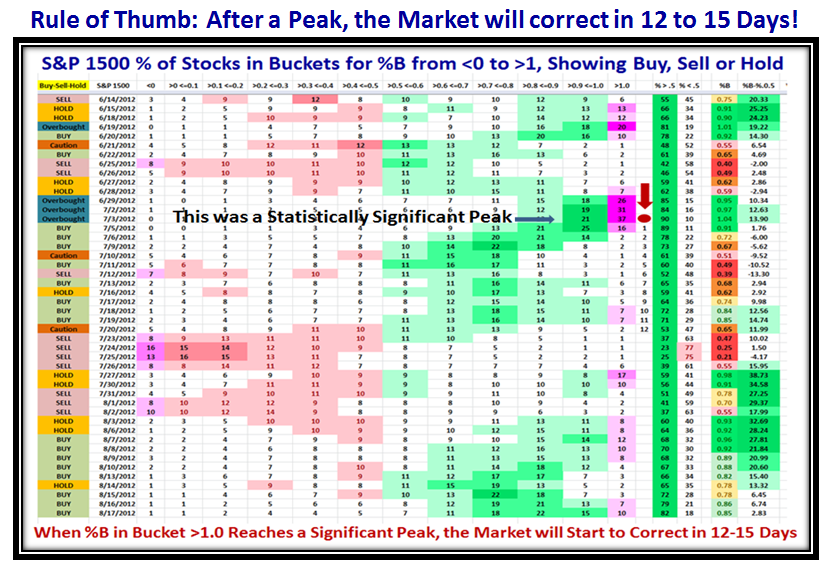

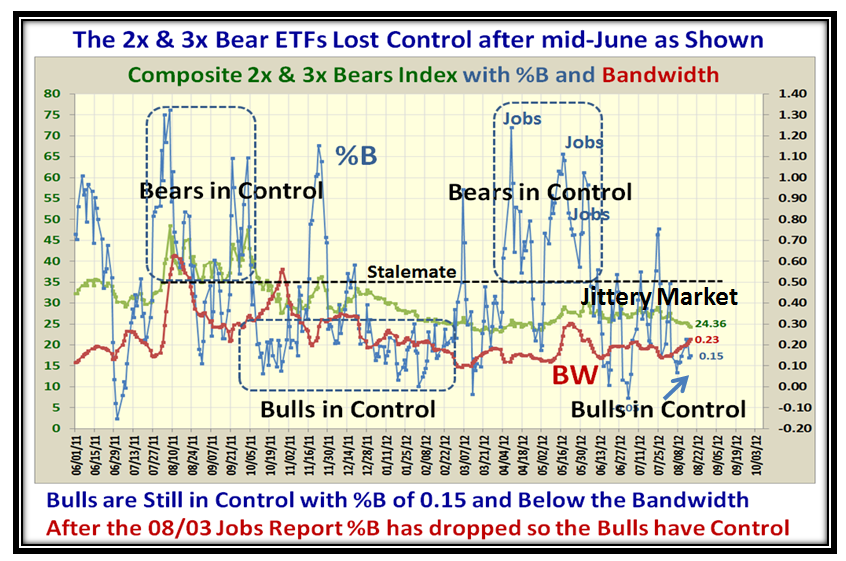

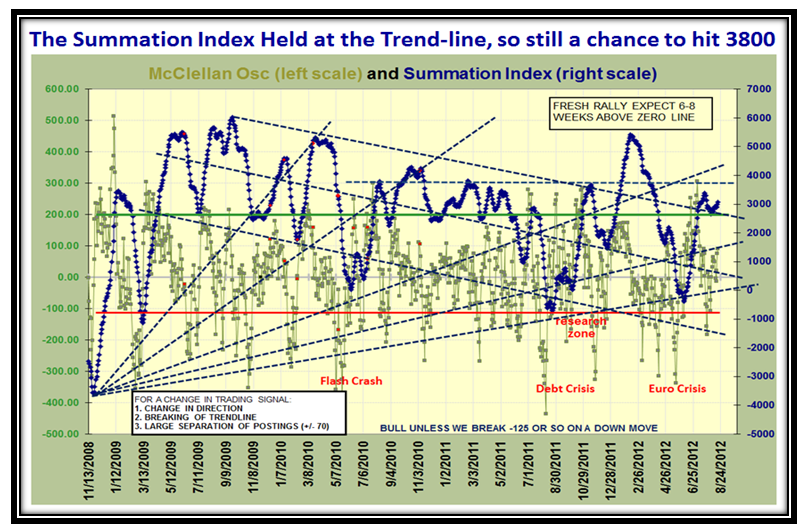

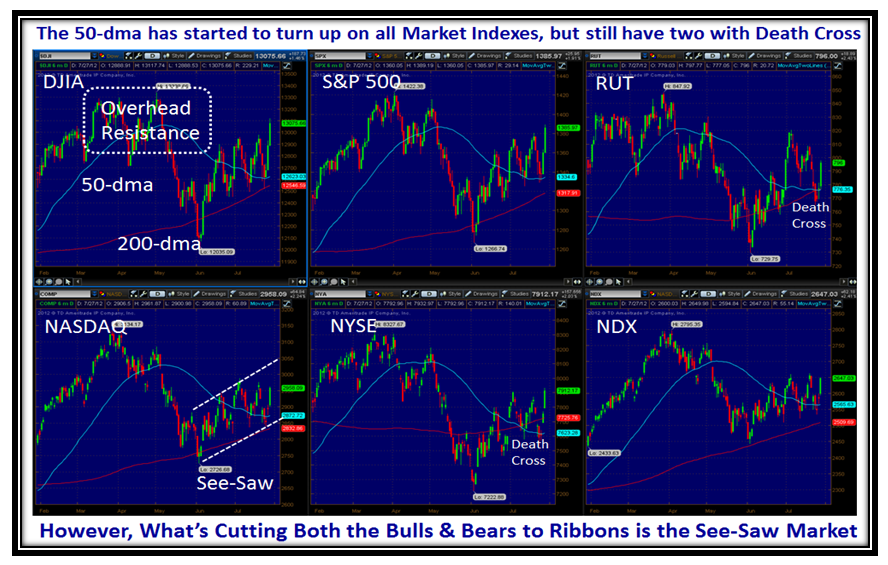

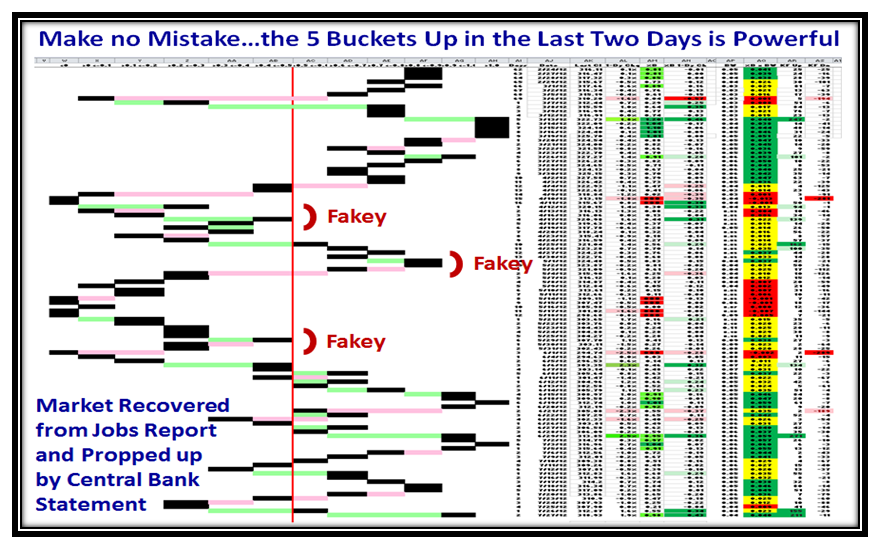

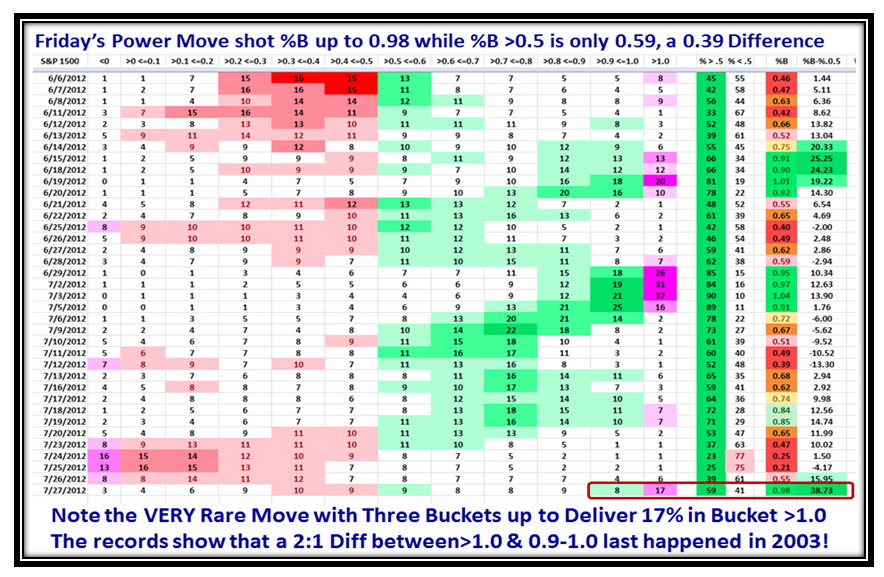

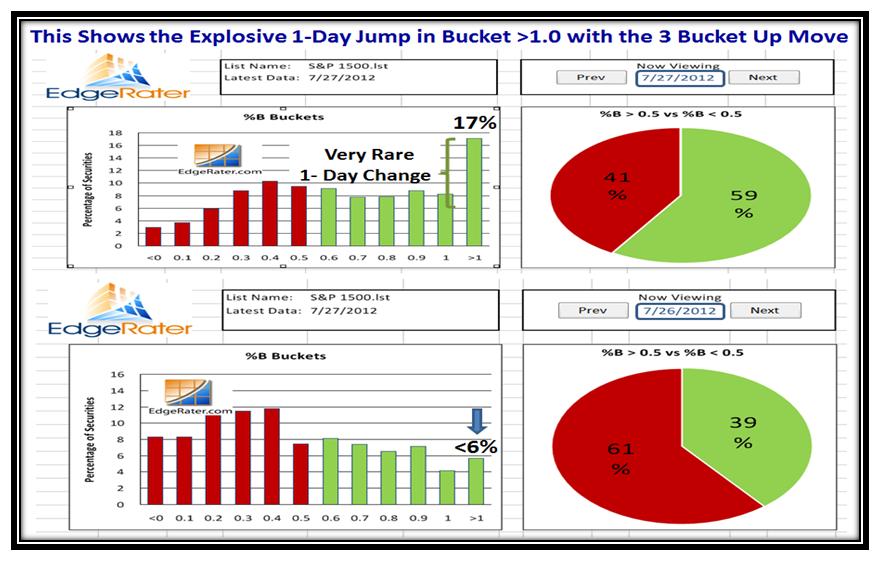

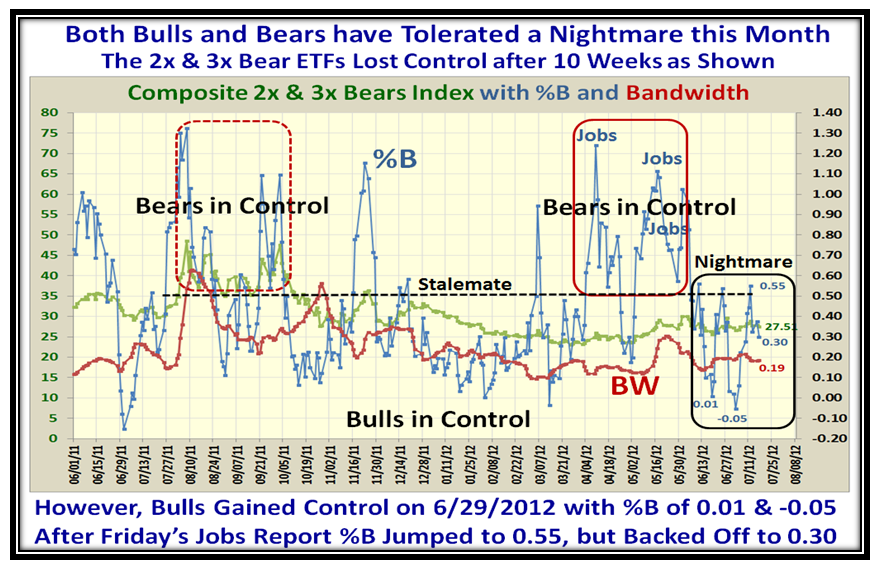

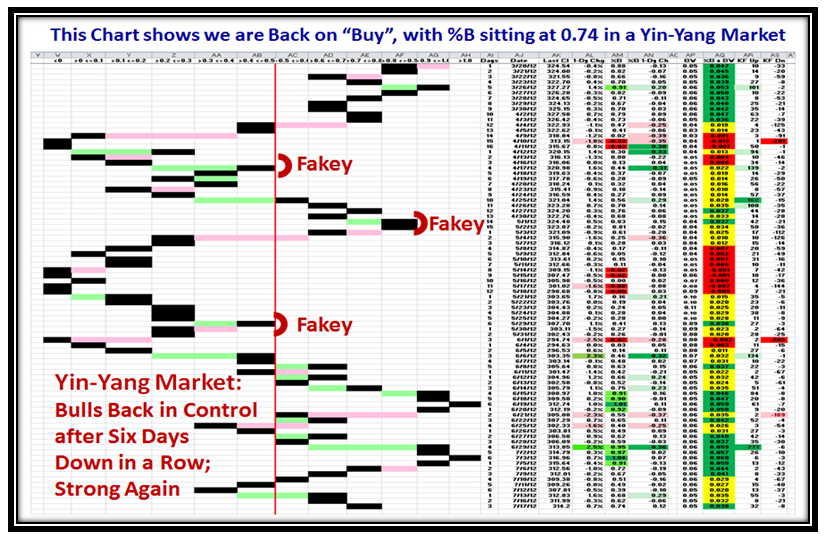

If you use Think or Swim (TOS), make yourself a Template for the ten 3x and 2x Bears I use to keep me a step ahead of the game and the whole world will be your oyster. Note that on a three month chart you will see the recent Highs back in June and they all bottomed on 8/21/2012 and have started to head up. It’s too early to call, but at least be aware that the sell off in the Market Indexes these last couple of days and especially today have given some hope to the Bears that we have put in a Double Top. For those of you who are NIMBLE Type 1 or 2 Traders and can sit and watch your computer all day you know how to play the game, but for those who are Type 3 & 4 Longer Term Traders and Investors this tells us when the wind is at your back or in your face. Just look at the Whallop the Bears theoretically had in these past three months playing this game. However, when the numbers get so high, the Bears are just itching to nibble and that is precisely what they have started to do in the hope that they have caught the bottom. Not for the feint of heart, but these give you a feel for the way the windsock is blowing to understand fear and greed and stay on the right side of the Market:

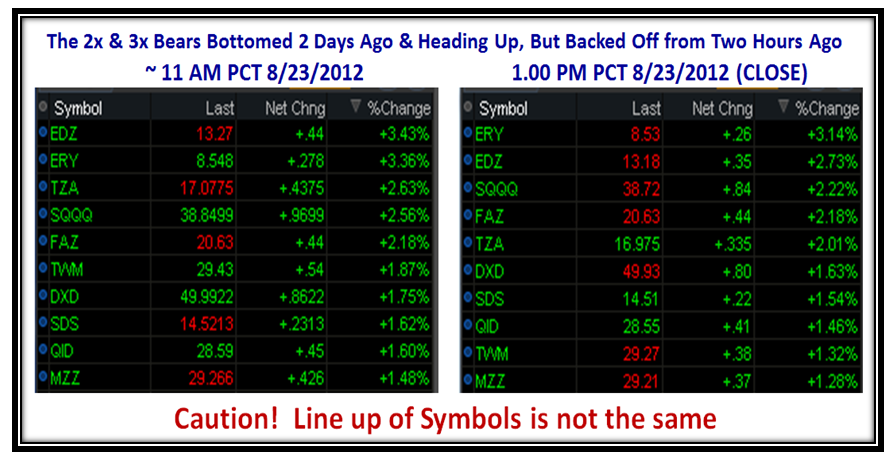

Now let’s look at the action of these ten in Real Time today with two snapshots in time, one at 11.00am PCT and the next at the close. All these ten bears were positive and had a respectable day. The Tables are in Rank order, so the two charts are not aligned…anyway you get the idea:

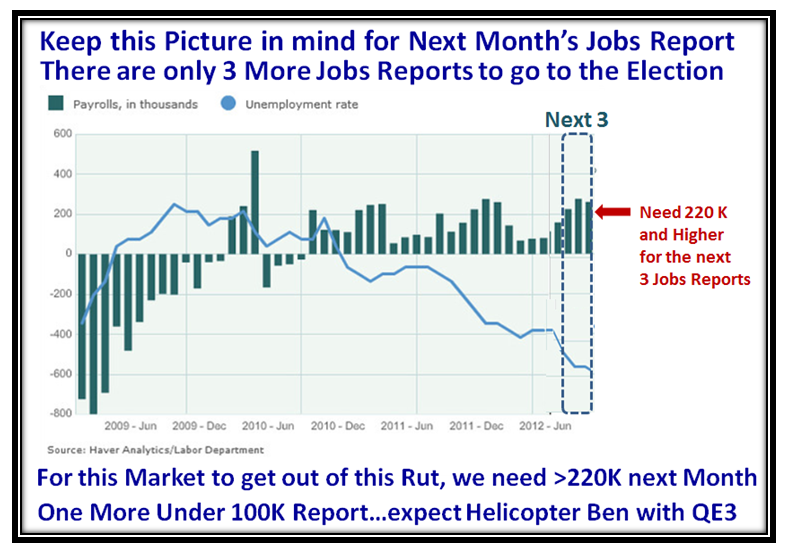

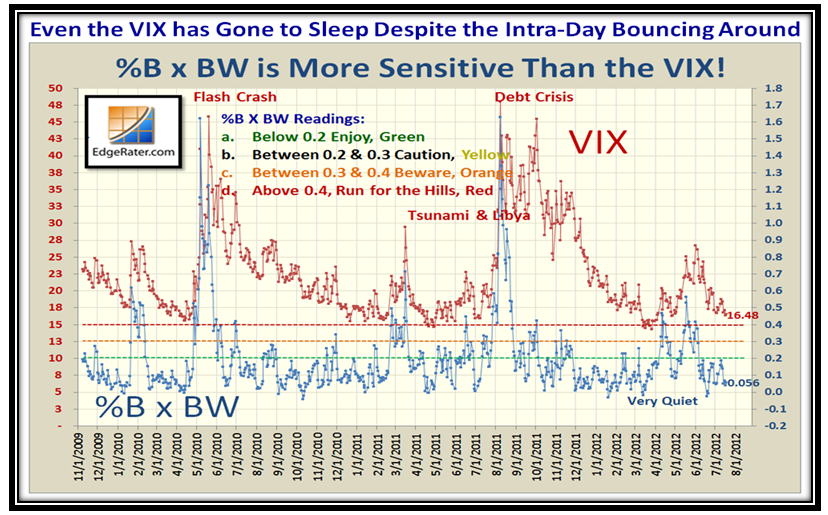

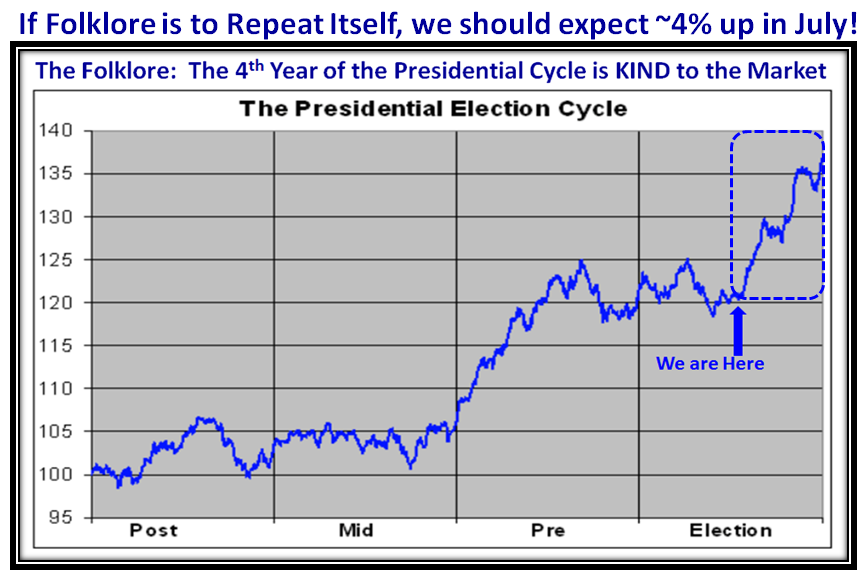

So now we are closing in on “Crunch Time”, with the Jobs Report only two weeks away. The buzz in this neck of the woods is that Helicopter Ben is ready to drop leaflets again if need be, but I am sure the FED will wait to see if the report is good or dismal:

I hope you enjoyed this update hot off the press.

Best Regards,

Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog