Beware of Irrational Exuberance of Green Shoots

Saturday, May 30th, 2009There comes a time when the Stock Market will confound you and do the exact

opposite of what most feel it should do. For the last few blog notes I have been

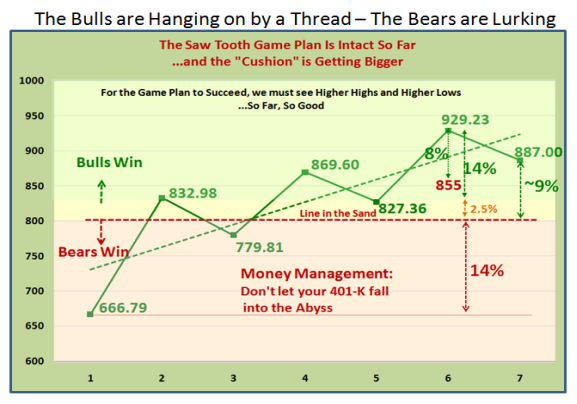

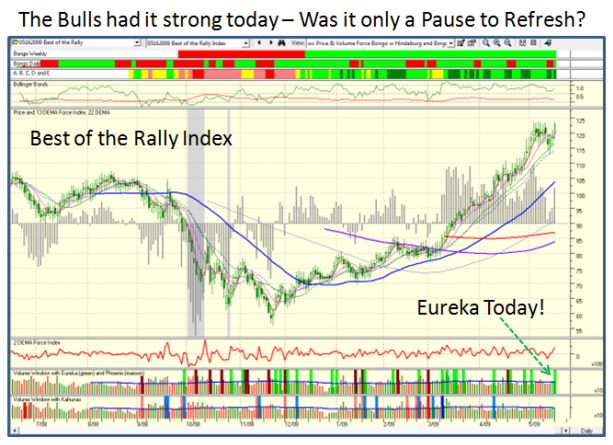

cautioning you as to whether this market was in a “Pause to Refresh or a Correction”.

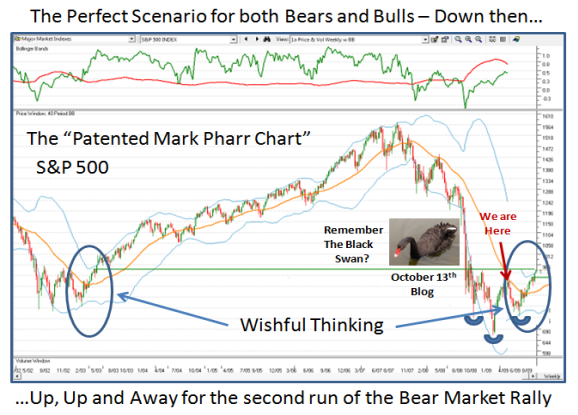

Also with my analogy to a London Pea-Souper and Coming out of the Fog, I feel I

have given you enough warning to be on your toes for either a knee-jerk downwards

or a new birth to get past the obvious resistance at the 200-dma on all Indexes.

I couldn’t help but give you one more warning where the latest buzz words around the Blogs and News Media are “Green Shoots”. That pair of words was resurrected from 1991, when the then chancellor of the exchequer Norman Lamont was criticised for saying, during the middle of a recession, that he detected “the green shoots of economic spring”. It goes without saying that those words haunted him to eventually step down. I was reminded of another saying of “Irrational Exuberance” which I have frequently used, so take your pick, as I now couple the two together with those who said it. Enough of that but I have always reminded you to have an Up, Down and Sideways Plan and let the market tell you which way the wind is blowing. Sometimes the Calendar rules the roost, as it did on Friday when it turned turtle from a 20 point loss to a 100 point gain on the Dow inside the last 1/2 hour…if that. The reason is the end of the month window dressing. So we wait another week to really see which way the wind is blowing.

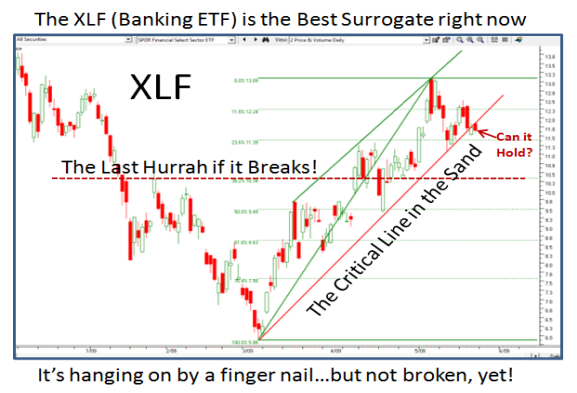

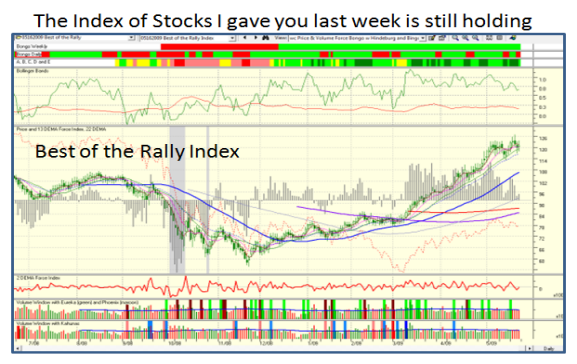

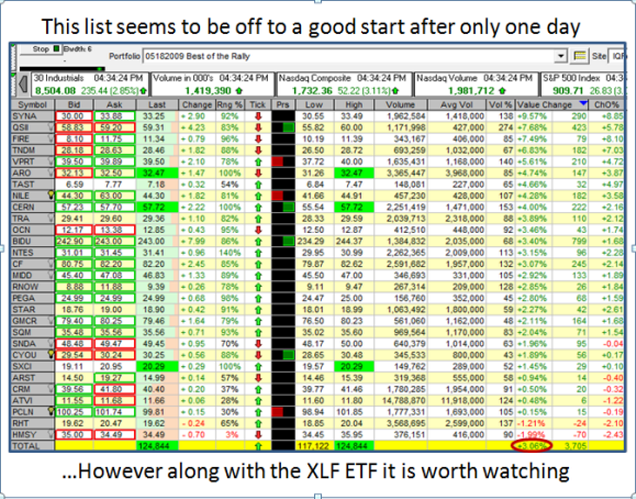

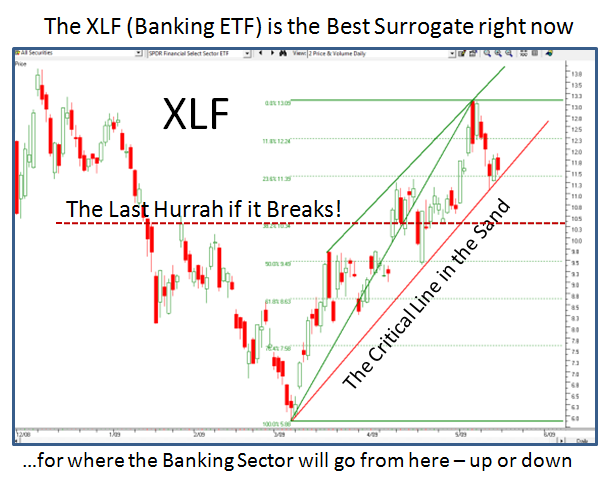

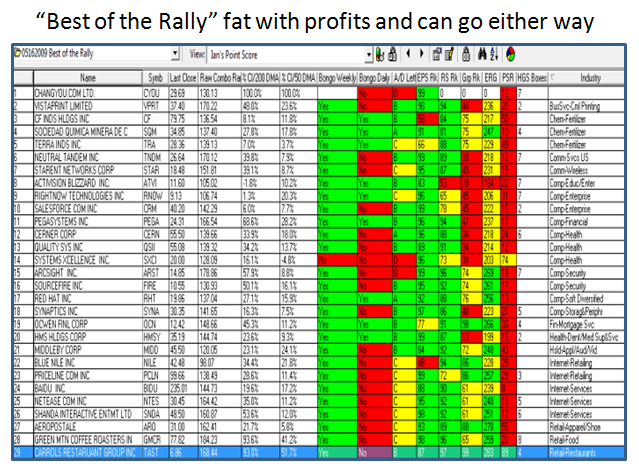

I feel the three pointers I recently gave you of the XLF banking ETF, the 40 Week Bollinger Band around the S&P 500 Index and the list of stocks which were first round winners that were pausing to refresh give you the focus of what to watch. Every single one of them are perking up again and beauty is in the eye of the beholder:

1. The technicians will point to myriads of Market Indexes and ETF’s that are at the 200-dma for what would seem key resistance and in a sentence “They either break through with authority or fall back from a Double Top.”

2. Others will suggest that the Leading Stocks have now all set up respectable Bases, above both the 50- and 200-dma, and more beautiful set ups you could not wish for with Cups and Handles, Flat Bases, and High Tight Flags coming out of their ears.

3. Yet again, others will suggest that this rally is long in the tooth and is producing a rounded top especially as the S&P 500 has done little but go sideways, albiet in a tight pattern, since it hit a high of 930. This is only a matter of ten points from where every technician had pointed to as a point to watch for a peak.

4. Ask the Type 1 and 2 Short term traders how they are fairing and they will all say “Tricky Market, and you better be nimble within Intra-day moments to cope with the wild gyrations”.

5. Type 3’s who comprise three groups of swing traders are either:

a. Out of the Market and kicking themselves for having missed a decent Bear Market Rally

b. In the Market and trying to garner the profits they have lest they slip away

c. Already playing their cards as if they were budding short-term Types 1 and 2

6. If you belong to bulletin boards which most of you do, you can see there is little enthusiasm since most are waiting for a correction of some sorts before they engage in the next leg up.

7. Long Term Type 4 Buy and Hold Investors are patiently waiting in the wings for better signs of a true improvement in the economy and the usual Fundamentals that show that the S&P 500 can prop up the Price given the dismal Earnings it now has. They also know that the long term test from a technical standpoint is to be patient and wait for a “Golden Cross” of the 50-dma coming up through the 200-dma, which by my estimate will be around the fall of this year as I have shown you many times before, unless we have a further disaster.

So I come full circle to the Theme of this blog note which is to beware of politicians propping up this market with platitudes and precious little substance other than hope. To round off the tidbit I gave you earlier, the ex-chancellor – now Lord Lamont – said there was always “huge pressure” on ministers to talk up the economy. But he warned that ministers risked getting into “very dangerous territory” if they strayed too far ahead of events in the real economy. “The recession now has only just begun and recovery is very unlikely before the end of 2009,” he told the BBC back in January after chiding the Business minister Baroness Vadera had denied she is out of touch after claiming she could see “a few green shoots” of economic recovery.

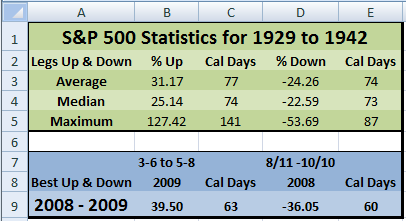

Lastly, let me leave you with a Summary Comparison of the S&P 500 from 1929-42 and Now, with the latter the best up and down since the peak in 2007. Except for the maximum, this Best Up and Worst Down have beaten the Average and Median of that era.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog