I’m Sitting on Top of the World

Tuesday, September 25th, 2007After just five weeks of turmoil, grief, and then joy who would have thought that we are just a stones throw from reaching a double top on the Market Indexes. Never count your chickens before they are hatched, but I thought you would enjoy a view from the Top of Mount Everest. Having planted a flag in one of the earlier notes to declare the Bulls as winners of Round #1, which was to get above the Major Line in the Sand for the Nasdaq above the 50-dma, our next objective is to hit double tops or better on the Indexes and earn that view while sitting on top of the world. Before we look at that challenge, let’s review the bidding on “Whence we have come from” and what we have learned.

-

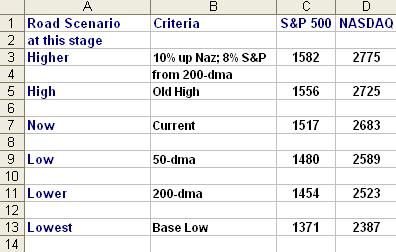

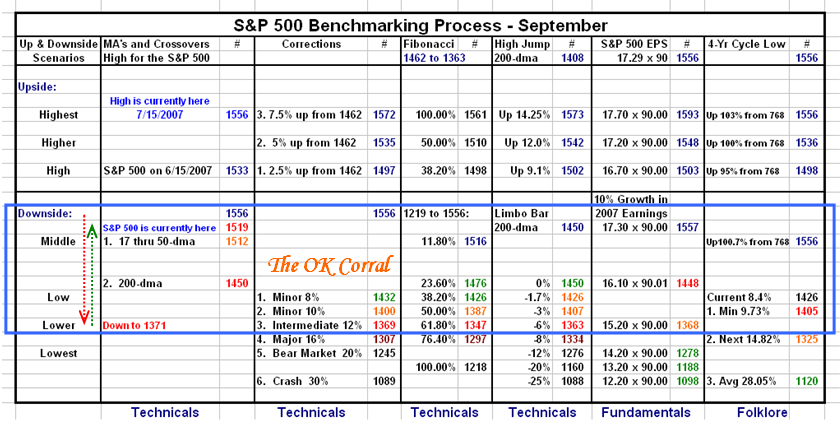

. After a recovery from a low, we need to plant the Base Low. That is the starting point for the next leg. If it fails we uproot the Stake in the Ground, but once we get into new high territory, it becomes the New Base Low. That Base Low for the Nasdaq is 2387 and for the S&P 500 is 1371.

-

Recall I said that “V” bottoms are very rare, but this time we had one. Every single one of us were waiting for a retest of the lows, but in marched the Grand Old Duke of York, Ben Bernanke with not one but two magic wands. The lesson learned is to never underestimate what the Fed will do, especially when it comes to propping up the Financial Industry. For sure the Bears feel cheated, but their day will come later.

-

We need to step back one phase and recognize that the big hue and cry was that we hadn’t had a 10% correction in over four years and once we reached a climax run to the top, it was painfully obvious that with all the media hype that correction had to be achieved. Please understand that the ground rules for measuring the correction is from the IMPRINT High to the IMPRINT low and not from Close to Close. So as far as I am concerned that requirement has been met as we had an 11.7% correction on the S&P 500, which was all the folklore fuss was about in the first place. For the record, the Nasdaq had a 12.4% correction, which as we well know also meets the criteria of an Intermediate Correction.

-

What we also learned is that if one is to have a V bottom then we need to see a reverse Head and Shoulders, which is the strongest formation one can have to battle the possibility of a double bottom. You will recall I showed you that with my Sherlock Holmes Flyspecking picture.

-

Now I know that many of us did not want to test the waters especially as I emphasized that we had never had so many days with 200 points up and then down and then up again all within the span of a week. I called it a yo-yo market. Don’t forget this clue…a low above a low above a low is usually a sign that the market is repairing and when you have the same of three higher highs then for sure it is time to pull the trigger.

-

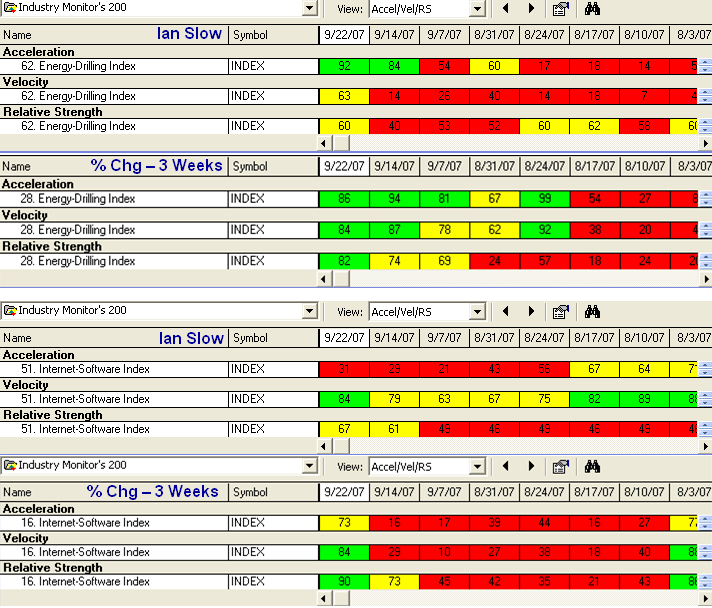

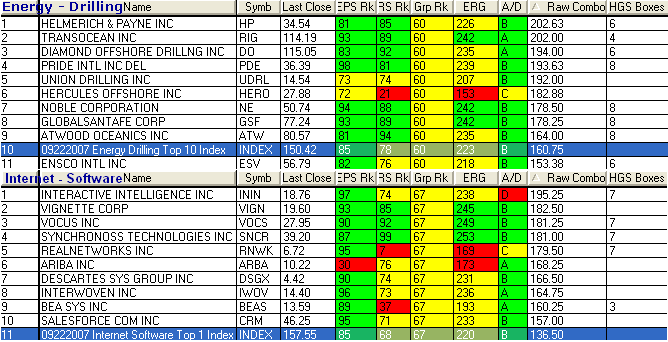

Another objective is to make sure that the Market Indexes are above the 50-dma, and then select the one index which has exploded up the best, in this case it was the Nasdaq 100 (NDX). Once you have spotted that, focus on why and go with the leaders. The reason is that with the reduction in rates the dollar was weak and therefore favored Large Cap Multinationals, and since the Financials had been trashed there was need for Technology to take up the slack. Besides, I am sure you will recall that the second quarter EPS reports for the usual suspects were excellent such as RIMM, GOOG, AAPL, CSCO, etc.

-

We learned that successful Bounce Plays need to achieve at least 10% to 11% before there is a hope that the Indexes have a chance to recover from an Intermediate Correction.

-

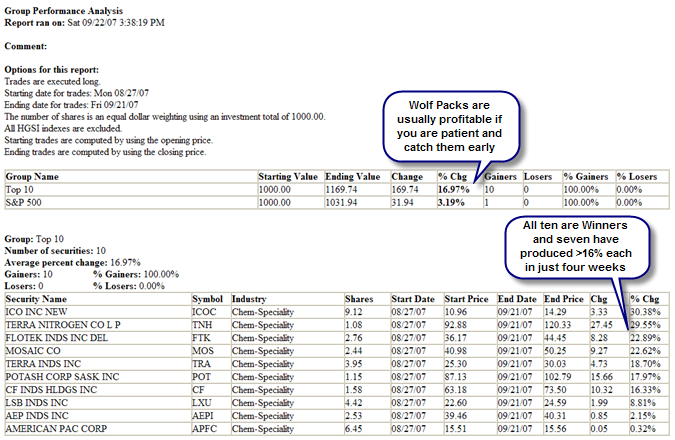

Along the way we learnt the value of spotting Wolf Packs, and that if you are patient one can make >15% in a month which is not shabby. Likewise, it is wise to pick stocks that have decent ERG but are true leaders with an RS of 87 or greater. We proved that with the Game Plan Index.

-

Anyone who hasn’t participated in this rally is now scratching their heads since they are staring at double tops which are not far away. With that big boost from Bernanke when the Nasdaq and all the other Indexes had a huge up day on September 18 with the Nasdaq hoisting a Flagpole of nearly 70 points, it was only natural to expect the makings of a flag, i.e., a pause to refresh with the Market Indexes going sideways for the past four days to all intents and purposes.

The Upside Scenario: I recently reminded you that the Requirements for the next round for the Bulls to continue to win are:

- Drive to the old high at 2725. The Nasdaq is currently at 2683.

- Stay above the 50-dma on the downside which is at 2589.

After a brief pause to refresh, the Nasdaq must drive above the old high for the new bull run to be fully underway. The Lines in the Sand are between 2589 and 2725 for Round #2. The second leg of a High Tight Flag is a minimum of 70% of the first leg, and since we are but 57 points away, that next target of 2725 is certainly reachable. Beyond that, we also know how to apply the High Jump Rules of Thumb for both Stocks and Indexes. The most important one at this time is 10% up from the 200-dma on the Nasdaq which takes us to 2775. Therefore the odds are that if this Market runs up the second leg of a High Tight Flag that the correction will occur somewhere between the Old High of 2725 and the 10% High Jump of 2775.

The Downside Scenario: Unless the Nasdaq breaks 2589 on the downside, this market remains bullish. Note how the 50-dma now becomes the first line of defense and once broken then one resets the target to the 200-dma at 2523 and then the Base Low of 2387. Likewise with the S&P 500, the three downside lines in the sand are at the 50-dma at 1480, then the 200-dma at 1454 and lastly the New Base Low of 1371. Looking at the numbers for the 50-dma and 200-dma of 1480 and 1465 shows there is strong support now at that level, and any breakdown below this would be viewed as significant.

I gave you the entire process in the blog called “The Road to Success – Following the Signposts” including the Road Map for the various scenarios, so use it and come up with the equivalent for the Nasdaq and now you are golden. The Market tells you which road we are on, and not you trying to dictate where you wish it to go. It’s not difficult if you stick to these Principles of High Growth Stock Investing.

Summary Simplified Plan:

Best Regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog