Surf’s Up on the Stock Market!

This week could be critical to establish if the recent rally holds up or peters out.

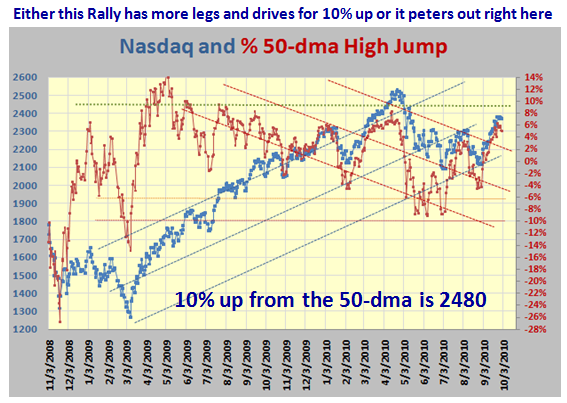

Last week I gave you plenty of fodder to watch so this week I will give you a review of where we stand and what must be achieved going ahead. First, let’s look at the Golden Cross and High Jump Picture:

Now let’s take a closer look at the Nasdaq and 50-dma High Jump. We can see that we are at a critical juncture. The upside is that we could go 10% higher for the Nasdaq, which would put us at around 2480, but we are already showing signs of turning down and need a boost next week to send us higher:

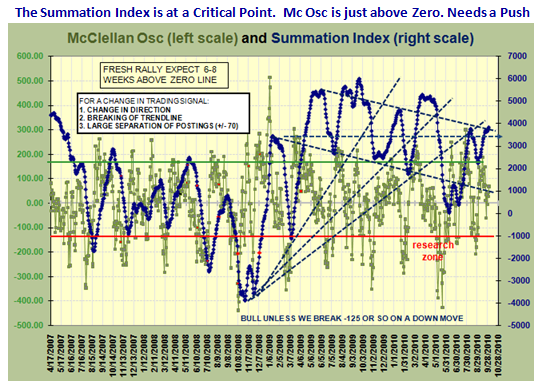

Thanks to my good friend Mike Scott, these next three slides come from his work. The McClellan Summation Index is showing signs of fatigue and also needs a fresh push in the Mc Clellan Oscillator which is at the 68 mark, and must drive up to over 180 for comfort.

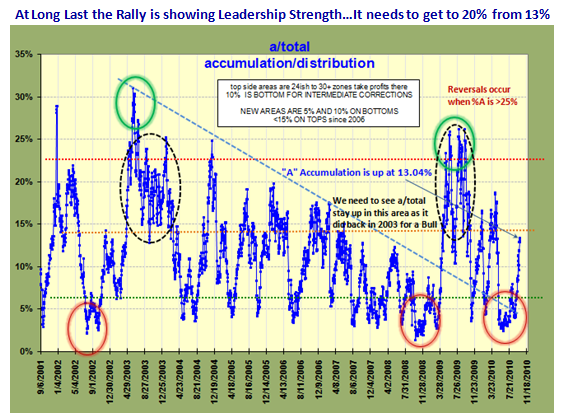

As I showed last week, this market has plenty of Leadership with High ERG Stocks leading the way. However, I am sure you have noticed that the Nasdaq 100 (NDX) got hit this past week…I am not surprised as it has led all the Indexes since the July 1st Base Low. None-the-less we show that the A Accumulation is now at a healthy 13% and A+B is very strong at around 62%:

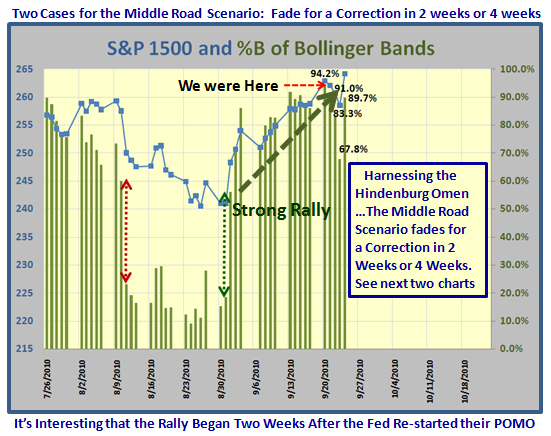

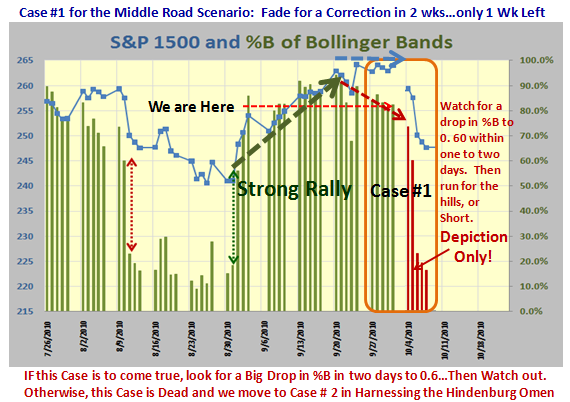

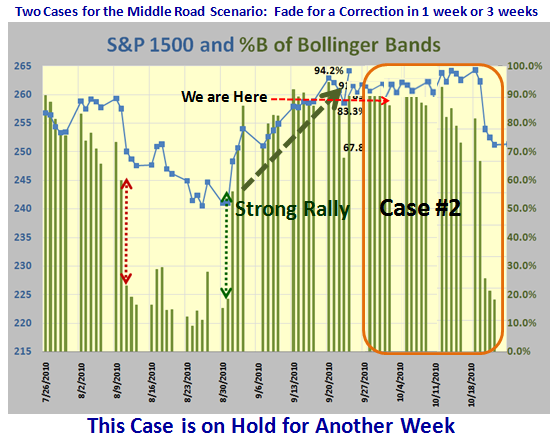

Last week I gave you two Cases to watch in the Middle Road Scenario for Harnessing the Hindenburg Omen where I am sure the Naysayers are itching to come out of their woodwork and crow “cock-a-doodle-do”. Here is the slide to refresh your memory:

…And here is where we stand today on Case #1. We have had a healthy week with the %B sitting up at 82% (0.82), but it has descended from its perch the previous week which reached into the low 90’s. You will recall that we are on a Calendar Day track and this will be the critical week for Case #1 to either happen or be behind us and finished:

It doesn’t have to be at the start of the week as I have depicted, but the important point is to watch out for at least a 20 point drop in a couple of days in %B to around 0.6. At least WE WILL HAVE AN EARLY WARNING. If it skips buckets in doing so, watch out below as I have taught you. In all probability it will mean the finish of the rally for now. On the other hand if %B can stay up above at least 0.7 then we have a fighting chance that the Rally can hold for another couple of weeks. Case #2 lies in waiting should such an event occcur:

The bottom line Message is that as long as %B of the S&P 1500 stays above 70% (0.7) and shows strength with well over 500 Stocks (33%) in the top four buckets above 0.7, the market will remain strong. Otherwise watch out below, especially if we see skipped buckets to the downside and 500 stocks in the bottom four buckets below 0.3 for %B. This rally will then be kapput!

Oh, by the way, Helicopter Ben is still pumping away with his Quantatative Easing (QE) or POMO as they call it, so that helps to keep the wolves at bay. Unfortunately, it is a two edged sword and I suspect that one day we will see the dark side of all of this pumping action.

We have only three weeks to go to the seminar, so if you intend to come, hurry, hurry, hurry, but we do have seats available at this late stage.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog