Archive for the ‘HGS Principles’ Category

BullsEye on the Markets, ETFs and Stocks

Saturday, May 8th, 2010One of my favorite sayings is “Keep a Beady Eye On….” Over the years I have also given you the BullsEye on the Markets, ETFs and Stocks as I now chalk up going into my fourth year on this Blog. Those of you who are our strongest supporters know there is always a tid-bit of information in each blog note relating to which way the wind is blowing, if you would only take the time to look for it. This is a “Teaching Blog” and gives something back to those who are eager to learn.

Over the course of the last six weeks here is a synopsis of those clues to stiffen up your backbones that Impulse Indicators in the HGSI Software give you eyes in the back of your head…if only you will take the time to look and use them.

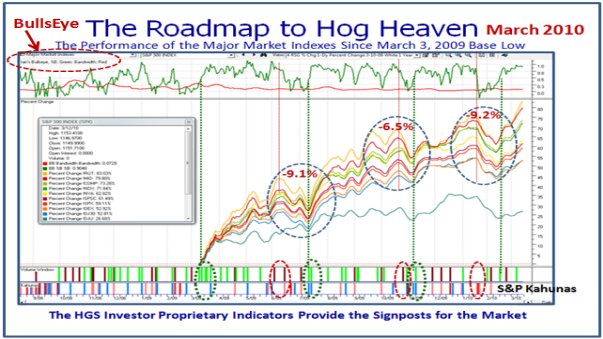

March 30th Blog: “The single most effective slide that shows the power of the product’s strength is its proprietary Indicators as shown in this next slide. Now that we have a year’s worth of this booming rally, a picture is worth a thousand words to show that power”:

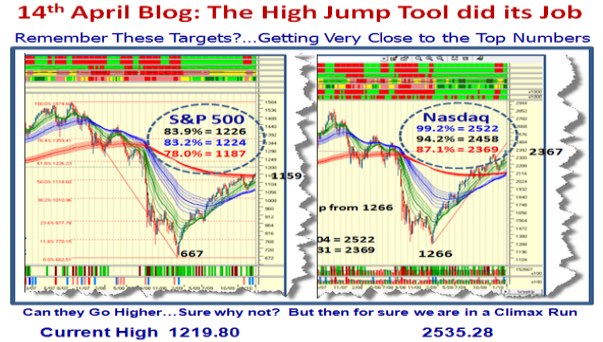

Fast Forward to 14th April Blog: Recall the Targets I gave you at the seminar and have since posted twice on the blog…it suggests we are very close to the top for now. I have updated the final Highs on the chart for your convenience:

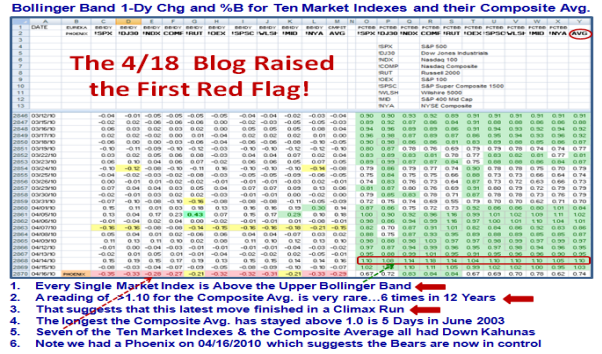

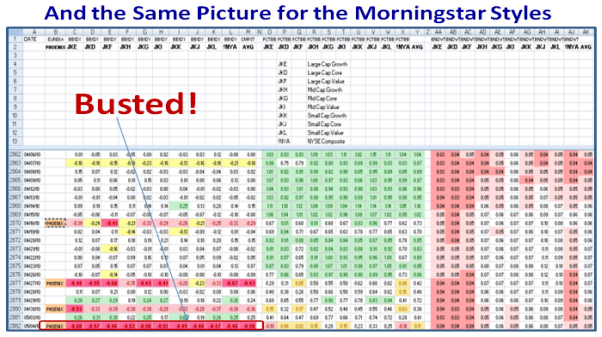

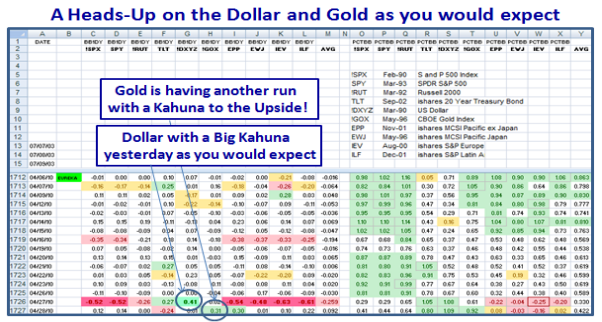

18th April Blog: My sincere thanks to Messrs. Bill Roberts and Tom Ellis for this spreadsheet, which gives us “Eyes” in the Back of our Heads”:

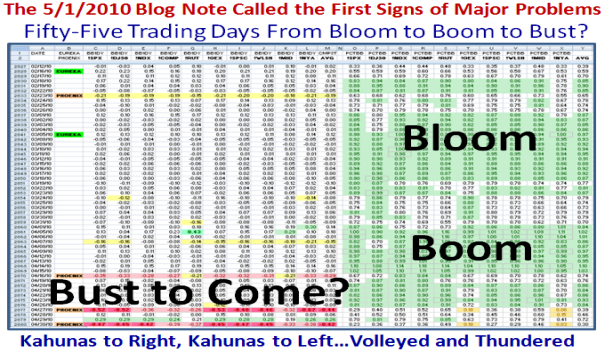

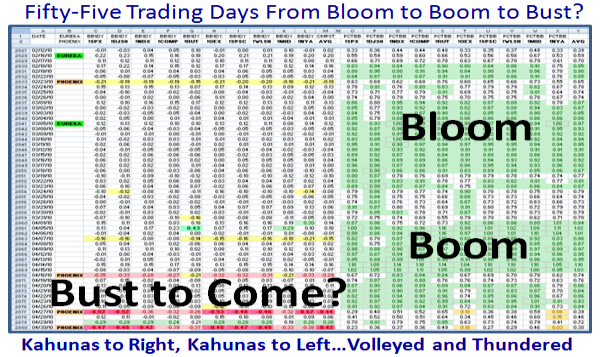

May 1 Blog: Gave you two views that said “Bloom, Boom, Bust to Come?”

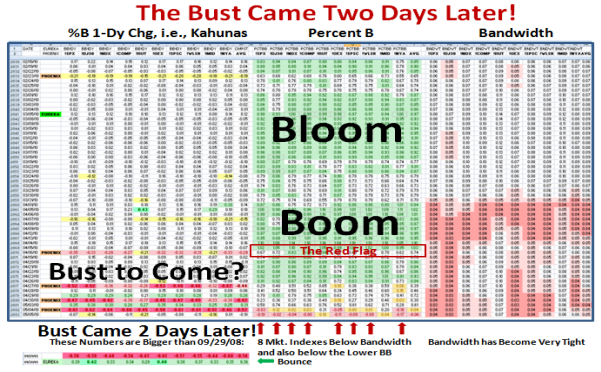

The bust came two trading days later on 5/4/2010 as I explained to the HGSI San Antonio Group last Thursday in a Webinar that Ron and I did for them, where I used the following slides at that time:

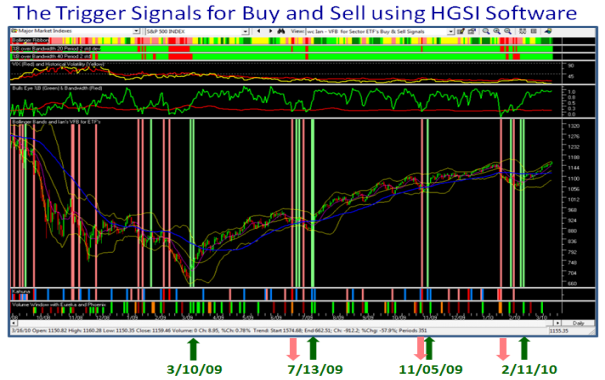

So I am sure by now, some of you are saying “That’s all very well, but Where’s the Beef?” It’s the Impulse Indicators that give the Trigger Signals to be found in the HGSI Software. Here’s a teaser for you:

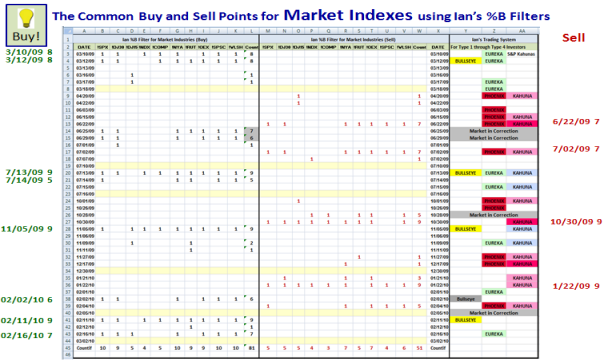

But more importantly, the message is that they all fired on the same Golden Dates of 3/10/09, 7/13/09, 11/05/09 and 2/11/10. That should stiffen your backbone.

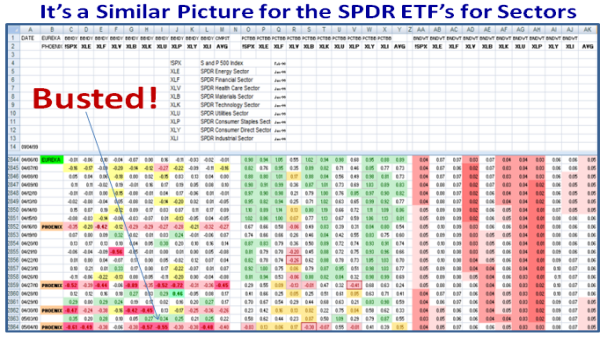

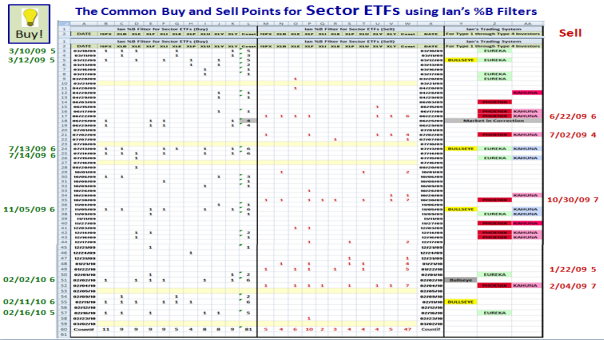

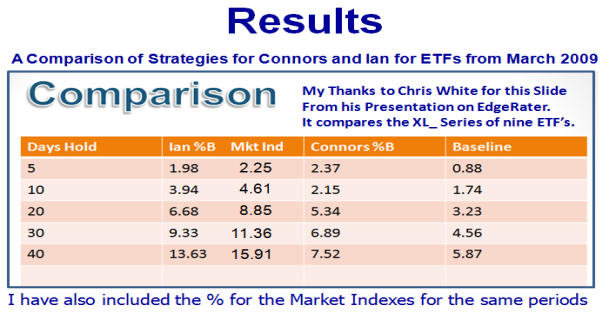

If that is not enough, you ETF Fans had the same signals:

And if that is not enough, anything beyond 5 days makes this technique a better winner!

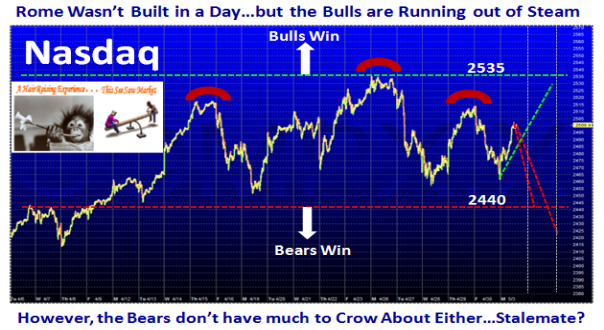

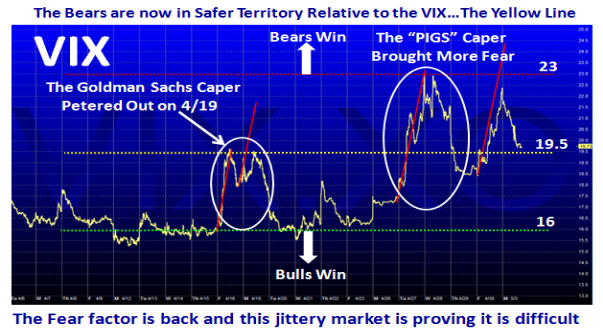

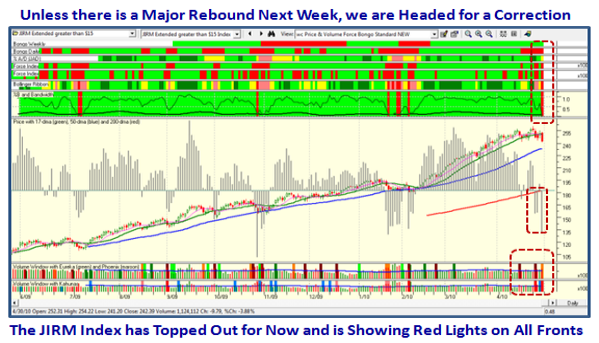

Late Breaking News…I don’t have to tell you: bottom line we are in a mess:

Hurry, hurry, hurry to Dallas where my good friends Ron Brown and Dave Steckler will be speaking at the MTA Associations Seminar next weekend and hopefully can point them to this Blog on the subject, while I enjoy some R&R with my Family. Furthermore, sign up now for the HGS Investor October 23 to 25 Seminar or send me a note to ian@highgrowthstock.com to put you on the list of possible attendees.

Best Regards, Ian.

Stock Market – Something’s Got to Give!

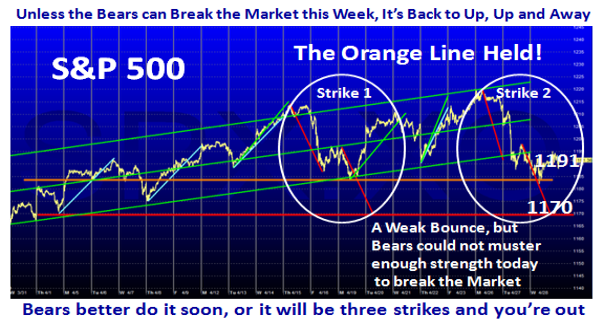

Monday, May 3rd, 2010The Stock Market is gradually coming to a Tipping Point, either up or down. Like Old Soldiers that never die but gently fade away, it is taking its own sweet time to cave in, and the count is Strike 2 and Ball 3!

We will surely know which way this Market will go before the week is out, but I said that last week. We can point to Head and Shoulders in the making, but then again, it only needs another couple of days push to the upside like today and we we would be pushing through a double top, so it’s all a Hair Raising Experience:

1184 is once again intact on the S&P 500, and there is breathing room for the Bulls to hold the line:

The VIX swung into high gear last Tuesday on 4/27/2010 with a >5 point jump in one day, leave alone two which is the normal yardstick one sees when things are beginning to turn, so the Fear Factor cannot be discounted.

Yet, some Leaders are still showing resilience as exemplified by AAPL, which has regained the higher ground. It now needs to breakout to be convincing in its Leadership to propel the rest of the JIRM leaders to New Highs:

Keep your Powder Dry.

Ian.

Odds for a Market Correction are Ripening

Saturday, May 1st, 2010Don’t want to be that alarming, but we can be in for a Minor Correction next week to start with.

It’s in the Balance as the Bears have already had two shots across the bow, and yesterday was the first leg of the third shot. Each time so far they have been thwarted , so we shall see if they break the Rally to the downside on Monday.

The next two charts point to the Leaders…when push comes to shove, always focus on the Leaders, and the most recognized of these is AAPL, so keep an eye on that one. It had great Earnings and produced a substantial burst to the upside. The question is whether it can hold at support or show signs of a correction to 8% and then 10% down as shown. Alternatively, if it holds, it will be a good sign for Up, Up and Away.

And then there is the JIRM Index which I have been featuring of late…it showed strong signs of being tired on Friday, and ominously like testing the 50-day Moving Average:

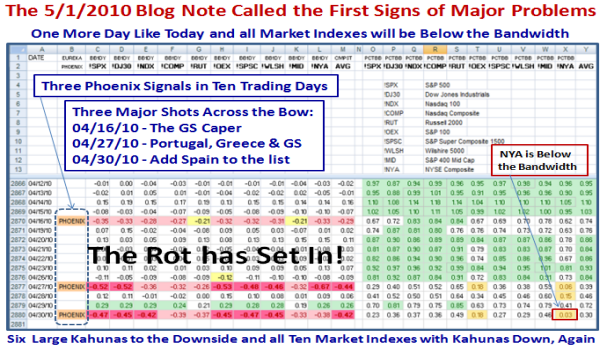

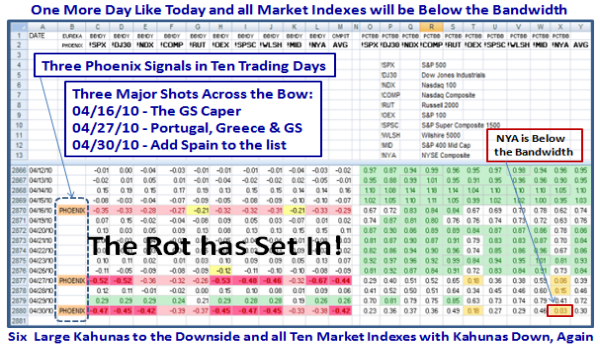

The Rot has set in with the third Phoenix in ten days and that usually suggests we are heading down for at least an 8 to 9% correction on the S&P 500. The NYSE Index is already below the BB Bandwidth, and the others do not have far more to go to join it to the downside, all currently below the middle band.

In fifty-five Trading Days we have gone from an Eureka to signal the start of a new Bloom to Boom as shown and now the question is do we now see strong signs of a Bust to come?

I have brought back a chart we haven’t seen in a long while as the Bears have been starved for all of 14 months as shown by the Ratio of the Total Dollar Volume between the QID and QLD. It has reached its lowest readings and the question is do the Bears now have their turn at a feast after a famine for so long.

Keep your fingers crossed and your powder dry.

Best Regards, Ian.

Stock Market – “PIGs” Fight Back!

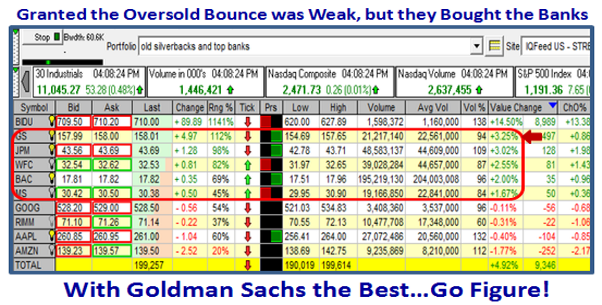

Wednesday, April 28th, 2010Maybe Hellicopter Ben came to the rescue today by announcing there would be no change in Interest Rates, or maybe it was a weak bounce from a badly oversold market, but the Banks were strong today with Goldman Sachs making the biggest gain…go figure!

Let’s see if my suggestion that the Bears must get cracking by this weekend or this market is headed up again one more time comes true. The Orange Line held:

It seems from the number of hits I had yesterday that many of you are enjoying the Bullseye picture which as you all know is the %B coming up through the Bandwidth and/or there is a big Kahuna which is a one day change in %B either to the upside or downside. Here are a couple of tidbits for you again today:

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog