Happy Days and Off to the Races?

Saturday, July 19th, 2008IAN: IS THIS A CUB BEAR MARKET OR A FULL SIZE BEAR. i.e. HAPPY DAYS ARE HERE AGAIN??? XLF OFF TO THE RACES?? Bob

Hi Bob, let’s review the bidding:

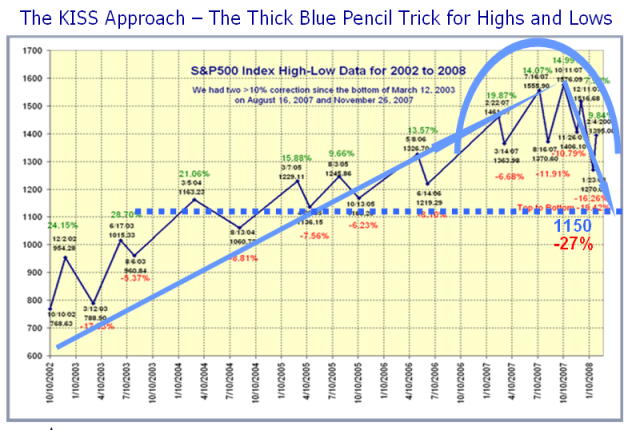

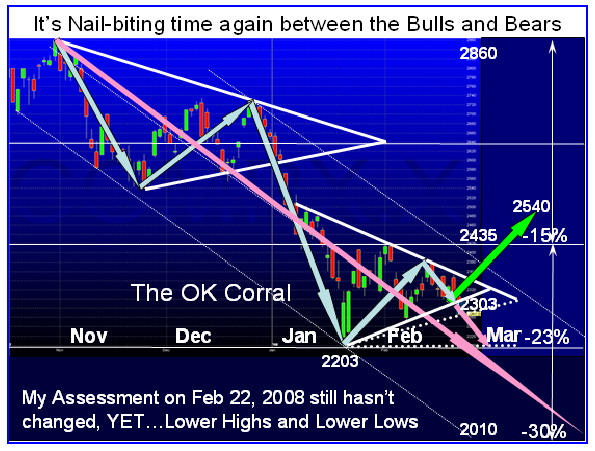

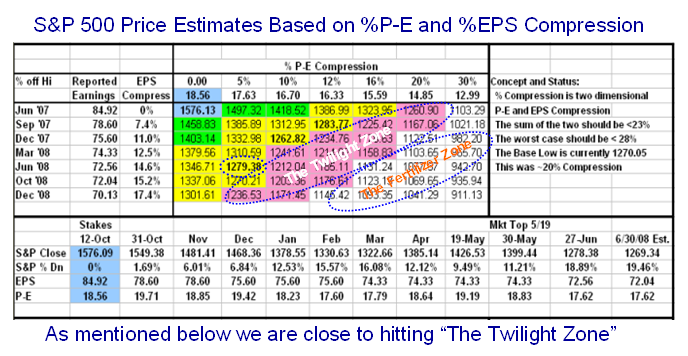

- We are already in a “Full Size Bear”, i.e., >20% down from the high last Oct 11

- We just finished a Bear Market Rally of ~15% in two months from March 17 to May 19

- We have just had an Intermediate Correction on top of the Bear Market of ~17% down for two months to July 15, so this “cub” is a trifle bigger than we wish!

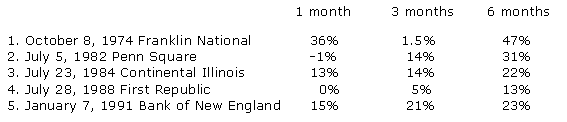

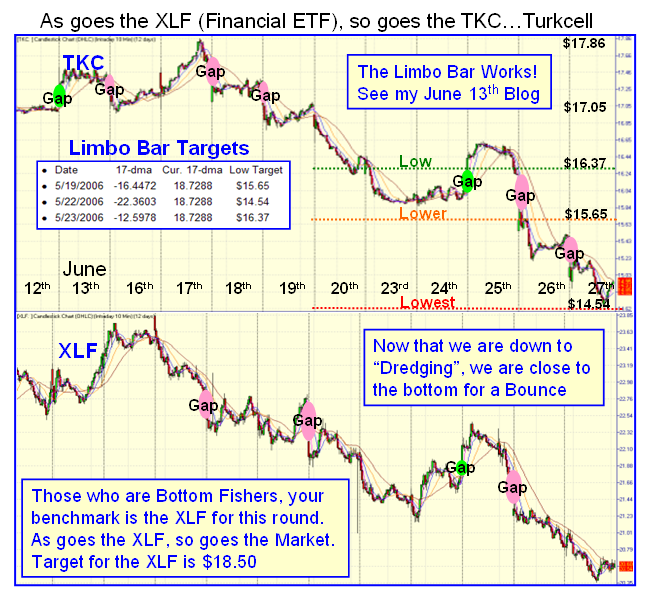

- We had Capitulation on July 15, where the XLF bottomed and produced $8 Billion Dollar Volume

- XLF bounced with last week’s shoring up by Bernanke and Paulson of Fannie May & Freddie Mac

- Whether XLF fully recovers or is just a bottom fish Bounce Play depends on the Markets.

- The Markets have bounced mainly on Short Covering these last three days

- The Markets recovering are dependent on:

- OIL continuing to drop

- The Dollar rising

- Strong EPS Reports over the next three weeks, beating estimates

- Institutions buying into Finance, Technology, Health-Care to replace loss of leadership in Oils

- Global Stability

- Inflation controlled, including Energy and Food Prices, which are killing the public at large

Now that we have temporary Capitulation, What are the clues to look for in a Bear Market Rally?

- A Strong Follow Through Day (FTD) with >2.5% rise in all Indexes and Nasdaq Volume >2.5 Billion

- This MUST occur in 3 to 12 days from the Low of July 15

- HGS Investors will expect at least 2 or 3 Eurekas along with Kahuna signals

- By that time the New Highs on the NYSE must show at least 100 New Highs and <30 New Lows

- Ideally the New Highs should rise above 150 for several days with New Lows down at <30

- Technically we must get above the 17-dma, then up to 1334 on the S&P to the 50-dma

- That requires a 10% Bear Market Rally which is the minimum, since >15% is considered normal.

- Otherwise consider anything less as a Bounce Play and expect a retest of the lows

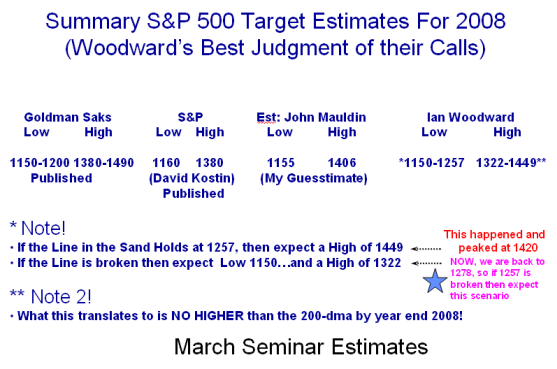

Net-net: Don’t expect Manna from heaven any time soon. It will take a long time for this market to repair, and don’t be surprised if we trot down to 1150 on the S&P 500.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog