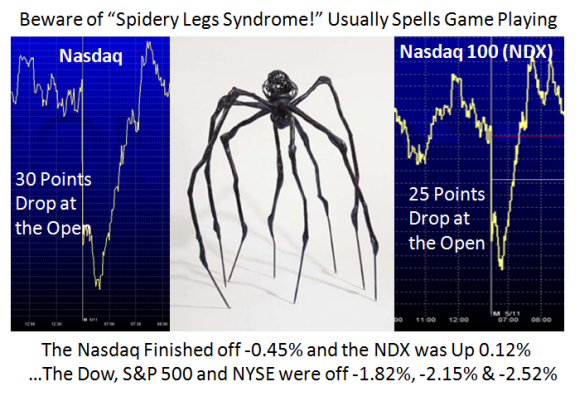

The Dreaded Spidery Legs Syndrome

Monday, May 11th, 2009How often have you been stopped out of what seemed a very safe “stop” at the

open or during the day only to find that the security you were in came right back

and went higher? I call it Spidery Legs Syndrome. I am always careful to look at

chart patterns that display this symptom as it gives a clue to beware of being

stopped out at an unreasonably low level, and if it is a prevalent problem I tend

to skip buying the stock. Sad to say it happened to both the Nasdaq and the NDX

today, and that can be translated to include the QID, but it goes with the territory.

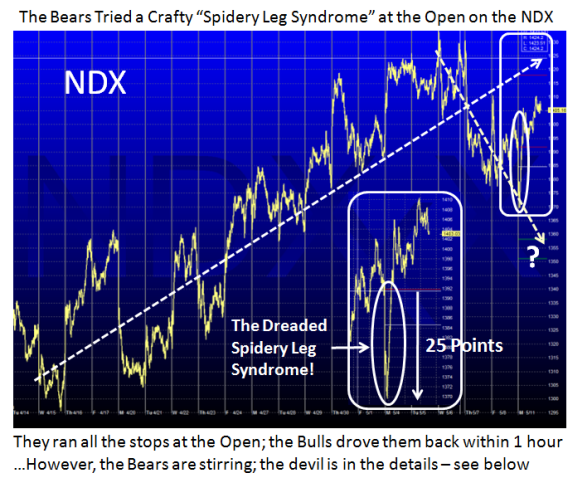

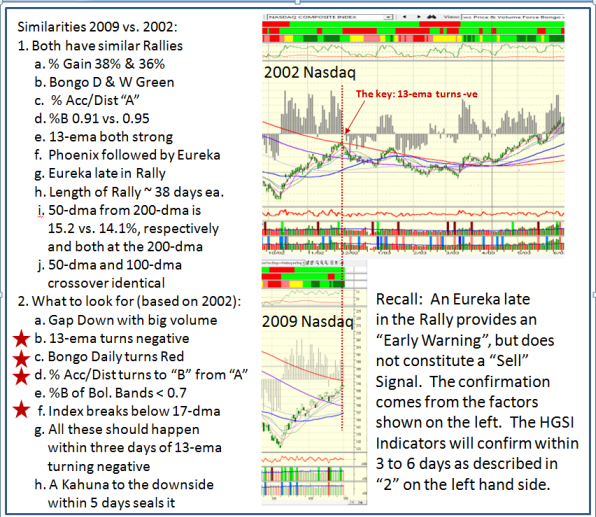

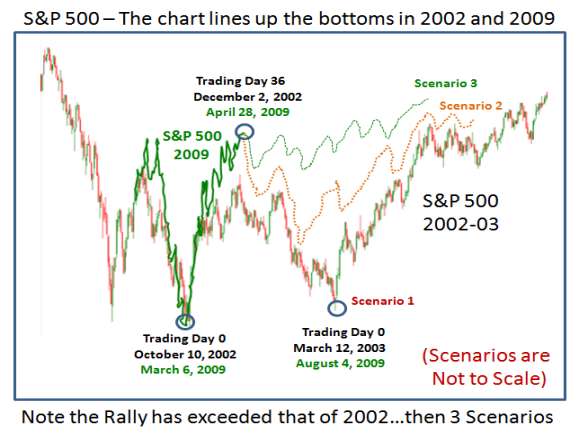

Just two nights ago, I suggested that an Early Warning Sign that could trigger a

cascade into a correction of the Bear Market Rally would be a sharp 50 point

drop in the Nasdaq. It opened today 30 points down but recovered as did the

NDX which fell 25 points, shown below. Both finished essentially flat, so be on

the lookout for another attempt at these shenanigans again!

This may be a shot across the bow, especially as the other Major Indexes of the

DOW, S&P 500 and NYSE all had sizable drops of ~ 2.0% to 2.5%. we have had a

nine week 40% rally which has recovered some of the drastic freefall; On the

other hand, an occasional back and fill is very healthy if this Bear Market Rally is

to continue.

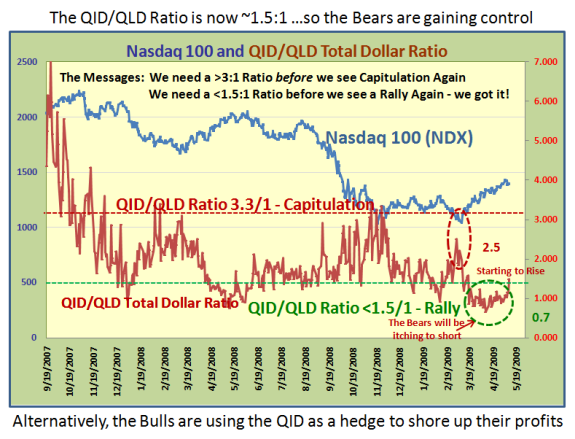

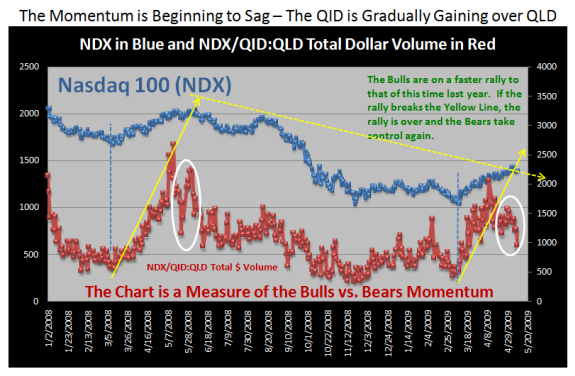

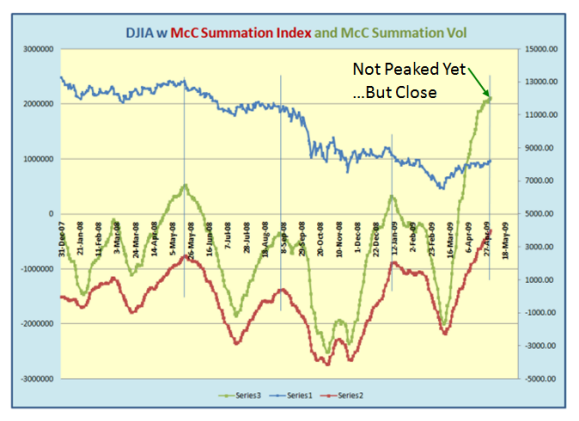

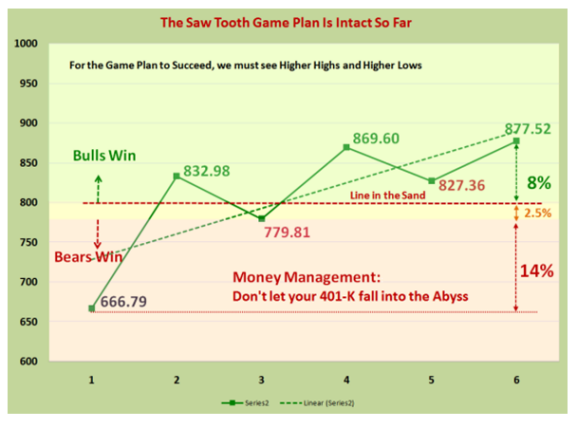

However, there is no question in my mind that the Bears are stirring and may be

getting the upper hand. I have featured the two charts below several times before,

so they need no explanation, other than to point to the “Stirring of the Bears”!

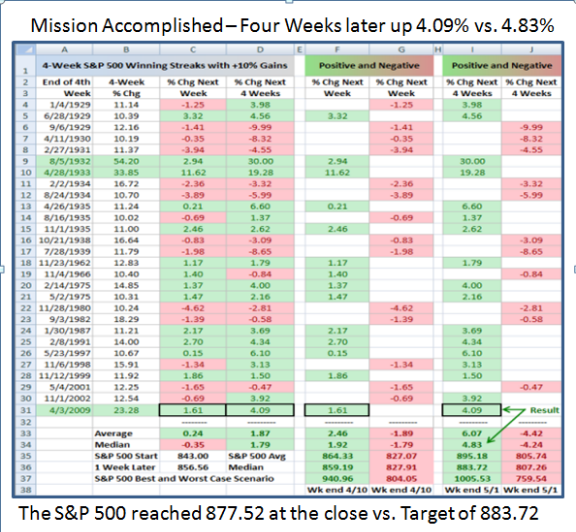

If these two charts do provide the underlying details that give us clues to rallies

and corrections, we may have a leg up on most in the future. Stay tuned and be on your toes. To be forewarned is to be forearmed and can help you both on the upside and downside.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog