This Stock Market is Back to Stalemate!

Saturday, February 26th, 2011In my last blog I gave you the simple short term three road scenario for last Friday:

- High Road Scenario – Big Bounce Play

- Middle Road – Pause to Refresh

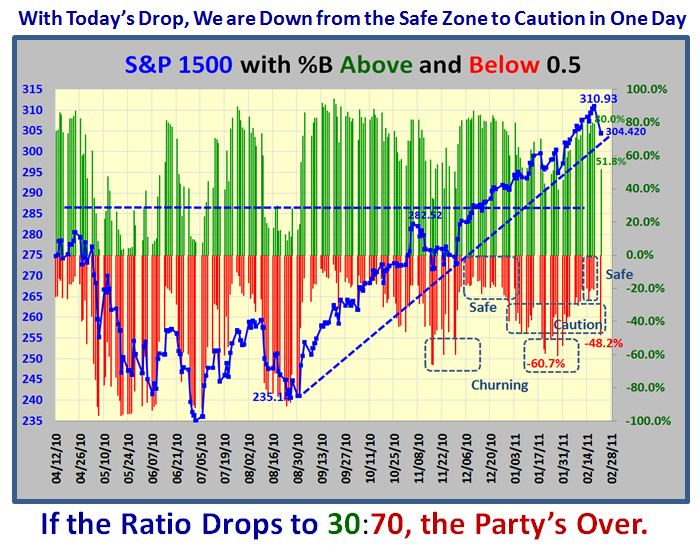

- Low Road – Correction with %B below a ratio of 30:70

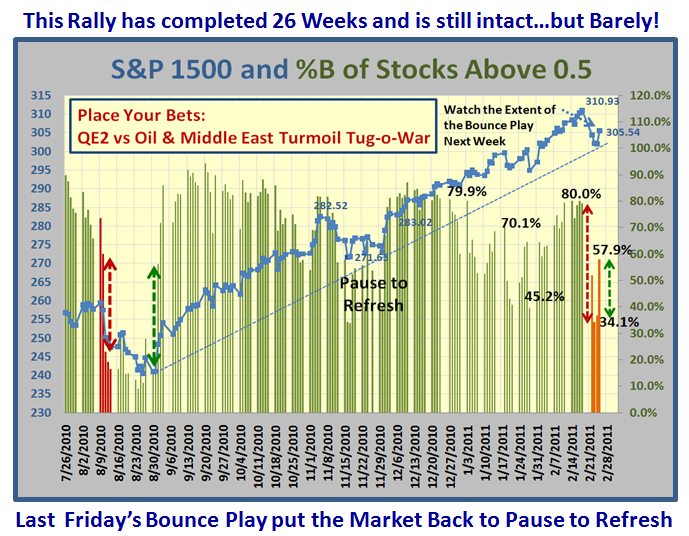

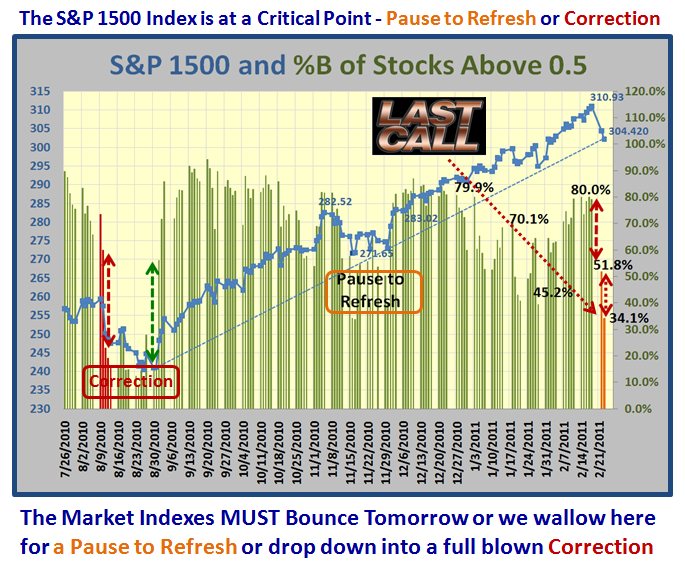

Well, we got the bounce play which was strong but not strong enough, so we now sit at “Pause to Refresh”. This means that we wait for next week to see if the tug-o-war between the Bulls and Bears can resolve the Stalemate of the QE2 vs The Middle East Crisis & the resulting Price of Oil:

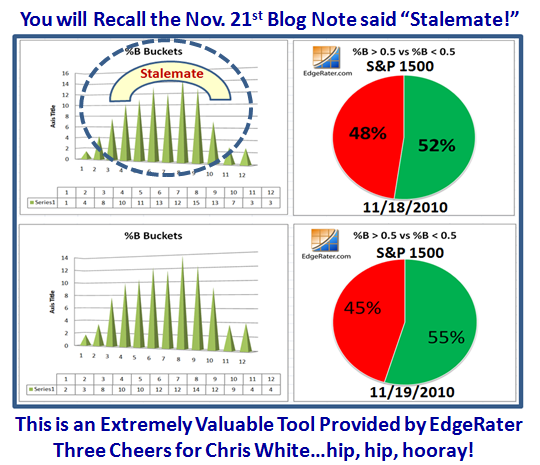

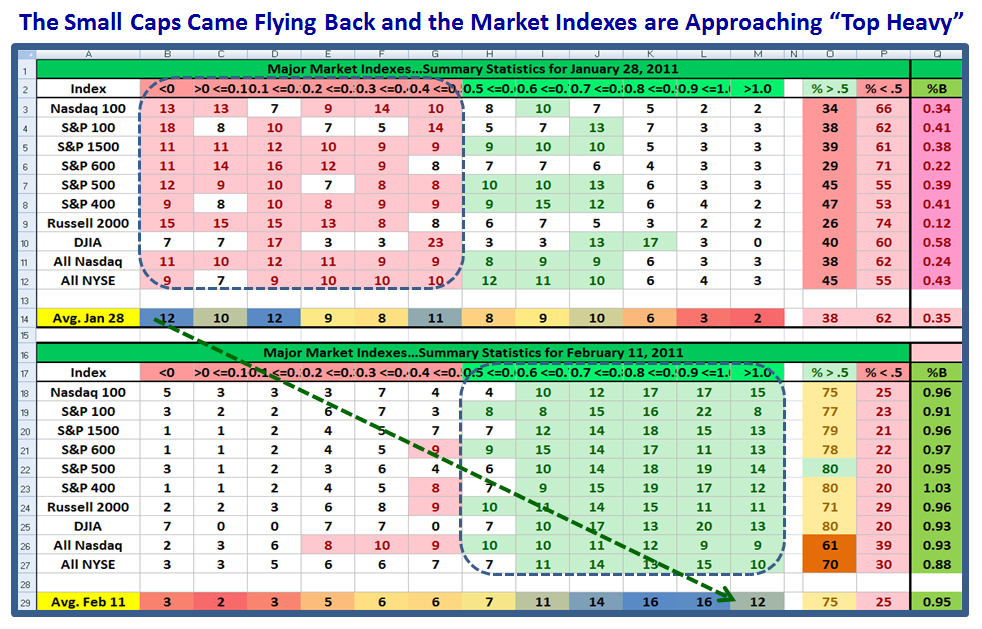

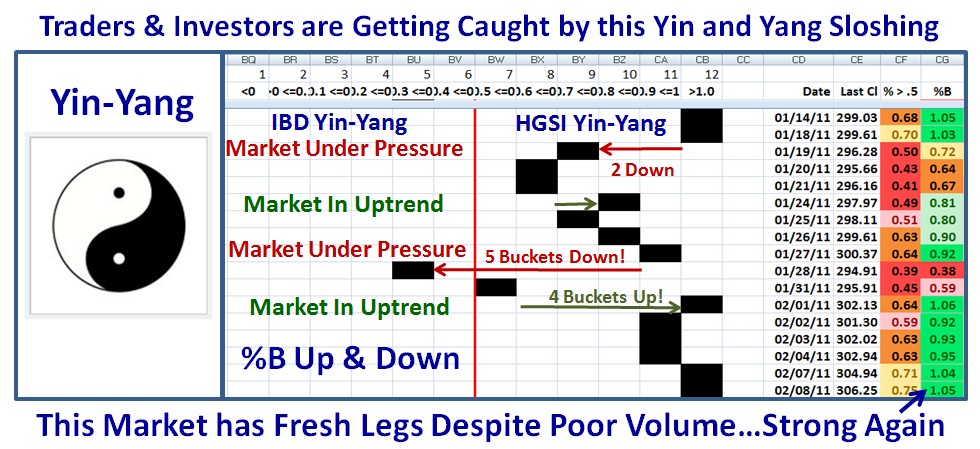

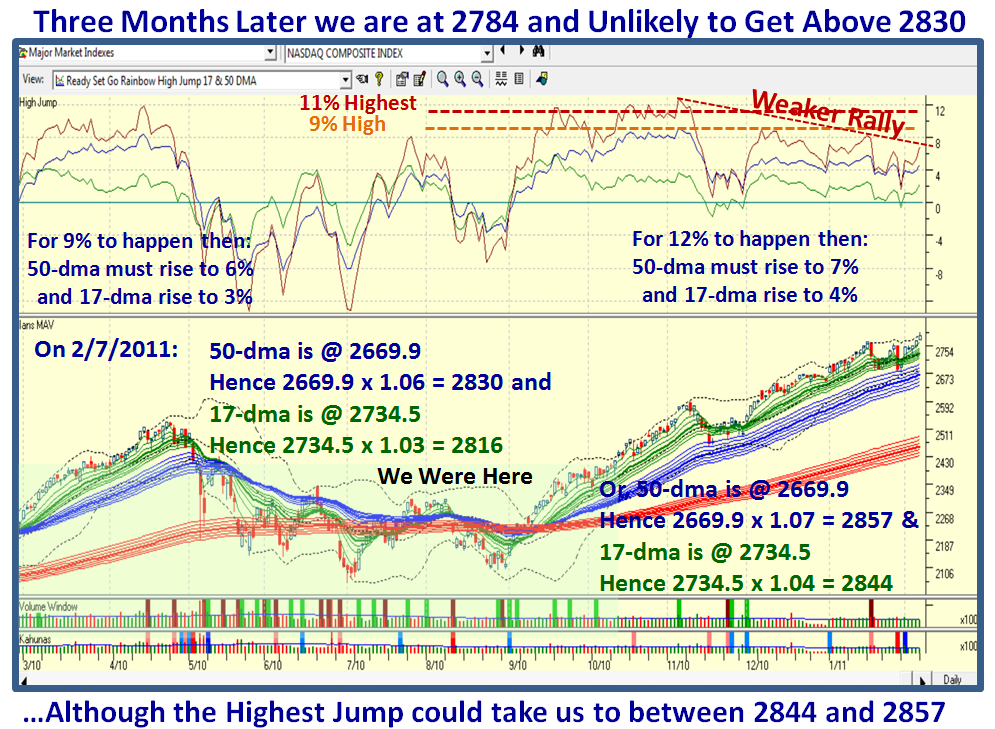

So why do I say “Stalemate”, you may ask? It is just my way of stating the CURRENT Status going into next week. My good friend Chris White who will be at the HGS Seminar from March 26 to 28 gave me the keys to paradise with his special set of software add-in that allows me to show you all this good stuff in relative terms. You will recall the picture which I first gave you all of three months ago before the Santa Claus Rally where we were at a similar stage of events. You will also recall that I informed you that the natural bias of the numbers for equilibrium is not 50:50 but 55:45 with a slight bias to the right hand buckets, otherwise the market would not have risen all these 100 years; so loud cheers for Chris with a Hip, Hip, Hooray! Note that Bucket #8, >0.6 <0.7 is the one to watch in the sloshing exercise as the market swings to and fro. When that is at a peak, you can expect a “Normal Distribution” which says the market can go either way. Here is the picture for the S&P 1500 at that time:

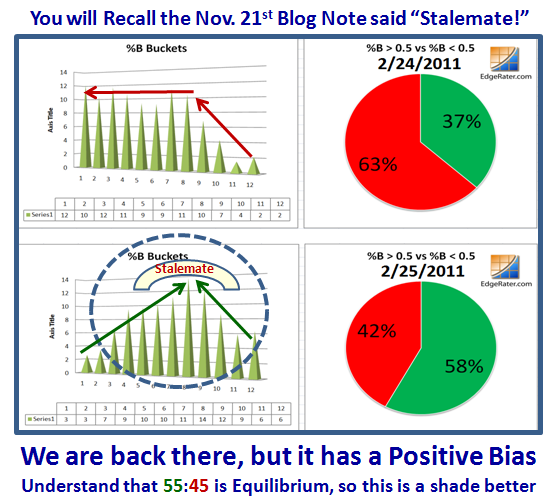

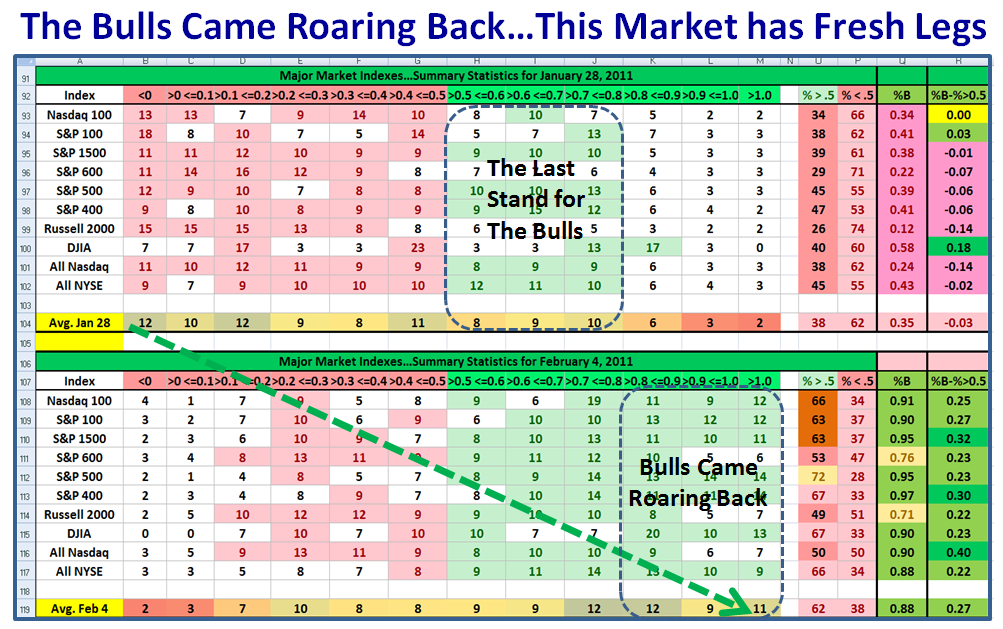

So now, by comparison, we fast forward three months later and we are back to Stalemate, but with a decided positive bias from the previous day and a major gloom and doom picture (not shown) from the day before that…so you see a familiar picture:

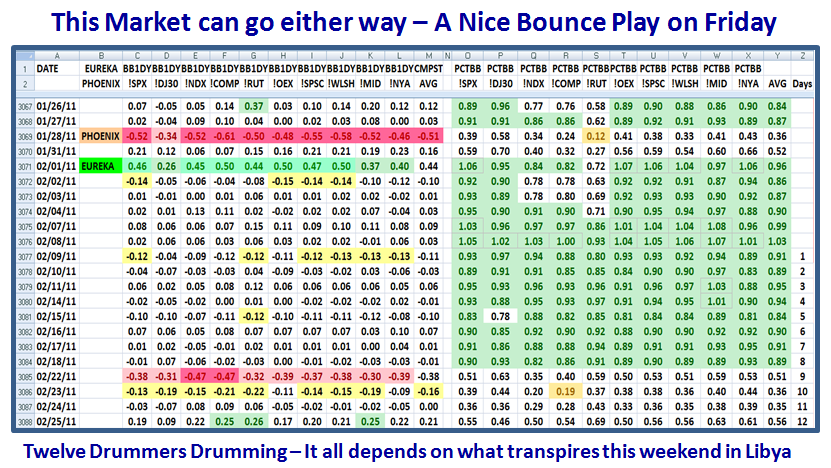

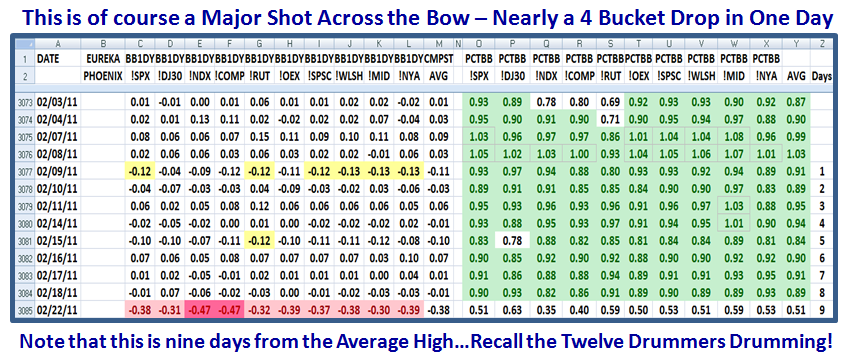

Well, you say “Ian, that is only for the S&P 1500; what about the ten Market Indexes which you have taught us to follow?”: Immediately you see that big shot across the Bow on 02/22/2011 and 02/23/2011, which took us from the Safe Zone up in the 80’s and 90’s to the dreaded 30’s in a matter of two days flat. In addition, you will note that the Twelve Drummers are Drumming once again, and we shall see if the market will cave in or resurrect itself with all the QE2 pumping that is underway. Note that the Bounce Play is not to be sneezed at as three Indexes gave Kahunas and the rest were close to that…look at the bottom line:

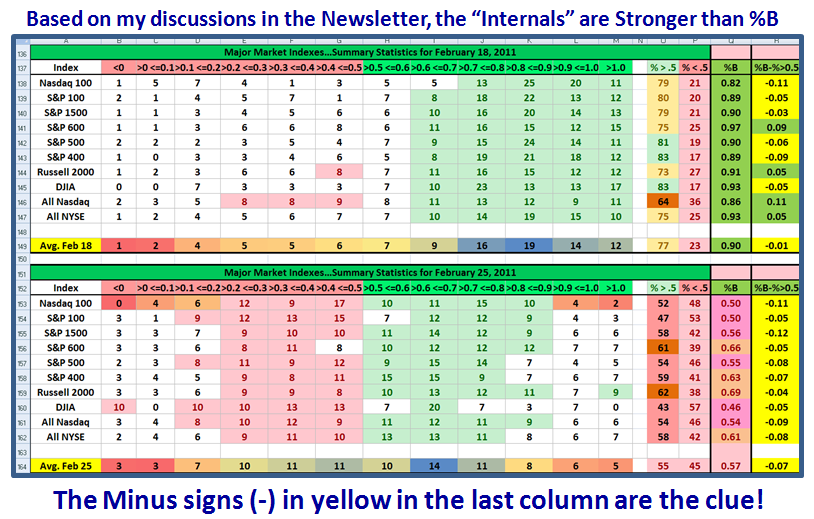

…And now for the clue by comparing the “Internals” of the Bucket Sloshing for this week to last week, and as you can see there has been a marked deterioration. Also, note how %B itself for each of the Indexes has dropped in concert with the sloshing, confirming the picture I have just shown you above.

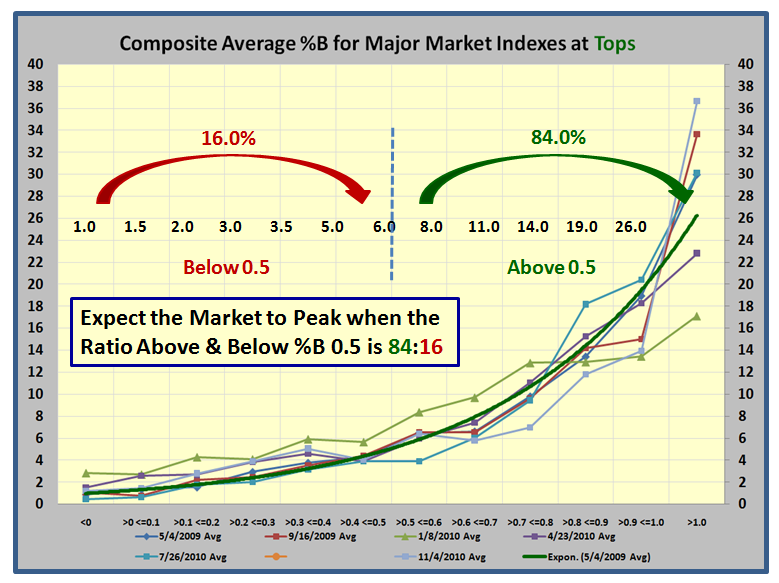

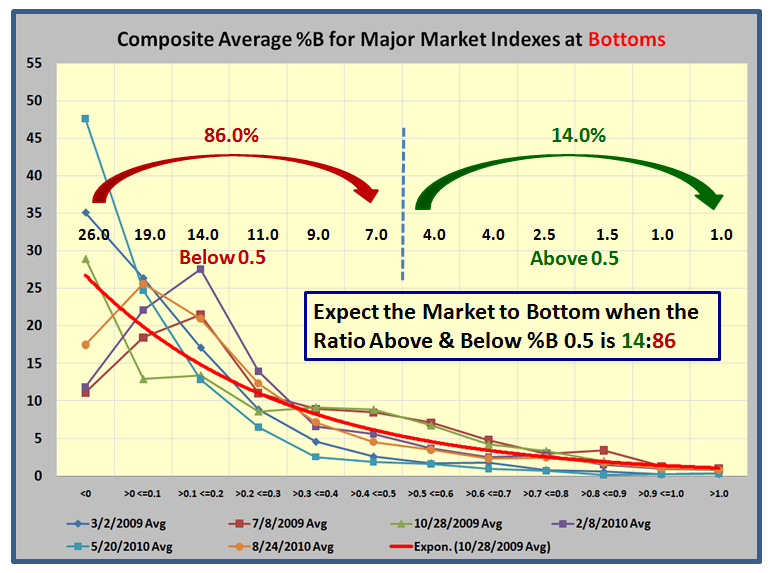

“What’s all that yellow stuff at the extreme right” you might ask? That shows a quick way of seeing that the so called “Bucket Sloshing” is leading or lagging the Bollinger %B for the Market Indexes. When the signs are minus in that column, the Internals are leading. It stands to reason…no matter how overbought or oversold the market is, the buckets themselves above and below 0.5 are not going to be 100:0 or 0:100, unless there is an utter calamity ala 1987, which I haven’t seen in this work so far. In other words there will always be a “residual %” in either the top or bottom half, and I have done the homework that says a good rule of thumb is around 85:15 or 15:85 for overbought and oversold, respectively. Take that rule of thumb to the bank. The precise numbers for recent tops and bottoms are shown below:

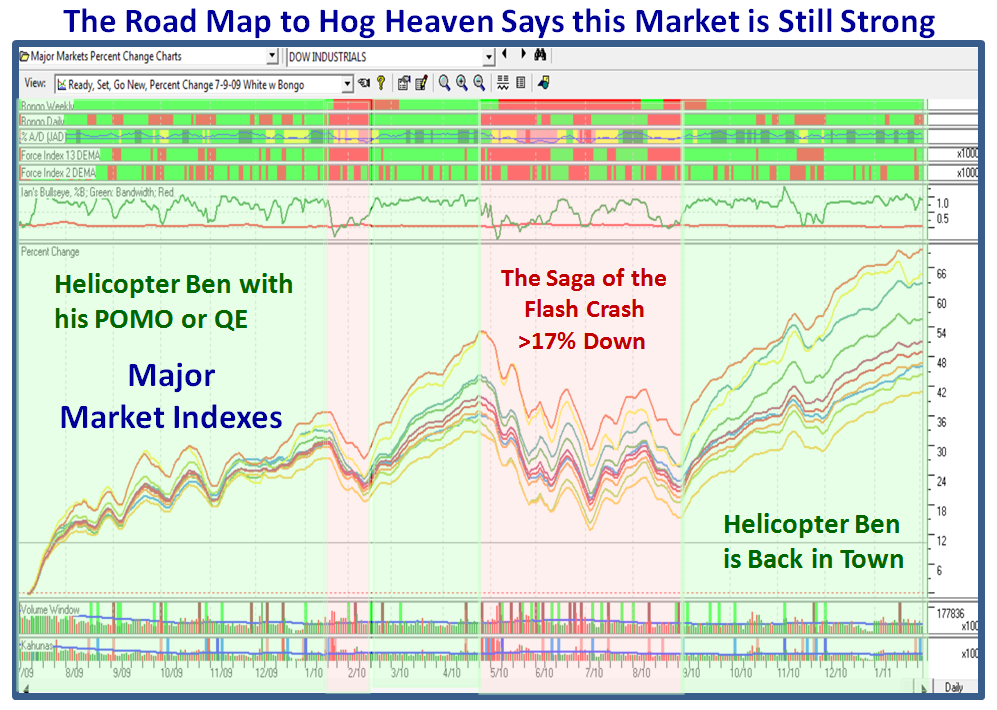

Notice how the top and bottom buckets of >1.0 and <0 for Market Tops and Bottoms, respectively, vary substantially depending on the strength of the sloshing at the extremes of the Market. It clearly shows the ebb and flow of the market which this is intended to demonstrate. It’s no wonder that we hit rock bottom with 48% in bucket <0 at the time of the recent Flash Crash when the average of all ten Market Indexes came down to 4%:96%, the worst I have seen so far in these past two years. Don’t forget that the resultant correction was >17% over three months.

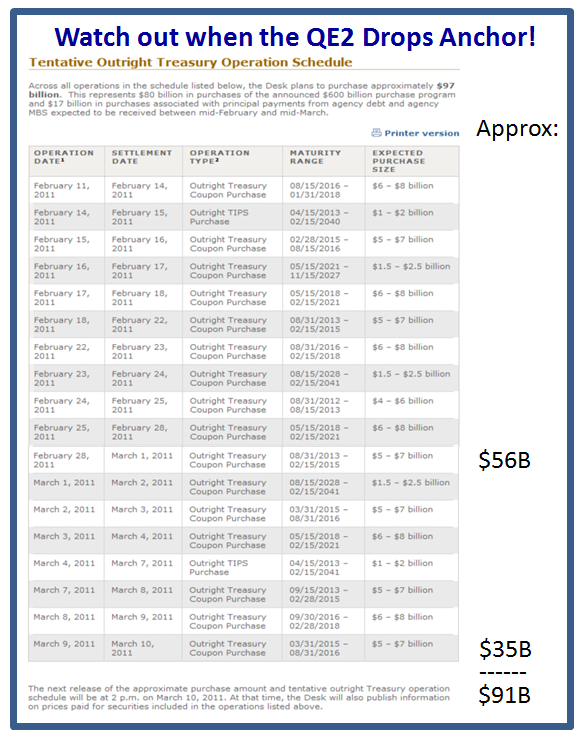

So where does all of this leave us for next week? I return to our favorite summary chart that shows the road map we have followed faithfully for the past 26 weeks of this rally and I have color coded the last week in orange to depict “pause to refresh”. We are by no means out of the woods and although the Bounce Play on Friday was encouraging we need to see a follow through day with an Eureka to stiffen our backbones that the Middle East crisis has subsided for now and that oil is once again in check; and let’s not forget that Uncle Ben with his QE2 pumping remains alive and well and continues to rule the roost for now.

This time in four weeks we will all be engrossed in the HGS Investor Seminar which goes from March 26 to 28 and it is high time you signed up if you intend to come. Thank you for attending the Webinar that Ron and I held last Thursday night which had a good turn out.

Best regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog