August 7th, 2013

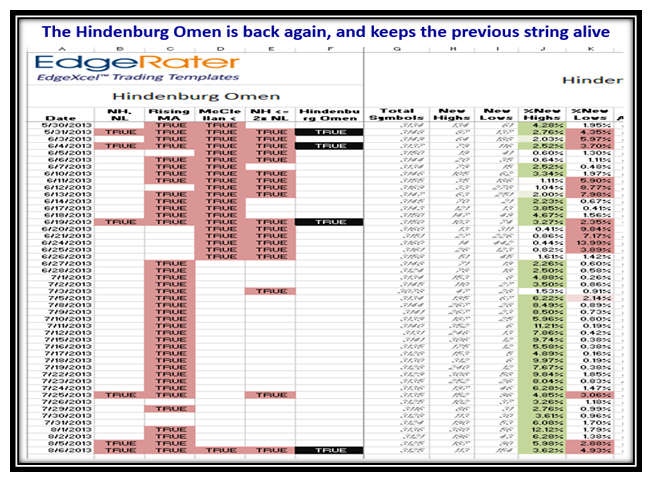

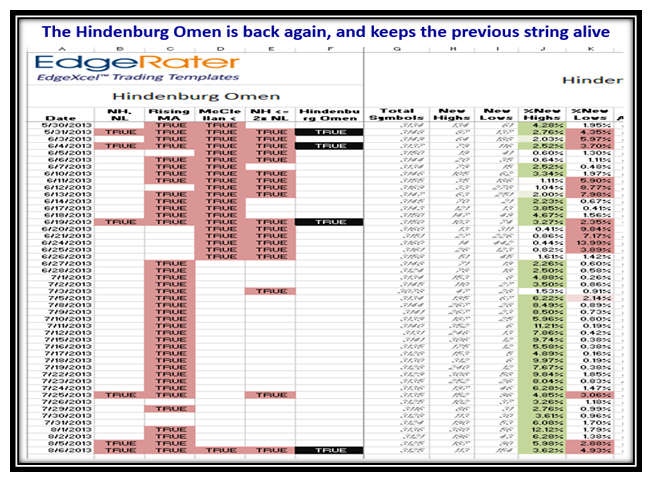

Yes, the Hindenburg Omen Scored another hit yesterday.

Chris White, the CEO of EdgeRater has provided us with a Template of the Hindenburg Omen which makes it simple to watch for this, and here is the recent evidence of when it has struck, including yesterday:

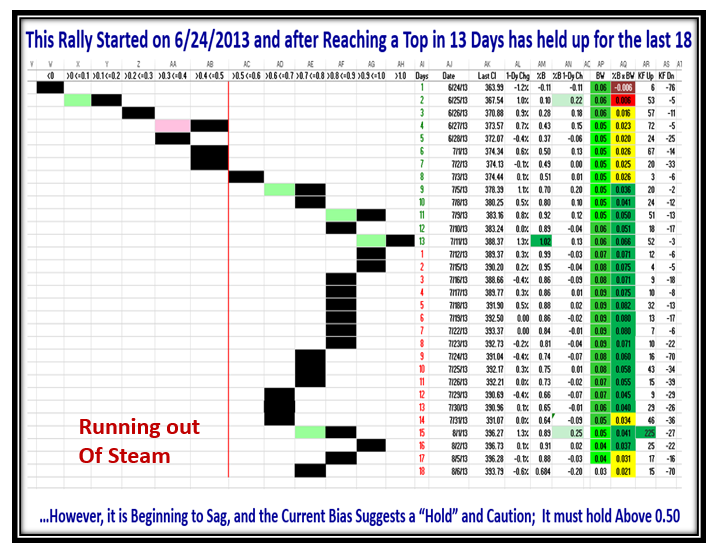

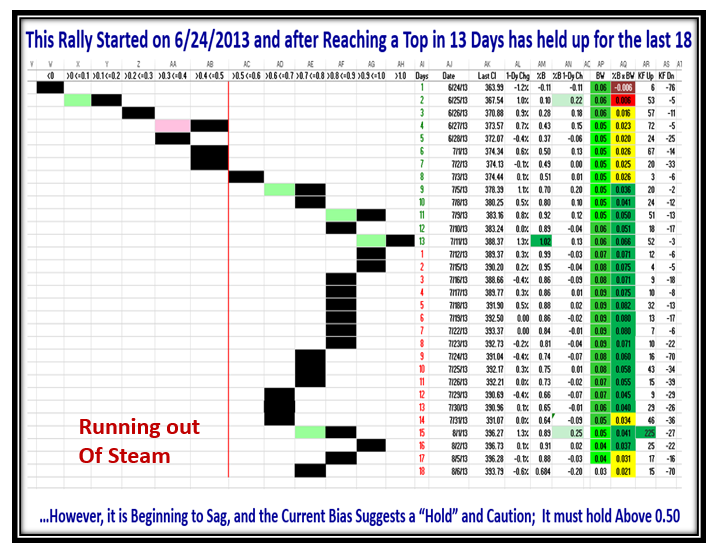

This Recent Rally is now long in the tooth and deserves a rest as it has been 31 Trading days since it started back on 6/24/2013. It has held up very well but is now running out of steam:

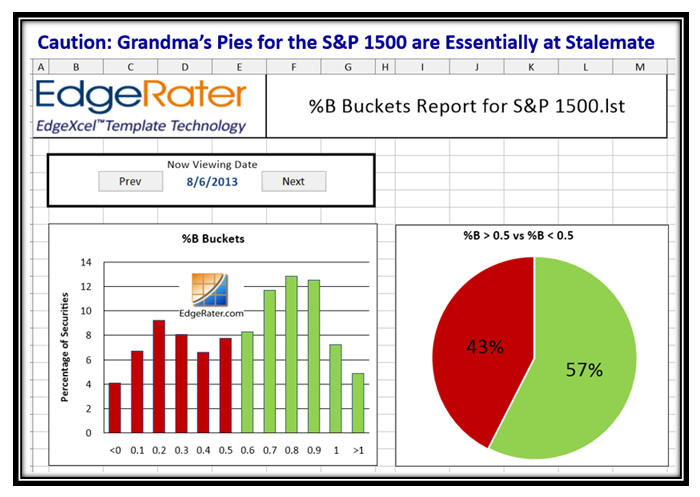

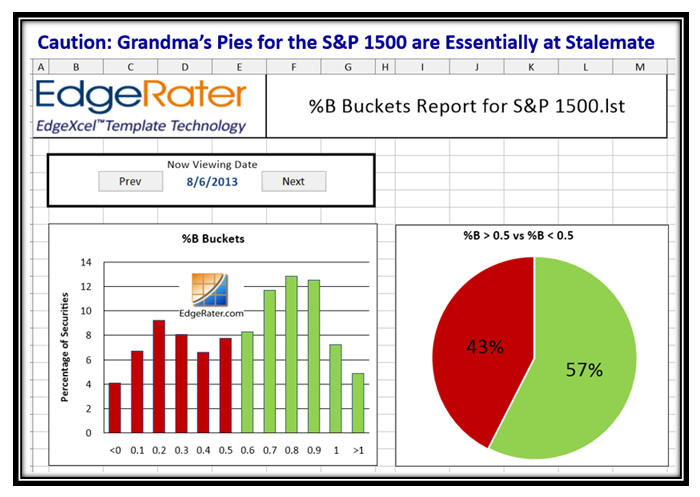

Further evidence comes from Grandma’s Pies for the S&P 1500 which confirms sluggishness:

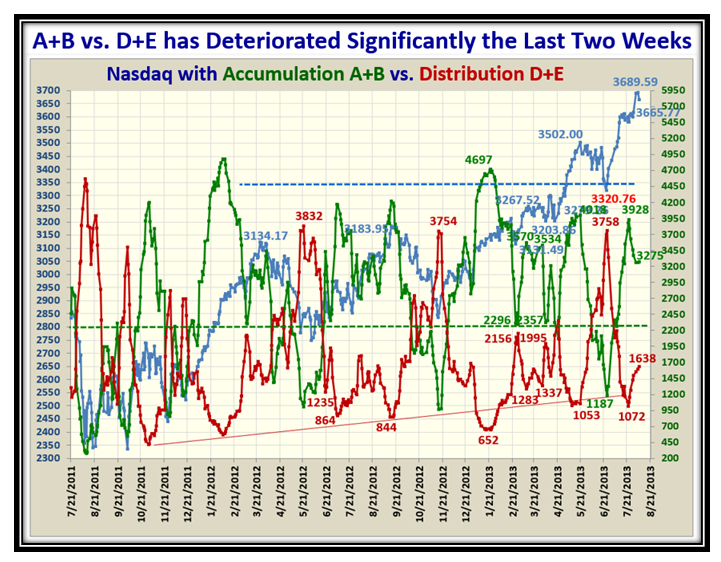

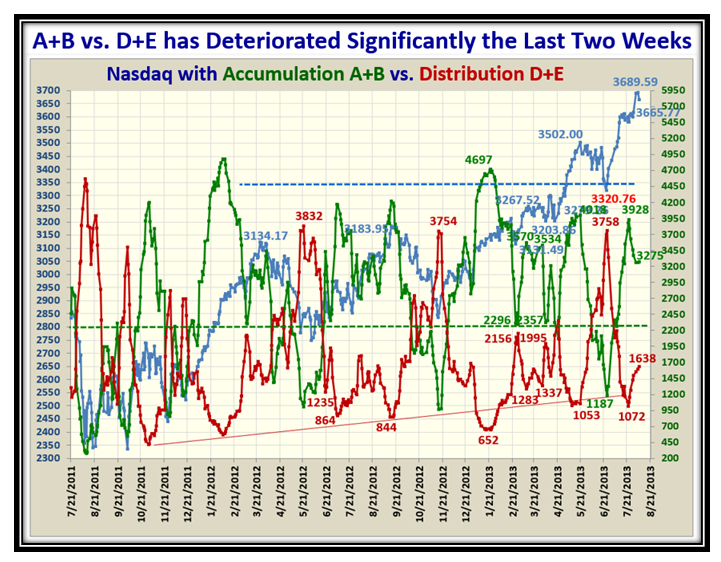

…And, more of the same with A+B vs D+E showing deterioration in the last two weeks:

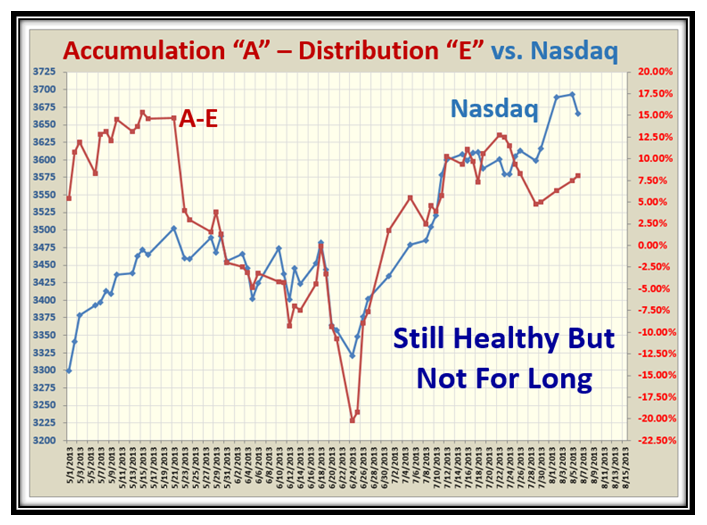

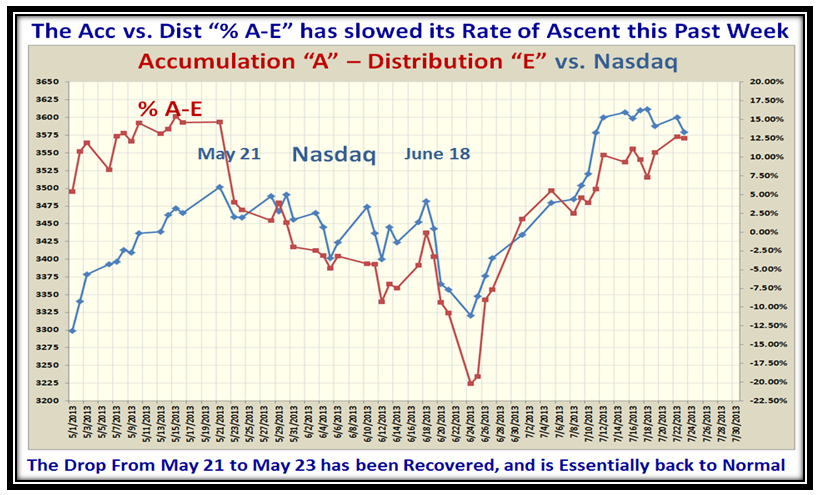

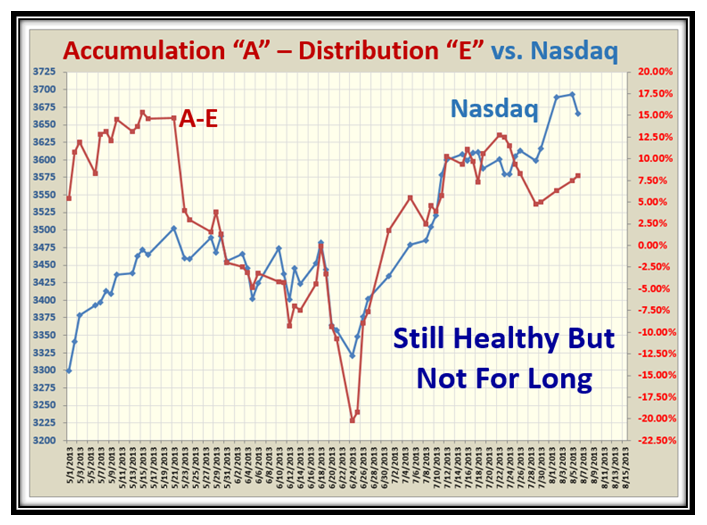

Lastly, %A-E is still healthy but not for long, so take heed of all these warning signs:

Best Regards,

Ian.

Posted in HGS Principles, Market Analysis | Comments Off on Stock Market: Hindenburg Omen Yesterday!

July 23rd, 2013

We are at a point where its time to bite your finger nails, as this Market can go either way:

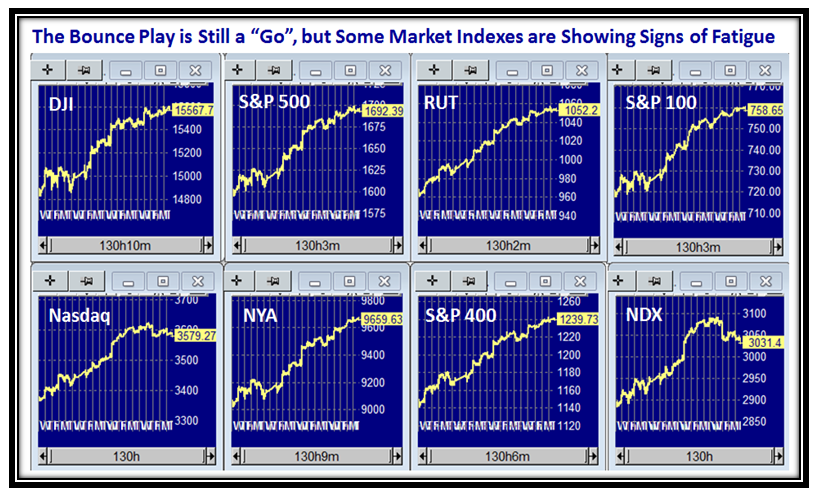

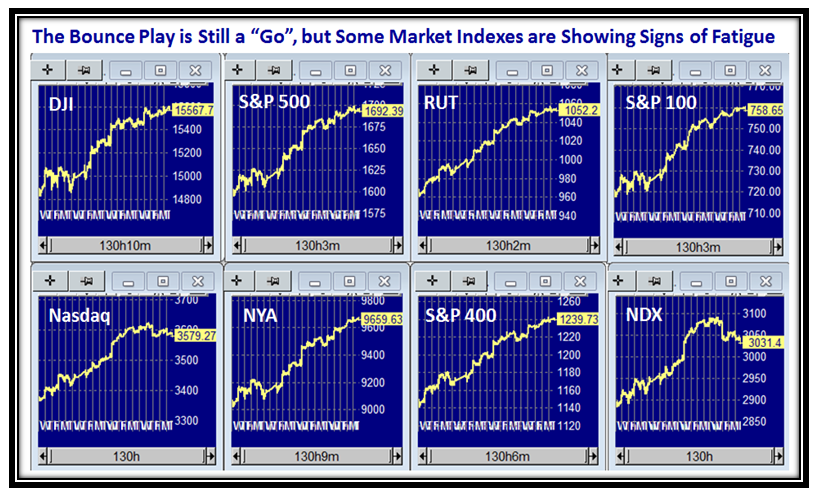

The NASDAQ and NDX are already showing signs of Fatigue, and the others are running out of steam:

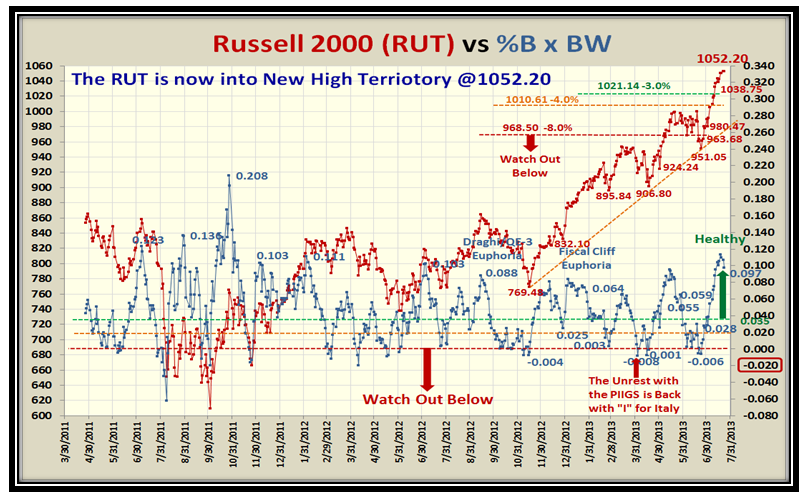

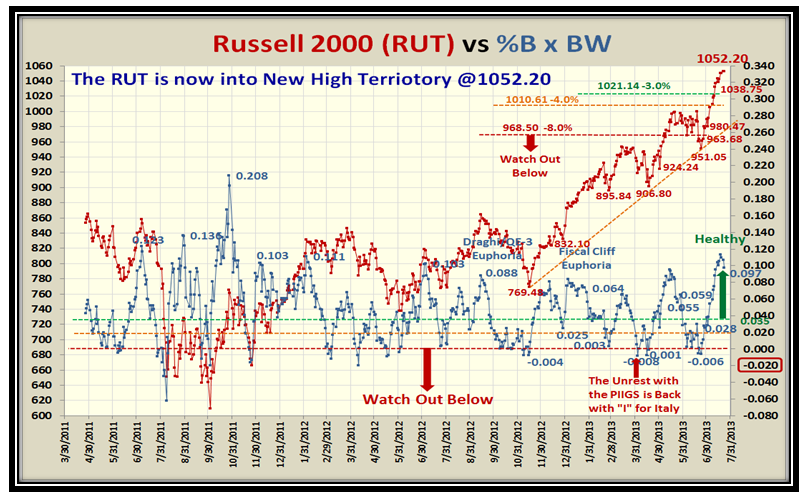

The RUT is still the strongest and now provides plenty of cushion:

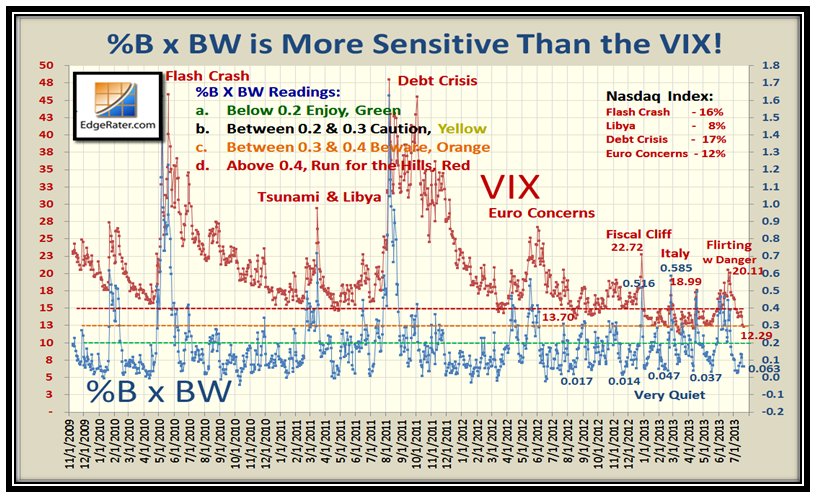

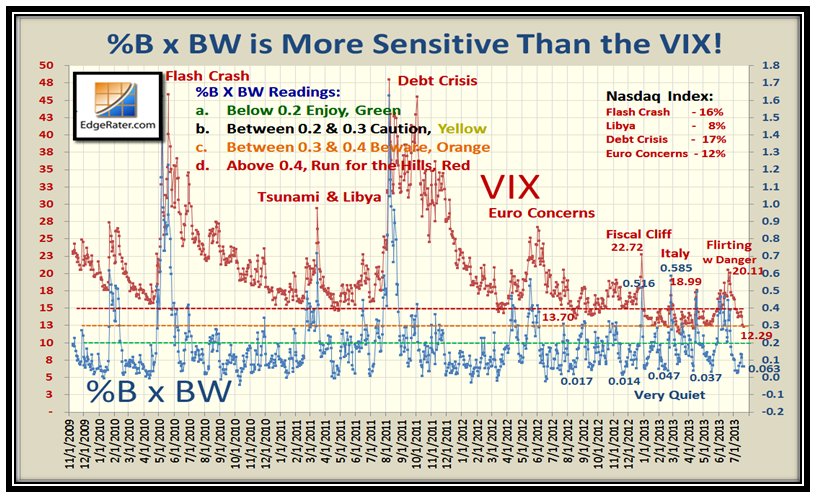

What helps the Bulls is the complacency on the VIX at the moment:

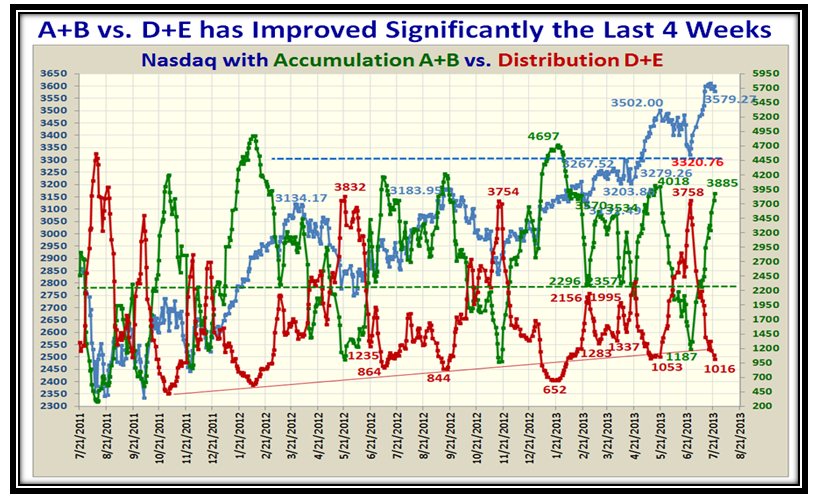

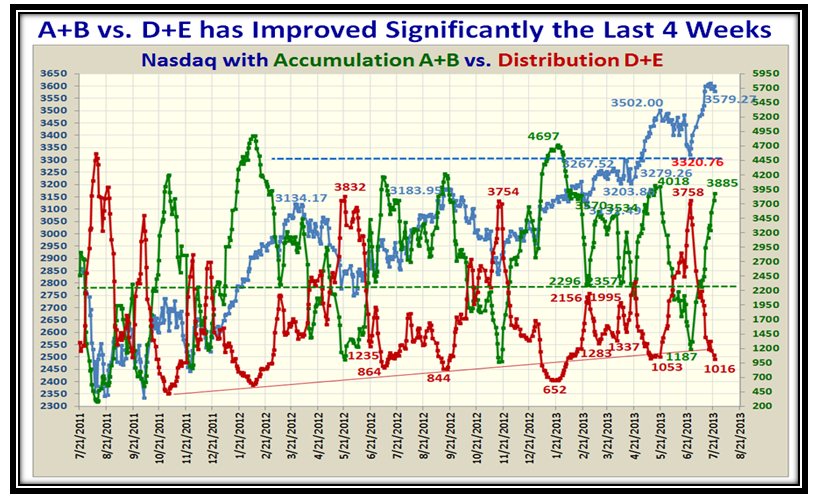

Accumulation vs. Distribution Ratio has improved significantly over the last month and reaching the point to turn around:

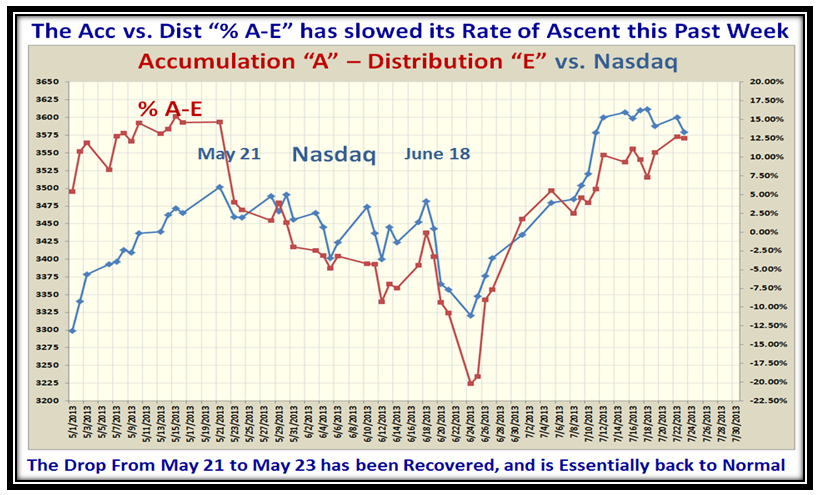

We cannot complain about the strength of the Rally over the last month, which shows that we have recovered:

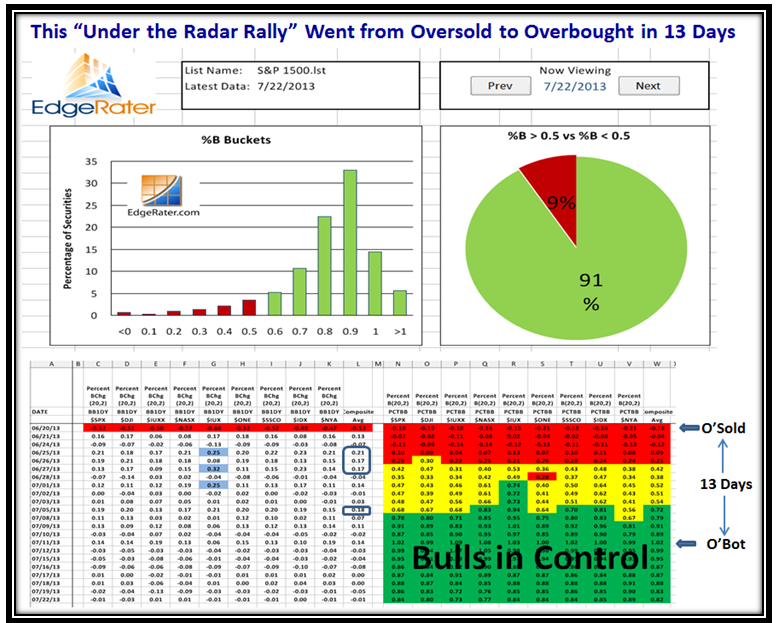

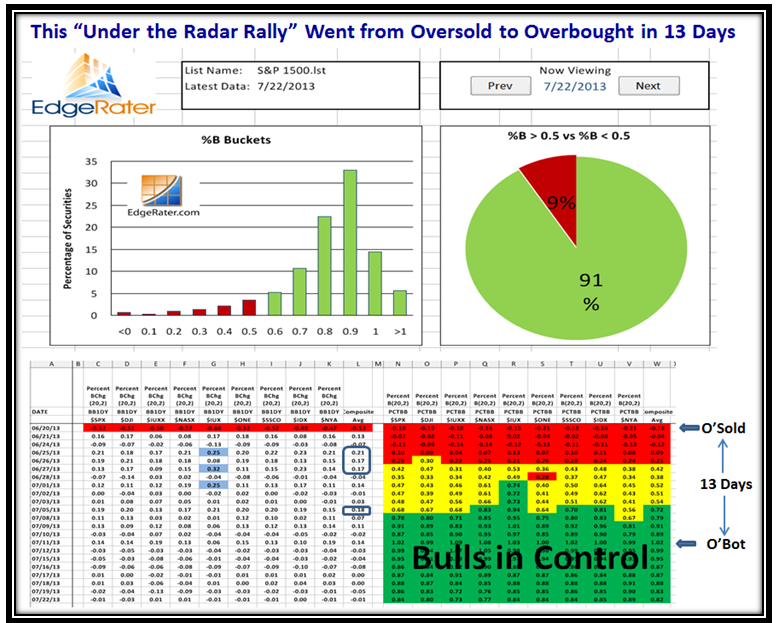

…And to prove this was no ordinary rally, it went from oversold to overbought in just 13 Days:

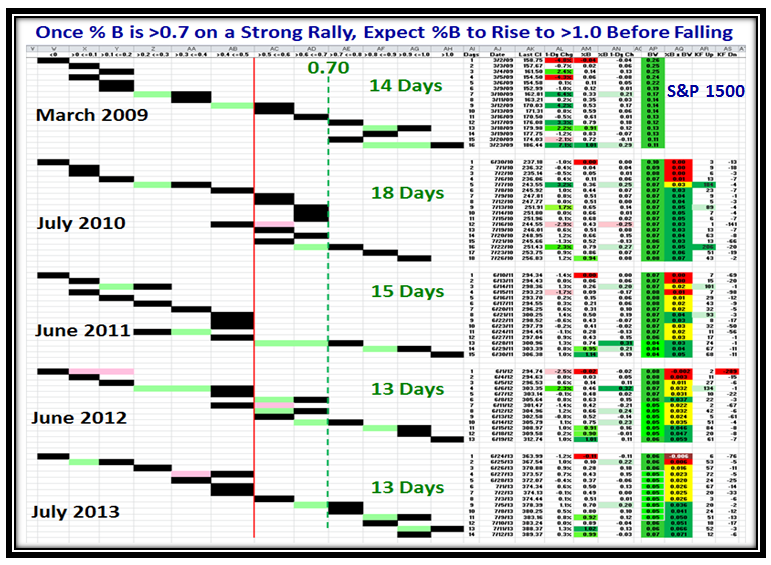

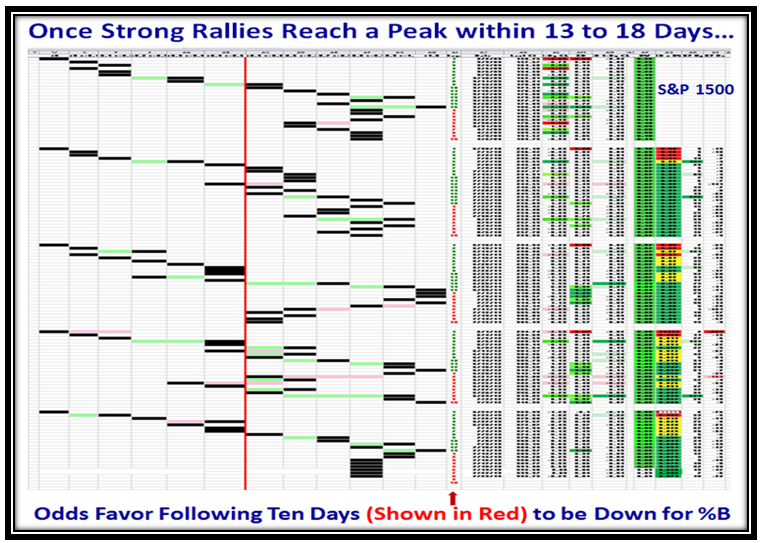

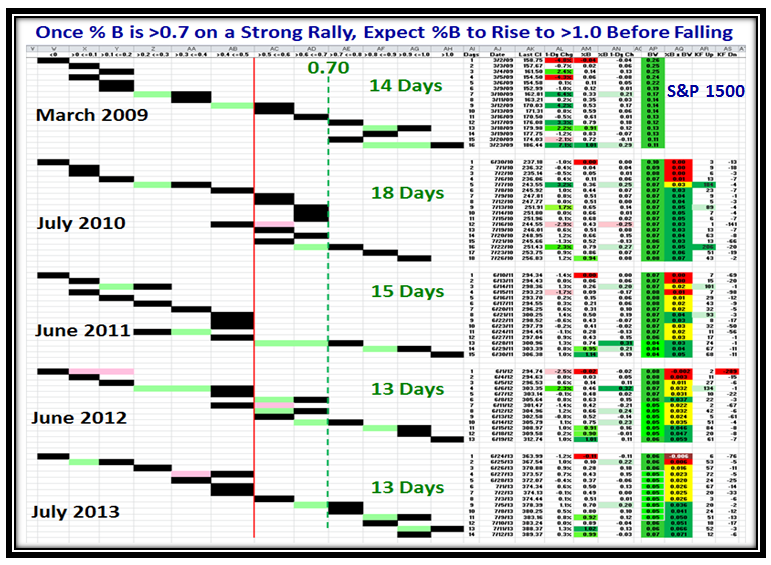

The natural next question is how often has this happened before over the past five years since the start of the Rally in 2009? The answer is that the range is 13 to 18 Days for the best Rallies over five years. Once past %B of 0.7, expect the move to continue up:

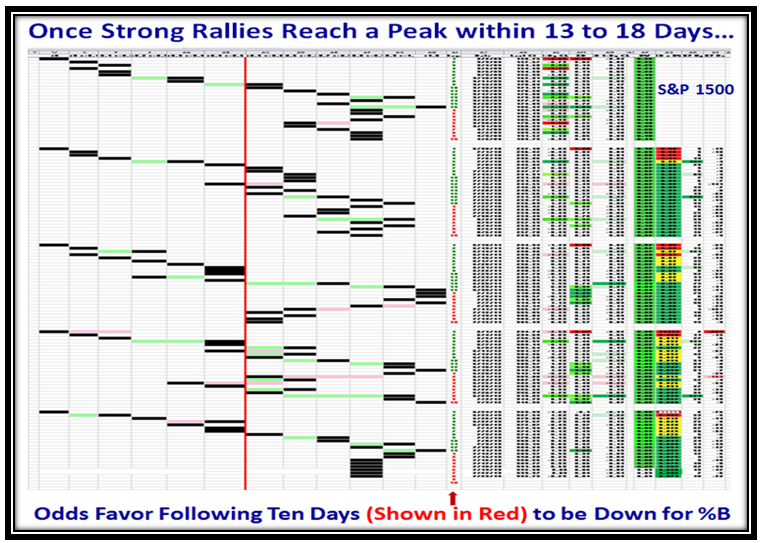

Then inquiring minds would like to know what are the odds for up or down of %B over the next ten trading days? Down. However, the Market Indexes can usually hold up for at least five days, and then trot down or sideways:

Stay on your toes, and watch the signs I have taught you of 4% down at a time with -8% from the high to think about vacating.

Best Regards,

Ian.

Posted in HGS Principles, Market Analysis | Comments Off on Stock Market: Bite Your Finger Nails

July 10th, 2013

Here is a recent question from Paul R regarding the State of the Union ala Kahunas and Buckets:

Ian any thoughts about the current rally in the market as we haven’t had any Kahunas in the indexes other than the Russelll 2000 since the Eureka on June 26?

That would suggest to me we really don’t have a broad market participation.

Paul R

Hi Paul: As my younger son Paul would say “You are a Smart Dude”!

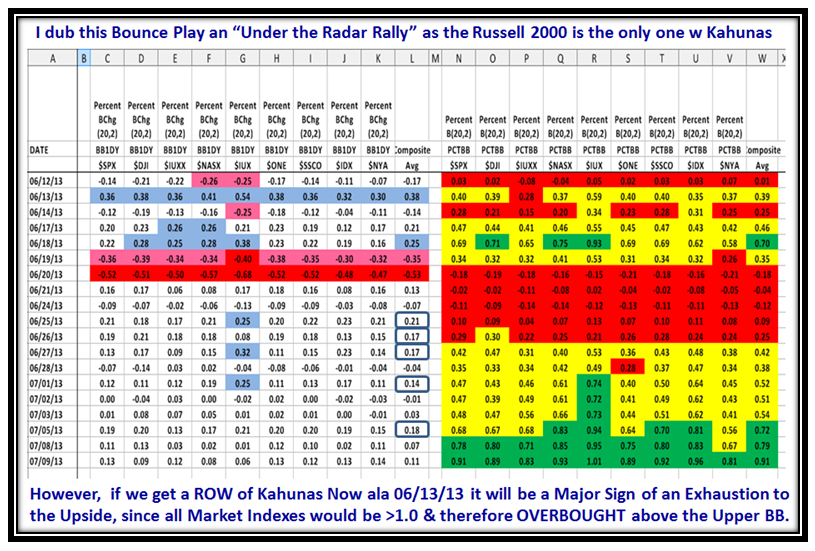

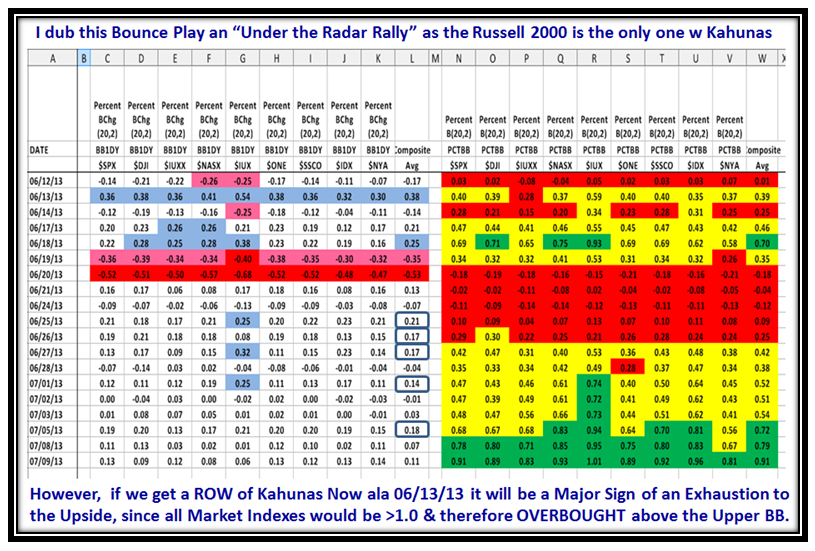

Sometimes hard and fast numbers can mislead one, so I had to look under the covers to come up with the answer. I dub this Bounce Play an “Under the Radar Rally”, as you will see from the chart below. As you rightly say the RUT is the only beast that has shown Kahunas, as the others have all been slightly below the 0.24 requirement to signal a small Kahuna. To my eyes, that’s “Close enough for Gov’t work”!

The right hand side of the chart says we do have broad market participation, since %B on Average is at 0.91 and knocking on the door of being very overbought, as it is so close to 1.0, the upper Bollinger Band. We can immediately see that the NYA is the laggard and everyone knows by now that the Small Cap RUT and S&P 600 are the leaders.

Looking ahead, if we get a ROW of Kahunas NOW ala 06/13/13, it will be a Major sign of an Exhaustion Gap to the upside, since all Market Indexes would be >1.0 and therefore OVERBOUGHT above the Upper BB.

Since we are now at “Double Tops” or higher for most Market Indexes, we should expect a correction sooner than later as I described in my previous blog note , but the alternative is to see an Exhaustion Gap to the upside.

Now the Game Plan is simple, but you had me tossing and turning in bed last night trying to figure out the conundrum!

This stuff is fun! Italy seems to be getting the hang of it as they were all over my blog note the other day!

Ian

Posted in Uncategorized | Comments Off on Stock Market: Game Plan using %B Buckets!

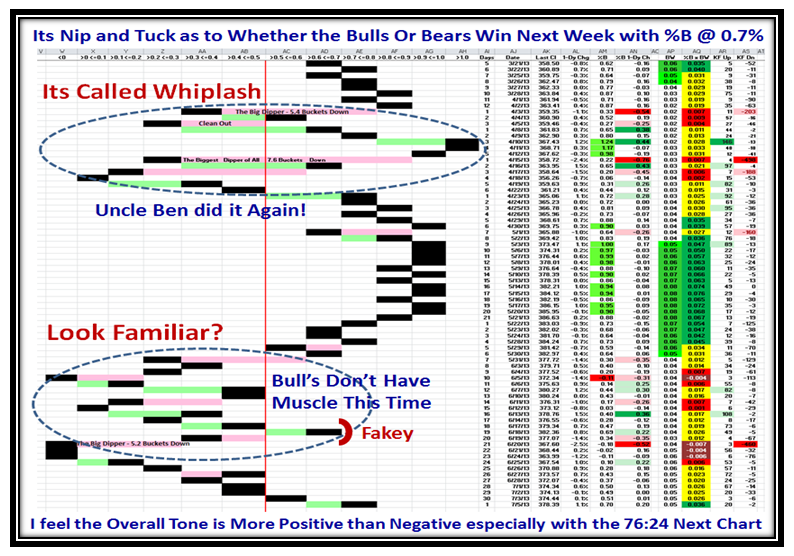

July 7th, 2013

Ten Days ago the Bears were dancing that at long last the floodgates were opening and now we are in a Strong Bounce Play where it appears the Bulls have the upper hand. The Champions of both sides are full of chatter, but in essence it comes down to the Blind Leading the Blind!

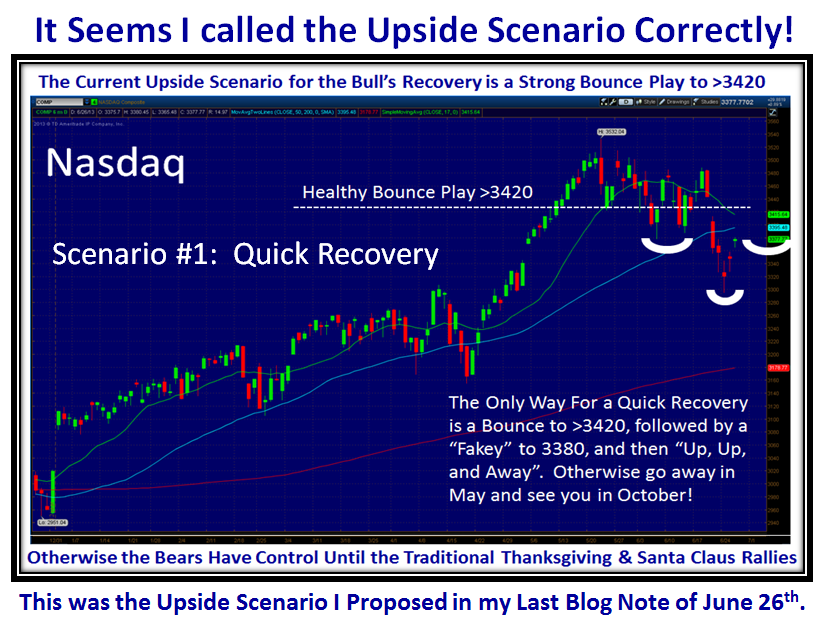

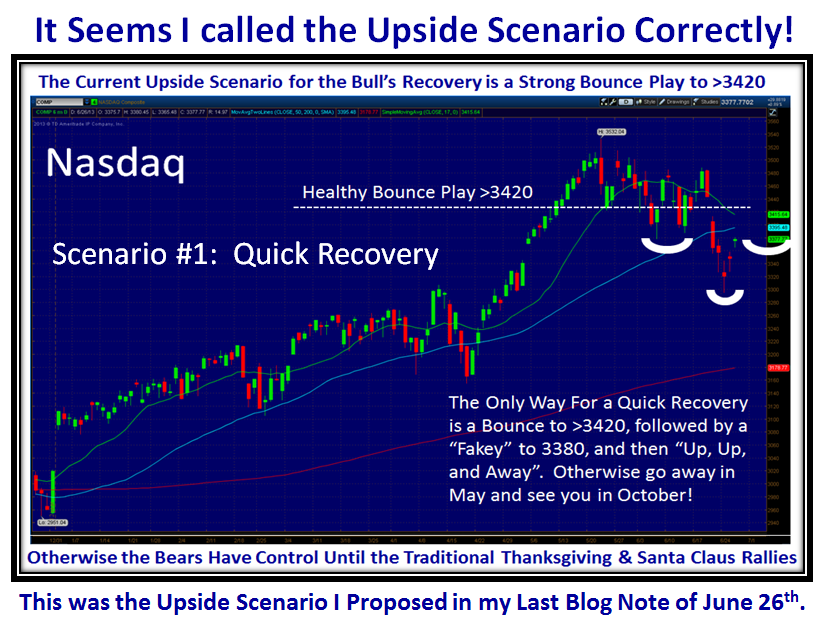

I am happy to say that of the two Market Scenarios I gave you, Scenario #1: Quick Recovery is winning:

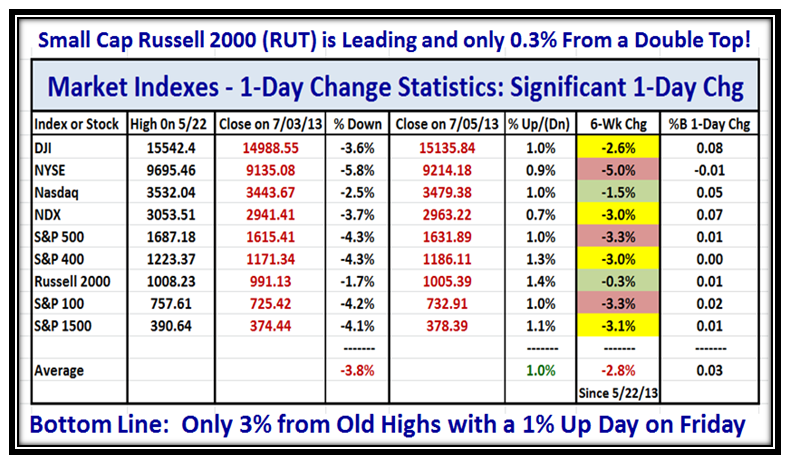

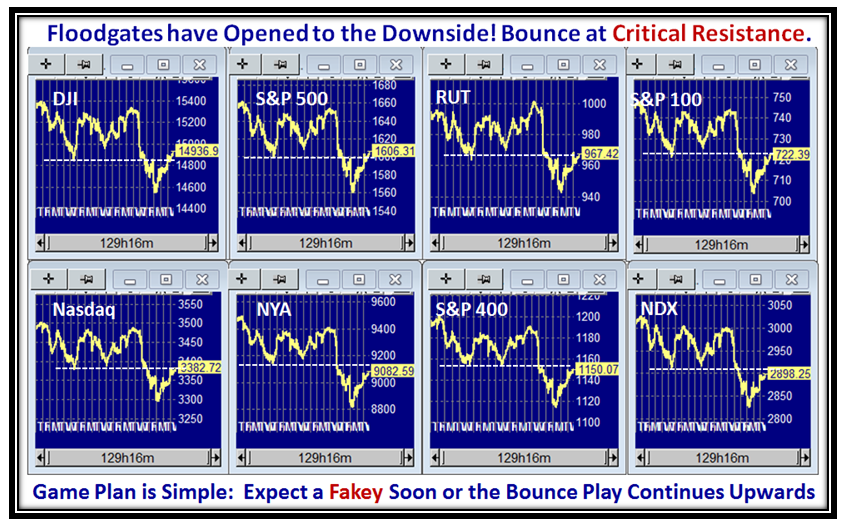

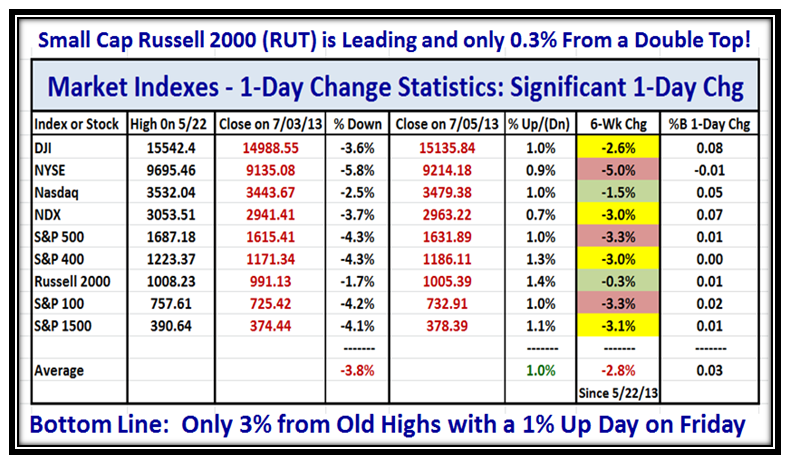

Ten Days later here is where we stand with an impressive cushion of 100 points as we expect no more than a -3% Drop to complete the Inverse Head and Shoulders I predicted.

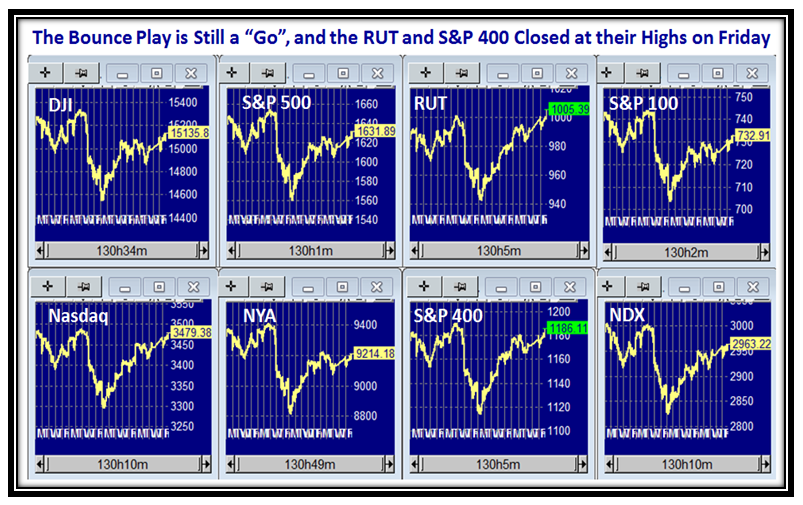

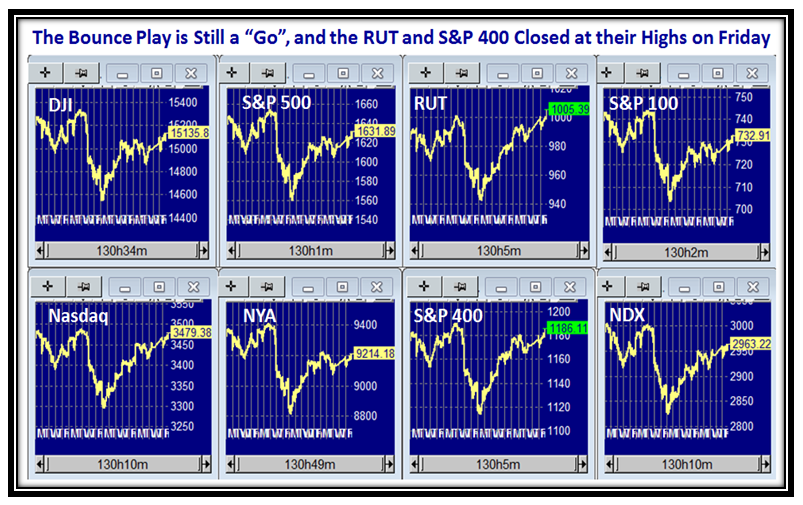

Here is the standard picture of the eight Market Indexes which shows the progress to a Double Top with the Small Cap Russell 2000 (RUT) leading the way:

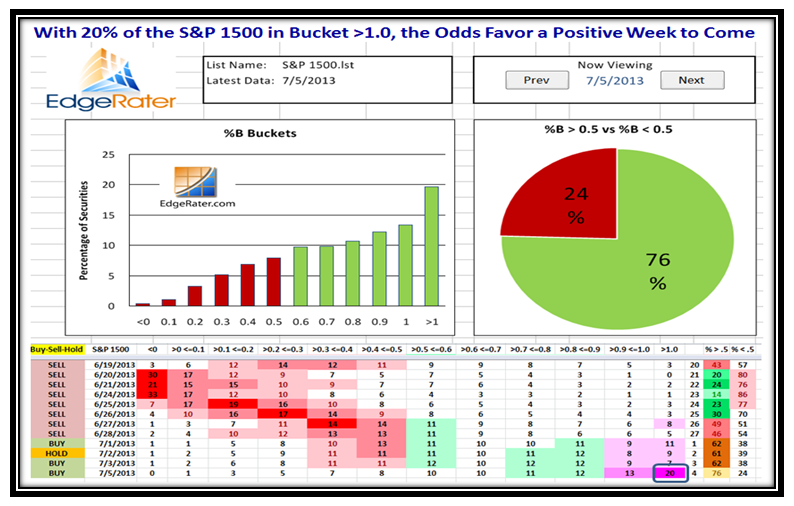

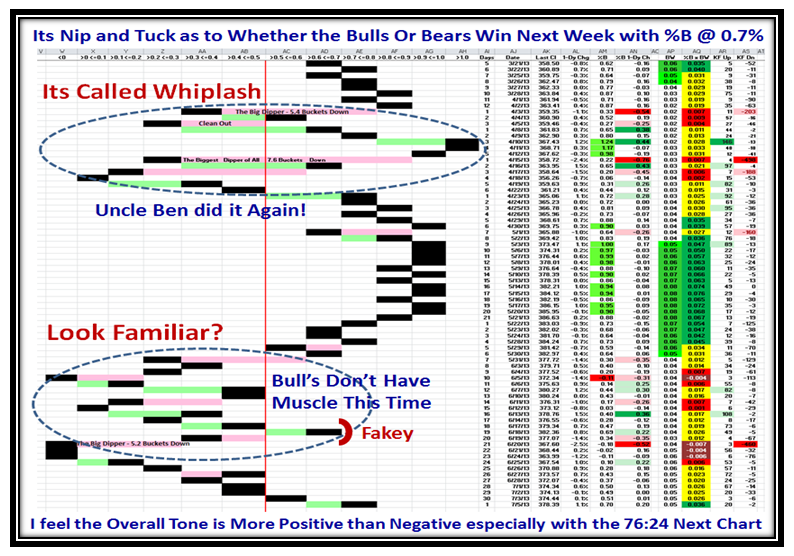

Fakey’s usually occur for %B <0.7 and the S&P 1500 is right at that reading, so it is a toss up.

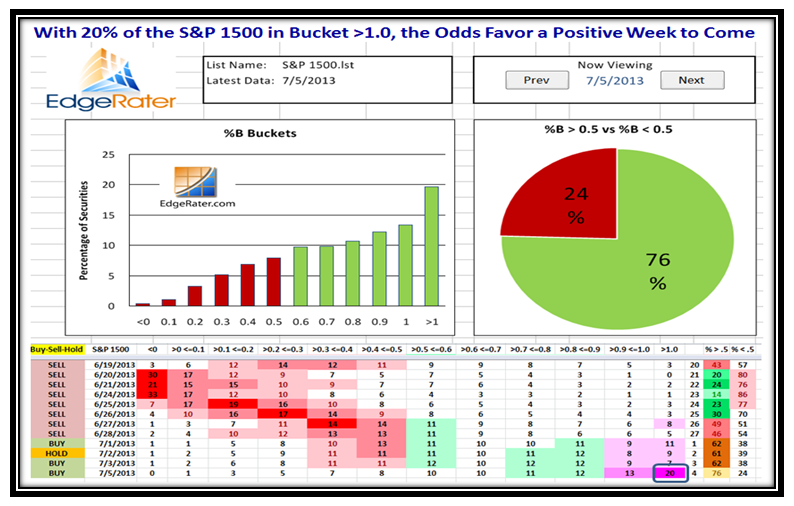

This next picture using Buckets is the most encouraging as the Market seldom dies with 20% in Bucket >1.0:

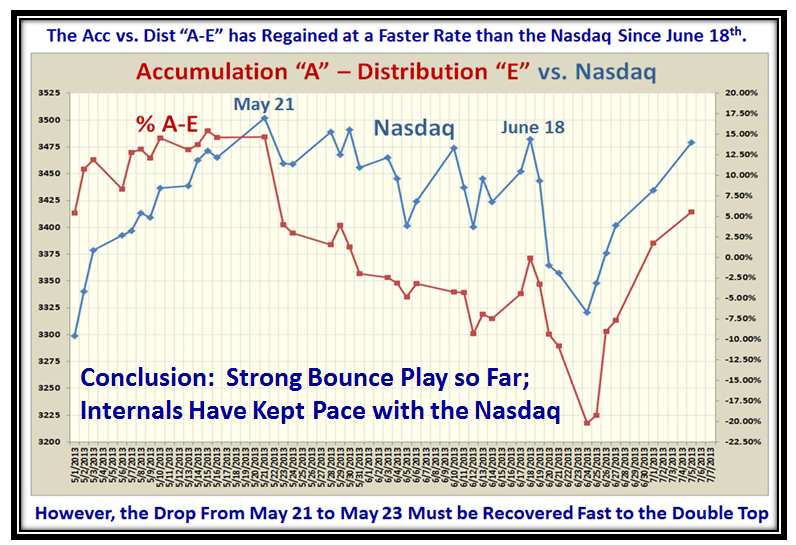

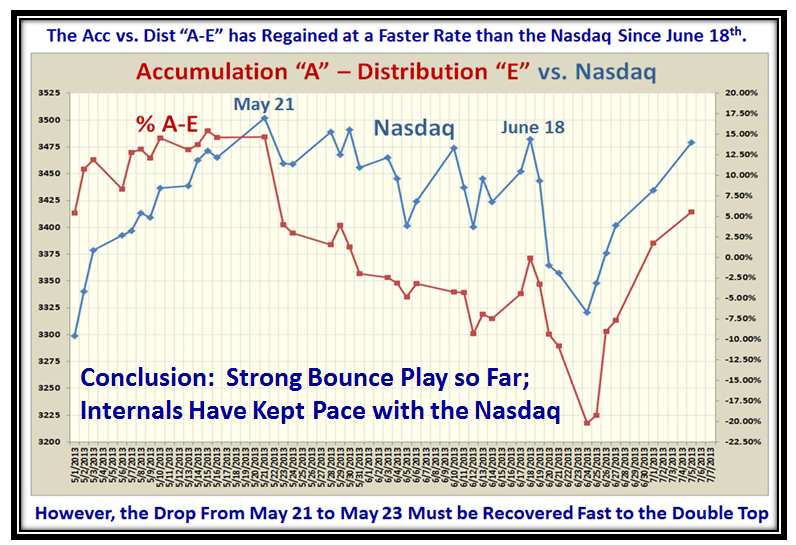

We see a big improvement in %A-E for Accumulation vs. Distribution, but there is still work to do:

And last but not least, here is the most encouraging news in six weeks since the top in all the Market Indexes:

Have a Happy!

Ian.

Posted in HGS Principles, Market Analysis | Comments Off on Stock Market: Blind Leading the Blind but Bulls Winning

June 26th, 2013

Today’s Bounce Play is strong…However with the Indexes at resistance it is too soon to judge if the Bulls can maintain the Rally. Bears are still in control for now:

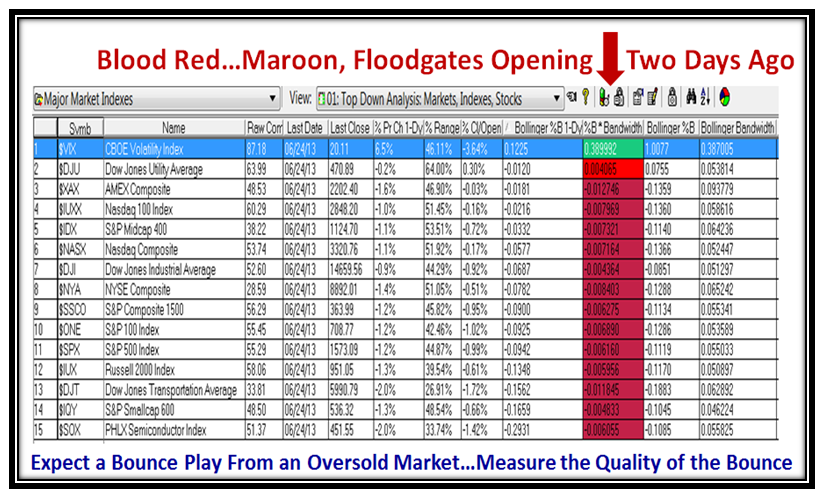

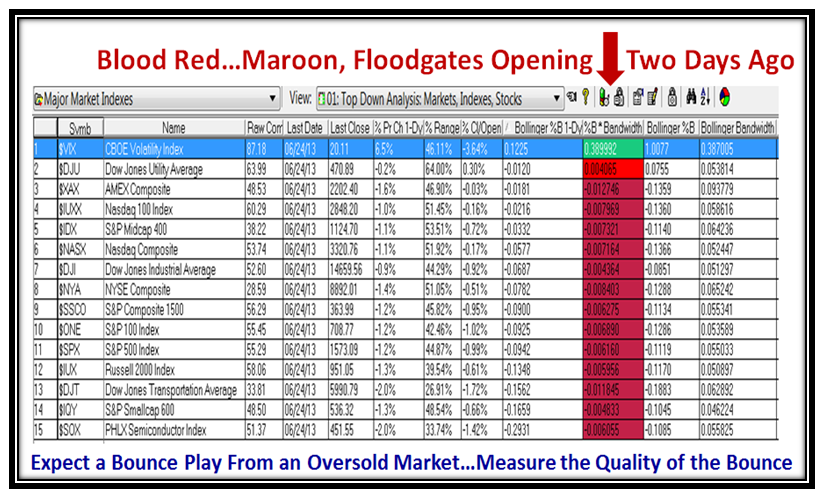

So let’s review the bidding for Past, Present and Future, starting with two days ago which looked very ugly:

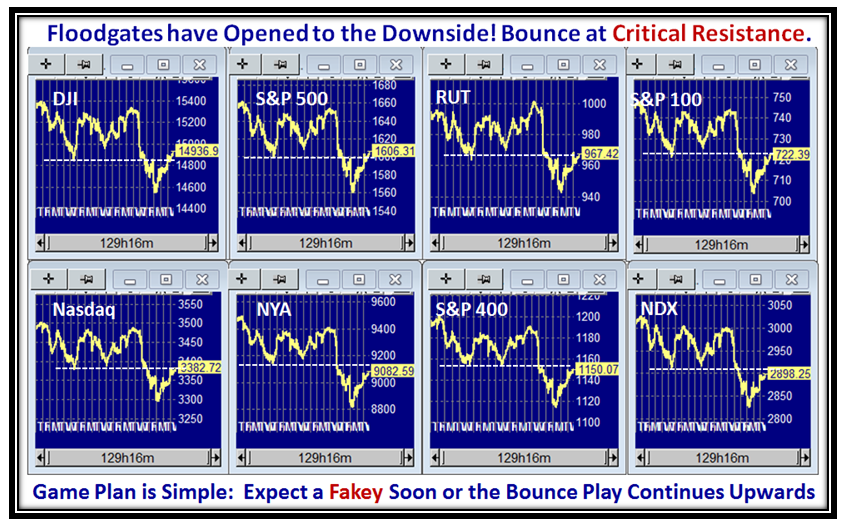

Present: With half an hour to go, this is a Strong Bounce Play, but as we can see the Indexes are now at Critical Resistance:

Future: Scenario #1: Quick Recovery…the expected plan is shown below as a follow up to my previous note to Paul Reiche in the Comments Section of “Scary Ride to Come or Up, Up, and Away?”

Future: Scenario #2: Correction & Slow Recovery…Bears maintain control until October or later with more to the downside. Key Support will be at -8% down from the high…if broken we will have a Major Correction on our hands:

Caution: Never fall in love with one Scenario. Let the Market guide you, but it is always worthwhile to have “What If Scenarios” so that you can judge and recognize what the Market is telling you. Then let your stomach be your guide as to whether you play or not. News is always an overriding factor in all of this and you need to be on your toes, and don’t forget the big one hanging over our heads is the delayed action on Sequestration due now in September!

Best Regards,

Ian.

Posted in HGS Principles, Market Analysis | Comments Off on Stock Market: Decent Bounce Play, but Still Favors the Bears

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog