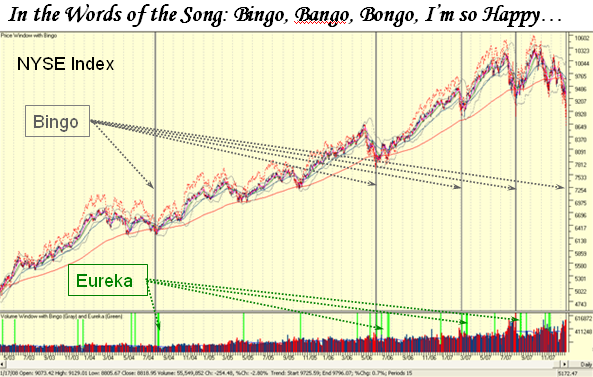

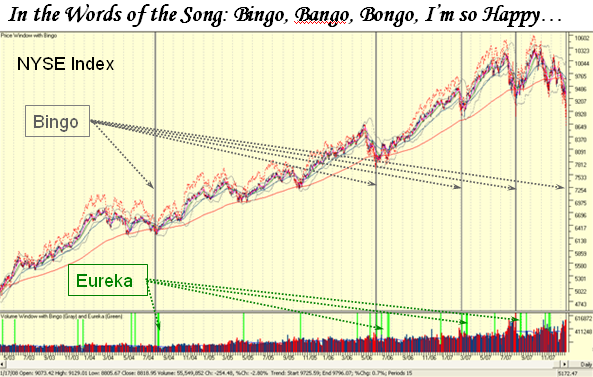

Heads-up! We had a Bingo Signal on Thursday, and I cannot be more elated that all my hard work has come to fruition! I am delighted that we are all keeping a beady eye on “Bingo”, and it might well be my best work yet and comparable to the Hindenburg Omen of others which this blog signaled many moons ago and has proven itself to once again be true. But before we get too euphoric, I have to give you all a warning. Those of you who understand our proprietary indicators will recognize this is certainly one small step for HGS Investors in identifying a bottom. Note that I said “a bottom” and not “the bottom”. Likewise as we know, the combination of a Bingo followed by a Eureka has been very powerful in identifying the potential for the next move upwards. But let me bring you down to terra firma, i.e., earth with a quick jolt! Before you get too excited that at least the first leg of the equation in getting a Bingo signal is behind us, take a deep breath and look at the Indexes back in the 2000 to 2002 timeframe, and then trot all the way back to 1994. My point is this good stuff is not infallible. I have always said that there is no Silver Bullet in this business, but two lead ones are better than none. Likewise, sometimes even Lead Bullets can fire blanks. The bottom line is don’t be too quick to bet the Farm on this occasion. Why? It’s simple:

- When a Bull Market is in full swing as we have experienced since early 2003, the odds are that along the way there will be Minor and Intermediate Corrections, and maybe even an occasional Major Correction. For those who don’t know what my parameters are for these standard definitions I use, I refer you to the Quick Glance HGSI Barometer of the Market which I introduced you to in the January 5th Blog “Big Foot is Back and the Others are looming”.

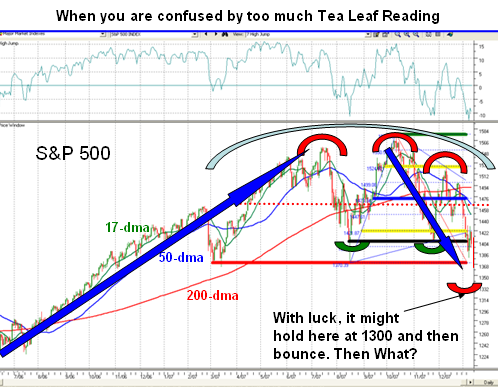

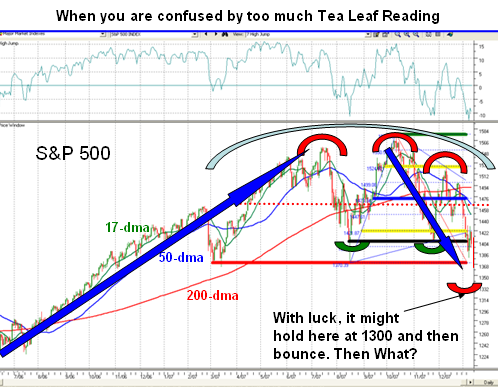

- Once a market starts to labor towards the top, and heaven knows I have shown you that happening before your very eyes these past few months and more so in the last month, you just cannot afford to block out the signals of the Winds of Change. I know that one can get fogged with all the paraphernalia that is trotted out but the simplest approach is to try the Big Blue Line Pencil Trick…it always works. Once the psychology of the market turns from Bullish to Bearish, and all the various signals say down, it takes a lot to turn the herd around, especially when every second word on the airwaves is Bear Market and every third word is Recession.

3. The last vestige of a Wolf Pack got hit hard on Thursday in that the Chemicals – Specialty Group was hammered. Sure there are always pockets of opportunity somewhere including some Health Care and the safer ‘go-to” staples of the Minerals, Utilities, the Foods and the usual litany that is trotted out of PG, JNJ, KO, etc. Forget it, that is just fiddling while Rome is burning, unless you are in for a moment trade during the day. Alternatively, play the QIDs and the FXPs to your heart’s content on the short side, depending on how the wind blows on a daily basis…FXP’s got walloped today, so they feel that avenue for shorting is overdone for now.

4. I’m sure you observed what happened yesterday as Chairman Bernanke was speaking to the House Banking Committee as the Market went down tick by tick with his somber discussion on the health of the economy. The DOW finished down over 300 points for the first time in 2008, after several of these recently in 2007.

5. Look at the ho-hum reaction to President Bush’s stimulus package for up to $150 Billion to boost the Economy and he has asked Henry Paulson to lead the Administration’s effort to forge an acceptable plan. Meanwhile the Muni Bond Market is already cracking at the edges with the extent of short interest that is in place. Bond Insurers are being battered and if MBIA and Ambac get hurt watch out even further. At long last the whole of Washington has realized they better stop talking and start doing…we shall see how the Congress and Administration will work this out. Amazing that every second word on the airwaves yesterday was “quickly”…it’s all talk and no do, and the resulting primary thrust for you and I is Capital Preservation, period.

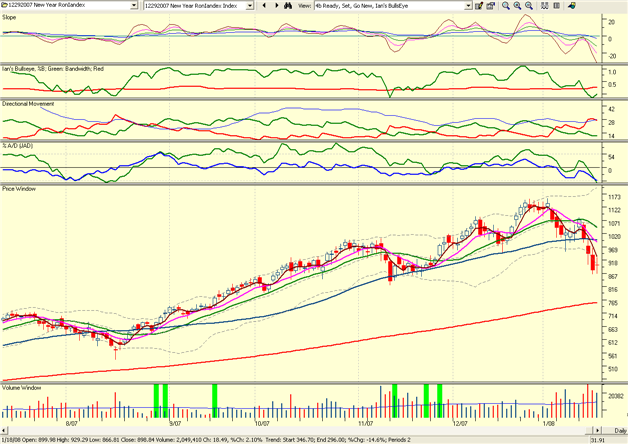

6. The Bingo with Eureka Indicators have served us well in identifying when the next leg up is underway, but not when we are potentially at the borders of a Bear Market. One more heavy down day and we will clock 20% down on most Indexes, with the Nasdaq leading the way.

7. Of course our favorite longer term view Bollinger Band 40-Week chart shows the S&P 500 Index broke down through the Lower Bollinger Band with a vengeance on Thursday. We can also go one step further and look at the 3-standard deviation 50-dma Bollinger Bands to see it too is broken, so it is no secret we are vastly oversold and with luck should get a bounce play soon.

8. I wouldn’t bet too heavily on the quality or quantity of that bounce, as Bear Markets don’t turn on a dime. Then there are always the surprises that come from left field that try to prop things up, so be aware that this Stock Market is very much EVENT driven right now, more so than ever.

Summary – The Value of Bingo:

The short answer is that the first Bingo is a confirmation that we have reached a first stage strong BOTTOM. I didn’t say “the BOTTOM, I said “A bottom”. It signals a much oversold condition in the market, and you certainly didn’t need a Bingo to tell you that. The Bingo is the first of two lead bullets that usually work extremely well in UP Markets. The second signal we want to see happen is a Eureka which is tantamount to the potential first day of a rally. Then as usual we want additional confirmation(s) with a follow through day which is invariably measured by additional Eureka’s. As I say, that has worked extremely well in all of the recent legs up from 2003, where the sequence is a Bingo followed by several Eureka signals shortly thereafter. But under these circumstances, the result may only lead to a Bounce Play with more to come on the downside after that.

However, things can get murky in a Bear Market Scenario. In addition to the above normal scenario which predominates, we can sometimes get additional Bingo’s without any Eureka, we can get Eureka’s without any Bingo, or have the normal Bingo-Eureka combination for a short Bounce Play and then fade again, etc. etc. Let the market tell you what it is doing, not what you wish it to do. Enjoy your three day weekend and Best Regards, Ian…Late Breaking News! We had another Bingo Signal today, Friday.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog