Stock Market Up or Down Next Week?

After four weeks in a row with the stock market up, the question on our minds is what happens this coming week?

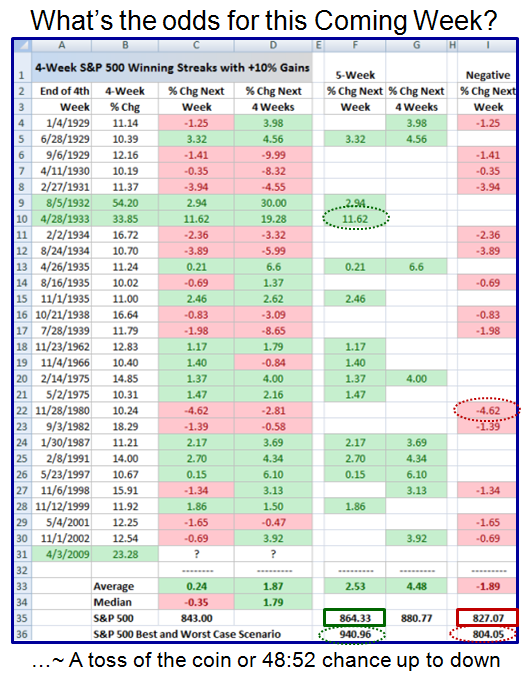

Fortunately I found some statistics that shed light on this question. Sad to say that the odds based on past history is almost a toss of the coin, as seen by the chart below for those 27 previous occasions where the S&P 500 gained more than 10% in four weeks:

However, we can dig deeper and get a flavor for the boundaries of the move based on

past History and it will be fun to see where we land on this next (fifth) week.

1. Note that the only two occasions that the S&P gained more than the current 23.28%

over the 4-Week period was in 1932 and 1933 when they rose a humongous 54.20% and 33.85%, respectively.

2. If you cast your beady eyes down column “C”, you will see there were 13 weeks up

and 14 weeks down…hence the odds of up to down based on history is almost a toss of

the coin or 48:52 to be precise.

3. But what about the coming week is the big question? I have separated the positive

and negative weeks into columns “F” and “I”.

4. Here are the key statistics which I have ringed on the chart:

S&P 500 Current 5th week +ve 5th week -ve

�

Average S&P 500 843 864.33 827.07

Average % up or down 2.53% -1.89%

Best & Worst Case S&P 500 940.96 804.05

Best & Worst % up or down 11.62% -4.62%

The figures would suggest that we will do no worse than dropping to the 50-dma which

is at 790, and a fighting chance to reach the next rung on the ladder at 880 which I

mentioned as the high road scenario in my blog last night. I have kept the numbers the same as the chart to make for easy reading rather than rounding up.

Best Regards, Ian. �

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog