Stock Market Targets – The KISS Approach

In reviewing the Blog Note I wrote yesterday, I realized that the Multi-Taskers might like to see the KISS Approach, so here it is in one slide with the key Messages at the bottom of the picture.

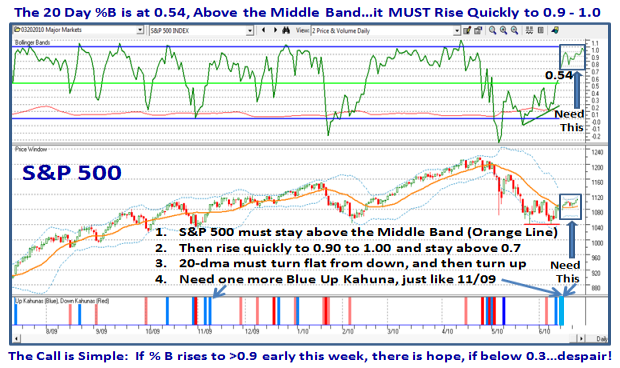

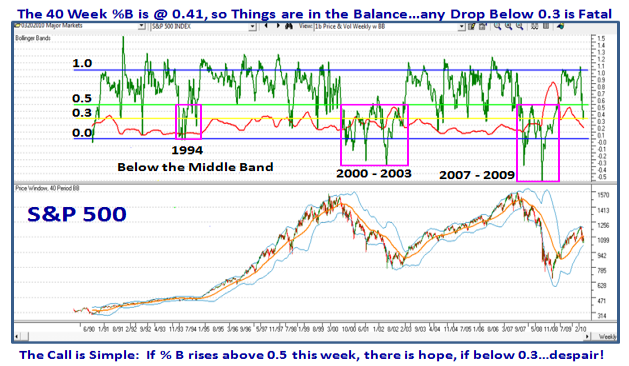

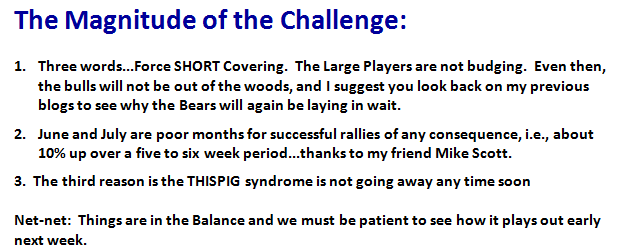

Others who want to learn how to get to the bottom line or as I call it “So What?”, will always ask “Why?” So for those who want to dig further to see the rationale the next two slides should do the trick:

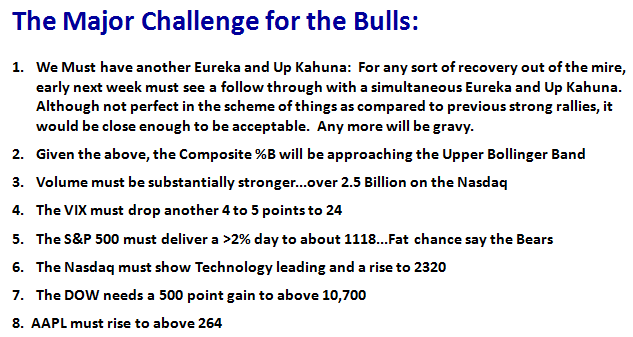

…And then there are those who prefer the words instead of the music and look for the “What, the “When” and the “How?” That is what I gave you yesterday, but to keep it simple for you because “I don’t have time, Ian” here it is in the next two slides:

But before we get too excited about all of the above, I warned you last week that the Volume was pitiful, especially with the likes of the Nasdaq and Russell 2000. My good friend and partner, Ron Brown, summarized his Weekly Report as follows “The most striking thing about the market rallies on Thursday and Friday was the lack of volume.” Make a point of catching his valuable weekend movies at:

www.highgrowthstock.com/WeeklyReports

So there you have it just as you get it on all my blog notes, the Newsletters and the Seminars…”The What, the Why, the When, the How and the So What”. There is no substitute for seeing how your stock portfolio is doing, and then having the appropriate key candidate lists for both the long and the short side. In the most recent work we have done that is exemplified by the JIRM list, which needs to at least be outperforming the Market Indexes (which it is), and then the fresh list of new candidates which should be providing respectable bases and attractive set-ups.

Please understand that I primarily focus on the Market and Tops Down analysis on this blog, but you ALSO KNOW that I do my homework with what others would call a Bottoms Up approach. Call it what you wish, the HGSI Software provides the flexibility to fit your Approach, Style, and Stomach…I’ll spare you the acronym!

Lastly, don’t suffer from Analysis Paralysis…get to the “So What” Synthesis quickly.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog