Strong Black Friday was Wishful Thinking for the Market

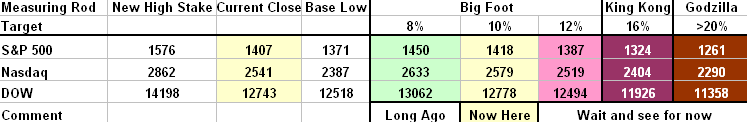

Right on queue, the Stock Market opened up this morning but then the gloom and doom set in with the Credit Crunch problem once again looming high on the list and taking center stage. The net expectation for a decent rally was obliterated within an hour, if that and the DOW finished down a healthy 237 points or -1.83% and the Nasdaq down 55.61 and -2.14%. Big Foot is back at over the -10% correction level, and with the Ten Year Bond now below 4% at 3.87% the Market is running scared. There is little point in my belaboring the point, but this does not bode well for a decent Santa Claus Rally. Here are the amended numbers for the Stakes in the Ground:

We are knocking on the door of a 12% correction and it won’t take but one more bad day to get down to that level. Nimble day traders are the only ones to make a “buck” in this market, and the VIX shows the high Volatility with a reading of 28.91. Keep your powder dry and stay in your foxhole is the message for swing traders and intermediate term buy and hold types or stay short with ETFs of QIDs and FXPs.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog