An Early Stock Market Gift From Santa

Monday, November 16th, 2009Last week I told you that the Santa Claus Rally would come early this year, and true to form he is as proud as a Peacock as he drops in with some goodies for all of us:

Having recovered from getting the Newsletter posted yesterday, I offer two brand new Leaders Indexes as a Santa Gift to you and trust they will serve you well in the weeks to come. One is an updated RonIandex from the work we did at the seminar which now replaces the tired and worn out 06152009 Gorilla Mkt Leaders which has served its purpose very well. The other is a brand new idea which builds on the work that Ron has developed to make use of the Force Index and Total Dollar Volume Combo Rank we provided in the Newsletter of yesterday.

Twenty years ago when I first introduced the concept of the Ian Index, with a name change 15 years back to Iandex, and then ten years ago to the RonIandex when Ron and I teamed up, we have successfully provided you with a set of about 20 to 25 leaders at critical points in time. These Indexes have paid their dues time and time again in two ways:

1. The primary purpose was to provide an early warning of when the Stock Market Indexes might correct.

2. Since no one can identify exactly when the market will top, many of the stocks on the list provide a winky-winky to do your homework for additional profitable gains until they do break down and correct. Look for pullbacks in these Gorillas and hop on for the ride.

The underlying principle of the RonIandex is based on the axiom “The higher they rise, the faster they fall”. It is an Aggressive Growth Stock Index aimed at identifying tops, as well as a snapback after a correction. At minimum it can be classed as a Minor Correction of <8% on the S&P 500 and about 10% on the Nasdaq. Most often when a rally has been as long as nine months, the correction can be at least an Intermediate Correction of between 12 to 16% for the Nasdaq.

The intent of the RonIandex is to select those stocks that are the leaders in leading HGS Groups once the Nasdaq breaks out into new high territory and at this time is >18% above the 200 Day MA. It did that on 9/23 when the Nasdaq peaked at nearly 27% above its 200-dma High Jump. It then slipped back under heavy profit taking and just as quickly snapped back up.

That shows that buying on dips is once again in vogue, so now is the time to identify those leading, and usually very extended, stocks that will give us an early warning sign, hopefully before the Market curls over and corrects once again.

The logic is that since these stocks are fat with profits and are in leading groups with High ERG and strong Rel Str Rank, they will get hit hardest when the market corrects. The primary purpose of the RonIandex is to show that it is breaking key support points such as the 9 Day MA, 17 Day MA and ultimately the 50 Day MA, if the correction is MORE THAN MINOR. So the secondary purpose is to identify the best of the best 20 to 25 stocks in 15 or more leading groups that will provide a steady climb based on their behavior the past few months. However, to all NEWBIES my strongest warning is don’t play with dynamite until you know how to handle it – you can get eaten alive if you go in blindly and buy these stocks and the market turns sour on you.

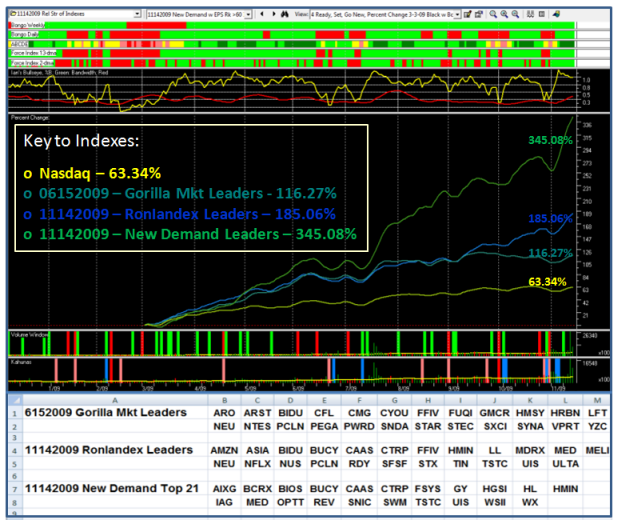

With all of that as background, here is the chart which compares the 06152009 Gorilla Mkt Index with the two new indexes and the Nasdaq to give you some idea of the relative strength of these Indexes when measured from the Base Low in March 2009. The stocks that make up the Indexes are shown below the chart for your convenience:

If you stare at the chart, here are some pointers for you:

1. Note how the 06152009 Gorilla Mkt Leaders Index is nearly twice the strength of the Nasdaq. Being of stalwart make-up, it matched the fresh RonIandex of 11142009, until it tailed off in strength in mid September, and is now essentially flat, indicating it has served its purpose. However, it still has life in it as it surged 1.57% today and is up over 33% since 6/15/09, when I first introduced it to you.

2. The 11142009 RonIandex is made up of a few old warriors and several new leaders which are showing their muscle, now that the EARNINGS REPORTS are behind them. There is nothing worse than selecting stocks for such Indexes that haven’t announced their earnings. The whole purpose is to time the selection of such Indexes after the bulk of the Earnings Season, so that one can quickly identify NEW Leadership. This Index is up 1.42% at the close today.

3. Albeit, we are too quick to paint this rally as “Junk off the Bottom”, but I learned many moons ago that the fresh new companies that are coming out of the woodwork which I call Box 7 stocks with >100% earnings the last two quarters is the best kept secret HGS Users have known for Years. So fresh off the drawing boards, I built on Ron’s portion of the newsletter to give you the “New Demand Leaders” which has a mixture of up and coming new leaders and “tiddlers”, so that there is something in there for everybody to taste. Naturally, its Index is “To Da Moon” with a reading of 345%, over five times the Nasdaq! If you don’t work with stocks below $15 just overlook them, but there is a smattering of six tiddlers in this Index. This Index is up 2.26% at the close.

4. Just one glance at the steep rise in % Change in mid-July, and again confirmed two weeks ago from early November, should leave no doubt that these stocks are worth reviewing and selecting and discarding as one sees fit according to your fancy. Note the surge in Volume on those two occasions. Also note the Dark Green ribbon, third from the top, which confirms heavy accumulation of the stocks in this Index now.

Those of you who attended the seminar need to dust off HGS 1001 and review Pages 179 to 181 to prepare yourself for the next targets for the S&P 500 and Nasdaq…now that 2206 is within the Nasdaq’s sites. Don’t forget there is still a residual “White Swan” volume vacuum, particularly for the S&P 500.

Yes, of course there will be Moose Droppings along the way, but Santa is enjoying the sleigh ride early this year.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog