More Stock Market Muscle from Cash for Clunkers?

The Bulls are enjoying the ride and seemingly this Market can do no wrong. The

psychology has changed from gloom and doom to the Bottom is in and the

Recession is behind us. How long the euphoria will last is another matter, but

with the chitter-chatter of “Cash for Clunkers” this weekend, it must surely spill

over to the Auto stocks if not the whole Stock Market on Monday. But watch out

for the looming Jobs Report this coming week which if poor can turn the Market

sour; but if good can send the S&P 500 through 1000 and on its way to the next

target of 1012.

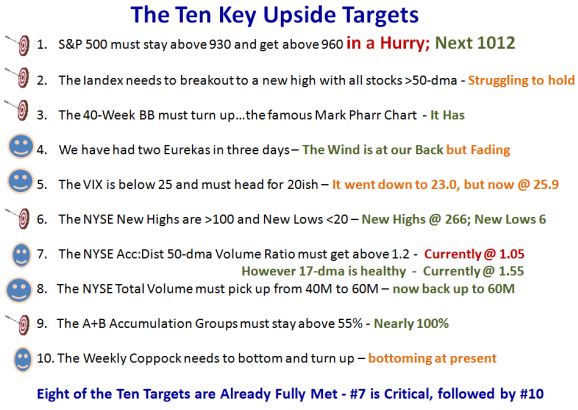

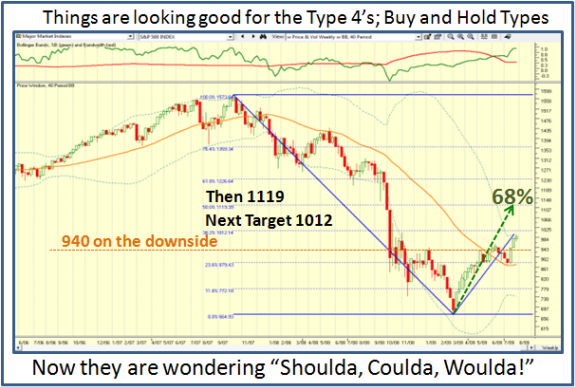

I gave you the Targets for the Bulls and Bears in the last blog and have updated the

Status for you below. As you can see things have matured and now it is a question

of whether the Bulls can hold the line or we pause to refresh yet one more time.

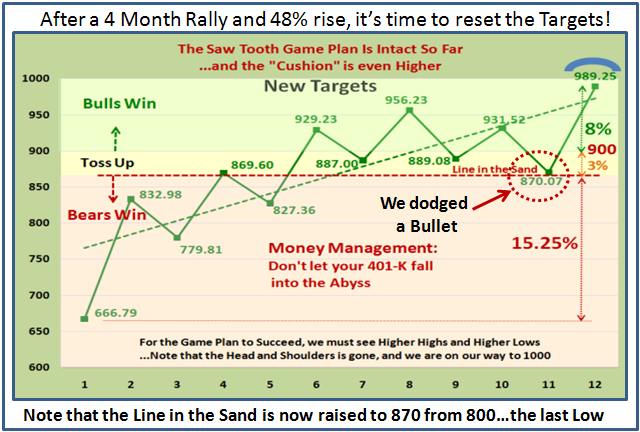

This Rally is now five months old and we have not had a 10% correction…the worst

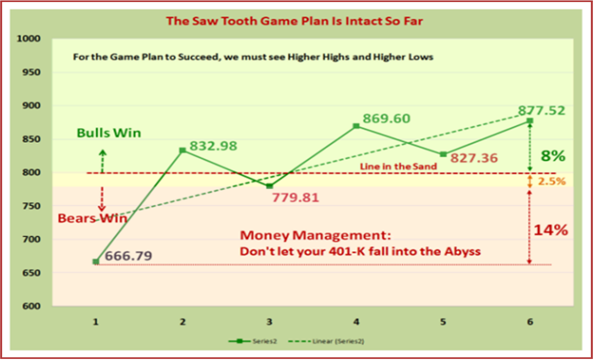

we have suffered is 9% on the S&P 500. You will recall that all of 4 Months ago I gave you the Saw Tooth Plan as a way of staying on top of your Money Management and

running for the hills to save your 401-K if things got tough. The chart below was on

the April 3rd Blog, and we have certainly come a long way.

The Bottom Line Message is that Higher Highs and Higher Lows with no more than an 8% correction is all you have to watch. Then raise the Lines in the Sand when the

Cushion gets more comfortable which I have done in this updated chart as we have

got long in the tooth.

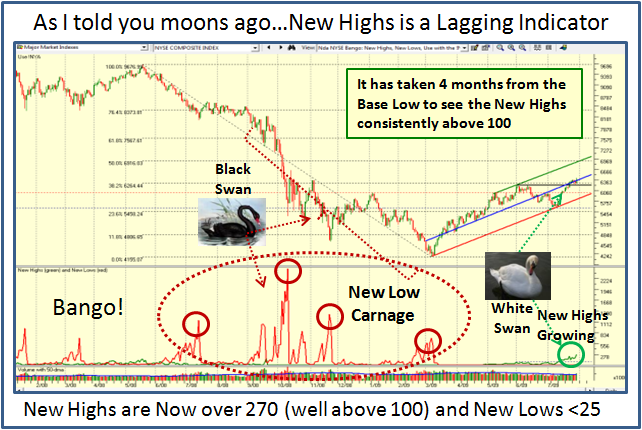

At the March HGS Investor Seminar, I told you that we would not fully recover from

this dreadful Black Swan swoon until we saw New NYSE Highs >100 and New Lows less than 25. I am happy to report that we are there and this is yet another sign that the Market internals are strenthening for Type 4 Buy and Hold Investors to begin to dip their toe in the water. If you are not already in, then it would pay to be ready after the next correction provided it is not disastrous. The next two charts show the status:

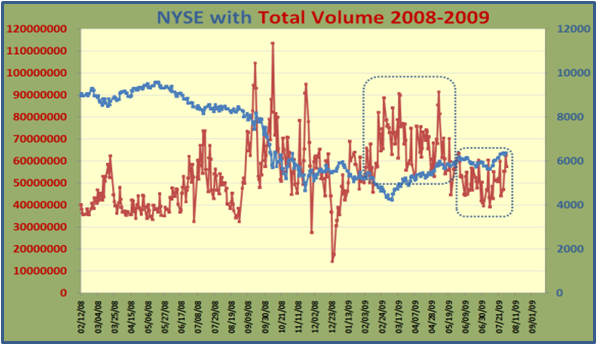

The NYSE Total Volume has improved and now sits just below 60 M shares. I expect

if it stays at this level there should not be any further concern of insufficient volume.

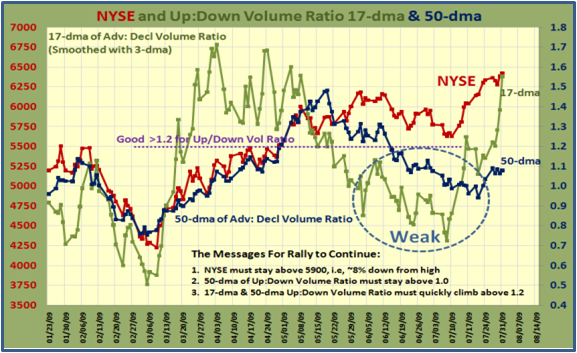

The only item on the Targets that is a little sluggish is the 50-dma of Adv:Decl Volume Ratio, but as I show the 17-dma of this item is very healthy @ 1.55, and given that the market went sideways for two months, the 50-dma will take time to return above 1.2.

The Type 4 Buy and Hold Investors should stiffen up their backbones and begin to feel that the market has repaired sufficiently to dip their toe in the water. Obviously, you need to watch the market and choose your spots carefully:

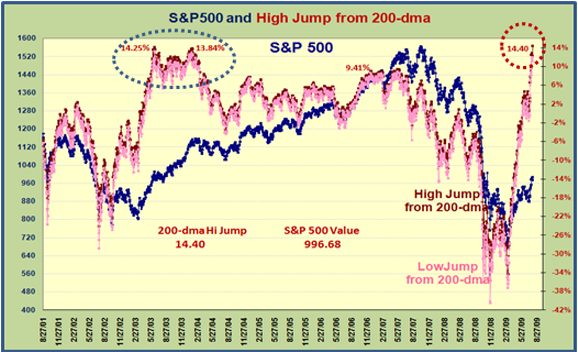

Lastly, let me finish with a caution on the High Jump which is screaming “extended”

when compared to what transpired back in 2003. Of course it can go higher, but we

are due for a correction as shown by the dotted oval line back then.

Good Luck and Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog