The Stock Market is Trapped in a Darvas Box!

I found this picture that suits the current situation to a T, as we have been in a tight range for the past twenty plus days:

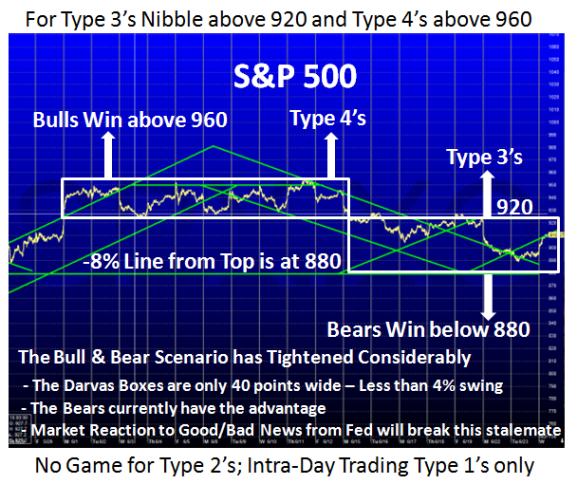

The Ballgame has changed substantially; I can’t recall a recent previous occasion when the market went sideways for ten days in a row and couldn’t put together more than two days up or down, and then spend another ten days in a similar box between 890 and 920ish as shown below. As my notes indicate, this market is down to Intra-day Trading with the bias in favor of the Bears as the Market awaits news from the Fed Report:

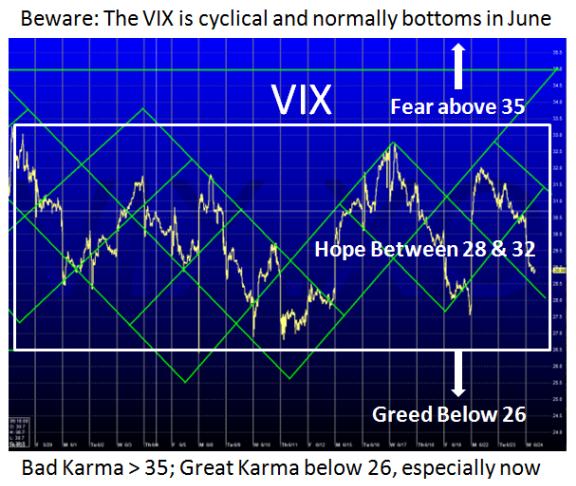

In sympathy with the S&P 500, the VIX has trapsed up and down in a similar Darvas

Box, where I show in the following chart that Bulls win below 26, bears above 35 and

we can only Hope for Relief between 28 to 32:

Many moons ago I came across Bill Luby’s blog “VIX and More” which I highly recommend to you as being THE expert on the subject of Volatility, and how to evaluate the VIX, etc. One recent report that he has again covered is that the VIX is indeed Cyclical and shows you his research over 19 years for each month. The bottom line is that the statistics show that the VIX invariably bottoms in the month of June and peaks in September. He also suggested back in April this year that he did not expect the VIX to drop below the 25-27 area in the current bear rally. Since we have reached that level, it does not bode well for the Bulls until we get past the summer doldrums or have a major surprise that drives the market to the upside in a hurry. So please bear this cyclicality in mind going forward.

On days like today when the Fed Report is due, most short term traders are cautious

and today was no exception. The DJIA was up over 100 points at one point in the day having been up until the Fed Report came out. It finished down 23 points at the close.

Let me make sure I do not mislead you as to the reaction to today’s Fed Report as at

around the same point in time an explosive accusation came from a California

Congressman making a charge of a Fed Cover Up on the Merrill Lynch acquisition by

Bank of America. For the record I show four snippets of comments on the bottom of

the above chart, and leave you to make up your own mind. You be the judge what took the market down to finish in a trading range yet again.

Anyway, the bottom line was yet another ho-hum day and hopefully with the Fed

Chairman due to speak to Congress tomorrow, you can rest assured we have not heard the end of this accusation and rebuttal in which the Chairman denied.

The problem we still have is that this Market is so event driven based on news from the administration, the Treasury Secretary, the Fed and the Congress that we are treading on egg shells with every new day.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog