Follow Through Days (FTDs)…What’s an usun to do?

The last couple of weeks the Bulletin Boards have all been abuzz with the Follow Through Day (FTD) good stuff. Worse luck the simple aspects of an FTD in the 4th through the 10th day (7th by those who are more cautious) is just not enough in these volatile times to be assured of a turn around, leave alone any form of a rally. The so-called FTD lasted exactly one day before the Bears lowered the boom with a Phoenix on a -3%+ day in the Major Market Indicies.

I gave you the caution to watch for in my last blog for signs that there is at least a chance of a recovery. But before we get to that, there are three types of “Game Player” in these modern times that we need to understand in the scheme of things:

1. The latest buzz word is HFTs…High Frequency Traders who scalp pennies in nanoseconds with millions of shares and have become the bane of our lives, as we must find ways to understand their shenanigans with modern tools.

2. The very short term Intra-day Trader who is used to the whims and fancies of the former and have learnt to stay on the right side of the market and can swing from long to short in seconds if need be. They understand volatility in spades, have tools that can differentiate between Large Players and Small Players with regard to which side of the volume curve they are playing with due regard to price movement, and are accustomed to being glued to the futures that give them a leg up on which way the wind is blowing, intra-day. Likewise, they are adept at looking at reverse ETFs and managing the “Chop-Chop” in spades.

3. Then there are “usuns” who at least want re-assurance that when they get these signals from old tools of FTDs that there is at least a fighting chance they are signaling a decent call more than the 50:50 bet that one gets today. Unfortunately, if the Financial Newspaper says it’s so, it is good enough for the herd to follow, and thereby usuns are realizing that there must be a better way.

If all of that is not enough, there is now the problem that news around the world is instantaneous to all and a supposed slip in a single “bet” of 1 Billion shares instead of 1 Million can cause what is now called the “Flash Crash” of a few weeks ago.

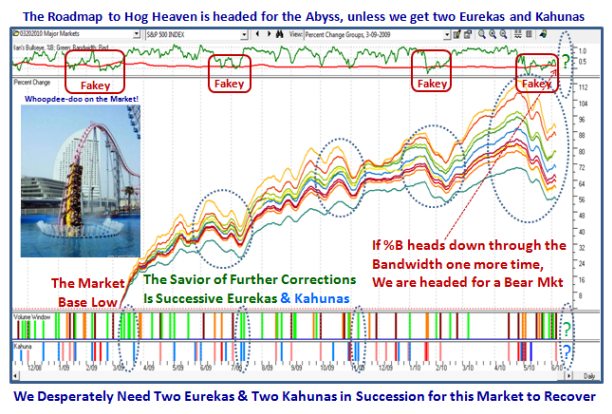

Many moons ago it dawned on me that John Bollinger’s Bands and specifically his %B and Bandwidth gave me just the type of Stakes in the Ground and Measuring Rods to help “usuns” to stay on the right side of the Market at those precious times when the Market provides High Volatility with swings of > + or – 2% to 4% days in price. They gave me the ammunition to understand unusual turns in the Market both at the top and at the bottom with days when the standard deviation is >3% from the norm.

The outgrowth of the past ten years of work is the Impulse Indicators I have developed for you. It didn’t take long for sharp minded people with equal interests to build on these concepts and this has produced a far better mousetrap with regard to FTDs. People like Jerry Samet, Aloha Mike Scott, Tarzana Mike Scott, Bill Roberts and more recently Tom Ellis have all played a hand in at least knowing when the odds are with or against us. Since these folks are generous givers to help the usuns along, here are three cardinal rules based on the tireless work they have done:

1. 80% of FTDs fail if there is no Eureka. This one had an Eureka

2. 75% of FTDs fail if %B 1-Dy Chg is <0.18. This one had >0.21 for the Composite of Market Indexes we follow

3. 80% of FTDs fail if %B is below the Middle BB. All Major Market Indexes except the NDX were below 0.50

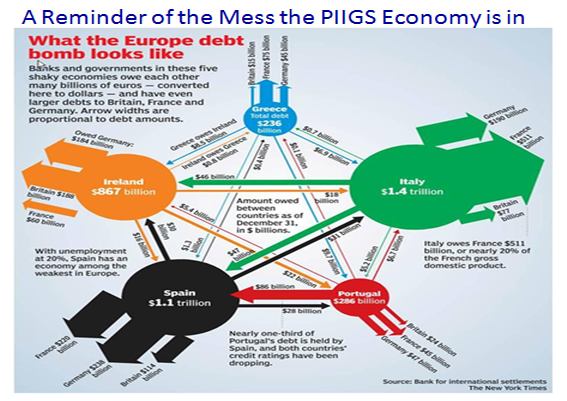

So you say two out three is not bad, until THISPIG by way of Hungary throws a spanner in the works and the Jobs Report turns out to be less than scintillating. I’m sure we cannot account for what might happen say the intra-day players. But, wouldn’t one think it prudent to wait before making the Official Call on a FTD when something as BIG NEWS such as the Jobs Report is only one day around the corner, and the call was made on just an iddy-biddy increase in Volume on that day on the Nasdaq and not the other Indexes? After all, the Value-In-Time folks knew better in that the Big Players had not covered their shorts! This penchant for calling THE BOTTOM is the problem of Greed. Now we sit with a Phoenix on Friday with heavy momo from negative Kahunas and all but the Nasdaq 100 and Nasdaq are below 0.20 on %B.

So, I leave you with the picture as it is today, and hope you find a pony in it as we have done for the last year:

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog