These Uncertain Times…

It’s an uncertain week ahead for U.S. stocks, as IndyMac Bank falls and jitters slam Fannie Mae and Freddie Mac. Still to come: testimony from Bernanke and crucial financial results from top investment firms and tech giants.

- Reports that the Treasury Department and the Federal Reserve may be planning to rescue Fannie Mae and Freddie Mac were flying around in the media and in the markets late in the week, although most were officially denied or never completely clarified. Unfortunately for the Stock Market and for the US Economy these latter two are the big fish in the pond, and unless there are quick announcements to shore things up the Stock Market is in for a bumpy ride this coming week. My good friend, Maynard Burstein says it best…“My hope is that they announce whatever they are going to do prior to the market open. If not rumors might cause “bad stuff” and it won’t be capitulation.”

- Editor’s Note: Late Breaking News on Sunday Evening! Maynard called it right on the nose…Treasury Secretary Paulson has made an announcement that might have just snatched this Market from the Jaws of Death with proposed solutions for Fannie Mae and Freddie Mac. Of course it depends on how Wall Street views the medicine, but at least there is a positive change to the futures markets, where the DOW at 5.00pm Pacific time is showing +86, the Nasdaq is +16 and the S&P 500 is +10.20. It may give us breathing room at the open, and give us a chance to flip to Scenario 1 when it looked as if we were headed for Scenario 3, below. Good luck to you all. Ian.

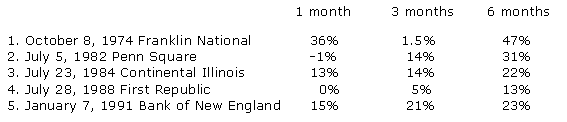

If it were not for this latter problem, the good news is that News of Bank Failures has invariably signaled a capitulation and a strong reversal in the Stock Market. There have been five Bank Failures since 1974, and here is the S&P 500 performance later:

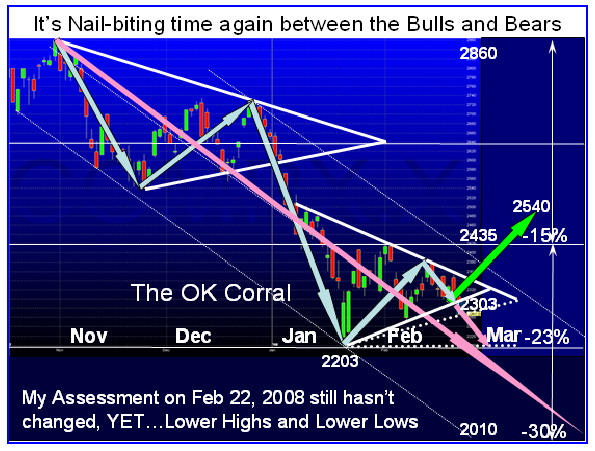

I am not suggesting that history will repeat itself this time as the situation of the Indymac Bank pales in relationship to a debacle in Fannie-Mae and Freddie-Mac. We will have to wait and see how Monday unfolds, and again it all depends on what happens before the open or soon thereafter in what the FOMC and Treasury do. At times like these, Cash is King for most. The Three Road Scenario is simple from here:

- High Road…Capitulation, Reversal Day, Bounce Play from an oversold situation

- Middle Road…Fluctuate between 1200 and 1250 on the S&P 500; most unlikely

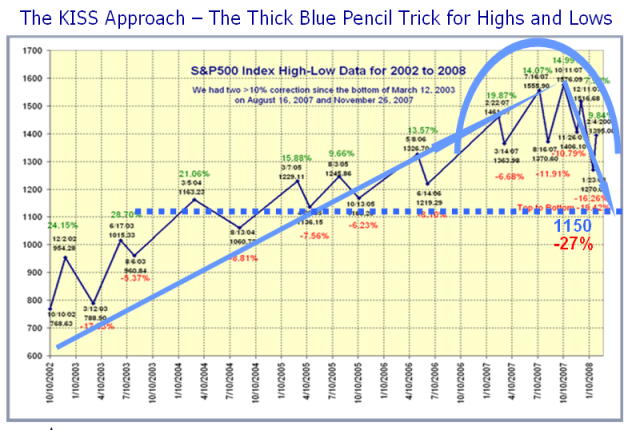

- Low Road…Down to 1150 as the Next Target as I posted in my February 17th…And 2010 for the Nasdaq as posted in my blog of February 23rd.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog