Bernanke, the “Quiet Man”: Will He Pull a Rabbit out of the Hat?

Friday, August 31st, 2007A picture is worth a thousand words, so I hope you will agree the picture sums up the Message.

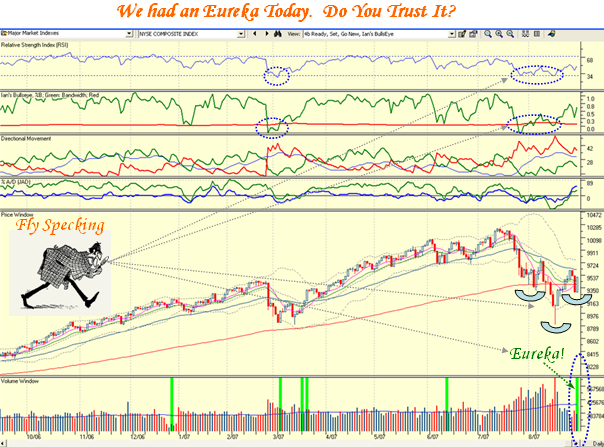

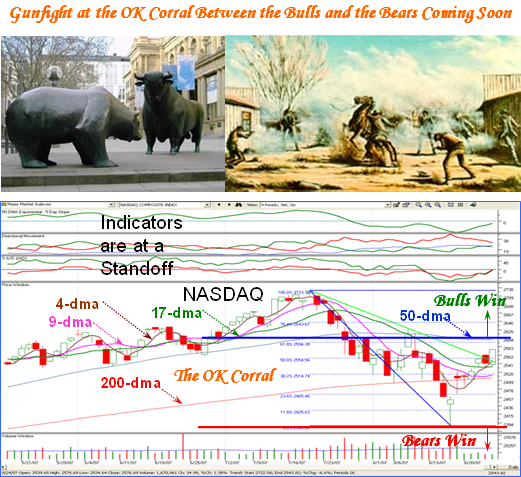

Talk is cheap but let’s “Cut to the Chase”: There was a strong reaction today to all the talk that led the market to go up. Whether that will last or not is for another day? What is far more important on this long weekend is to take stock of the targets we set a while back, see how we fared compared to a strong or weak bounce and assess the alternative roads ahead. I reviewed the progress in my August 25th note and update it now:

Index Criteria Low Target Actual % Up 8/31 Actual % Up

-

The S&P 500 above the 50-dma 1371 1485 1479 7.9% 1474 7.5%

-

The NYSE back to 8812 9750 9607 9.0% 9597 8.9%

-

The NASDAQ must get back to 2387 2575 2577 8.0% 2596 8.8%

-

The DOW needs to get back to 13209 13400 13379 1.3% 13357 1.0%

You will recall in the August newsletter, I talked to the importance of “Change Management”. So the assessment over the last week is essentially flat. I also said that we should feel more comfortable once we get over the 50-dma and have a >10% bounce. The numbers themselves are not the end; they are the means to the end. These benchmarks are tests-of-reasonableness that determine which way the wind is blowing and which way the psychology is shifting. Going forward into next week we remain with a stand-off at the OK Corral, as neither of these two hurdles has been crossed.

A Fundamental Principle of HGS Investing is the use of Stakes in the Ground. You measure against known Benchmarks based on past experience as you walk through history over the years, and you know when to tap them in lightly or firmly or uproot them based on performance. I know that some people love numbers, others hate them. So I will simplify the targets for those that can’t remember numbers. For the NASDAQ, I gave it to you ages ago, 2400, 2600 and 2800. For the S&P 500, 1485 is key, but I will simplify it again…call it 1500. If it is 1600, the Bulls will be standing on their heads and clapping their feet! If it’s 1400, watch out below, the Bears have it. Others who are adept at Technical Analysis will tell you where Fibonacci meets up with Moving Averages and High Jumps and Limbo Bars and folklore, but it all comes down to the same thing. My Way is to do the detail analysis first and then simplify it to the bare essentials.

Listening to the jabber-jabber-jee of the CNBC gurus can have your head spinning, but if you cut all the noise out and bring what the market is telling you down to your terms, then you will not get flummoxed and make a hasty and/or wrong move.

Please understand that as participants of either the Bull or Bear Camp, we are assessing the degree of negativity relating to the spill out of the housing mania into the lending markets which manifested itself as a liquid market turning 180 degrees to an illiquid one. How the Fed deals with bolstering the confidence of the Stock Market is front and center right now, but the negativity will remain part of the inherent concern for the next three to six months.

The saving grace this time with the Housing bubble is that we do not have an exorbitant P-E accompanying it as we did in the dot.com bubble. But don’t take too much comfort from that as Fundamentals will take a back seat to Technicals right now, until there is a general consensus that the Gunfight at the OK Corral was won or lost by the FOMC’s action or inaction.

Since it is a long weekend, I will give you a double dose and follow this with obvious winky- winkies you should have caught from my previous notes. There is always a method in my madness. The only way I know of to read the tea leaves is with little stakes I put in the ground along the way, and then revisit them later to see if there are any nuggets or just pebbles.

I will tell you ahead of time to re-read “Stocks are Like Wolves…they hunt in packs”, “Looking a Gift Horse in the Mouth”, and the Game Plan List (of 18 stocks) for the Short Term. That latter was written one month ago, and if you are not watching it, you don’t understand the key principles of HGS Investing.

I leave you with a fitting thought for this Labor Day Weekend, as my good friend Manu Kapadia reminds me:

Have a great weekend and enjoy your family. Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog