The Woody Indicators: Making the Right Moves at the Right Time

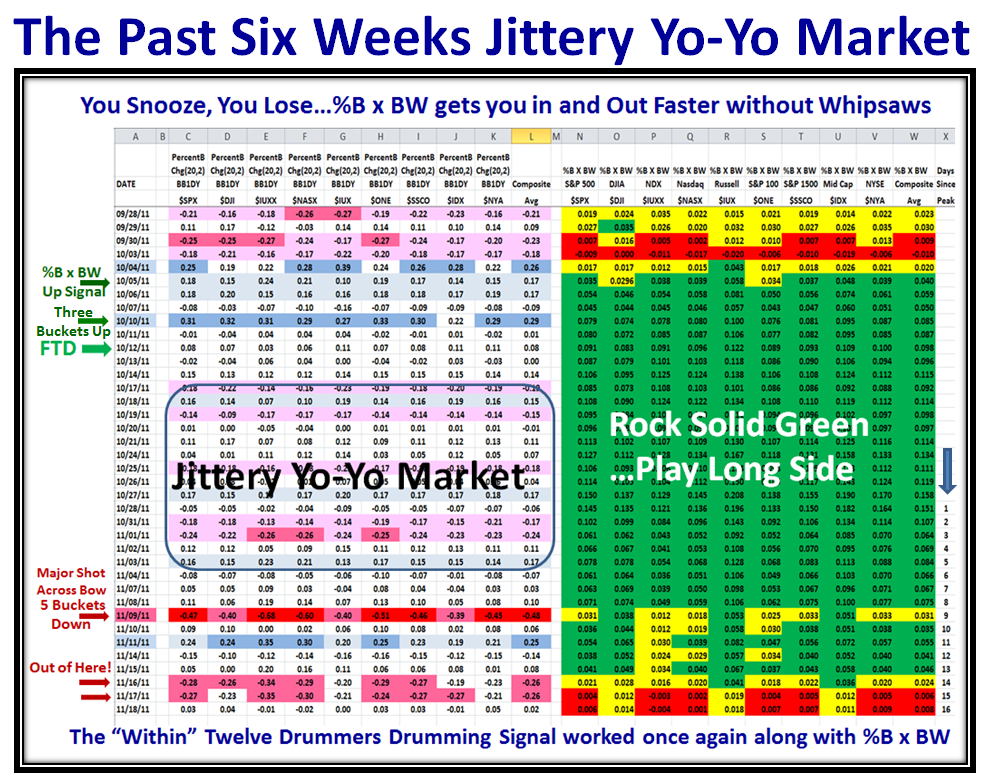

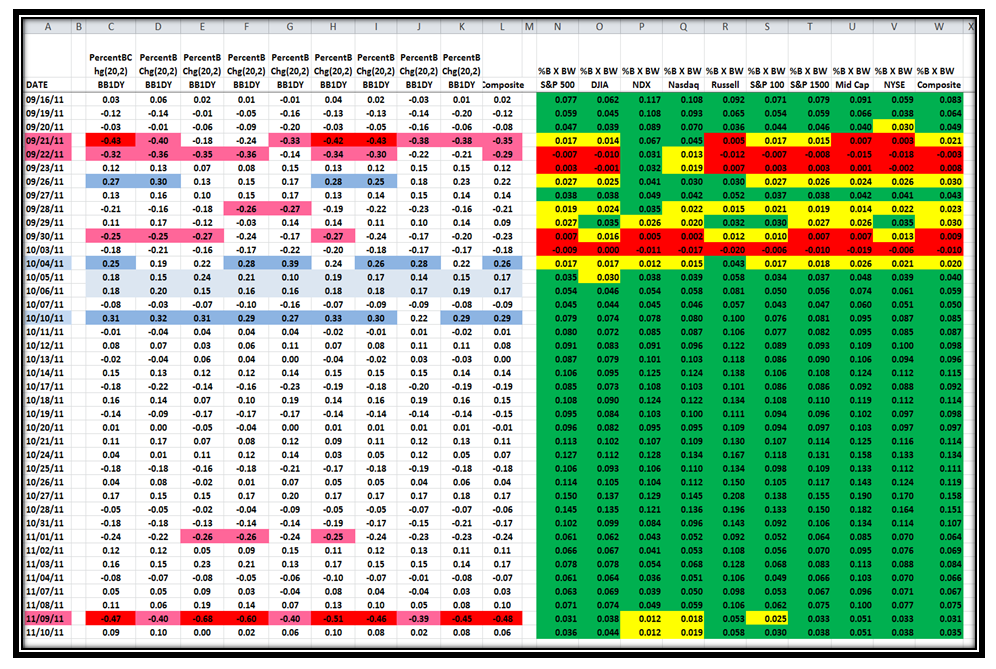

Thursday, December 1st, 2011I am delighted that you folks have seen the value of this latest Woody Indicator, and have already scraped it into Trade Station. Hopefully in time, you will find more value by having all this handed to you on a Silver Platter in EdgeRater. You are also aware that the HGSI software will include the %B x BW and %B x BW 1-Dy Chg in its list of factors in the next upgrade which will enable screening, slicing and dicing. Hopefully we will also see a similar feature to that of %B in the Charting Module so that we can have our cake and eat it without the need for the VFB feature.

Frank asks a couple of questions:

So Ian, rally should go first and test the 405 on the Nasdaq composite at 2700 and then the peak at 2880?

I’ve programmed %BxBW into Tradestation. Just to make sure >= .03 green <= .01 red, rest yellow?

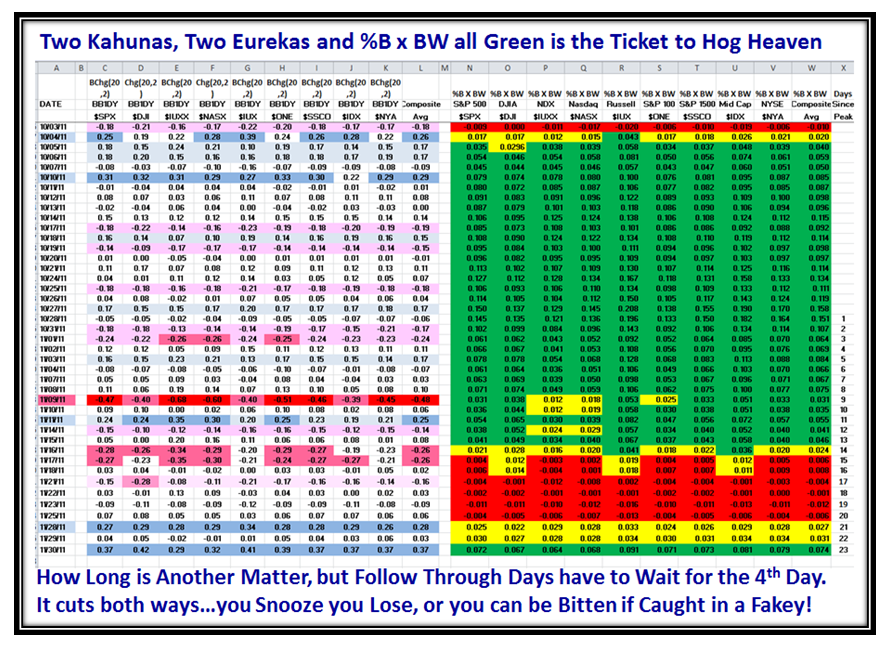

The answer to your second question is “That’s correct”…until we gain more experience.

Now for your first question:

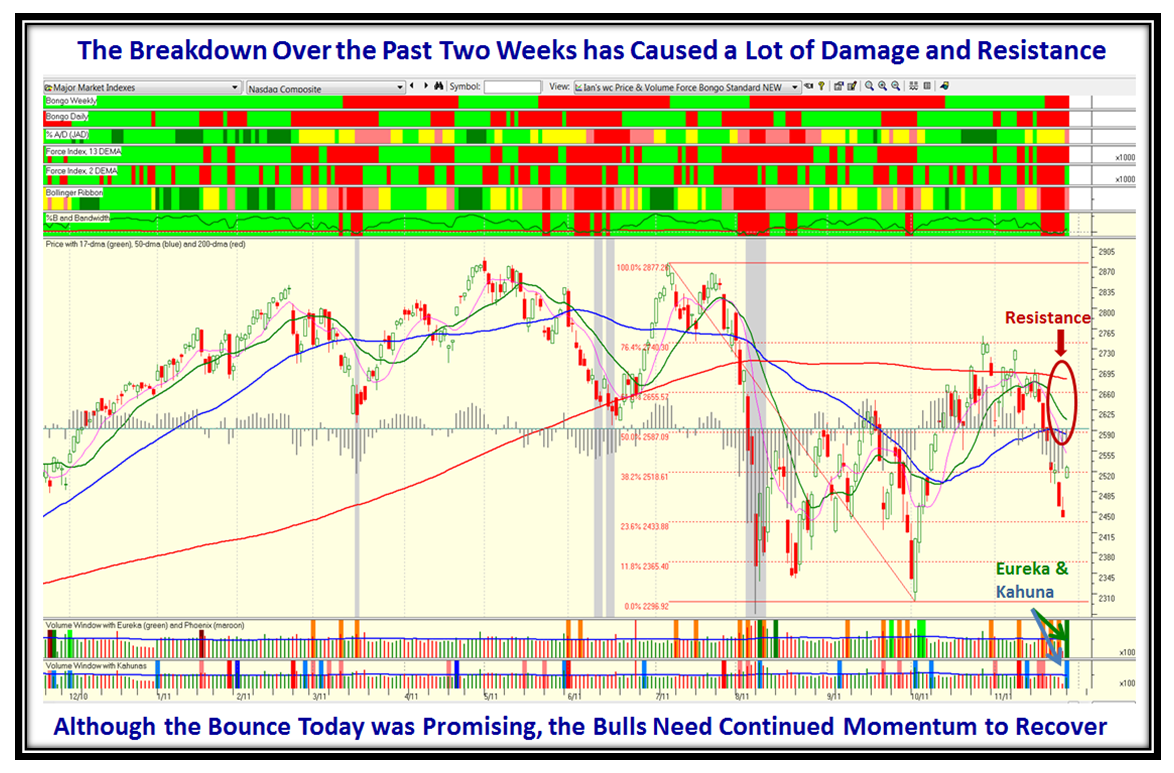

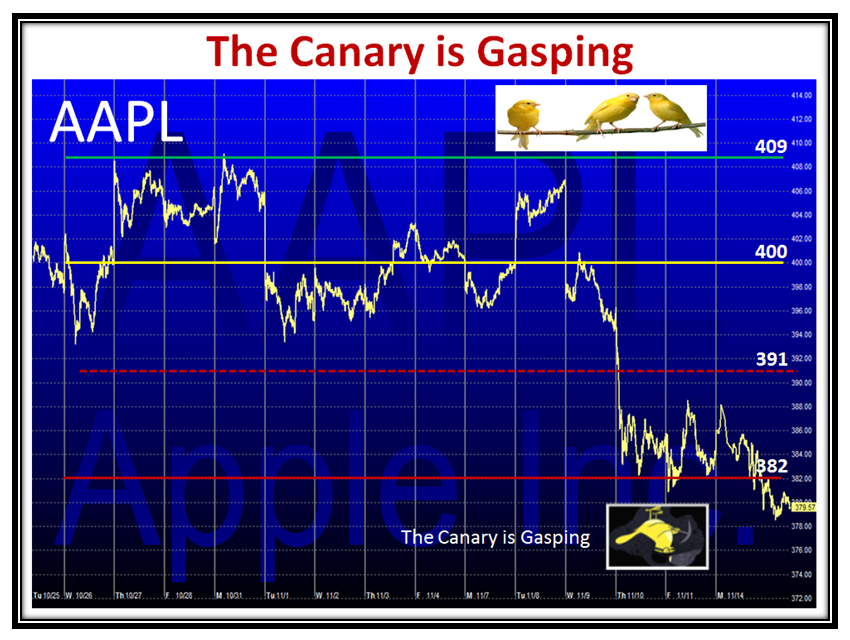

1. The 200-dma is the first and most important hurdle. The Nasdaq has been turned back three times so far and it should not be a surprise if it meets the same fate this time.

2. The News item for tomorrow is the Jobs Report and already the pundits are signaling problems

3. However if it can hold this weekend then the next hurdle is the 405 Freeway at ~2700 (DTL from Highs)

4. Let’s assume for a moment that it makes it through that hurdle, then it’s on to 2800, before it gets to 2900

I trust you faithful followers of this Blog realize that I call it like it is so before we get too excited about the Santa Claus Rally, it always pays to assess whether your stomach will allow you to get caught up in the moment. With that in mind, please understand it is a case of Risk vs. Reward, and only you can decide whether you feel comfortable, especially if you are a Longer Term Investor. I am sure you also know that as a general rule the biggest gains on a True Rally are made in the first five days or so.

Many of you have understood and watch carefully the 8% down rule, where invariably the markets will hold at that level and go back up ~75% of the time. Likewise, you also understand by now that once we get below that level, the flood gates open up and there is a mad stampede for the exits.

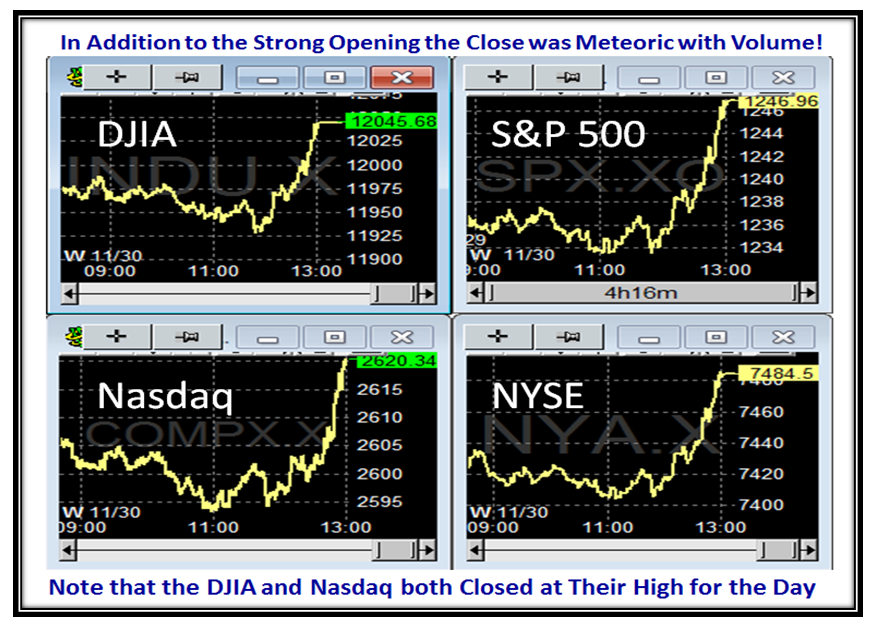

Likewise, that same strategy can be played to the upside, especially with the Nasdaq which conveniently can be played in steps of 100 points as you have often seen me use at round numbers going up from 2500. Why, you ask? 100 points up is 4% at a time and Markets tend to find support or resistance at round numbers. Hence the Fight at the OK Corral and Custer’s Last Stand invariably give you that Heads Up. Likewise, 12% up is the minimum for what one would call a decent rally, and it all depends on where you choose to get in. The longer you wait for your pet signals to trigger the more you cut into the cloth of % Gains for that particular Rally.

For the benefit of the Types 3 & 4 Longer Term Players:

5. Now do the Math:

Recent Low = 2441.48

Current Close = 2626.20

% Up = 2626.20/2441.48 = 7.6%

Next level = 2700…%Up = 10.6%

Next level = 2800…% Up = 14.7%

Next level = 2900…% Up = 18.8%

i.e., essentially up ~4% for every 100 Points.

6. The FTD has not yet been triggered… has to be on the 4th through the 9th day. So, it has already missed 7.6% of the Rally. Therefore, the very best one can expect = 2700/2650 (say) = 1.9%; 2800/2650 = 5.7%; 2900/2650 = 9.4%. Even the best number won’t cut it for a Successful Rally, unless we get above 2900!

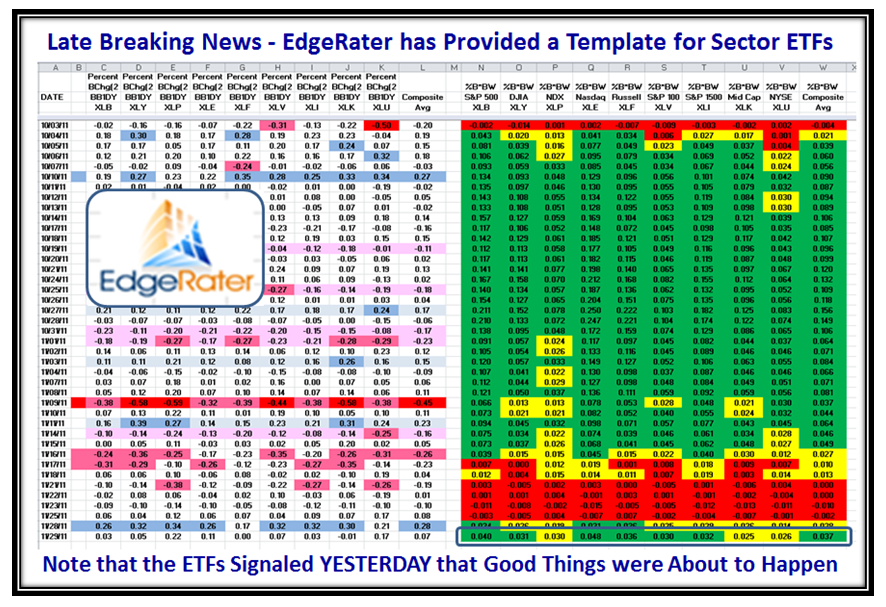

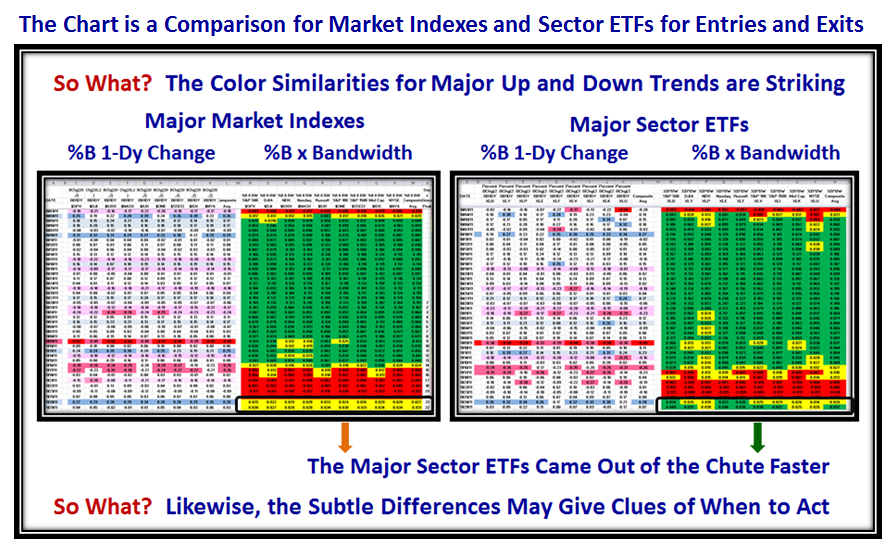

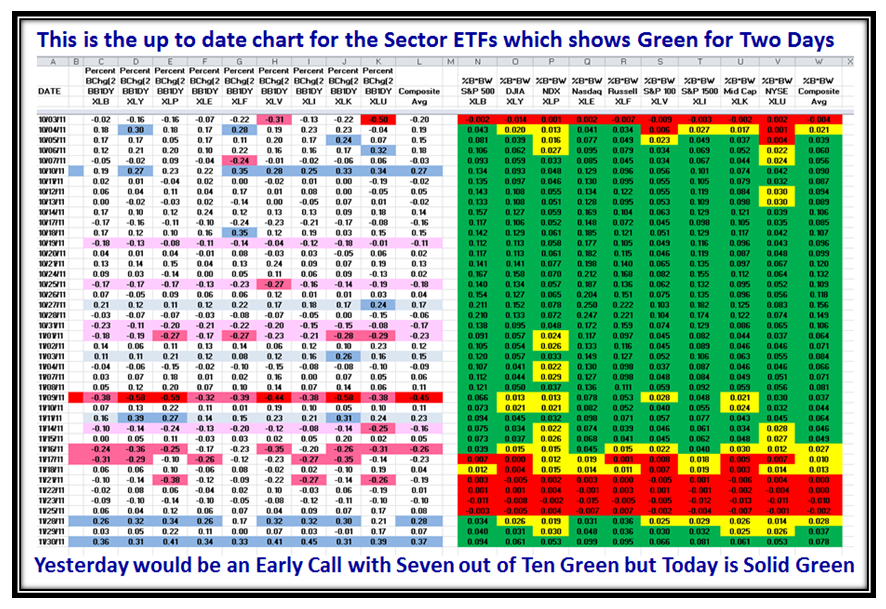

7. So What? Net-net, the best of moves which would be the signal 2-days ago from the Sector ETFs would put us at 2800/2507.72 = 11.66% and 2900/2507.72 = 15.64%, i.e., a “Successful Rally”, but it must get past 2800 first!

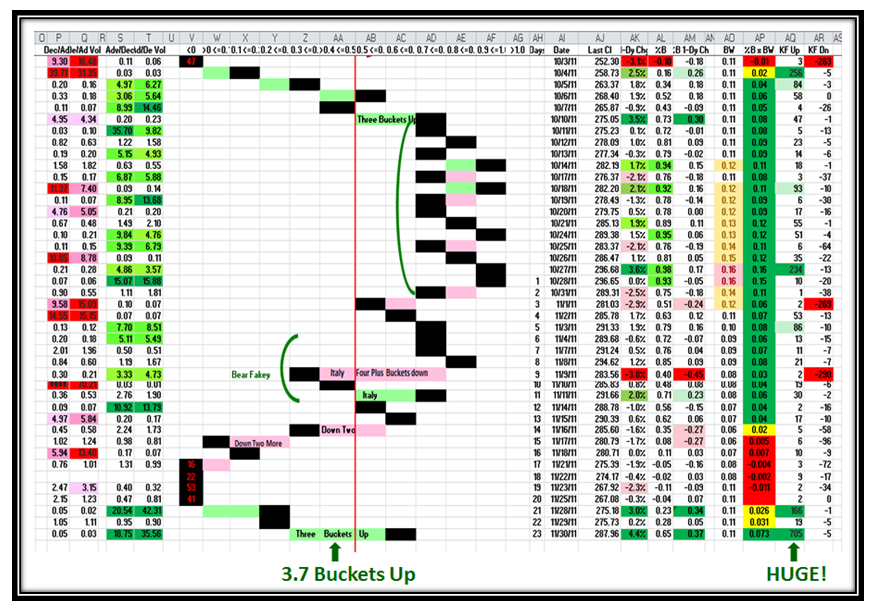

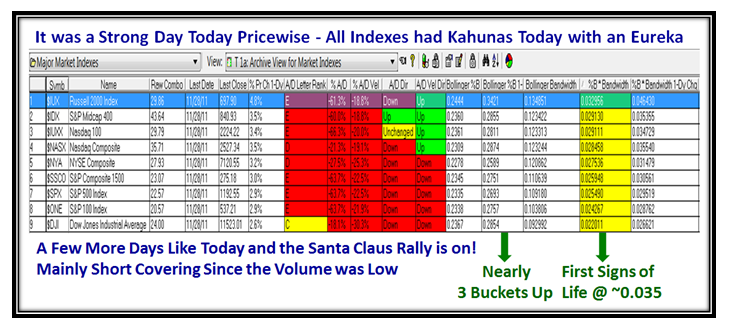

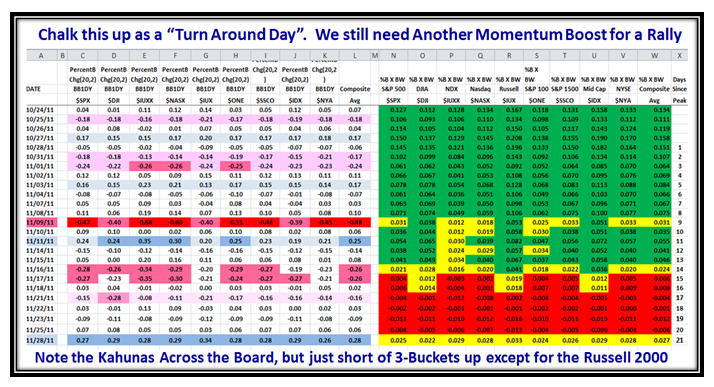

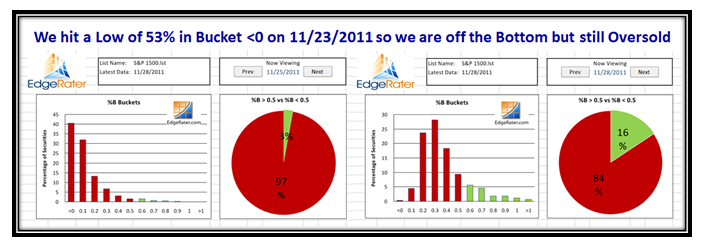

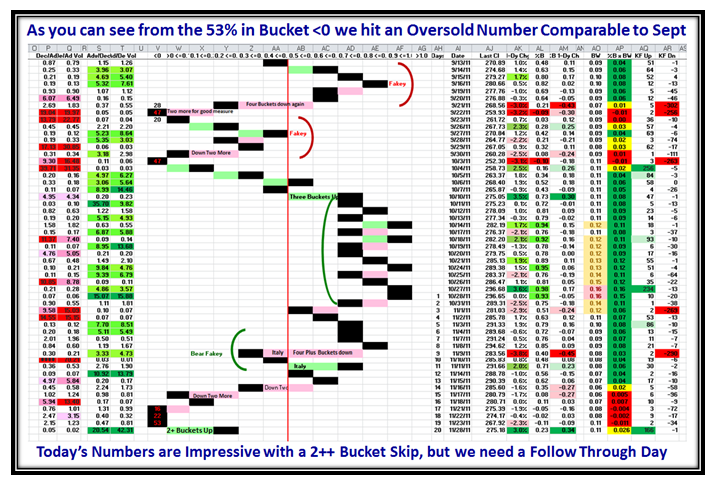

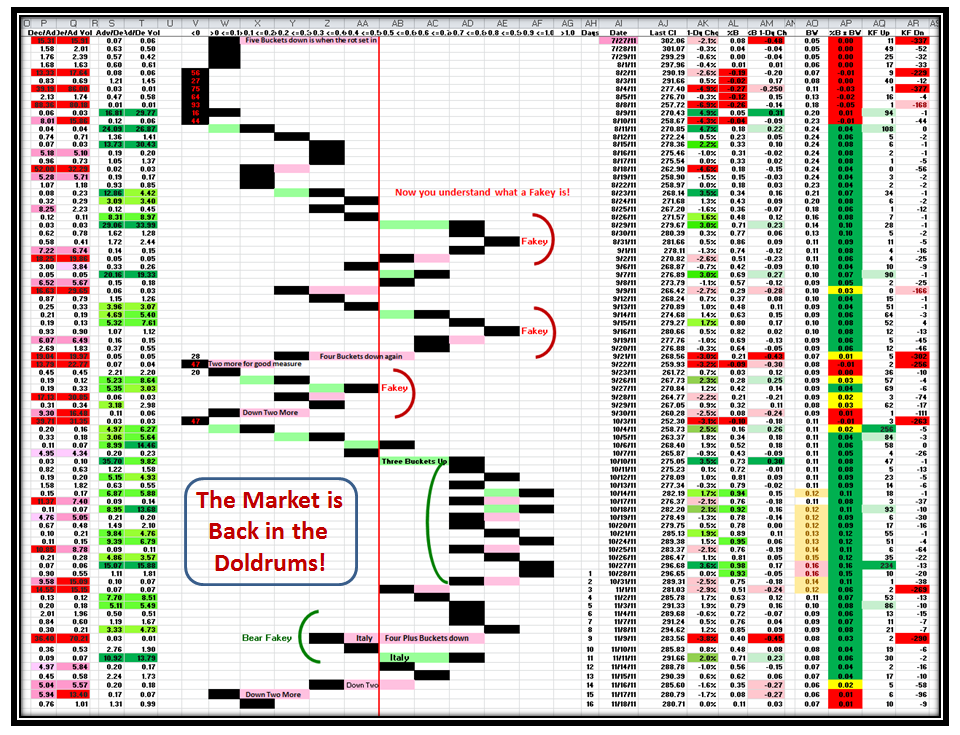

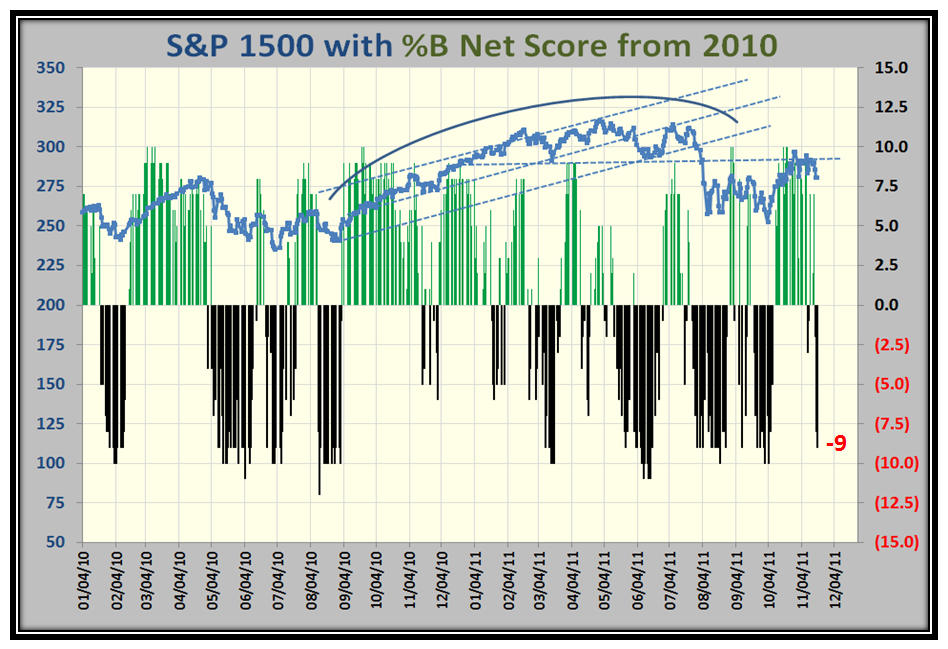

8. If you buy all of that mumbo jumbo (hopefully Good Stuff), this Santa Claus Rally can at best be for Short Term Type 1 and 2 Players only. But nine-tenths of the world these days are playing double and triple ETFs both ways, and turn on a dime, so that is why the “Woody” Indicator of %B x BW has major appeal along with the well tried and tested Eurekas and Kahunas. It gets you in sooner, keeps you in longer through Fakeys, and gets you out Faster when the world is rushing for the exits. However, You Snooze, You Lose! On the other hand if your stomach can’t take the heat, stay out of the kitchen.

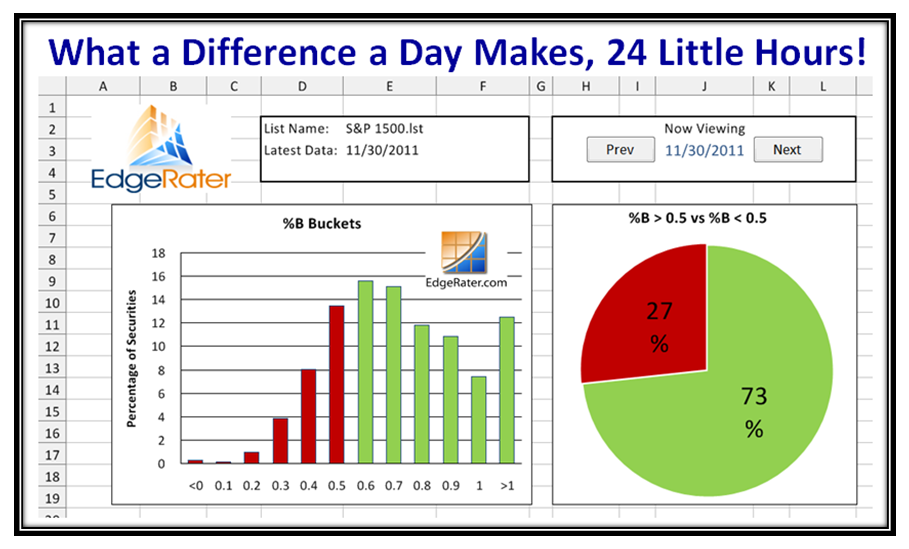

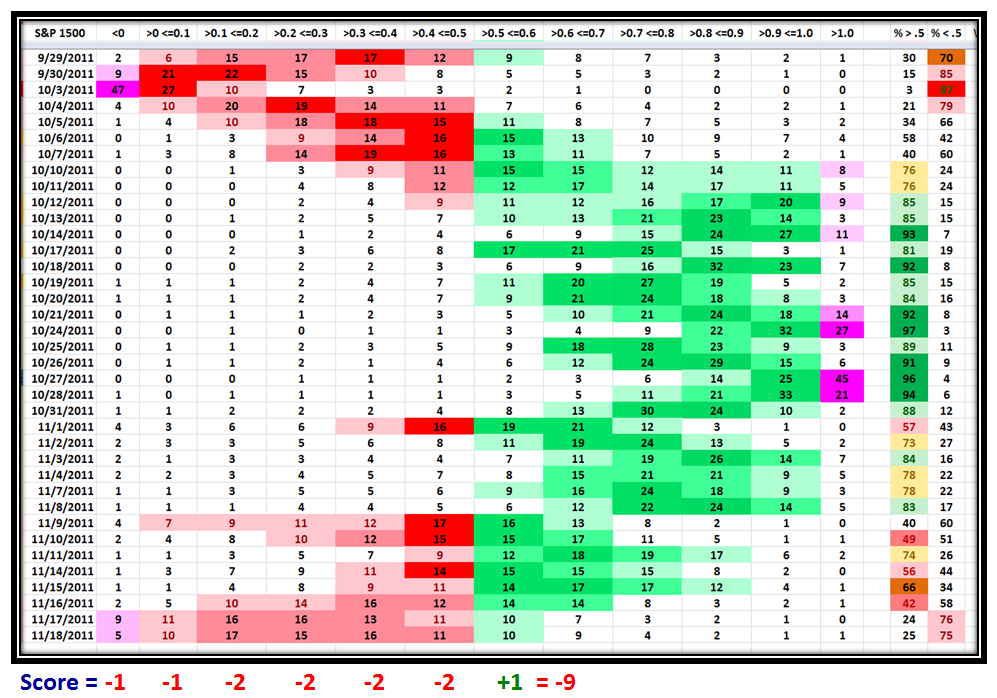

9. Three Buckets up and five Buckets Down on %B is Manna from Heaven.

10. Don’t expect a Golden Cross (50-dma coming up through the 200-dma) until March 2012 at the earliest, in time for the next HGS Investor Seminar if we are that lucky AND we push up through 2900, which has been the sticking point for 12 years when the Tech Bubble took off into the Ethernet…pun intended!

So What? This Rally is for Short Term Players, don’texpect miracles, and beware of Fakeys, i.e., Bull Traps!

Best Regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog