HGS Boxes to the Rescue!

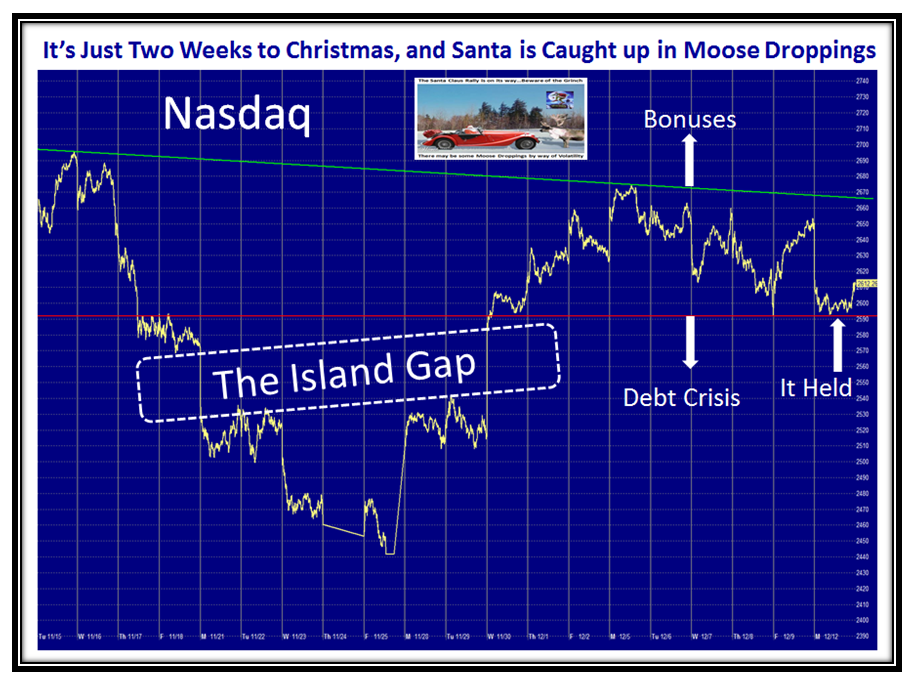

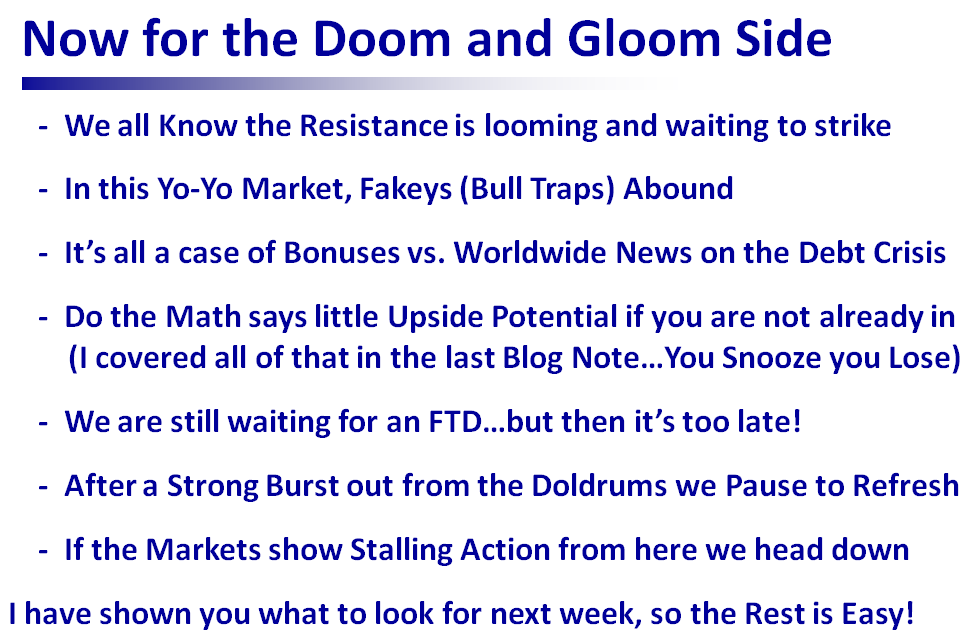

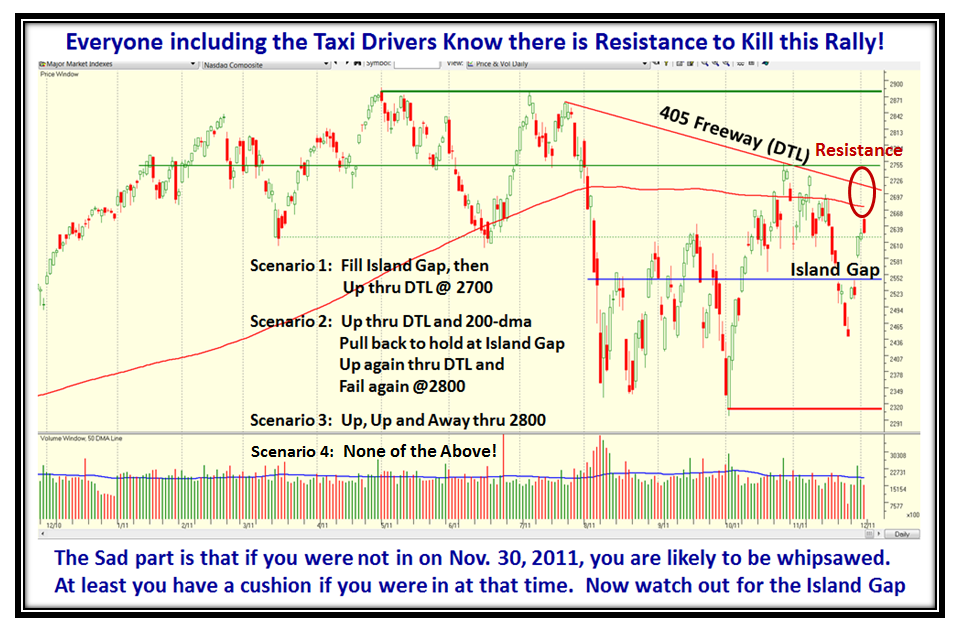

Monday, December 12th, 2011We had another “Shot across the Bow” today, and I haven’t waited to see the nightly results as we are back to the same old Yo-Yo Market that all of us are getting fed up with. Those that are firmly in the Bear Camp are chuckling about the heavy resistance at the 200-dma and until that gets broken or the Island Gap I mentioned a week or so ago gets filled we will ying-yang around. So I will summarize the Market situation with just one chart which says it all. I can’t make a silk purse out of a Sow’s Ear!

Those of you who are HGSI Software users will get a treat in this blog note as I have stirred up enough interest to quickly demonstrate a feature you will only find in it, which should convince you that one can find profitable stocks in rotten markets for the short, medium and long term if you will use the HGS Boxes Concept I developed over 20 Years ago. It is still as fresh today as it was back then:

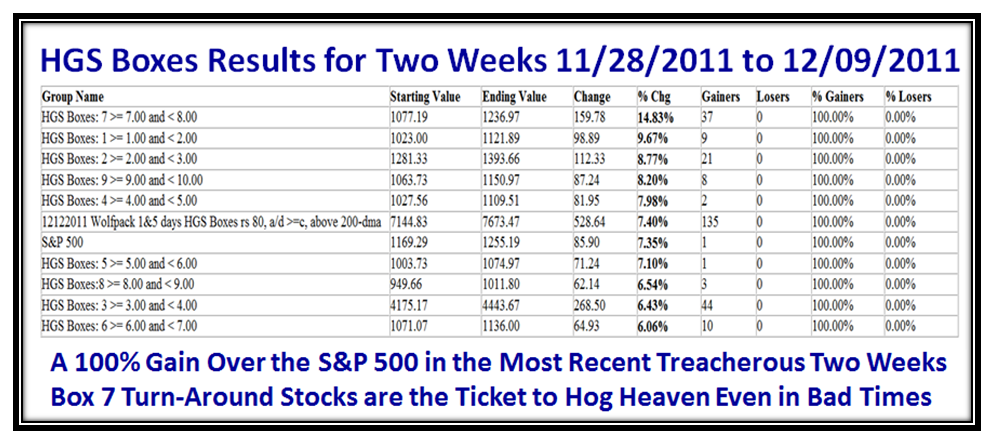

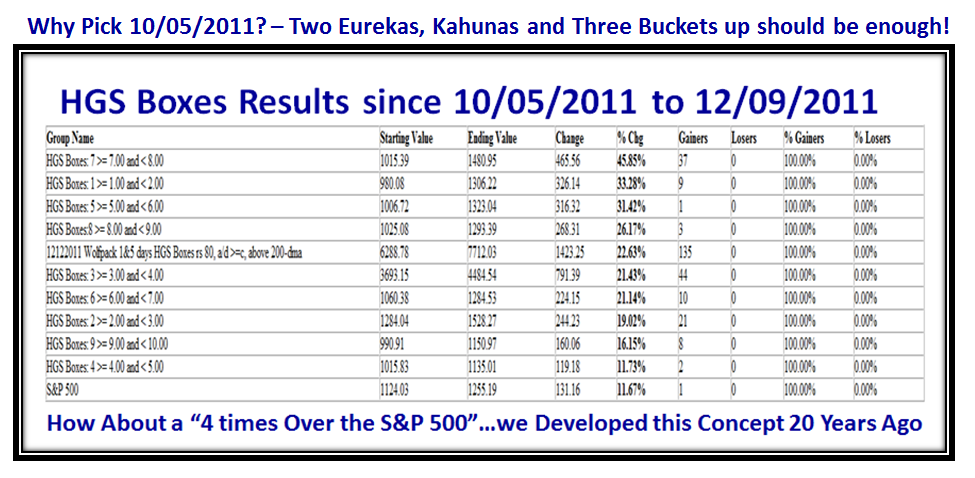

Those who follow Ron’s Weekly Movie were delighted with his subject of WolfPacks and his approach to ferreting for profitable stocks at times like these. Building on his concept, I have chosen to use his same screen and use HGS Boxes to find the big winners. It will be no surprise that the Box 7 Turn-around Stocks lead the way. You and I know that the last two weeks have been a nightmare, but let me quickly show you how the various Box stocks performed recently, where you could have theoretically made 100% over the S&P 500 by just working with Box 7 stocks alone. Let me first give you the results and then I will unfold how to find these gems in HGSI:

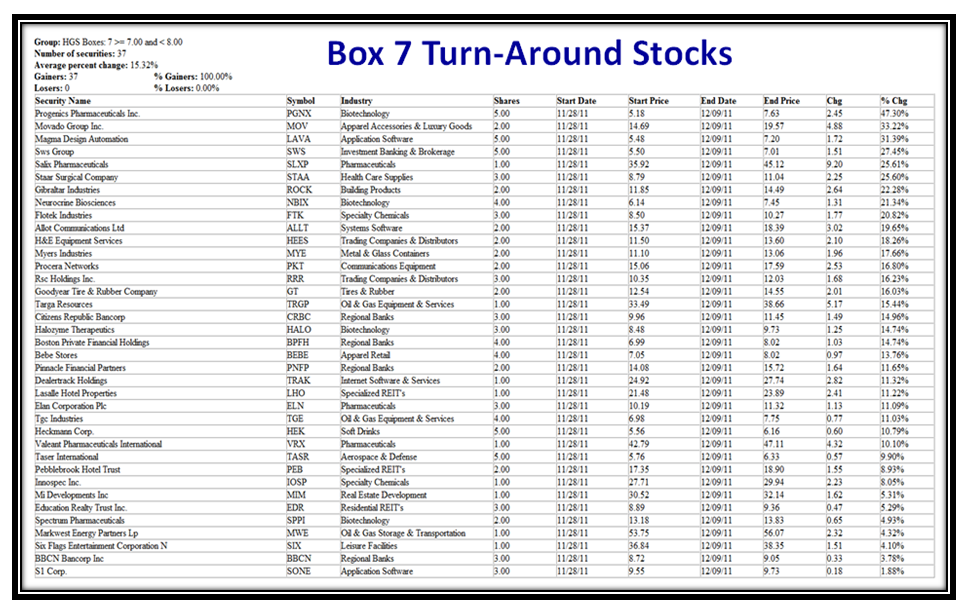

…And here are the stocks for Box 7 on the list. The Majority are over 10% in ten days and a few as much as three times that, so it is impressive:

Some may turn up their noses at low priced stocks while others find it their cup of tea, but there is enough of a mixture of quality stocks to go around, especially when small-caps are again in favor. The important factor is that they all have good RECENT Earnings Credentials by way of Earnings Growth in the last two qtrs. compared to a year ago…i.e., they have “Gas in the Tank”.

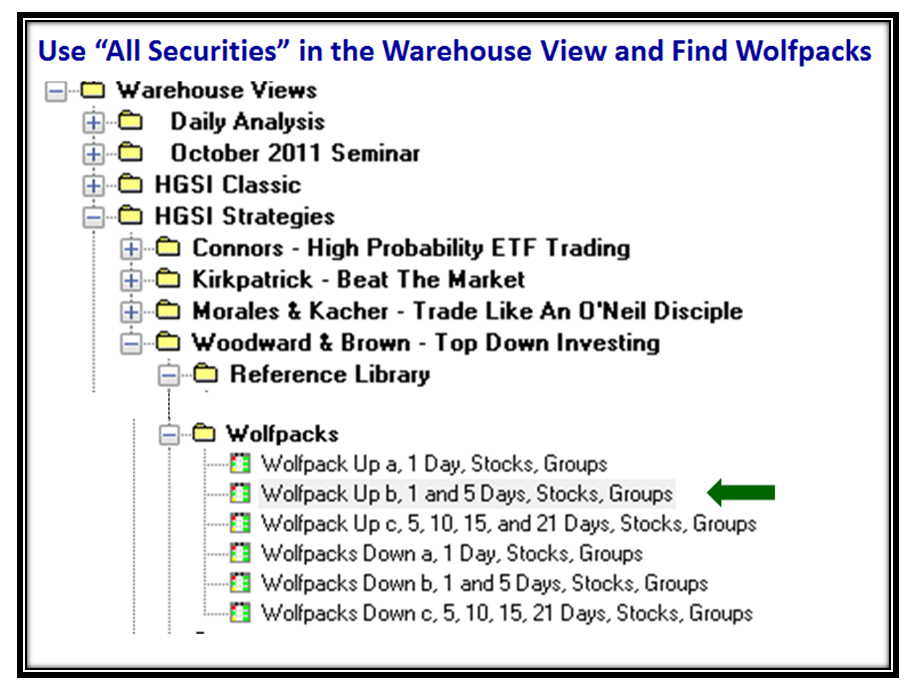

So how do you ferret for these stocks is now your burning question? By the way, thank you for responding to my question on the HGSI Bulletin Board, many of whom already knew to watch for Box 7 stocks.

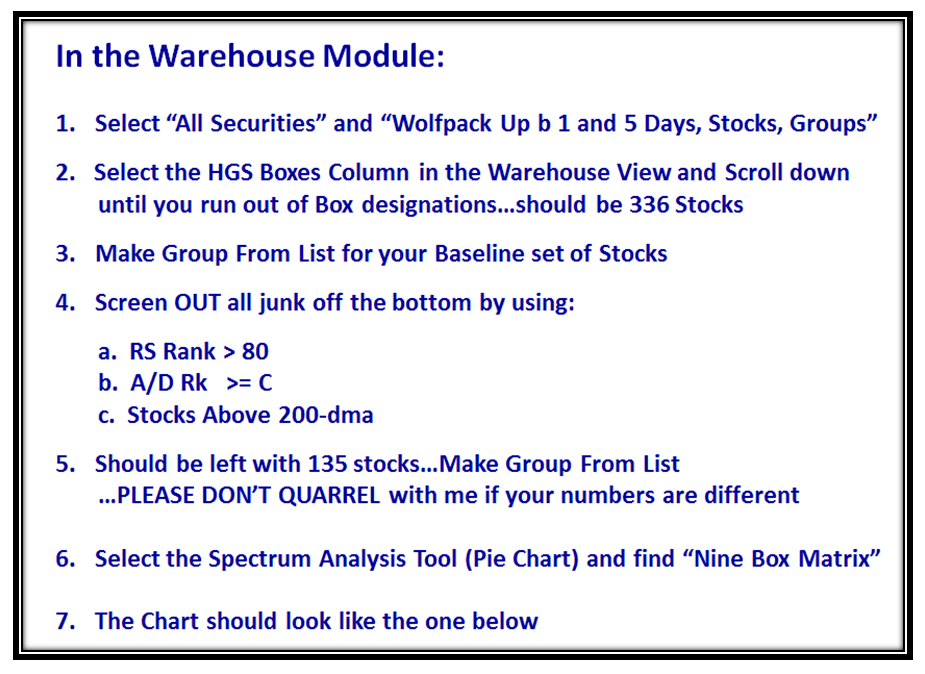

…And here are the Steps in the Process, which to most is a ten minute exercise if you are familiar with the program:

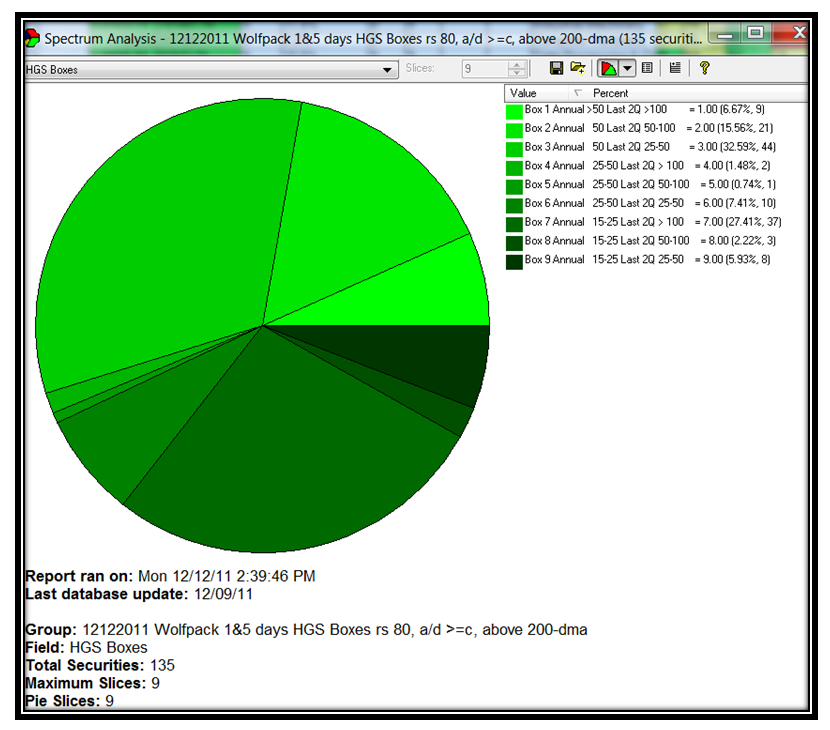

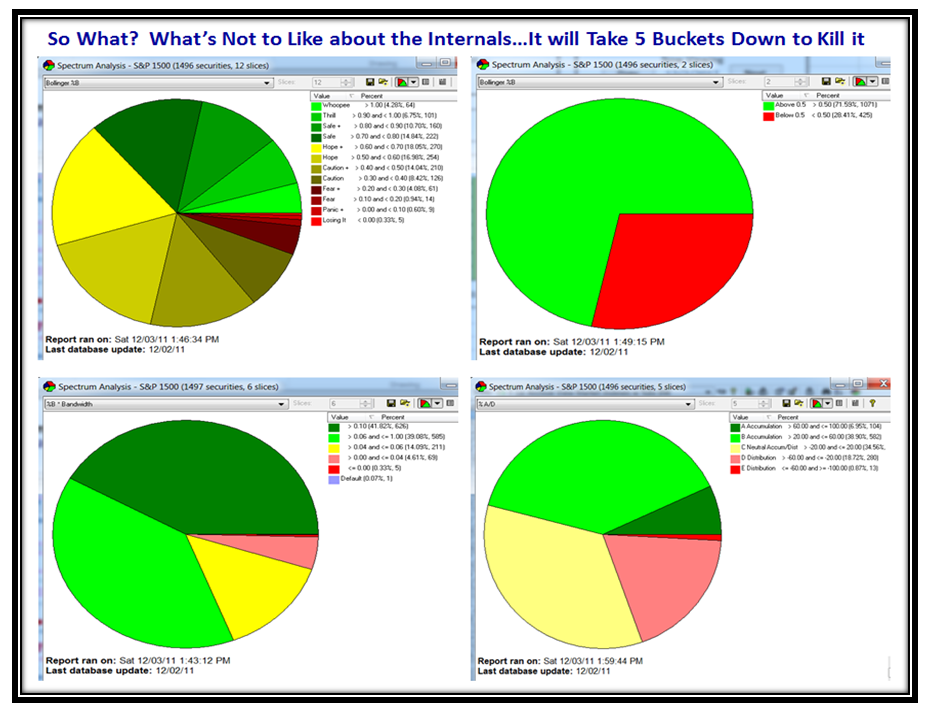

Here is the Pie Chart that provides the ability to ferret further:

If you know how to apply the Group Performance Analysis Tool, then you have manna from heaven as we have demonstrated to you at the seminars we hold.

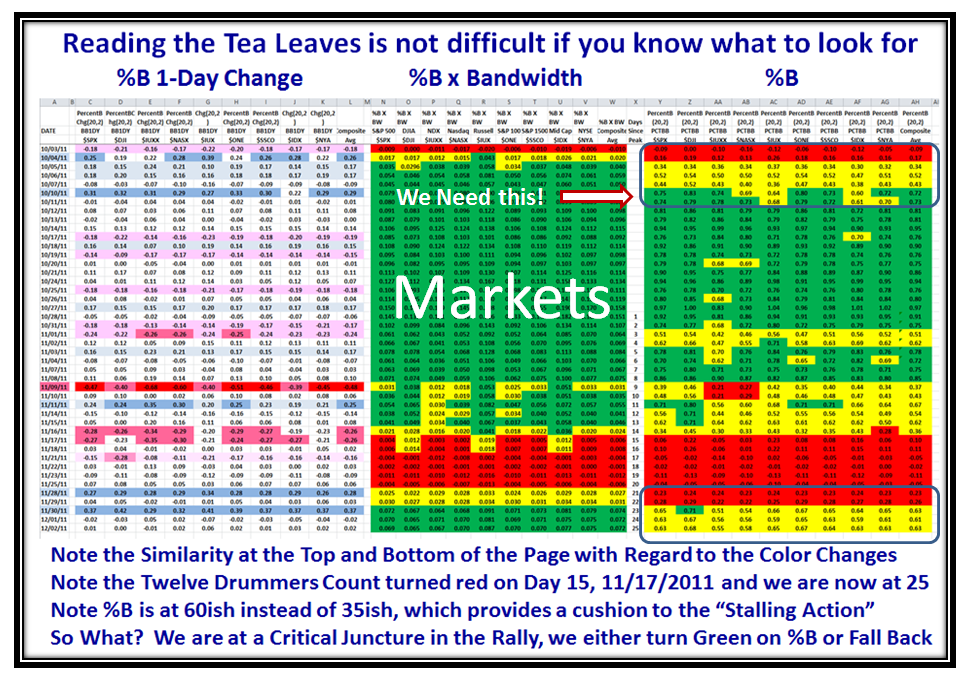

Now for those who are still sceptics, you have heard me many times before tell you the road map to Hog Heaven is two Eurekas and Kahunas in a row, coupled with three buckets up so feast your beady eyes on when we had that signal it was time to get aboard and take the Roadmap to Hog Heaven, or you snooze you lose. That signal was back on 10/05/2011 which you have faithfully followed if you keep up with my blog notes. Don’t all shout at once that these stocks did not all have earnings out back two months ago…that’s left as an exercise for you to try your hand at now that you may be convinced there is a pony in here!

From time to time I get a gem of encouragement for the tireless hours I spend at this stuff, hopefully giving back to you what I have learned. I would like to share with you the comments my good friend Aloha Mike wrote on the bb.

“I have used this method for many years – since we first developed it to use as a measure of risk. We soon discovered that it was a great sorting technique for ferreting out the fast moving/leading stocks. This was back when we only had the paper and had to do most of the work by hand. Early 90’s was a great learning and playing experience. Hiding out at Ian’s house and Malaga Cove Library basement we learned much. The new library is nicer, and more technologically driven but never forget the basics.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog