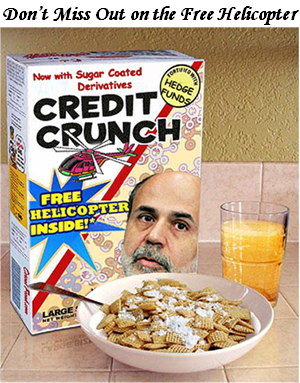

The Fed and the Credit Crunch – The Latest in Breakfast Cereal!

We are back to a critical juncture of “The Road Not Taken”, so I will give you two Blogs instead of one! Keep an eye out for the second note in this series. I can see from the past notes that are being read these last few days that you are looking for any recent similarities that may give you guidance as to how to assess the current situation and take appropriate action according to your Investing Style and Risk/Reward preferences. I trust you find my process is broad enough to accommodate any investing style and that I am consistent in my approach. There will ALWAYS be opportunities both Long and Short and the HGSI Software enables you to ferret for these. Likewise, the HGS Process is designed for investing/trading with the wind at your back or in your face, but it is how quickly you can manage the winds of change that will make you a winner or a loser. It is always “Your Call”.

By the looks of things the Fed has run out of handing out Free Helicopter rides, i.e., lifting the Market off the bottoms to snatch it from a Bear Market Correction. It did it successfully twice in the first two Gunfights at the OK Corral, but this time it is out of ammunition. The market sold off today after the start of a bounce back from yesterday’s 370 point drop, when Philadelphia Fed President Charles Plosser said today that an overly aggressive rate-easing campaign by the Federal Reserve would only fuel higher inflation down the road. He is a noted hawk on inflation and is a voting member of the FOMC this year. He went on to say that this is a “damn the torpedoes, full speed ahead” approach to policy. So we have major dissension in the Fed camp now that we have already had aggressive rate cuts these past five months. The Credit Crunch has caused at least three conditions to exacerbate the way one engages this market…I’m sure you can think of more, but three is enough to make the point:

-

Extreme Volatility leading to Moment Trading Intra-Day, leave alone Inter-Day

-

Nervousness for both Bulls and Bears when we are on the verge of a Bear Market

-

The Stock Market is EVENT driven where every little nuance of news causes perturbation

Under such conditions, there are quite a few Principles of HGS Investing that provide the foundation to successful Investing and above all Preservation of Capital:

- Have a couple of Scenarios for the Bull and Bear Case for the Gunfight at the OK Corral

- Establish Stakes in the Ground from which to measure progress both ways

- Define the Benchmarks for Measurement of what to expect in either direction

- Measure the progress using known rules of thumb for determining whether Bounce Plays are strong or weak and who potentially has the upper hand.

- The watchword is Rotation, Rotation, Rotation, and the HGSI software is top notch for spotting that, either for shorting candidates or fresh Wolf Packs.

- Remember that we are playing at the “Bottom Tail” of the Bollinger Band Normal Distribution curve, and one is looking for signals of Capitulation and/or Irrational Exuberance which is always exemplified by the components of the ARMS Index

- Watch the New Highs and New Lows like a hawk, because the numbers alone will distinguish when the true Market rally is on the cards, or that one is heading for another disappointment by a failed Rally.

You know me well enough by now that I either work in threes or sevens to describe the process, and for something as complex as we have now, I have given you the best seven I can think of on the spur of the moment to suit this situation. Think back to the Bubble Charts with the colors of the Rainbow in HGS 101, and if it can’t be said in seven colors then you have a Camel, and the best are just three…Green, Yellow and Red. I will post a more definitive set of factors for both Bulls and Bears to watch for in the next note relating to Bulls and Bears Scenarios NOW. As a reminder there are only seven weeks to go if you are planning on coming to the March Seminar, so please sign up ASAP if you don’t want to find we are full up. Your feedback is always welcome and I thank those who take the time to do so. Best regards, Ian

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog