Three Camps, Three Road Scenarios

I have always taught that it is imperative to have three scenarios identified and to then let the Market lead you to which one to be on. Wishing for your pet scenario seldom works in the stock market and those who constantly can anticipate being on the right side are gifted as there are few of them.

I was struck by an excellent article written by Jay Kaeppel of Optionetics.com who thinks in a similar vein and I felt I would take a leaf out of his book as I liked the way he described the “Three Camps” that people can be pigeonholed in as to their investment sentiments. He sugested “Camp Sunshine”, “Camp Just You Wait” and “Camp Go with the Flow”. I took his first one, but changed the other two to suit what I have taught you before now, and here it is:

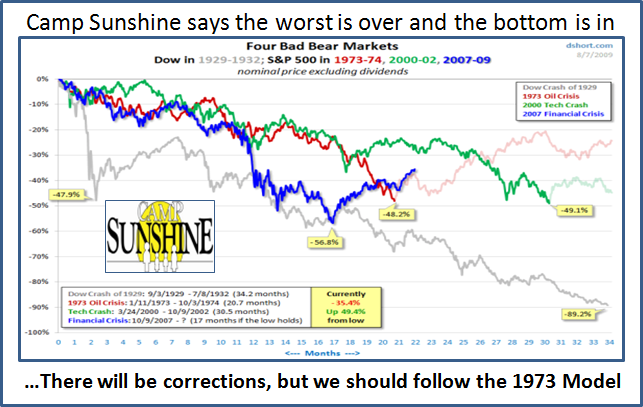

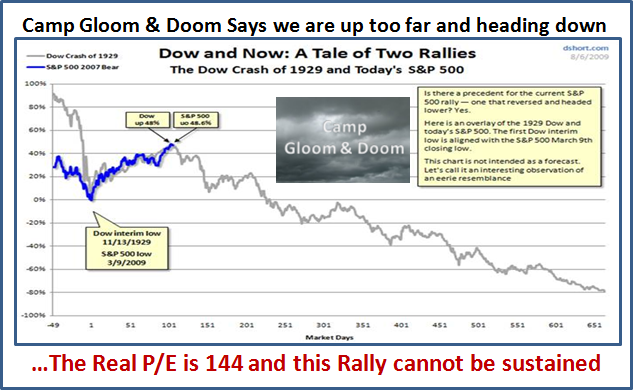

In scouring the web, I found an excellent site called dshort.com where I found the following two charts to describe the first two camps of Camp Sunshine and Camp Gloom and Doom. They are self explanatory, so I need say no more than show them:

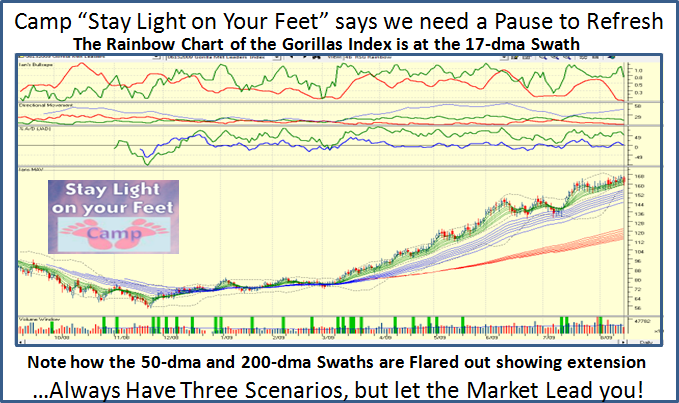

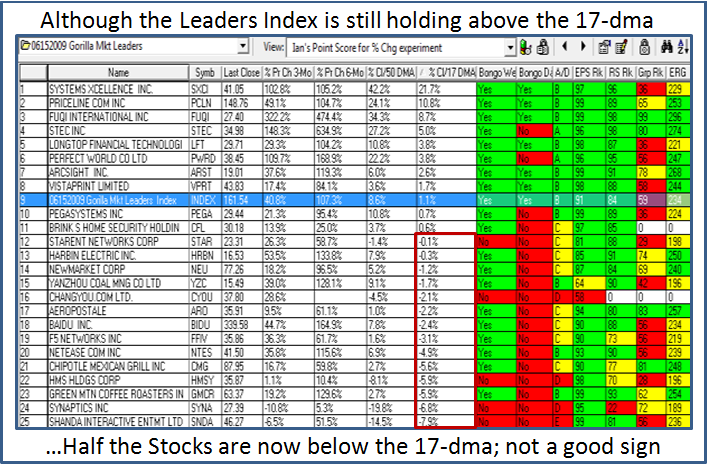

The third camp of Stay Light on Your Feet, is the one I suggest you stay on and I cover

the rationale in the next two charts below. Always watch the Gorilla Leaders:

It is important to review what has transpired this past month in the continued rally of 17% since the last minor correction which ended in early July:

1. We are now over 50% up from Low to High on Most Market Indexes

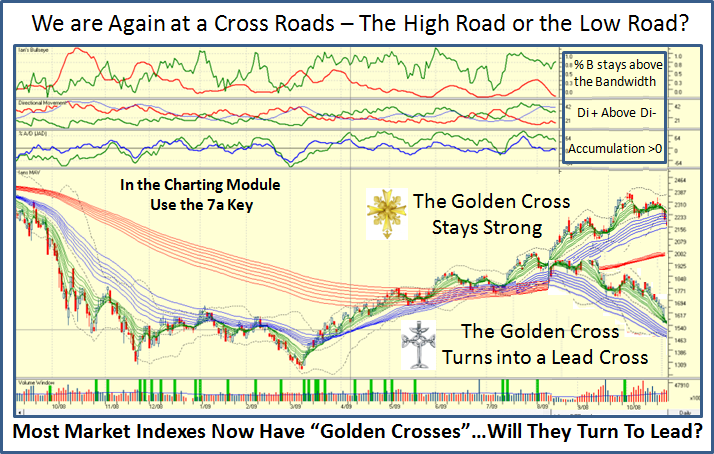

2. The Golden Cross is now behind us whether you are in the dma or ema camp

3. But now we are once again at the crossroads, since the Golden Cross can either stay solid or melt down into a Lead Cross.

For it to continue upwards, three items must remain solid, otherwise it’s curtains:

a. %B of the Bollinger Bands stays above the Bandwidth, and preferably above 0.7

b. The Di+ must stay above the Di- of the Directional Movement Indicator

c. The Accumulation %A/D must stay above “0” and preferable above 20%

There is little point in my covering chapter and verse on the upside since the targets are obvious…breakout again above 1018 on the S&P 500 and head for the 50% retracement level of 1119, as shown in a previous blog. Remember, this is feasible given the Volume Vacuum the Black Swan afforded us on the way down in October, which now presents us with an opportunity.

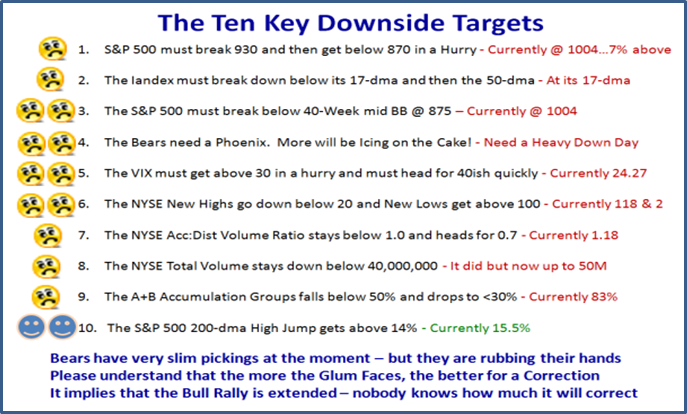

I have updated the Downside Targets I gave you in an earlier blog. Please don’t misunderstand my intent as the glum and happy faces are there to make a point. They show how far away we are from meeting the target, but also with a rotten scorecard as this, the contrarian opinion would suggest that good times are coming soon. It reflects the degree of extension by the current rally. It also suggests that until most of these are met, it is HIGHLY UNLIKELY we will suffer more than another Minor Correction. The Targets therefore represent a complete swing from Bullish to Bearish, which after all is a Gloom and Doom Scenario:

Best Regards and Stay Light on Your Feet. Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog