The Canary Got a Dose of Oxygen

My Mailbag had two notes in response to my last blog on AAPL being the Canary in the Coal Mine and thanks to them for their positive feedback:

Hi Ian !

I am sooo glad that I listened to you –and am grateful for the “wc” Chart. I bailed on AAPL while I still had a decent return—and am more thankful you still want to help us home-gamers even more! Becky

In a message dated 06/09/10 10:26:31 Pacific Daylight Time, Michael Kahn writes:

my .02 – Ian nailed this in his blog. ian wrote:

“However, I say don’t switch horses in mid-stream. If this market is to go “DEAD”, AAPL will keel over long before NFLX. Enjoy! Ian”

Their comments were four days ago, before the Big Up Day on Thursday where we got the first leg of what we were looking for…an Eureka and a Kahuna Up! We need a follow through of the same ilk, but for now “Half a Loaf is Better than no Bread”.

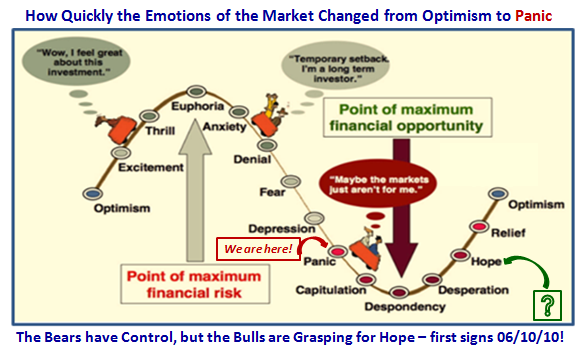

Things are in the balance as we have already had an Intermediate Correction of 14%, and need to see another boost before we see any signs of recovery. The shenanigans of early May with the 1000 point drop in a matter of minutes followed by a 400 point recovery caused a major change in the psychology of the market from Optimism to Panic in the ensuing weeks with all that I have previously discussed. Now the Bears are still in control with the Bulls grasping for Hope.

Friday’s results finished with a slight gain for the Bulls’ cause to at least hold the line to fight another day. It has to be called a “disappointing fizzle” as the volume was pitiful and this was nothing but a token hold for the Bulls. However the Composite %B of the Bollinger Bands for the Market Indexes is now 0.53, which is encouraging, since most successful rallies start from here. So where do we go from here and what can change this to a positive emotion? It requires a double Impulse as we had last Thursday, and in a hurry:

The Major Challenge and Near-term Targets for the Bulls:

1. We Must have another Eureka and Up Kahuna: For any sort of recovery out of the mire, early next week must see a follow through with a simultaneous Eureka and Up Kahuna. Although not perfect in the scheme of things as compared to previous strong rallies, it would be close enough to be acceptable. Any more will be gravy.

2. Given the above, the Composite %B will be approaching the Upper Bollinger Band

3. Volume must be substantially stronger…over 2.5 Billion on the Nasdaq

4. The VIX must drop another 4 to 5 points to 24

5. The S&P 500 must deliver a >2% day and take the Index to about 1118…Fat chance say the Bears

6. The Nasdaq must show Technology leading and a rise to 2320

7. The DOW needs a 500 point gain to above 10,700

8. AAPL must rise to above 264

Why even suggest such tough goals? To show you the magnitude of the Challenge:

1. Three words…Force SHORT Covering. The Large Players are not budging. Even then, the bulls will not be out of the woods, and I suggest you look back on my previous blogs to see why the Bears will again be laying in wait.

2. Another reason is that June and July are poor months for successful rallies of any consequence, i.e., about 10% up over a five to six week period…thanks to my friend Mike Scott.

3. The third reason is the THISPIG syndrome is not going away any time soon

Net-net: Things are in the Balance and we must be patient to see how it plays out early next week.

Last but not least, work with what the market gives you and don’t try to force your views on it.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog