Stock Market: Miracles Happened Overnight!

Wednesday, September 11th, 2013Before I address the Market, let me pause to Remember this fateful day which is all on our minds:

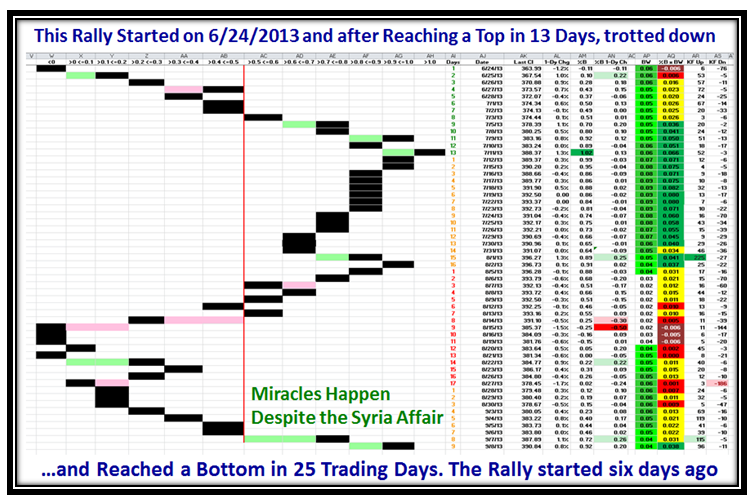

Out of the Blue with all the Gloom and Doom around us with regard to the Syrian Affair, we got a Miracle:

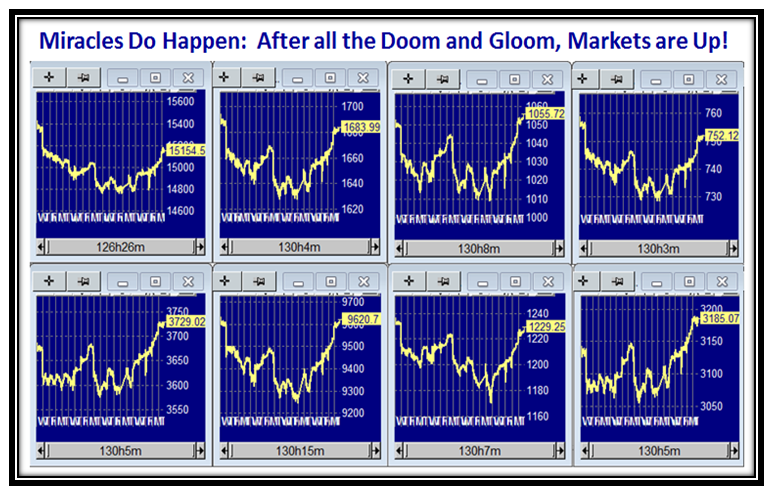

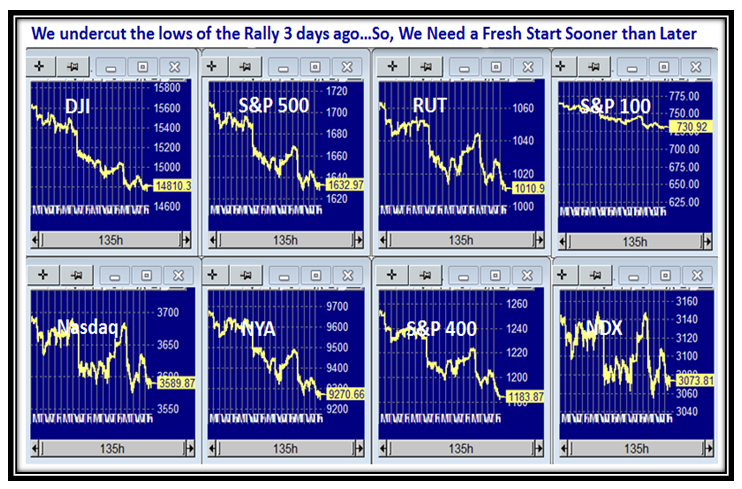

…And here to prove it the Markets were all up on Monday and Tuesday, and holding today:

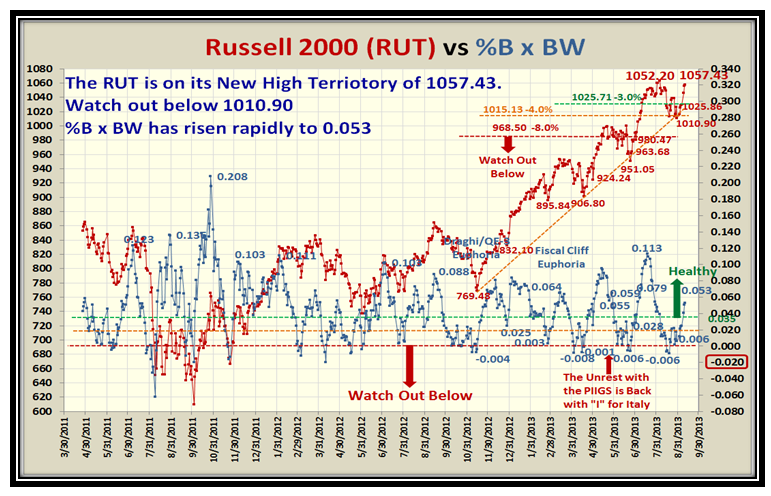

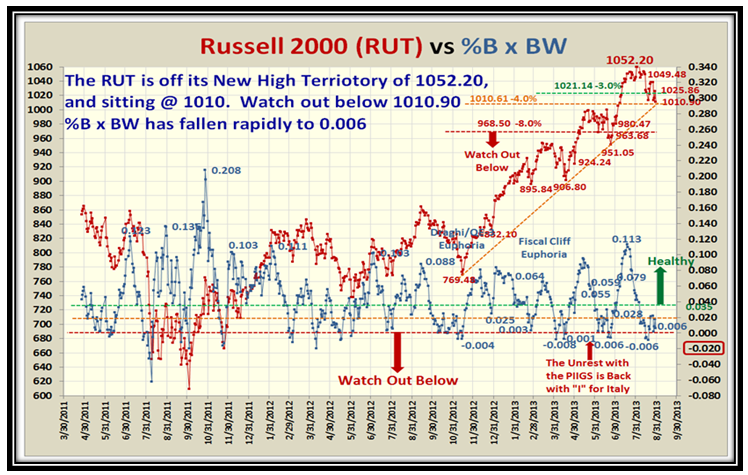

The RUT is flying high again at Mid day on Wednesday morning as I write this blog note:

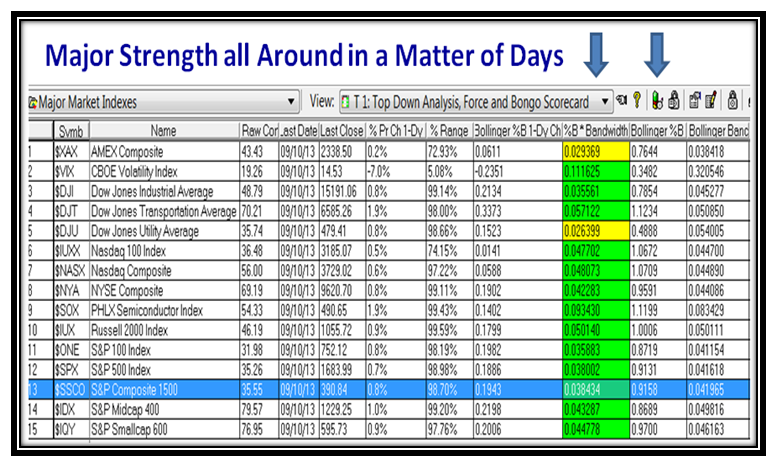

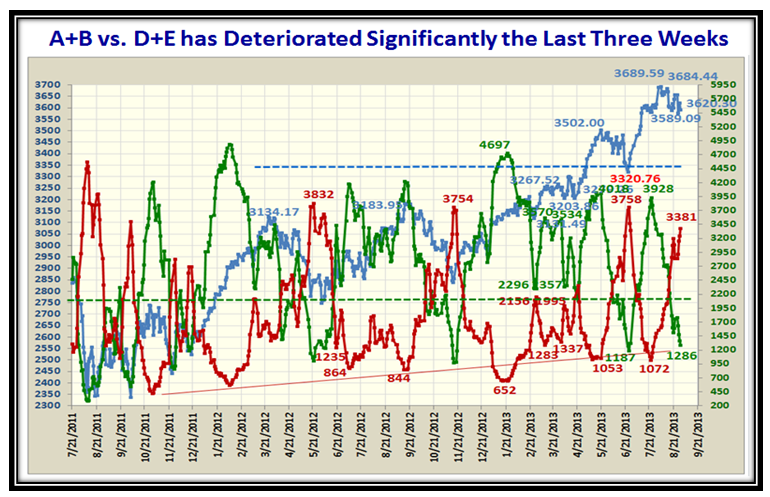

It doesn’t take two seconds to see the strength come back into the Market in the last couple of days:

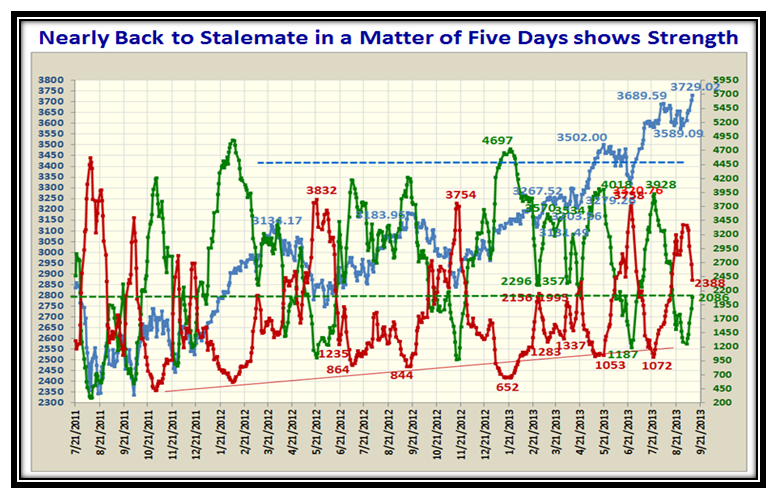

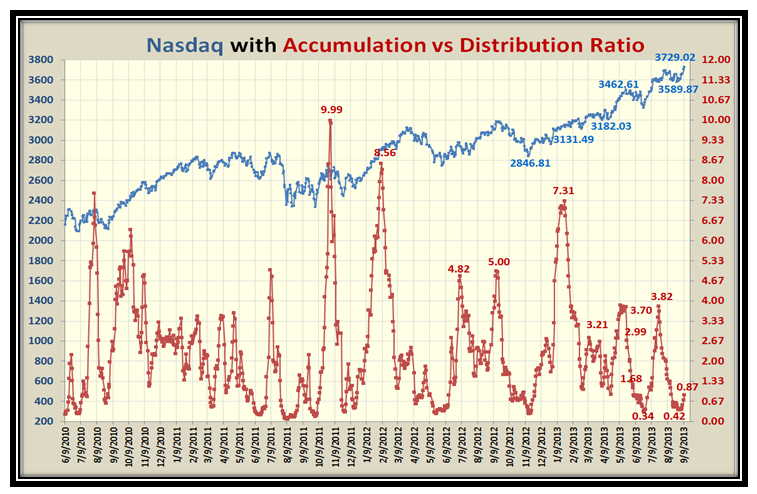

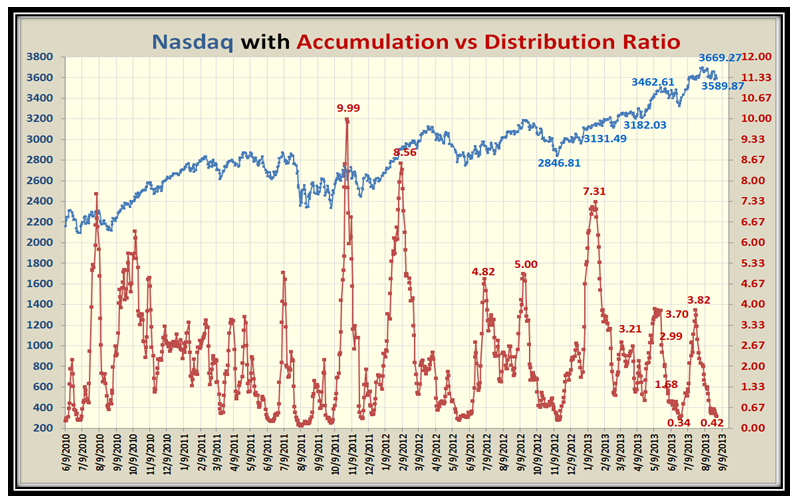

Even the Accumulation vs. Distribution Ratio is almost back to Stalemate:

With the Ratio this low at 0.87 and the NASDAQ into New High Territory, it suggests we have a lot higher to go. We’ll see:

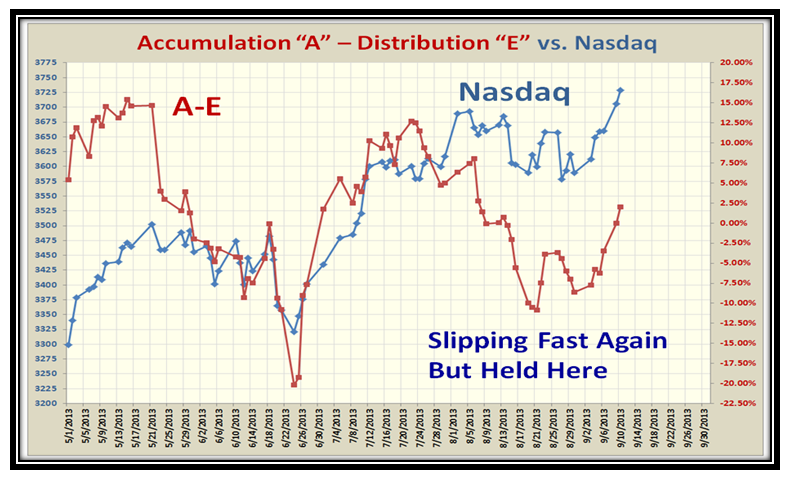

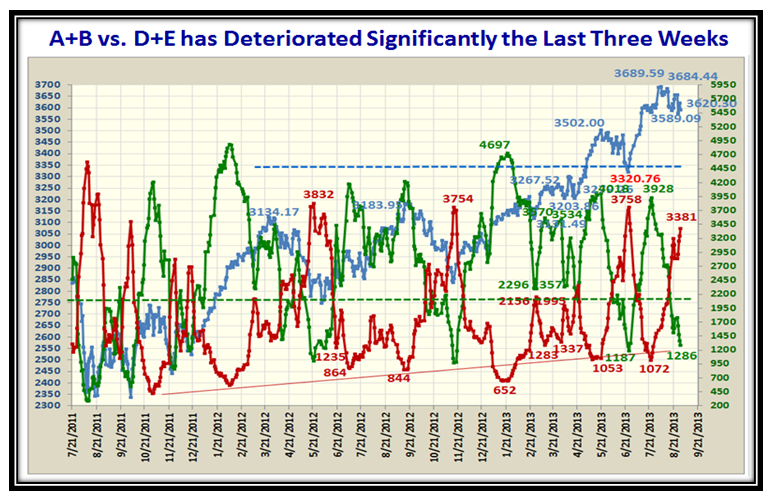

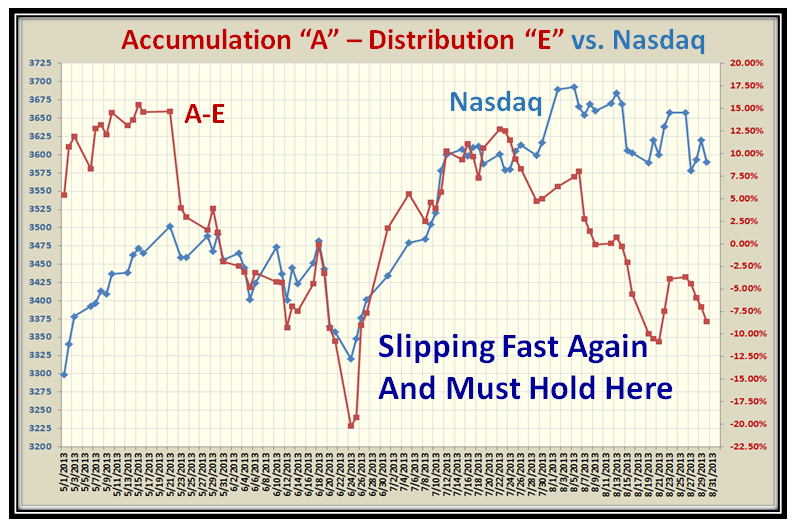

Even %A-%E is showing signs of life again:

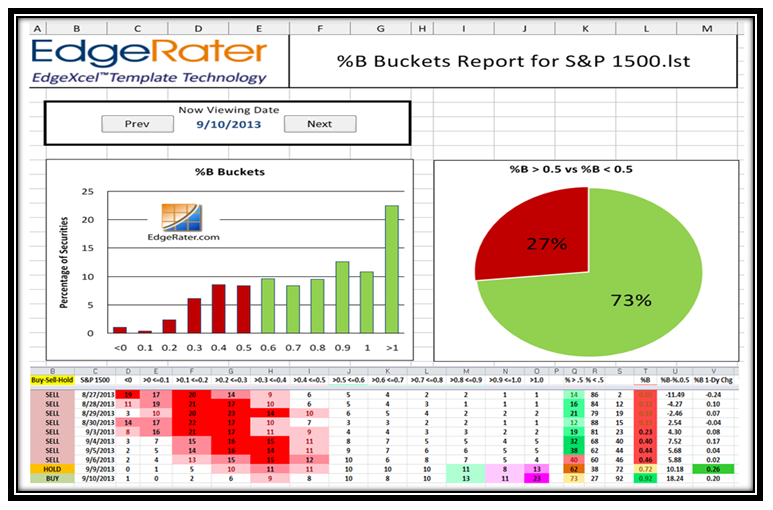

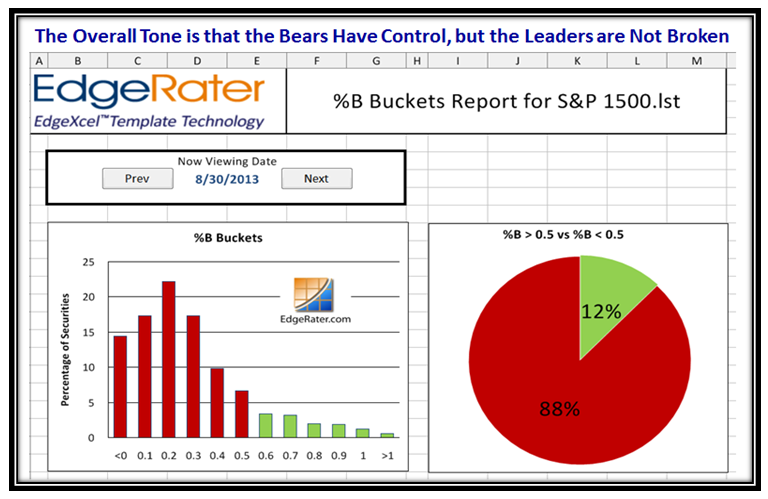

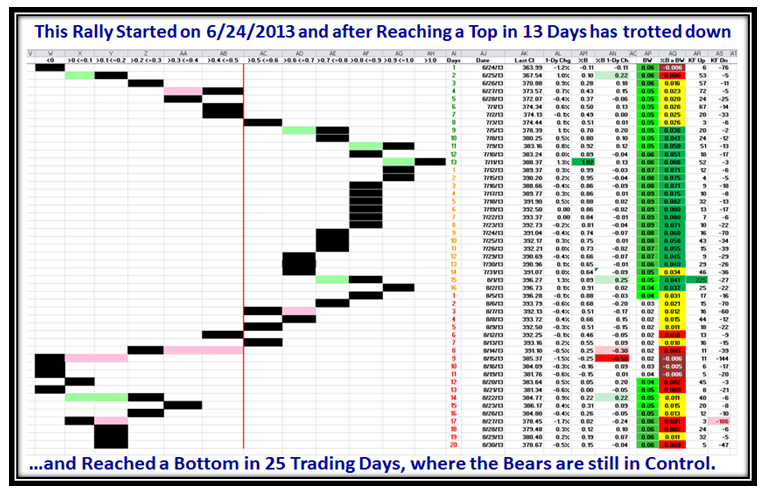

Grandma’s Pies show the Bulls are back in control:

…And last but not least, look at the Bucket Skips the last two days, showing the Bulls are back in control:

Many thanks to all of you who wrote to wish me for my Birthday last week.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog