Stock Market: Beauty is in the Eye of the Beholder

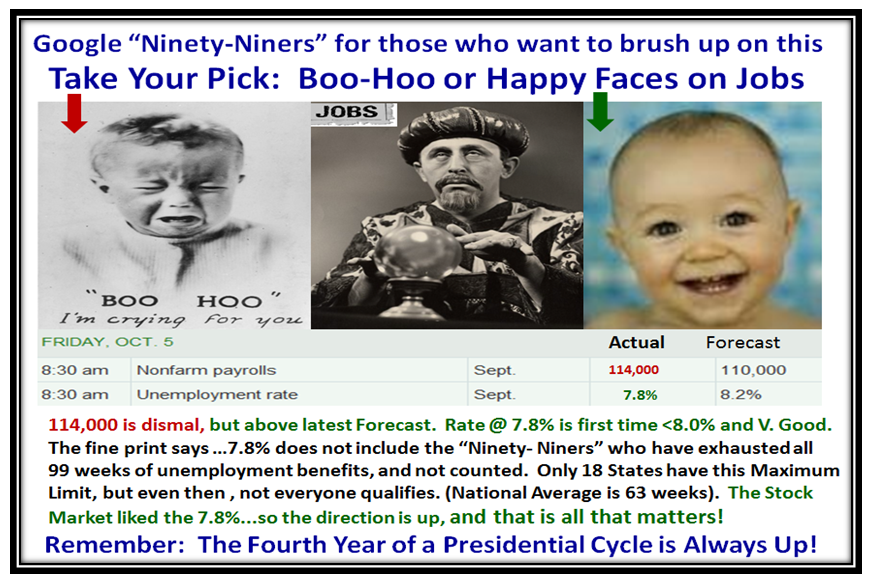

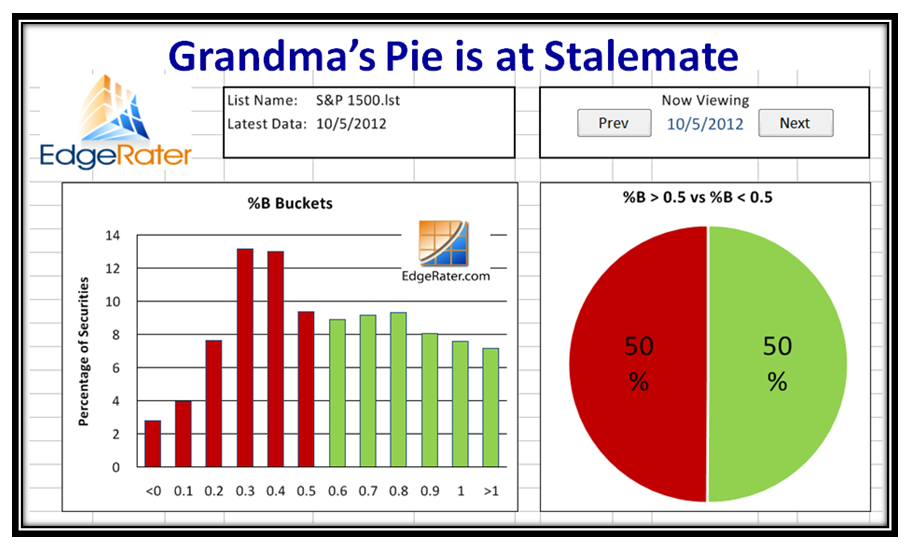

The Jobs Report was mediocre to say the least by any past standards, but the Stock Market was very impressed with the 0.4% drop in the Unemployment Rate which carried the overall number to 7.8% for the first time and below the 8.2% the previous month. The market shot up early on, but gave back most of its gains at the close to leave the S&P 1500 exactly at Stalemate, with a 50%:50% above and below %B at 0.5…the Middle Bollinger Band.

So, we come to the chart which you are now very familiar with. As I cautioned last month, August and September are traditionally low, and I set the expected bar at 133,000 jobs to suggest any signs of true economic recovery in the near term. It seems that is not to be, and further more was not important at this stage of affairs where the Unemploment Rate of 7.8% took center stage. It is the Market Reaction to news that matters, and that was very favorable to start the day on Friday, but petered out by the close. As I understand it, there are two items which account for the surprise of a 0.4% drop in the Unemployment Rate:

1. The Ninety-Niners as I mention above, which are not counted in the Jobs Report

2. The sloshing back and forth of Part Time workers included in the Jobs Report, which can affect the number due to seasonality

In the short term be thankful that we dodged a bullet, and as I have reminded you many times before the market invariably stays strong through the 4th. Year of a Presidential Cycle.

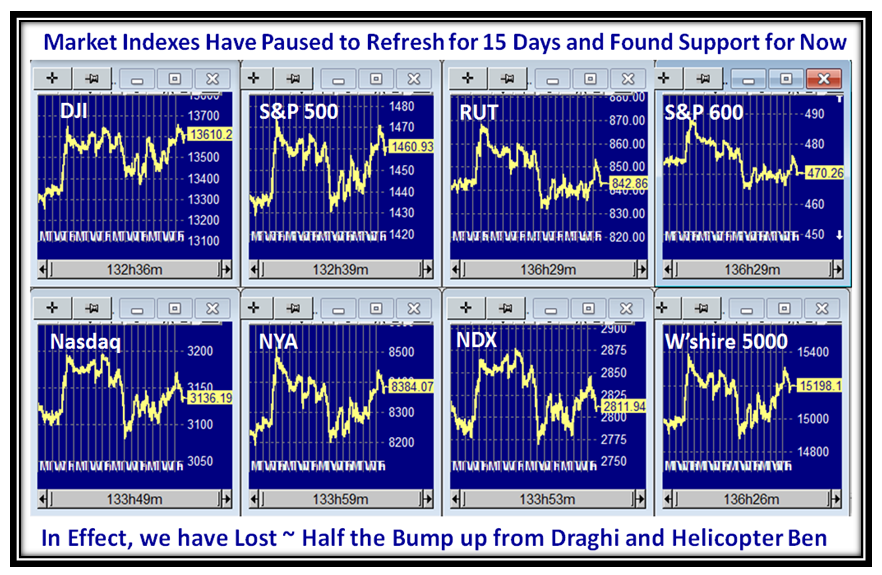

The Market Indexes have Paused to Refresh for the last 15 days and some such as the DJI and S&P 500 have recovered from being down 2 to 3%, while the rest are still catching up.

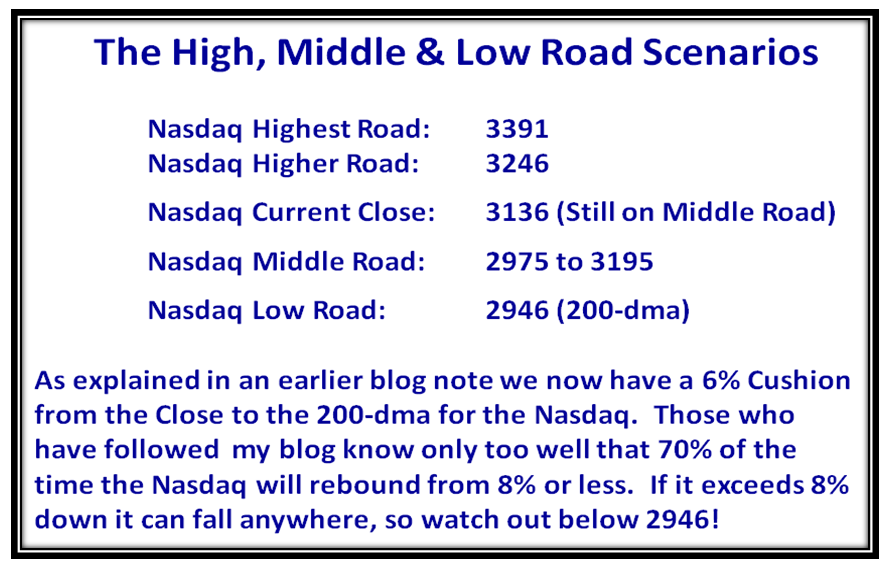

The net of all of this is that we are at Stalemate, and on the Middle Road or Marking Time Scenario as shown below:

…And to confirm we are at Stalemate, Grandma slices the Pie right down the Middle!

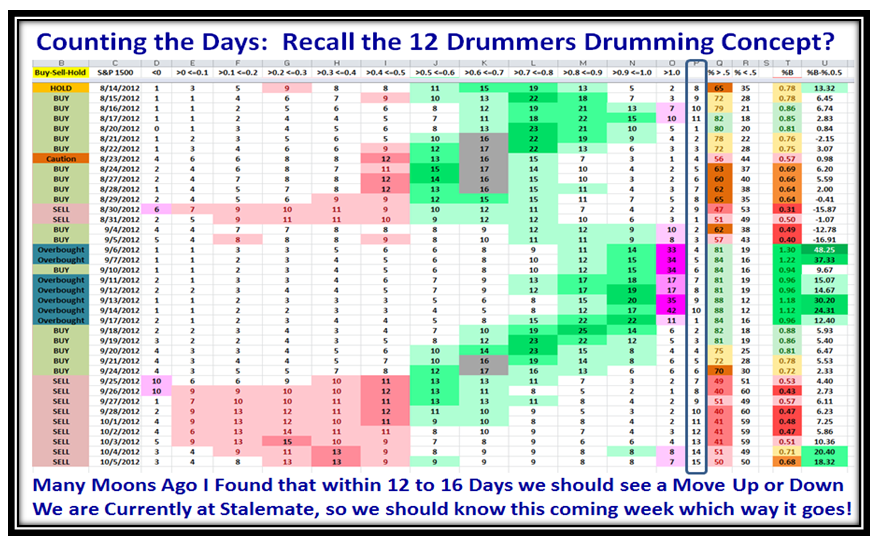

So what, say you? Turn to the 12 Drummers Drumming Concept which I introduced many moons ago when I found that after the S&P 1500 has hit a Large % in Bucket >1.0, in this case 42% as shown on the next chart, it is time to start counting. Invariably within 12 to 16 days the Market heads down, and the Bears are favored. This time we have dawdled around at Stalemate for all of nine days if you look down column “Q”.

However, if we now look at Column “T” which gives us the entire %B for the S&P 1500 we see that in the last two days we have respectable readings of 0.71 and 0.68 implying that the stocks above the Middle Bollinger Band are holding strong. Now cast your beady eyes on Column “O” and we see an unusual bit of “pink” at 8% and 7%, which suggests that those cells are up one Std. Dev. from the norm and therefore strong. Net-net it is a tough call and next week will tell us whether the Market wind is at our backs or in our faces:

So for now we sit at the Middle Road Scenario and the numbers for the Nasdaq are as follows:

Have a Happy!

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog