Mail-Bag: My wife’s 401k is down 50%. She is asking me if she should sell now and buy back later at a lower price. I have no idea what to say at this point. Have any ideas?

Answer: You are lucky as by this time my wife and I would be enjoying our grandkids, but like this Santa Claus Rally, the snow put a dent in our plans. I don’t give advice, but I will break the problem down for you and show you a Game Plan. Let’s review what makes sense at this stage. Since I presume you follow my blog, I would suggest you continue to do so to give you and her clues as to what to do:

1. It goes without saying that many have experienced the same fate as your wife with their 401-K. 50% down is a terrible hit as it will take 100% to get back to where she was. But that is water over the dam at this stage though it will take at least two years to get back to where she was if it doesn’t go down any further. That is a pure guess, but in terms of time it assumes we not only have a Bear Market Rally but also it recoups into a full fledged Bull Market again soon. Not very likely.

2. Invariably people throw in the towel when they have taken such a hit and feel that half-a-loaf is better than no bread. Sad to say that many times that turns out to be right at or close to the bottom. If anyone can tell you that we have reached a bottom and hang on…think again. Not even Warren Buffett can do that, but he can afford to get hit as is T. Bone Pickens as they have deep pockets. Hence the dilemma you face.

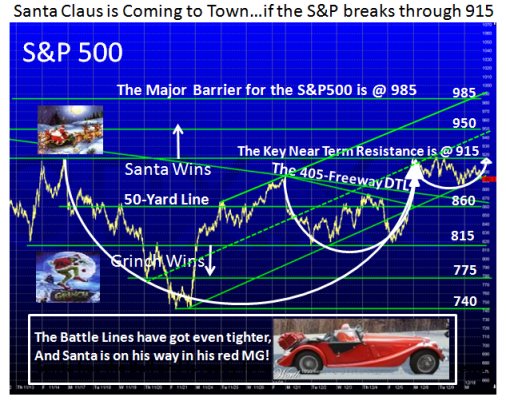

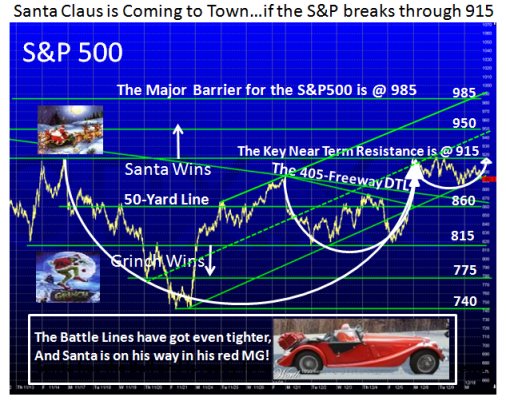

3. Since we have some breathing room with the recent Base Low on the S&P 500 at 741 (see many of the recent blogs I have put up which show the Lines in the Sand), we have at least bounced back about 24% from that low to its recent high. It is currently about 17% up from the Low and hanging on by a thread.

4. If you look at the Santa Claus Blog written on December 6th. with him sitting in his Red MG (I have saved you the trouble by providing it below), you will see there are three lines in the Sand to the Down Side:

a. The one at 860 which is the 50-yard line and is where most of the action will meander back and forth as it is right now.

b. The next important line of support is at 815 where I show anything below that the Grinch wins

c. The final line is at 740 and if that is broken to the downside, expect the floodgates to open and who knows where it will bottom next.

5. Again, if you have followed, the Upside scenarios suggest that:

a. The first hurdle must be above 915 which it hasn’t penetrated as yet and is meeting stiff resistance at that level

b. The next one is at 950, which is 33% up from the Base Low of 714. If it achieves that, it will be deemed as a very good Bear Market Rally.

c. Anything above that is sheer gravy at this time, and is wishful thinking until we get past the first two targets.

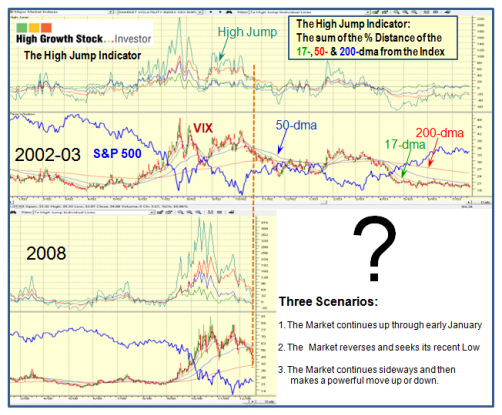

6. With the Global Market scene as bleak, the intermediate term and long term bias has to be to the downside for now. The best one should expect is a short-term Bounce Play (Call it a Bear Market Rally) if it can get above 950.

7. So her strategy should be fairly clear from here if you read between the lines:

a. If it goes up from here through mid January say and gets above 915, then 915 becomes her line in the sand to vacate should the market turn down, and she would at least have recouped something in participating in the Bear Market Rally and then vacating when and if the Bear Market resumes downwards. Since she can watch how her 401-K behaves as it moves up and down, it should not be difficult to see whether she is making any headway or not and then make up her mind.

b. If it never gets above 915, then her 1/2 a loaf scenario is the choice somewhere between 860 and 815, because her stomach tells her so! Since she has already experienced what it is to be down at 714, she will soon know where to call it quits.

c. If she waits until it gets below 714, she will be further in the mire and telling you “I shoulda, coulda, woulda”, kicking you in the shins and feeling “now I will never be able to retire!” Ready, aim, aim aim and never firing is what got her into trouble before.

The lesson learned Rob is that our whole life revolves around threes. What better evidence than the rules of the road with traffic lights as Green, Yellow and Red. Always break complex problems like this into three scenarios…the high road, the middle road and the low road, as I did in 7 a, b, and c. Under these circumstances, unless there is a miracle wand waved over the overall global gloom, don’t give up the half a loaf to see that evaporate when the market tells you it is headed down again.

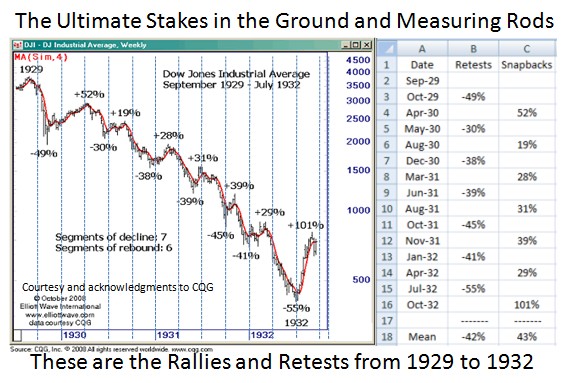

As I say I do not give advice and anything I say is “ALWAYS YOUR CALL”, but there are many people in the same boat as your wife and this may be of help to them too. My notes are written to help people understand the Stakes in the Ground and the Measuring Rods and most understand what to do once they have a reasonable Game Plan developed. The rest is up to each individual as to what their stomachs can bear.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog