Reviewing the Bidding of the Market and VIX

My Father was a great bridge player and taught me well. He would make sure to

say before the hand was played: “Son, always review the bidding”. So let’s

review the bidding:

In my last blog of March 10, all of 15 days ago, I left you with a strong winky-winky

that said:

“Late Breaking News – We have had a confirmed rally…how long it will last in this

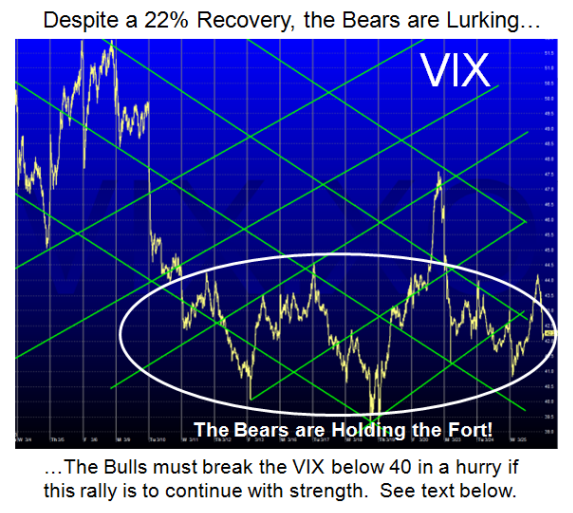

skittish Market is another story for another day”. That day is today. Unfortunately,

people are too busy these days as they spend time multi-tasking and don’t soak in

the messages that count. Those that attend our seminars are taught to read

between the lines, so although they were prepared for gloom and doom, they

also knew that there may be a ray of sunshine. “Confirmed Rally” with an Eureka was the clue I gave you 15 days ago, before I had to prepare for the Seminar.

1. We certainly got that boost this past Monday with the strong move of 50

points on the S&P 500 which took us from 770 to 820. A 6.5% rise in one day

is the reverse of what we endured during the landslide on the downside so

it was certainly time to sit up and take notice.

2. We have now had 6 Eurekas in a row with nary a sign of a Phoenix, so it

means that the shorts have scurried into their foxholes, are covering their

shorts mighty fast and for now are waiting for the Bear Trap to pounce. The

start of that trap could well be today, unless that Bulls can hold the line

above 800.

3. We know from past experience that a good rule of thumb for a reasonable

rally is between 20% to 25% up from the Base Low. With the Base Low at 667,

we now have a potential target of 800 to 834. We hit 826 today at its high so

that is close enough for government work…first mission accomplished.

4. Now What? Either we come rattling down with the Bear Trap to wind up

with a -8% drop which takes us down to 760 or the Bulls will have none of it

and hold the fort above the psychological barrier of 800.

5. Anything less than 741 means the Bears did the rally in and the Bulls must

re-group or once again throw in the towel as the S&P 500 trundles on down

to re-test and/or break the Base Low at 667.

6. Seminar attendees now have the “Saw Tooth” Game Plan that either

confirms the rally is on or find that Type 3 Swing Traders must once again sit

on the sidelines waiting for another attempt off the lows to start a bear

market rally that has some legs.

7. Now to give comfort to the Bears, the challenge is simple…their goal is to

hold the VIX at no lower than 40 and so far they have done that, despite the

rapid move of over 23% up from the Base Low. Until this is broken vigorously

to the downside with “three black crows” (big red candles) to drive down to

30, we will meander in a trading range or once again have the fear of morphing

into the depression scenario which I covered adequately to show the dark side

of the looking glass. Furthermore, an ARMS reading > 2.50 will trot out another

Phoenix sooner rather than later and the Rally will then be finished for now.

The Bears objective is to drive the Fear up with a VIX reading > 45.

�

8. The Bulls would have had less than a month between Phoenix signals to bask

in the sun and they now know what to look for on that score before the odds are

heavily in their favor. My point is that the HGSI Proprietary Impulse Indicators

have given us enough faith to follow them in these turbulent times to keep us

on the right side of the curve and to know when the odds are heavily in our favor

or no more than a toss of the coin.

�

9. Follow Through Days in Bear Markets are little more than a toss of the coin,

while attendees learnt that we now have better tools to guide us out of this mess.

The Game Plan is now straight forward and there is no excuse for you to lose your

hard earned nest egg. You and I know that the Market is totally “Event” driven by

the four principals as we discussed at the Seminar, so be leery and watch for

sudden bursts to the upside and downside. Those events will be captured with

Bingo, Phoenix, Eureka and Bango. In the words of the song “Bingo, Bango, Bongo

I’m so happy in the jungle I refuse to go!”

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog