Ian’s Musings – Some Principles of HGS Investing

Saturday, November 3rd, 2007Over the course of the last four months I have shared with you many of the Principles I espouse for High Growth Stock (HGS) Investing, and I hope you have begun to see a pattern in how I approach the Market, the Industry Groups and the Stock Selection. I covered many of these principles during the three day seminar we held last weekend and it seems fitting to recap a few of them that are most pertinent now.

- Never try to second guess the direction of the market…let it tell you where it is going. However, that does not mean that you do not prepare yourself for the direction it takes by at least identifying three scenarios for up, down and sideways.

- Skeptics say that History never repeats itself, and they are almost right, but it is uncanny how the lessons learned from History give us certain rules of thumb in order to develop a game Plan. I use them all the time to tell which way the wind is blowing, the size of the current ballpark in which the game is being played, and where the important boundaries are for reasonable next moves.

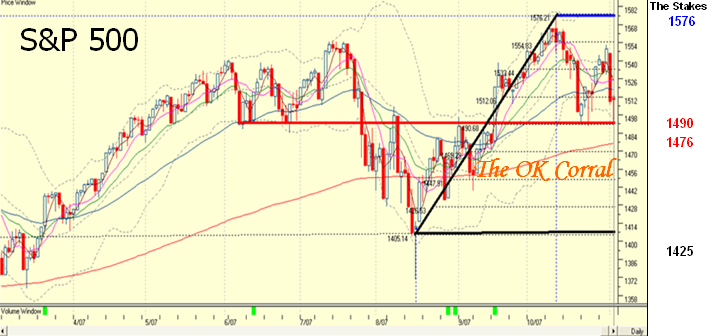

- I call them Stakes in the Ground, and time and time again these simple stakes give me a compass for the direction of the Market and the decisions I must make to buy, sell or hold. More importantly it tells me the shades of grey to apply, i.e. whether to lighten up or jump in with both feet. Black or white decisions are easier to handle than the numerous shades of grey we face every day in our lives. At this juncture, the Stock Market has played into our hands and we have two Stakes in the Ground depicting the black and white:

- The recent bottom that occurred on August 16 which we call the Base Low

- The most recent top which happens to be slightly higher than the previous one

- It’s amazing what one can do with those two simple stakes to determine the size of the ballpark in which the tug-o-war between the Bulls and Bears are currently playing, and who has the upper hand depending on whether we are above or below the 50-yard line and who is carrying the ball at the moment. I’m sure you now know that the Fight at the OK Corral is always between the 50-yard line and the Base Low. All of this may sound very elementary to you sophisticated Technicians who use Fibonacci, count Elliott Waves and spy various proven shapes and forms, but it is always surprising to me that so many make such a big deal out of trying to decide whether to tip toe into the market or get out when the market reverses direction. What I am referring to is indecision, that Ready, Aim, Aim, Aim and never “Firing” syndrome we are prone to get into when confronted with the important decisions.

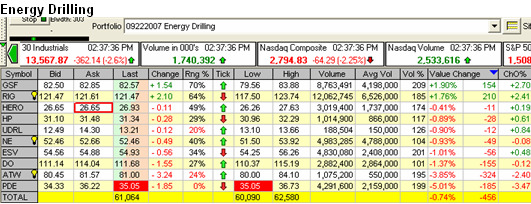

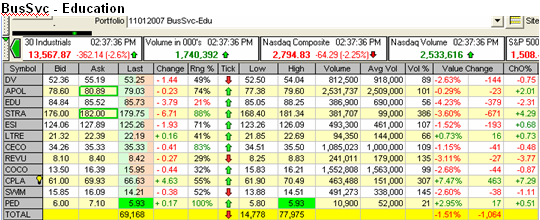

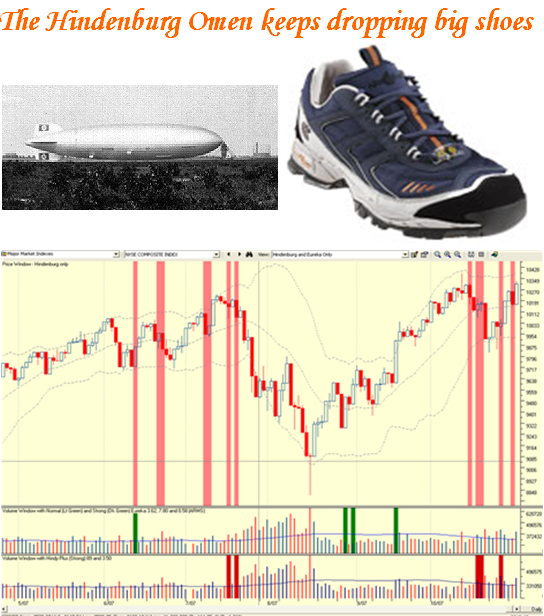

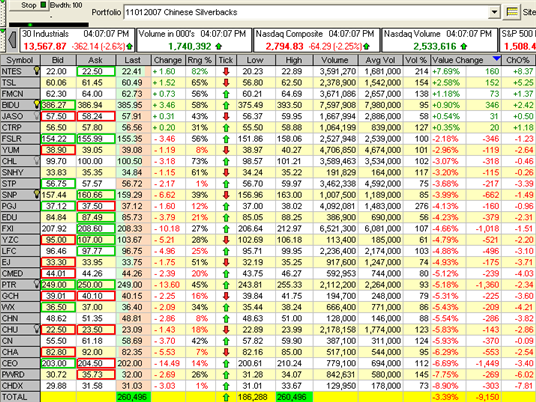

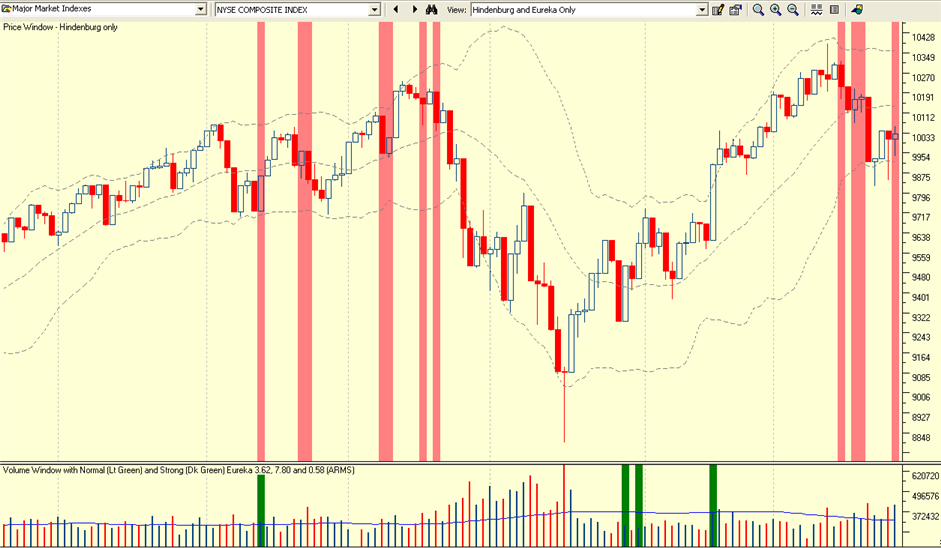

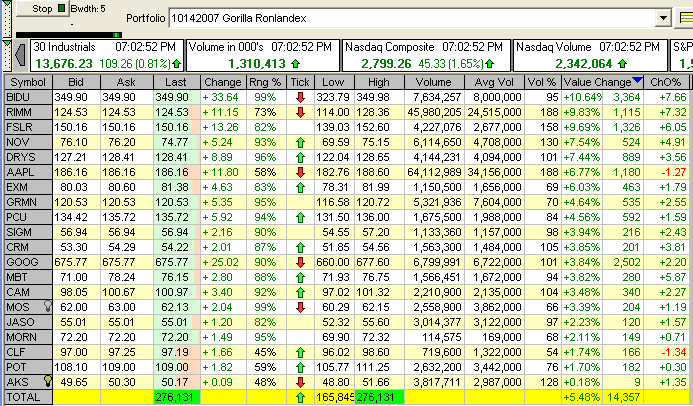

- At this juncture, you must realize from all the past notes that we are cautious and sensing the possibility of a major correction since there has not been one since 2002. Hindenburg Omens are more frequent these days and although they don’t promise more than a 5% correction to come in the S&P 500, they usually appear at Market Tops signifying irrational exuberance by the amateur and stowing away the profits by the professionals. Furthermore, when we look at the so-called Internals of the Market, we note there are more “E’s” than “A’s” for distribution and accumulation, respectively. This in turn implies that the market is gradually coming down to a select few stocks that are the gorillas still leading the market upwards. Fresh from the Seminar where a young tiger sitting in the front row coined the term Silverbacks immediately taught this old dog a new trick…and silverbacks they will be from now on. These are different from run of the mill leaders in that they are stocks that have reputation, have halo, are names instantly recognizable. The key ones this time are GOOG, AAPL, RIMM and GRMN. But there are others which have established a reputation for being the top two stocks in their Wolf Packs, such as DRYS and EXM in the Transportation – Shipping Industry Group, and POT and MOS for Chemical – Specialty, as examples. The most important trait is that they are all rising above their 9-dma and invariably above the 4-dma for short periods, meaning they are the most in demand. Net-net Silverbacks rise above the 4-dma. Note that GRMN has recently broken that trend.

- I know there is a dear lady with her husband sitting in sunny Florida that now fully understands the meaning of playing Snakes and Ladders with their money, but still need a guiding hand to show how I think in sifting difficult problems into threes to determine the best path to take. So, before this note turns into a bunch of platitudes, let me show you where the ballgame is being played and when to turn from bullish to bearish based on the Base Low and the recent Top.

The Playing Field for the S&P500 is the Top with a stake at 1576. The Critical Line in the Sand is the red line at 1490, just above the 200-dma at 1476. The fight at the OK Corral is between 1490 and 1425, the New Base Low until and if that Stake is uprooted. I used the 1/8th tool in HGSI for the demarcations…I wish they were tenths which would make it a football pitch.

- Your job is to decide when your Portfolio has taken a sufficient haircut that you can’t sleep at night and your stomach (meaning your risk/reward preference) can’t take it any longer. Usually by then you will be saying “shoulda, woulda, coulda”.

- The Bulls still have the ball just above the 50-yard line; they nearly fumbled it on Friday. Notice how they have always recovered it from the Bears at that line going all the way back to June. Always look for STRONG support lines and that is now at 1490.

- The Last Call is always at the 200-dma which is at 1476.

- After that, which tool helps you the most…the Low Jump or Limbo Bar? 3% down from the 200-dma takes us to 1442 and 6% down is 1387, so it will be right down to the Base Low at 1371 …between friends. Now you have a Game Plan and the only job for you is to execute. An exercise left for the student is to do the same thing for the Nasdaq and show it to your spouse!

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog