Stock Market: Santa’s on his Way…And Then What?

Time goes by so fast when you are having fun, and another year has rolled around and it is time to dust off my favorite video and wish you all a Merry Christmas and a Happy New Year from the HGSI Team:

As most of you know, my life revolves around threes: This time not only is the Market under the Weather; California is likewise with rain pouring down as we speak; and sad to say that my Wife, Pat, is also under the weather having caught a mild dose of flu from me which I had earlier in the week.

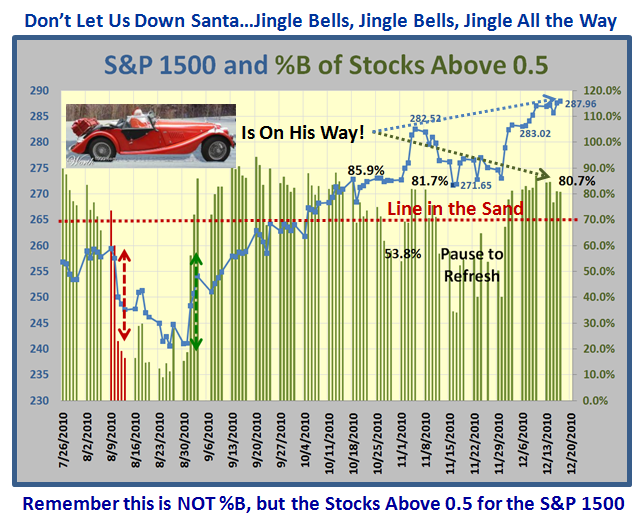

But what of Santa?…Glad to say he is still on his way:

It seems the Moose Droppings are in his way as those pundits who avidly follow the Hindenburg Omen (HO) mumbo jumbo will tell you we had two signals this past week PROVIDED you use Wall Street Journal Data. Skeptics will warn you that the last warning in mid and late August fizzled into a “nothing”. The avid followers will come back with the fact that the VIX showing complacency is also a good sign and this time we may have the real thing…just watch for the next 4 months! The only real point to remember is that one can have these signals and 75% of the time they fizzle into a minor correction, but a Major Bear Market Correction has never happened without being preceded by a Hindenburg Omen. It’s all part of the folklore, depending on how you want to present it.

Meanwhile, we have our own bag of tricks to keep us on the right side of the market, and given that we have now had 16 weeks of a rally with only a couple of weeks Pause to Refresh, it will be no surprise to anyone if we have a correction in the New Year with the market so long in the tooth:

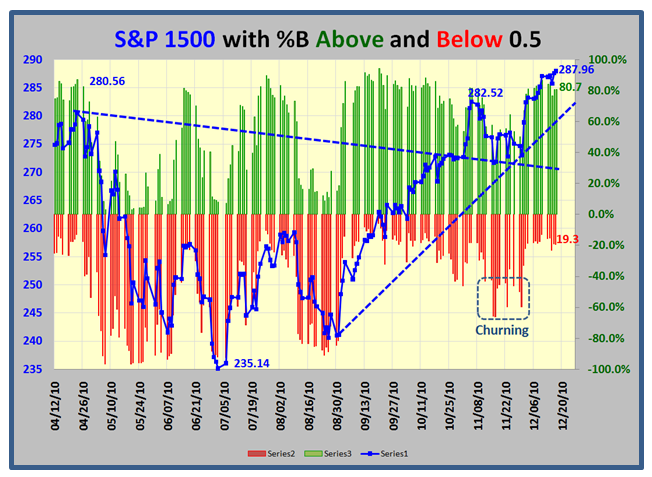

…And let me give you its twin picture for those who like to see both the red and green bars to get the full picture. We are a long way from the churning area, but that is what to look for FIRST, if and when this market decides to correct:

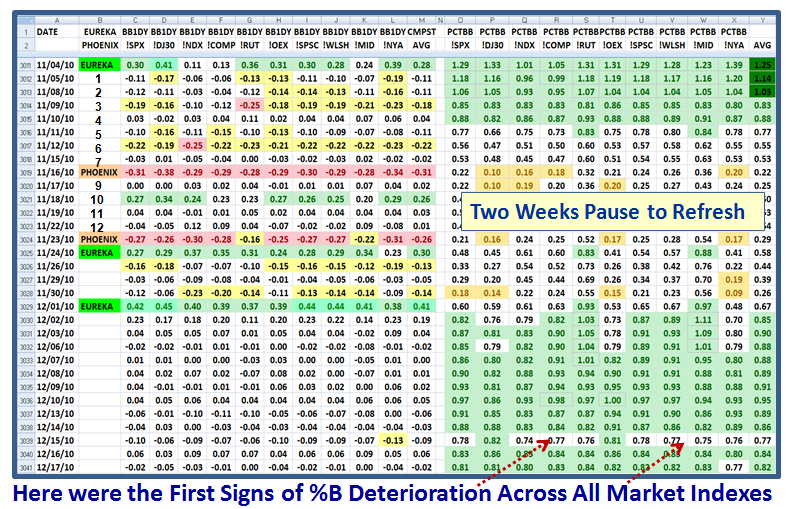

I make no apology for the pun since I feel part of my job is to drum home the key messages of my findings…I tell you 12 Drummers Drumming is working:

Just judge for yourself – we started the last correction WITHIN the last twelve days from the obvious warning sign of the 570 stocks for the S&P 1500 with %B >1.0 as shown before in a previous blog note. It hit on the eight and the 13th day with two Phoenix signals to take the market down as shown:

On December 15th, we saw the first signs of the market deteoriating, but it has snapped back, so the only conclusion at this time is to confirm that Santa is on his way next week unless we have a Flash-Crash-like correction. Understand that this picture shows the %B itself for each of ten Indexes on the right hand side with the Average in the last column. 0.82 is still healthy, but for a decent Santa Claus Rally we want to see this number rise to above 0.95 to show real strength compared to the high on 12/09/10, or else we remain skeptical.

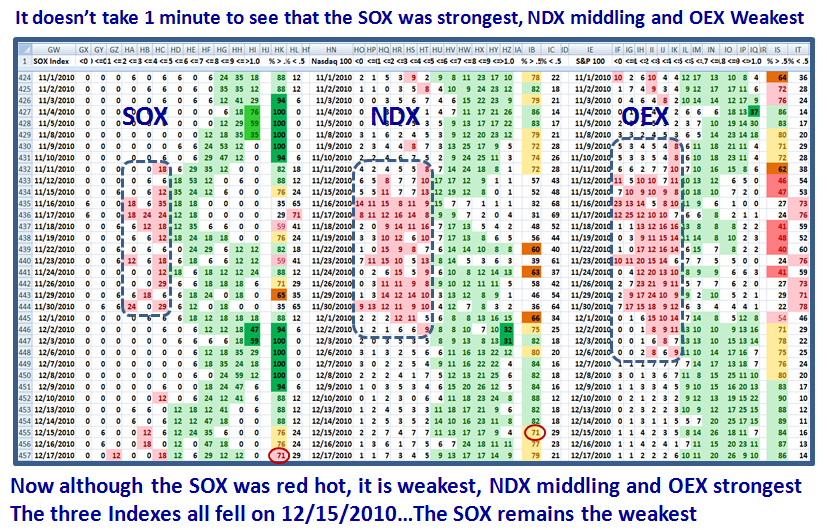

Why Skeptical…because we have observed a “biforcated Market” with all this HO stuff of simultaneous numbers above 79 for New Highs and New Lows. Let’s face it the Semiconductor Index (SOX) got a trifle overheated, and it didn’t take long to see that some of the true leaders we follow in the NDX were also struck down, but would you believe that there has been a strengthening in the OEX! Net-net, this market is sloshing around:

Of course I have taught you moons ago to watch the action of the Fed and you should know by now that Uncle Ben is distributing his POMO to the tune of 6 to 9 Billion dollars a day…yes a day for the next couple of weeks. You also know that this is a two edged sword that one of these days will bite us good and hard, so there is major skittishness as we approach the year-end.

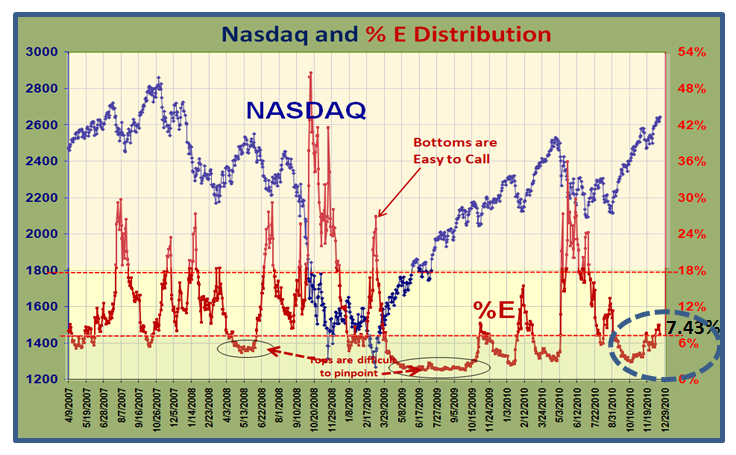

Let me leave you with one more chart that is a Major Shot across the Bow of a warning sign that my group of friends and I have spotted between us. As you well know, we keep a beady eye on knowing your ABCDE’s and at times like these, especially our E’s. Well, we have spotted that the %E’s are rising in concert with the Nasdaq. Big deal, more fly specking you say! Well, the last time this happpened was in 2007 on two occasions, in July when Uncle Ben waved leaflets around and again at the top in October. It’s trotting up as shown:

Look over to the left when this happened in 2007 and as circled on the right for now. Bottom line, all things are showing a caution flag as the market is long in the tooth.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog