The Value of Eureka Signals at Market Bottoms

At this important juncture, I felt I should post this note in its entirety without any editing. If it is too much to digest just move on, but I feel it is a good educational follow-up to the thread of posts relating to Follow Through Days (FTD) and a perspective of the pulse of the current market.

Mailbag Discussion:

I have spent some time studying. I like you have been waiting for a Eureka and confirmation with new 52-week highs. I created some new views on High Growth Stock Investor to help me go back in time. I looked at the Coppock, Eureka, NYSE new Highs and Lows as well as a follow-through day visual filter back test. I made up a daily Coppock that mimics the Weekly Coppock using 50 and 70 days and 50 day average. It tracks the weekly quite well.

I went back to 2003 in a NYSE daily chart and studied what I saw comparing to current time. In 2003 we did not get a Eureka until 30 trading days after the 17 March 2003 FTD, the Eureka came in late April. The NASDAQ followed through on 3/17, the NYSE did not as it was just day 3 on the NYSE. The NYSE 52 week new highs did not broach 100 for 12 days after the NASDAQ FTD and then it dallied for a couple of weeks before really taking off.

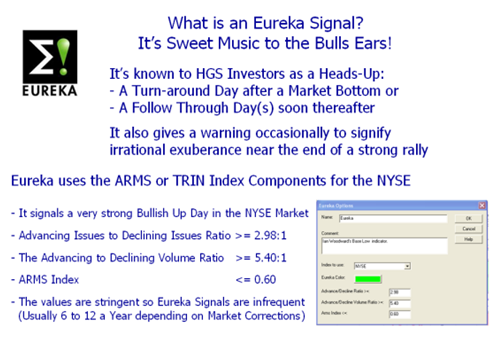

What I see now in the market looks a whole lot like the 2003 time frame (different stocks and groups breaking out). I also think that it is quite impossible to have a Eureka when the market is in a big rotation as we have now and as we had in March of 2003. I think the Eureka works well for follow-on rallies but when we are in a major rotation it may not work. Think about it. The Eureka requires a large ratio of new advancers to decliners. When the decliners are so huge like the oil base stocks tanking it is quite a high threshold to expect that advancers could overcome this downwash. It took 30 trading days for the market to confirm the rally in 2003 because of this. Mike Scott

Response: Mike: You are absolutely right that one’s expectations for a Eureka should not be within the normal 12 to 15 days of a Capitulation, given the parallel to 2003, but there are at least a few other factors that must come into play on the positive side while the tide is out that we should like to see shaping the internals:

1. As I said on my blog the first expectation must be that the New Lows go dormant. I note that over the course of 21 days after the Temporary Base Low, one should expect this number to average about 40, with less than a handful of days at above 50 during that period. Over the past 14 days that number is at 64, so it is not dormant yet, and we have not had a single number below 42 to date, using HGSI data.

2. The second yardstick relates to the components of the Eureka. I buy your argument that New Highs and Advancing Issues to Declining Issues cannot be expected to rise from the ashes in so short a time given the rotation and Oil stocks being a big part of the clobbering. However, on that which is moving I certainly expect that there be some more enthusiasm in the beaten down stuff they are now buying to the extent that the Advancing Volume to Declining Volume should show some perkiness. Furthermore, back in 2003, the ARMS ratio itself kept dropping below 0.60 at least ten times and the Adv Vol: Dec Vol was up at least 6 of those occasions to above the 5.40:1 requirement while waiting for a Eureka. In effect, we had six 2/3rds. of a Eureka! That tells me that there is insufficient buying pressure with conviction on the NEW Groups to which the herd is rotating into, since we have not had a single reading on either of them making the yardsticks. The inference is that we are so badly trounced that either there is insufficient conviction or we have still a ways to go before we see more enthusiasm. The bottom line is that we are still stuck in the mud. Even the Biotech’s got clobbered today.

3. Let’s not forget the simplest and most reliable of requirements which are that the 50-dma must be flat, and the 4-dma, 9-dma and 17-dma must all come up through it at the 405 Freeway mark. The 50-dma is not flat at the moment, to say nothing of the 200-dma which is pointing down. Both items appear to be at least a week off for either the Nasdaq, or more so the NYSE at this time…though all our past history on this particular item has been on the Nasdaq.

4. Sadly, on this occasion just like 2003, we have the black cross of the 50-dma below the 200-dma, so the expectations of the ceiling is at that very point of any rally before it peters out, if it even gets there.

5. The bigger question is whether we are truly at early 2003 or one stage removed from there at October 2002. In which case we had plenty of Eurekas in that phase, but what is missing so far are the leaps and bounds of Price Gains that propelled the Nasdaq out of the basement back then. In my blog I mentioned that we need some catalyst to cause this to happen. Back in 2002 and 2003, everyone had thrown in the towel and more importantly had done so over three years, not less than one. Somehow, I don’t feel the swamp is fully drained yet, nor is there the irrational exuberance to really come into the market with a vengeance, which is usually signaled by Eurekas.

6. What is more important is the extent of the Bingo count this time which is similar to back then, so it suggests at least we are seeing some signs of throwing in the towel, even though the VIX is relatively quiet.

7. If Industry Groups don’t show signs of improving towards the A and B column in a hurry, this attempted rally is little more than mostly bottom fishing and identifying some potential leaders for the next round trying to repair their bent up chart patterns into decent shapes. We can take some comfort that the number of A’s have improved from 5 to 19 with the last two FTD’s and from 56 to 74 on the B’s. That means we have a 60:40 split between the former and the C to E Groups, since as you know we have a count of 154 Groups. I am sure today’s action will kill some of this again.

8. Now I know all the stock market forums are anxious to know whether FTD’s are enough of a signal to go by and we have both proved that it is no better than a toss of the coin, so it was comforting to see the second punch at it yesterday where at least the Nasdaq is showing a lot better response than the DOW, the S&P500 or the NYSE. However, it seems to be two steps forward and one or two steps back, which does not allow for even holding overnight, leave alone a few days to weeks. When one has three black crows without five white soldiers any rally is suspect.

9. It appears to me that Type 1 and 2 traders are the only people who can make money provided they are nimble, turn on a dime, and essentially moment or day trade. Type 3 and 4 longer term investors are not going to miss a thing given what we have seen these past two weeks.

The bottom line is that it takes more than a couple of Eurekas to confirm a decent rally and if I left you with that impression then I feel sure I may have done so for most of my readers who are not so well versed with the dynamics as you are. In which case, I would like to use your note to me and this response as a teaching tool on my blog by way of educating them and perhaps your readers that life is not that simple in Bear Markets.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog