Black Spot Disease and Rust – Simplified

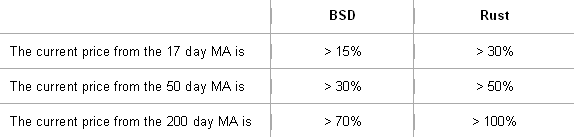

In my last note I mentioned Rules of Thumb for quickly establishing if a stock is extended. I call it Black Spot Disease (BSD) and Rust after Rose Diseases. My wife loves her garden and grows roses with tender loving care and she is always using her flit gun to get rid of the diseases. So I took a leaf out of her book and go after my stocks with the same care! Here are the parameters:

Tim Higgit who is one of our loyal clients came up with a brilliant idea for charting the BSD and Rust parameters in the HGSI software, and I am featuring his work here in this note. I built on his concept by adding a Red line as shown down in the 200-dma window to show that DRYS, the stock I covered in my previous note on the High Jump Indicator, had reached a peak of 160% from its 200-dma. You can immediately see that the Rules of Thumb work very well to give one the clue that DRYS should peak again at between $85 and $87 as shown on the chart. For HGSI customers, this Charting View is posted on the HighGrowthStock.com Yahoo Bulletin Board for you to download into HGSI:

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog