The High Jump – The Most Trusted Tool I Invented

Sunday, September 9th, 2007

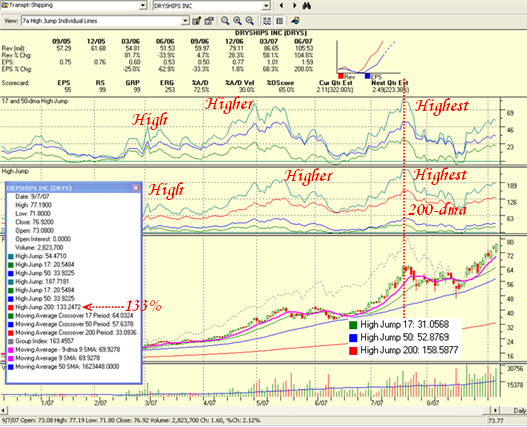

At a recent seminar I was pleasantly surprised to find that many in the audience make use of the Ian High Jump Indicator I have developed to establish when a stock is extended and due for a correction. There are three elements that will guide you to understanding when a stock is fully valued, relating to the % distance of the stock’s price from its 17 Day, 50 Day and 200 Day Moving Average. Just as the fundamentalist is concerned when a stock is overvalued and generally applies the yardstick of P-E to establish this, we can also use Technical Analysis to arrive at the same conclusion. The concept is very simple, and can certainly be a good guide for extended stocks.

Those who are lazy and/or do not have time need to remember only one rule of thumb. Fund Managers will invariably take profits when the stock has made 100% above its 200-dma. In other words they feel the stock is extended, and rather than be greedy, they lighten up and take profits.

I see my good friend Manu Kapadia’s son Vince is contributing to the highgrowthstock.com bulletin board. Now he is a chip off the old block, and has no fear, but is a young tiger. Yet he has learned the tricks of the trade and is super nimble. He has just contributed to conversations on the bb on two hot stocks, DRYS and EXM. So let’s cut to the chase and review the bidding:

I show the High Jump at 133% up from its 200-dma, so we know it is in Rust Territory already, just like that rusty old car I show in the picture.

The chart of DRYS above shows the High, Higher and Highest Jumps that it has made. One can immediately see that the stock is currently at between the higher and highest level for the 17-dma + 50-dma on the upper window and at the Higher level on the middle window. I show the High Jump percentages when it reached its highest level, and we see the highest was at 159% for the 200-dma so theoretically it has room to go another 26% on the High Jump. Since the 200-dma is currently at $33 that means it could go to $85.47. If we do the same arithmetic we get:

- 17-dma $64.0 x 1.31 = $83.84

- 50-dma $57.6 x 1.53 = $88.13

- 200-dma $33.0 x 2.59 = $85.47

It closed at $76.92, so there is a potential for another 15% up if it can reach over $88. As Vince notes, the stock had a strong up day when the market sold off, so there is major upward drive.

Late Breaking News on Sept 7: Analysts at Cantor Fitzgerald reiterate their “buy” rating on DryShips Inc (ticker: DRYS), while raising their estimates for the company. The target price has been raised from $71 to $94. But the real reason for all the excitement is the EPS estimates for FY07 and FY08 have been raised from $7.28 to $7.75 and from $7.50 to $10.81, respectively.

So with the stock the leader in the strongest group of all at this moment, there is a chance it can beat its previous highest jump and head for $94. However with the market this skittish, realize that traders like Vince are prone to take their winnings and scarper…leave the scene of the crime in a hurry. It only takes a couple of down days to take all the steam out of these high fliers.

The Message is with High Fliers like this, don’t sit there waiting to be taken out with a stop loss, but sell into the high and go. Don’t get me wrong, you need to have a stop to protect yourself, but unless you can play with the mentality of a day trader who understands when the stock has peaked for the day, you will get stopped out at the low every time. Likewise, you can’t afford not to get back in, because these trains leave the station fast. The basic premise is you must understand that the stock is already very extended and you are playing on the steepest part of its ascent and therefore the most rewarding in the shortest time but with the highest risk.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog