Stock Market: Tired and Needs a Pause to Refresh

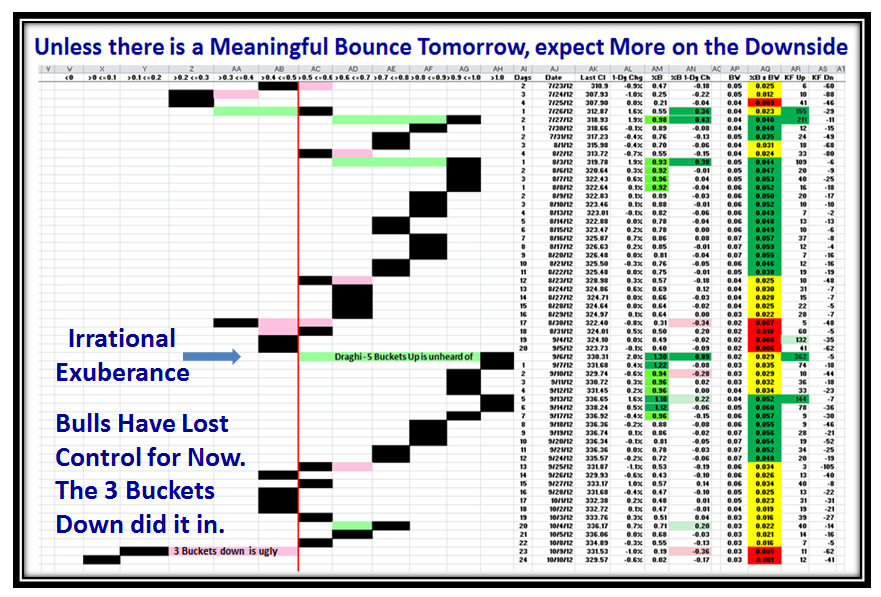

After the reaction to the Draghi Plan on Sept. 6th., and followed by Q-E 3 from Helicopter Ben on Sept 14, the market essentially shot up into a Climax Run and the Nasdaq topped out at 3196.93. Now it is evident that we have more than “Paused to Refresh” as a result of the last five days action:

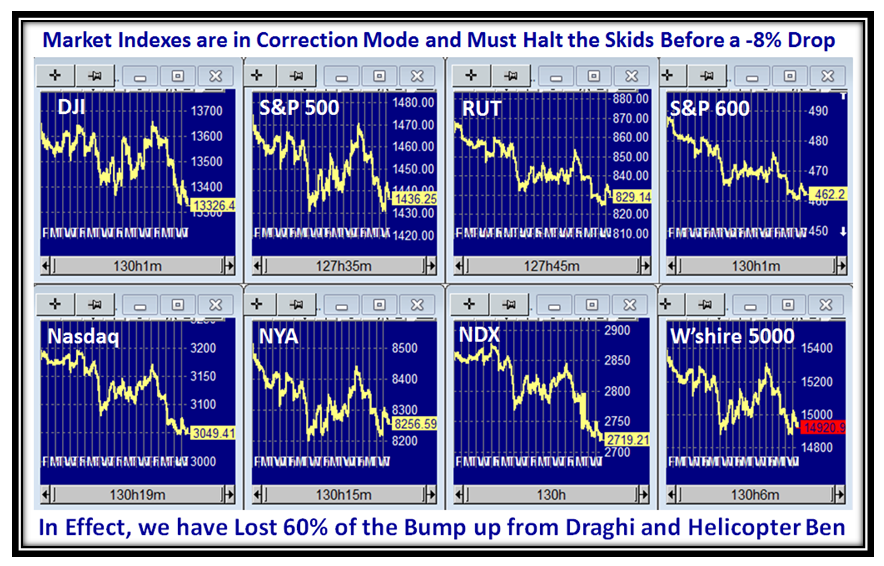

The Market Indexes look a trifle ugly today as shown below, and we have lost all of 60% of the Bump Up from those two events:

That stake in the ground of 3196.93 helps to establish the measuring rod of -8% down to take us to 2940 from the high, which if broken sets us on the Low Road Scenario. If you have followed this blog, you know full well that 70% of past corrections have turned up again at -8%, but heaven help you if it goes down further as it can land anywhere! We are fortunate that we have three numbers 100 points apart that by co-incidence separate the High, Middle and Low Road Scenarios at critical support and trend line points:

With tomorrow being the end of the week, the Market needs to produce a meaningful Bounce Play to arrest the current rot that has set in albeit with no flood gates open as yet in terms of down volume, or we should logically expect more on the downside next week. The three buckets down on October 9th. took the wind out of the Bulls’ sails and we are now wallowing around in the doldrums:

Be careful at this stage unless you enjoy the Volatility and can turn on a dime.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog