A Follow up to Late Breaking News!

Ian,

Thank you for the blog. Would it be possible to post a list of the symbols … am having a difficult time getting some of the symbols right due to shadows? Also, would be handy to have a link to the blog included in your update notice.

Thank you. Earl

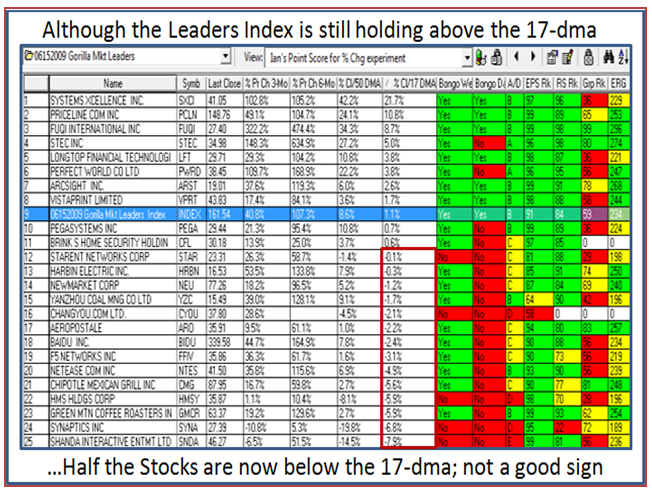

Hi Earl: You have been a faithful follower of the HGSI bb and teachings for ages. I know you won’t mind a leg-pull if I say you are behind on this one, as you should know better than that I would leave you guessing. It is one of the “Articles of Faith” all HGS Investors know of what to do at peaks. All you had to do was scroll down to the blog preceding this one and you would have found a more legible list of the identical stocks. Here is that snapshot:

But you should know that I would have been posting this list earlier and right before your

beady eyes if you dared to go back a couple of months, I posted the good stuff again and

this time with the list of symbols listed at the bottom, because someone sitting out in

Israel couldn’t read the original list:

Now to answer the other questions:

1. You will note that in this last list ONLY one stock, ADY, has been dropped. Realize this

list was displayed two months ago on the June 16th blog, and for some rhyme or reason

ADY got hit hard and never recovered, so it was an “oddball”.

2. I did not remove it until we were assured that the MARKET was on a new leg up. It

would defeat the purpose of the Leaders List. Do NOT change the list as you would have

removed the “Stake in the Ground” and your “Measuring Rod” would be useless.

3. We usually change the list and produce the RonIandex as it is now called at the Seminars.

A couple of years back it was the JIRM list of >$35 and <$35, which served us for a while. It

is one on the exercises the attendees look forward to participating in, as then they have

skin in it.

4. The list can be used in two ways:

a. Its primary purpose is to give an early warning sign of a Rally top and correction.

b. Its secondary purpose is to buy the very stocks on the list as they are the leaders.

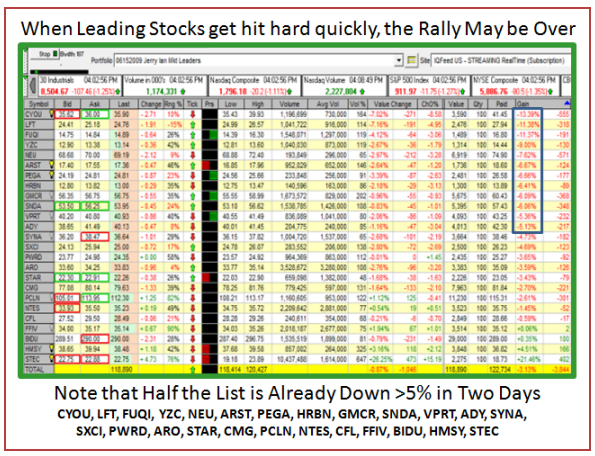

5. It all depends on your stomach as to whether you do item 4b. I have two such instances

where it paid off handsomely. The most recent one is when one of the attendees said he

bought a few stocks on the Monday morning of the seminar and had made enough to return

to five more seminars. The other occasion was at the last Telescan Seminar I gave in Houston in October 1998, where a Doctor out in Hawaii had friends who attended that seminar and the list was already in his hands before I got back to L.A. They again made out like bandits.

6. The more important point is that these hand-picked stocks are in several Industry Groups

and are the best of the best from March 13, 2009. You can tell this by using the new percent

change feature in HGSI, which will be another feature we will cover at the Seminar.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog