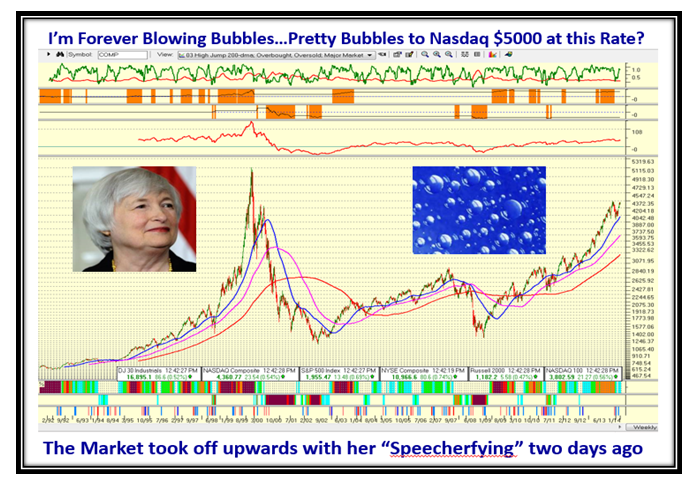

Stock Market: Will Soon Be Reaching “Bubble” Territory

June 21st, 2014I just couldn’t resist showing you how the Market behaved as Ms. Janet Yellen was pontificating to the Senate despite all the turbulence around us with concerns of the situation in Iraq uppermost on our minds:

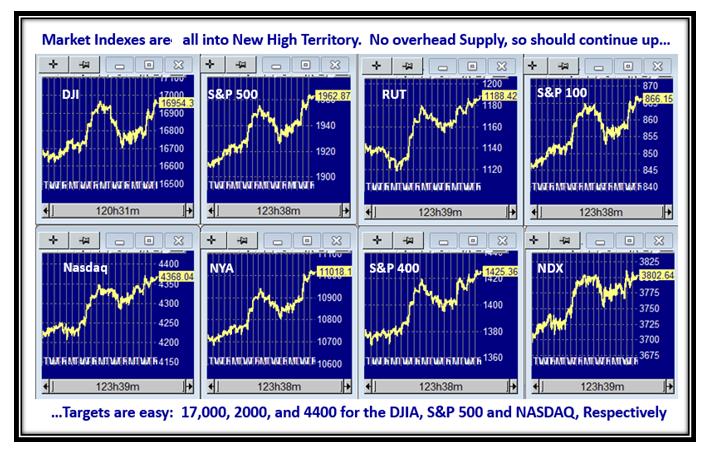

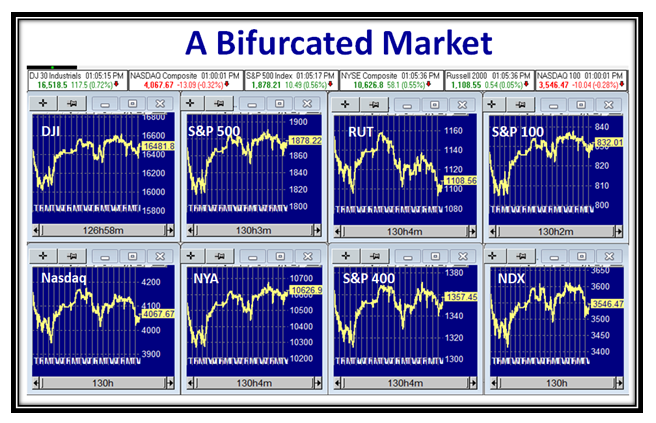

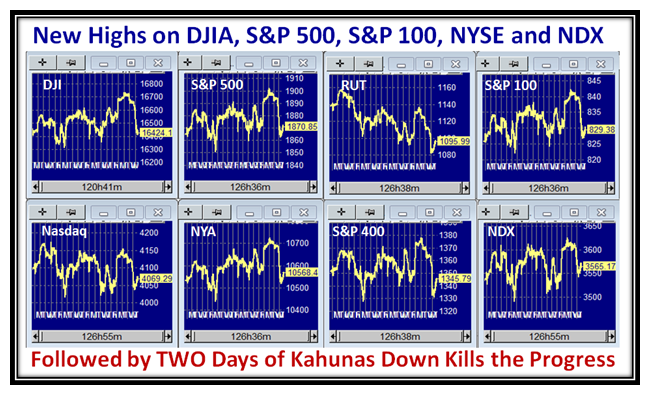

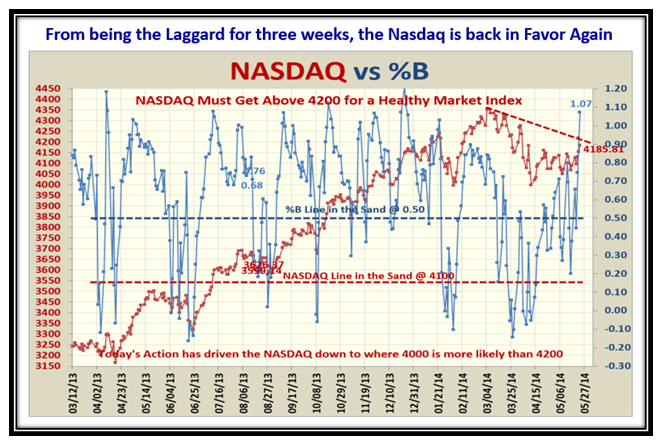

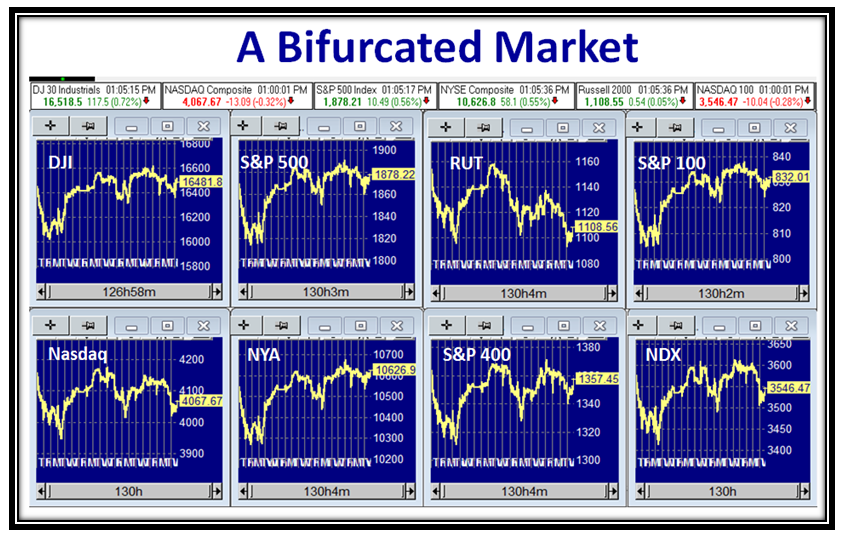

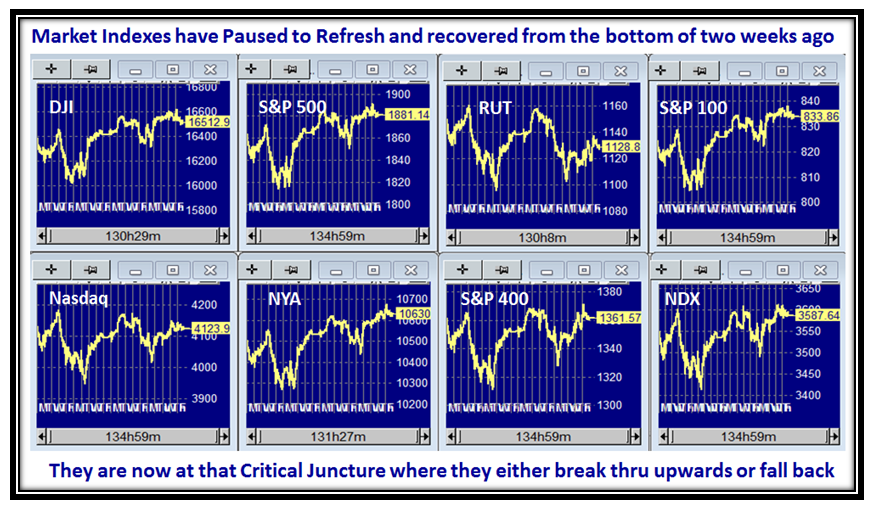

The Market Indexes have all reached double tops, so we either pull back again or burst out upwards next week:

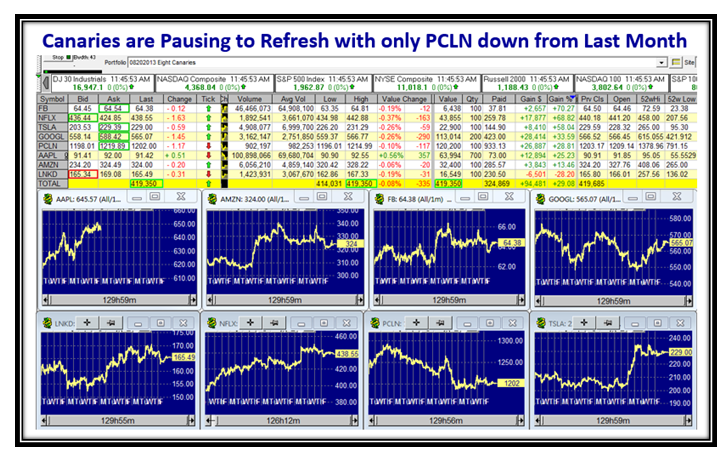

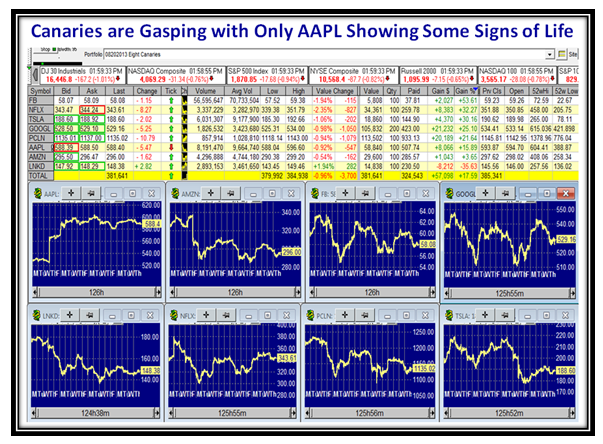

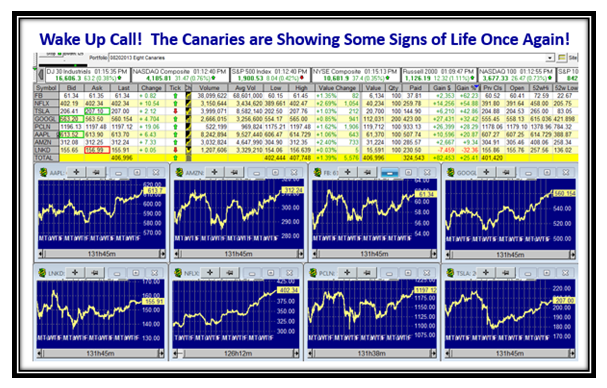

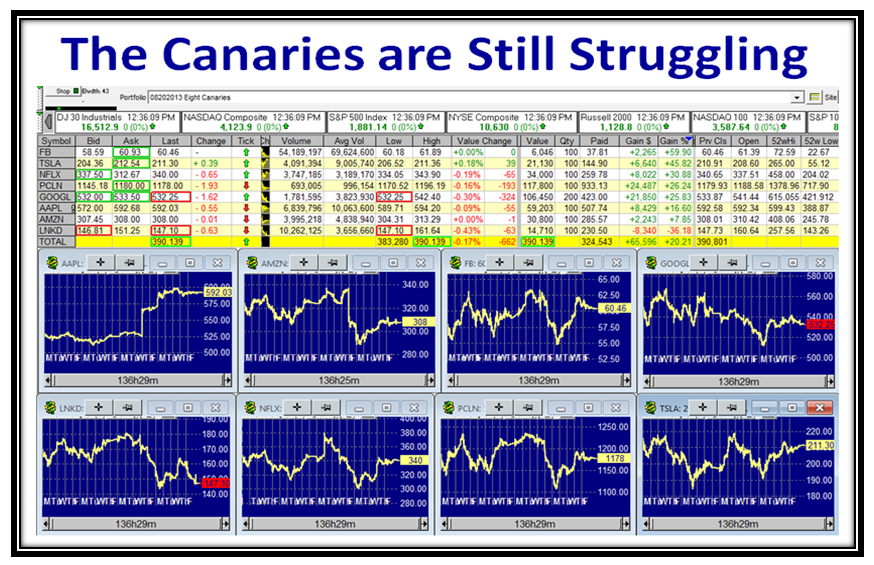

The Canaries have behaved relatively well during this period, but pausing to refresh at the moment with PCLN lagging:

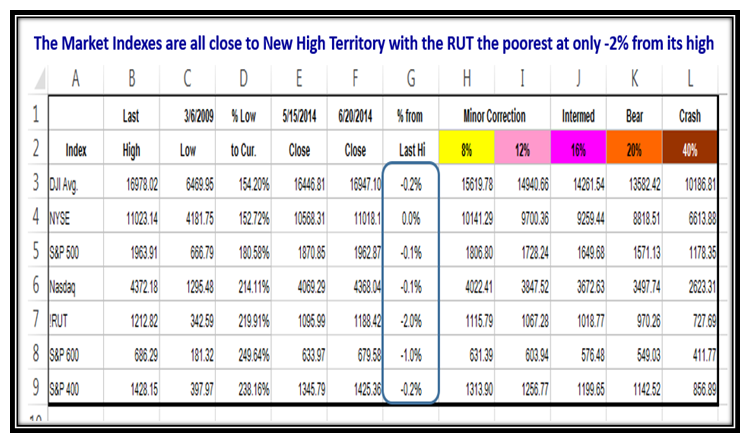

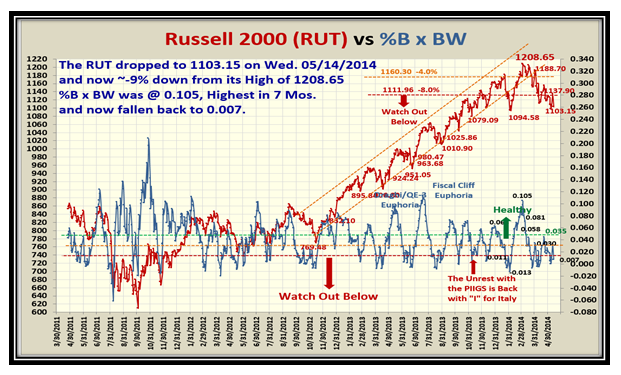

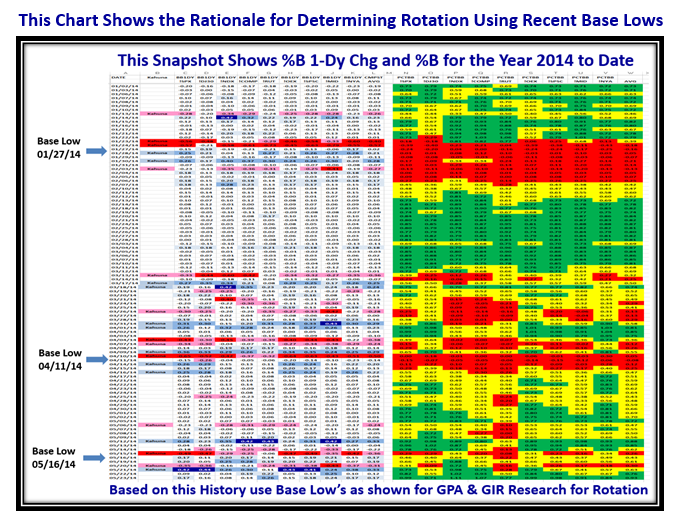

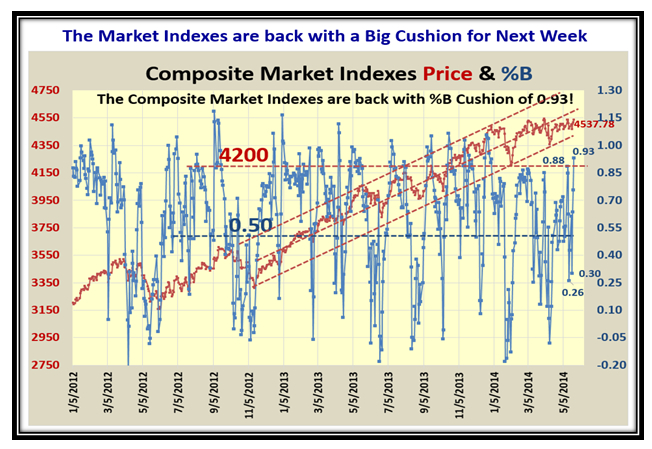

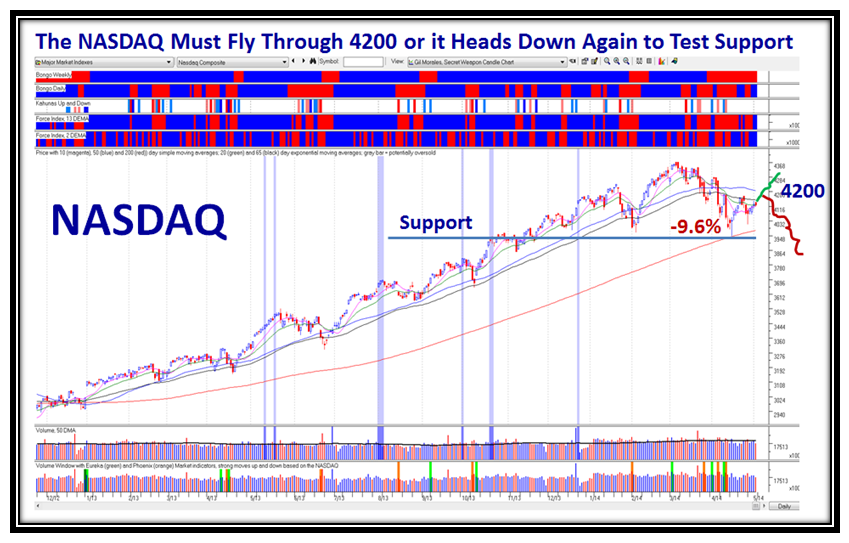

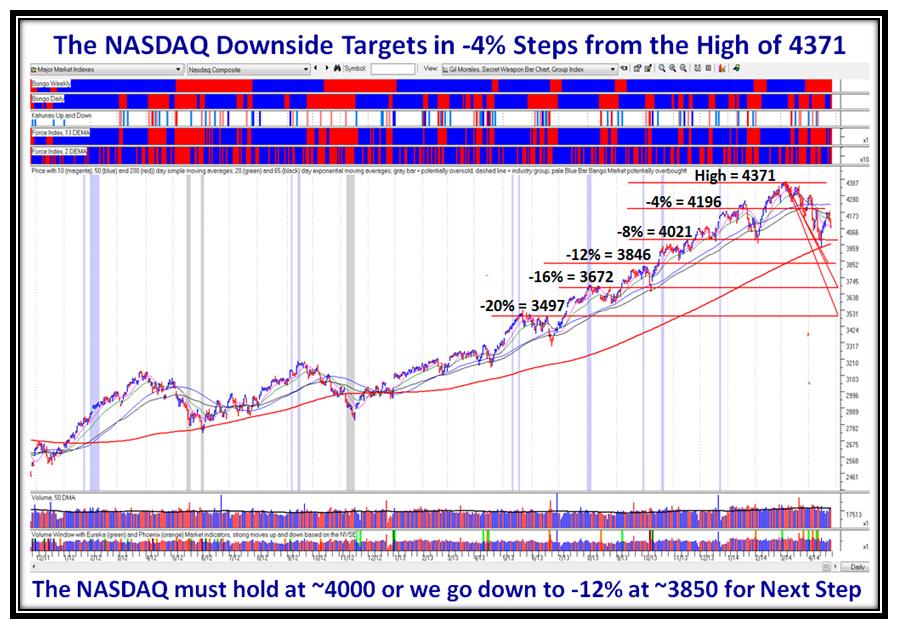

This next chart is worth its weight in gold and summarizes where the Markets stand relative to the New Highs they have just made and when you need to have taken some form of action if they all drop violently towards -8% Corrections:

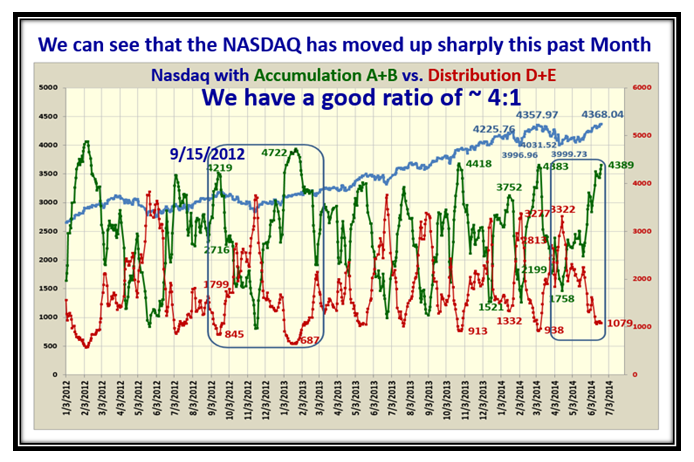

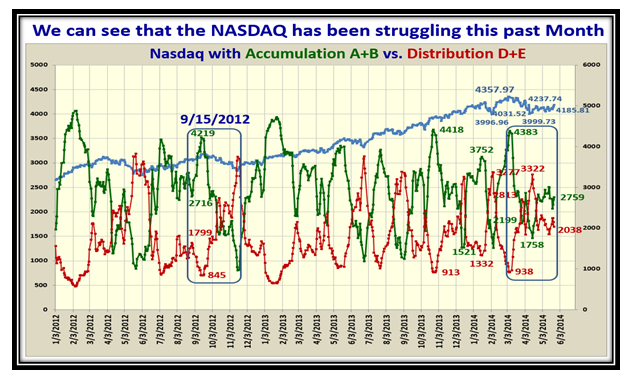

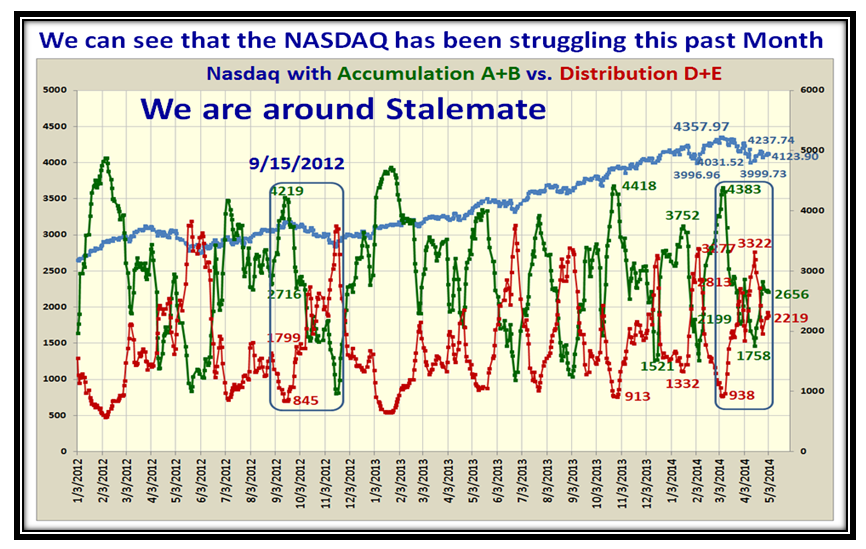

As we would expect the Accumulation: Distribution ratio of A+B:D+E has now reached a comfortable 4:1. so good cushion:

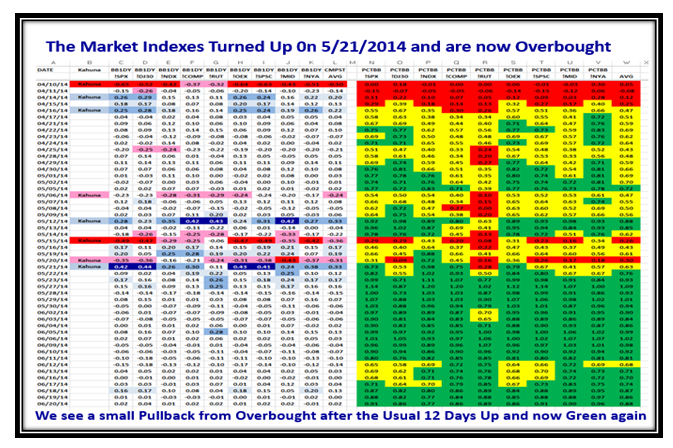

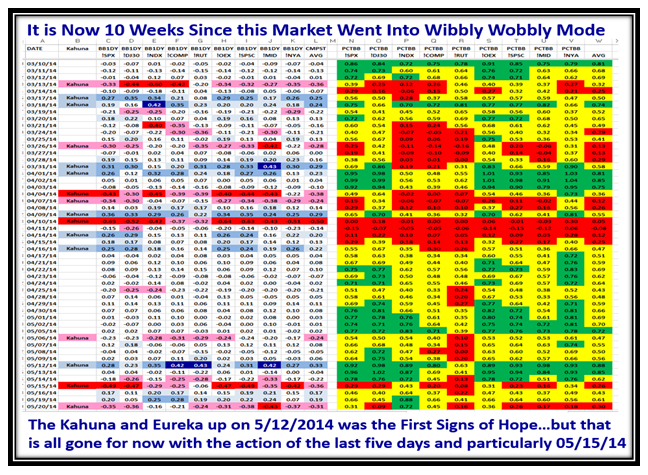

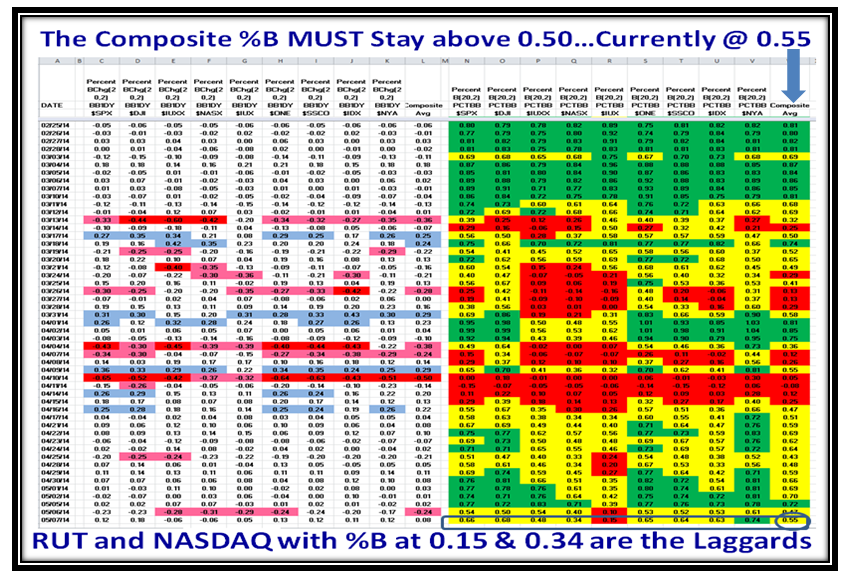

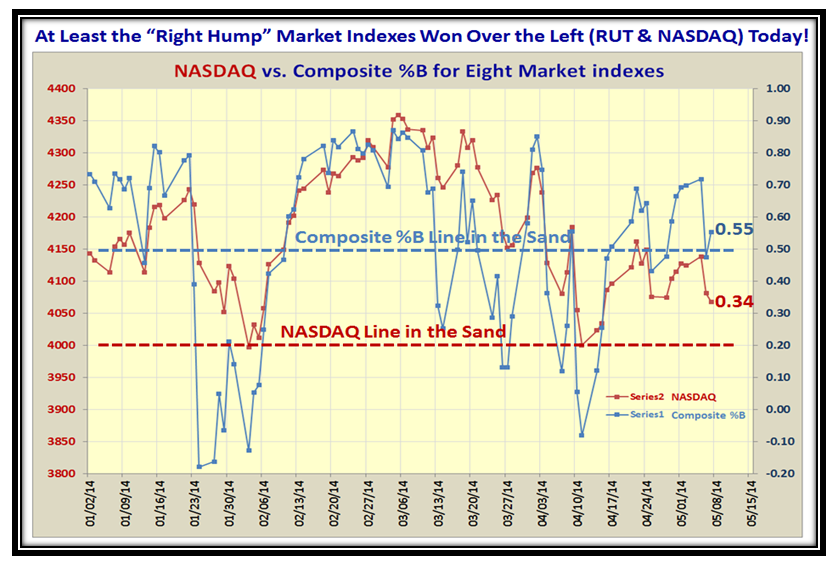

The Markets have settled down again with %B for the Indexes all in Green Territory, with only a minor correction last week:

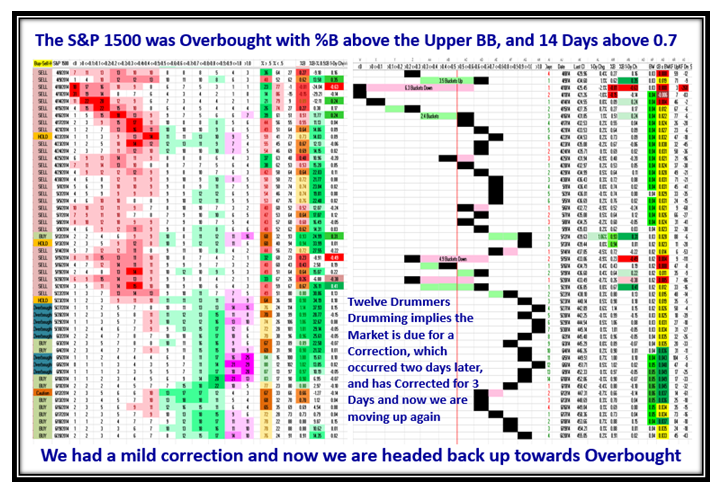

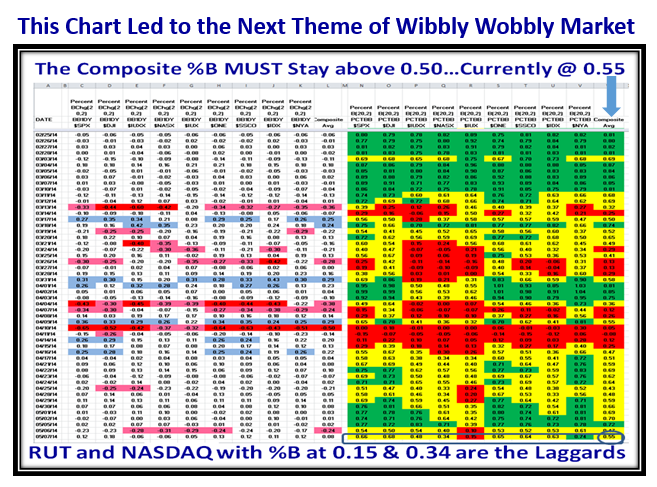

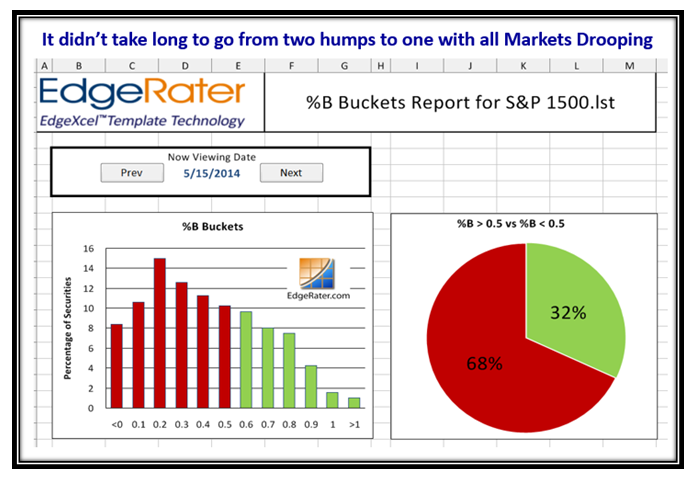

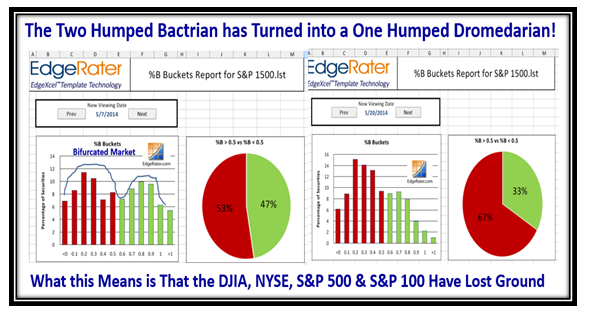

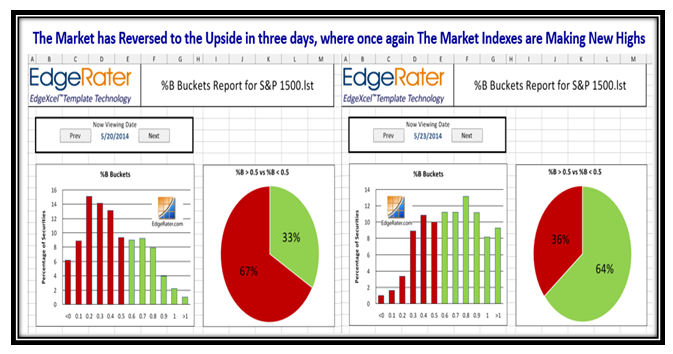

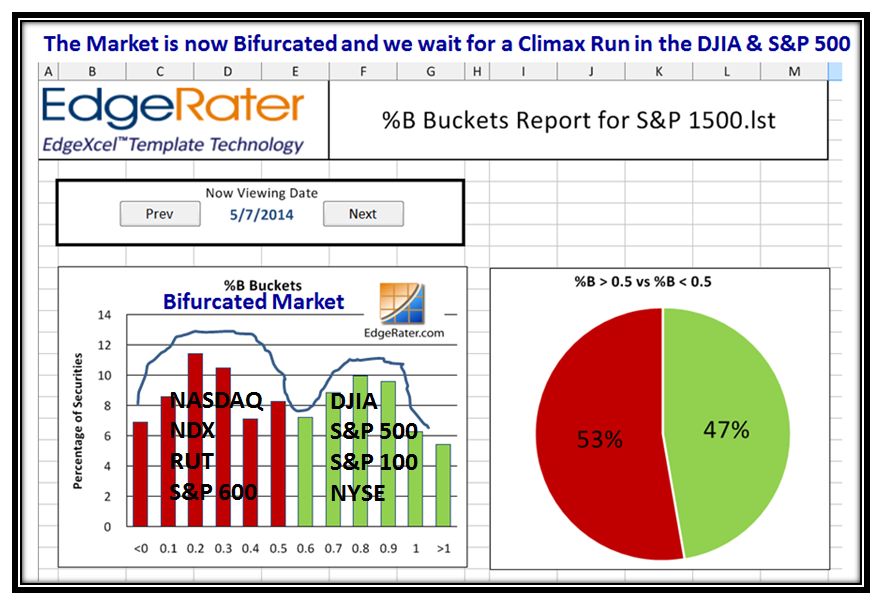

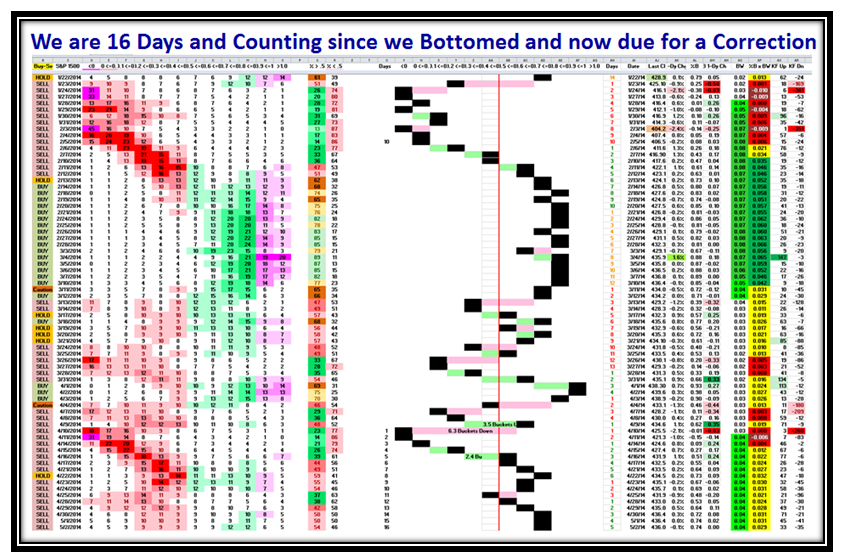

Likewise the picture of the behavior of the S&P 1500 looks equally good as we once again rise towards Overbought territory:

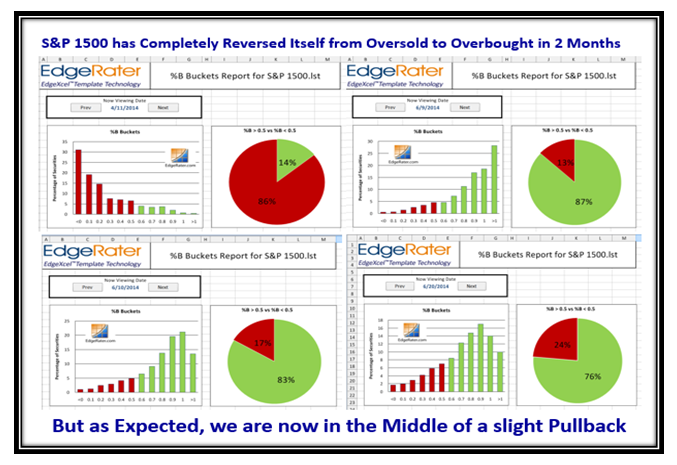

Grandma’s Pies Confirm the see-saw action of two months ago and the current strong performance of the last few weeks:

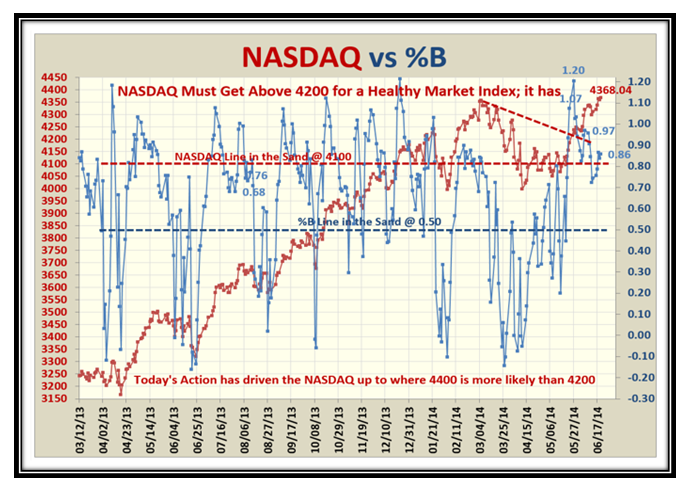

We are a long way from being at the lows of %B with a reading of 0.86, but when the rot sets in, it trots down fast:

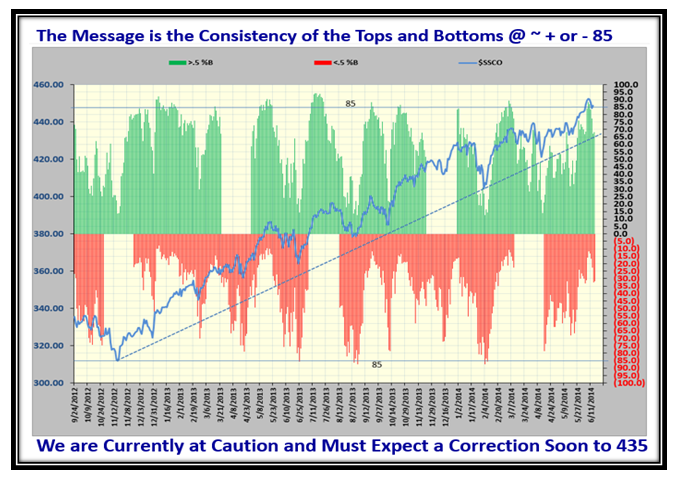

…And here is a similar picture for the S&P 1500…the value is in the Consistency of the Tops and Bottoms, so we can act:

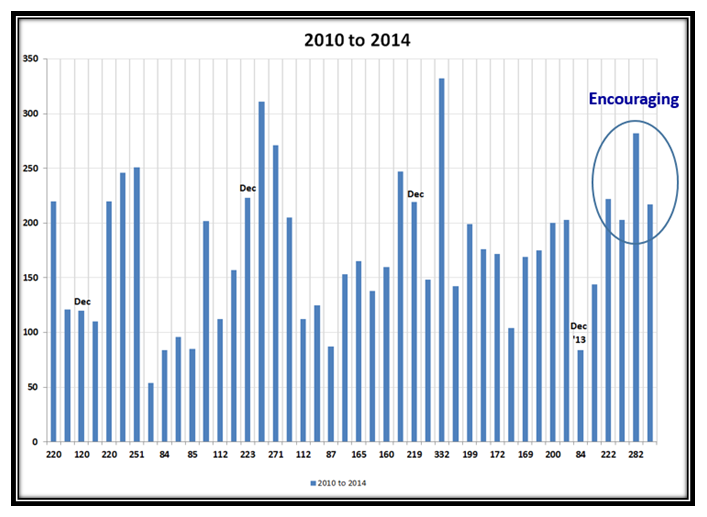

Now for the Jobs Report of a week ago, where at least they are encouraging with the past four months above 200,000/mo:

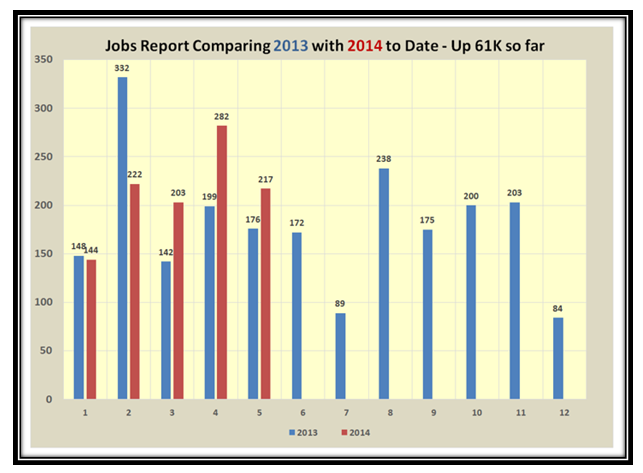

…And here is the comparison to last year. Since the next two months for last year are low, there is hope!

I trust all of this was worth waiting for?! Enjoy.

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog