Overview – September Newsletter

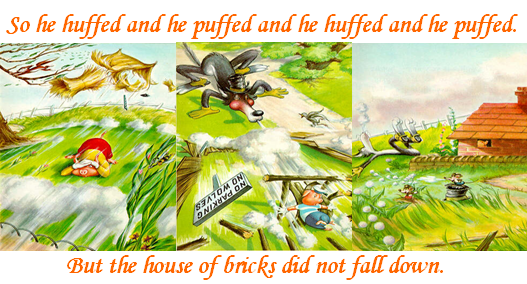

The Big Bad Wolf huffed and puffed twice and blew the house of straw and the house of sticks down, but try as he might, so far he has not been able to do any damage to the house of bricks. After the initial drop to a precipitous low in mid-August the market has righted itself with a respectable Bounce Play, and is now waiting for its second wind to hopefully return to its old high. We have one more big item of anticipated news next week when the FOMC meets on September 18. Then either there will be gnashing of teeth or hoorahs depending on whether Ben Bernanke lowers the Fed Funds Rate or not and by how much….25 or 50 basis points?

I hope all of you are enjoying my Blog, which is a challenge, but I hope it gives you a blow by blow assessment of the market in these tricky times. I have some good news and some great news. With the help of a member of our Saturday Monthly Meetings who is a whiz at spreadsheets, we have come up with insight on Tops using the Hindenburg Omen and

Ron has applied his attention to the Barron’s 400, a new stock Index of their 400 selections. We felt you would like this in your bag of tricks. Ron has done a great job in slicing and dicing the good Fundamental stocks from the bad in terms of their current Technical performance relating to price momentum.

The next Seminar will be in Palos Verdes Estates (PVE) just 15 miles south of the Los Angeles Airport for 3 days from October 27 to 29, 2007, inclusive. The price is $1100/person.

Best Regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog