Playing Checkers in Volatile Stock Markets

As I said in my last blog the market has played into the short term traders and

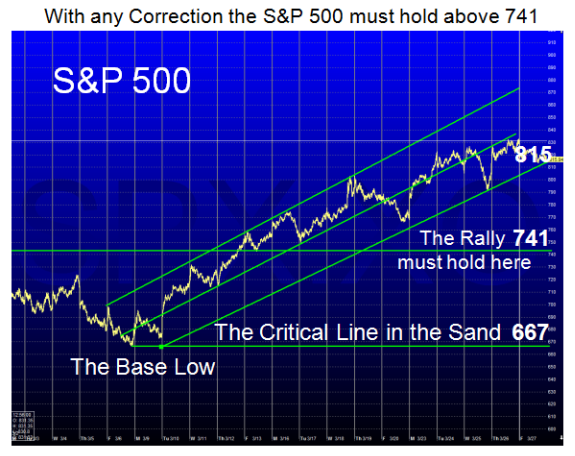

Type 3 swing traders hands. The Rally this past month has given the Bulls

breathing room and a cushion above the abyss of 667 for the S&P 500. As I said

before, that line in the sand is crucial:

1. When one has five uncontested Eurekas inside 12 days, that suggests the

Big Bulls are beginning to put their money where their mouth is. They have

tread water these last four days as shown by the chart of the S&P 500 below.

If the S&P 500 breaks down below the lower channel at 815, the line in the

sand is 741 for any chance of this rally to continue. That is 11% down from the

rally high of 832 and is as much as they dare give up. Any further drop and the

rally is suspect if not over. 667 is a strong line in the sand for the Bulls and is the

last stand at the OK Corral. After that the Market morphs to the depression

scenario once again.

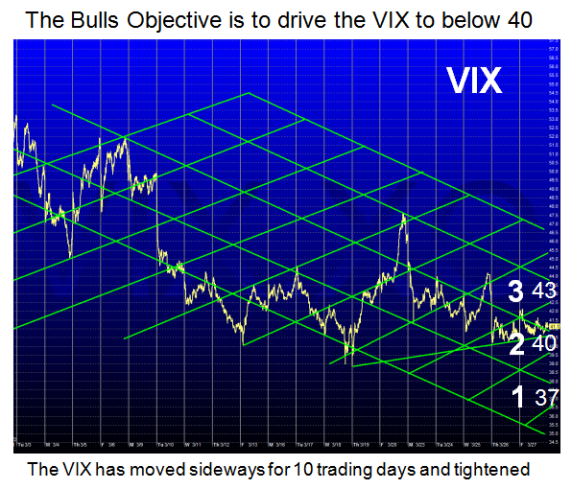

2. We have now gone sideways on the VIX for two weeks…gone quiet, and

sitting quietly in the 40 to 42 area. That would seem surprising as I remind you

that the Bulls have charged up 22% from the Base Low during this period. We

would have expected it to break down below the 40 level by now.

3. The Fear, though subsided, is still hovering around for the next shoe to drop in

either direction. It must break to the downside below 40 and head down rapidly

towards 30 for the second leg of the Bear Market Rally to continue. Conversely,

if it drives up rapidly above 45, the fear will be back and the rally will be over for

now.

4. The Game of Checkers is simple. We are currently hovering in Square “2”. The

Bulls want to drive it down to Square “1” while the Bears can’t wait to move to “3”:

5. As I said in the last blog, the Bulls must break the fear by driving the VIX down

to below 35 and then with luck to 30.

6. How do we know if the Bulls are winning and have the Bears on the ropes? There

must not be any Phoenix signal for 50 days from the last one on 03/02/2009 and we

are just half way to that point. At that stage there is an 80% chance after a small

pullback that the Bear Market Rally is still intact and on its way to achieve a sizable

rally measured as over 40% to 60% from the Base Low of 667.

7. Conversely there is a 50:50 chance that a Phoenix can appear now, so we are still

in the arena of a toss of the coin that we could trot down.

Net-net, the Messages are:

I. If the 815 trendline of Lower Lows is penetrated to the downside, it must hold

above 741, preferably above 757, and then move up to go for a second leg up per

the Template I gave you at the seminar. A strong push up from here is key.

II. At that time Type 3 swing traders may feel they should try to nibble for a move

which could last a further few weeks until the bulk of the Earnings are out by the

first week of May, when the Market traditionally is inclined to swoon.

III. The street will be watching the EPS reports for the Big Banks for the 1st qtr. and

if they are not positive, the rally will probably fizzle.

IV. The Big Banks, Technology and Small Caps will probably lead if the EPS reports

are healthy. If not…back to the foxholes and/or go short.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog