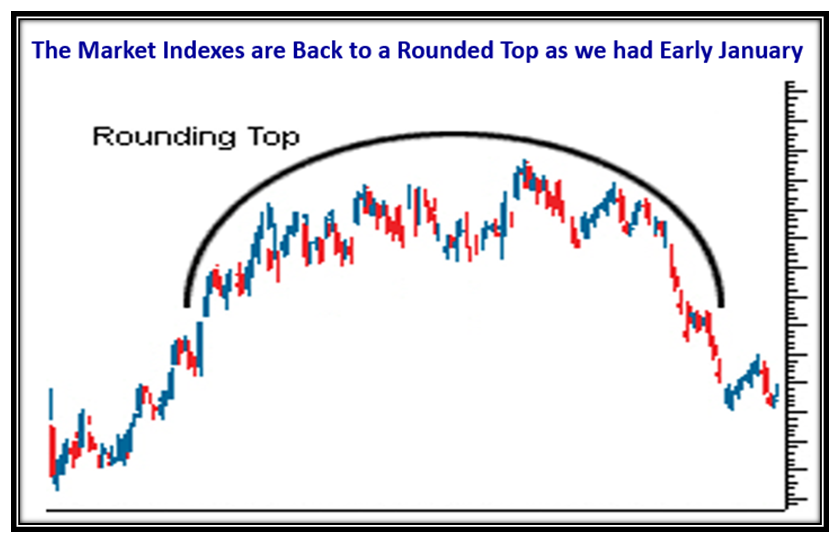

The Stock Market Indexes are back to a “Rounded Top”

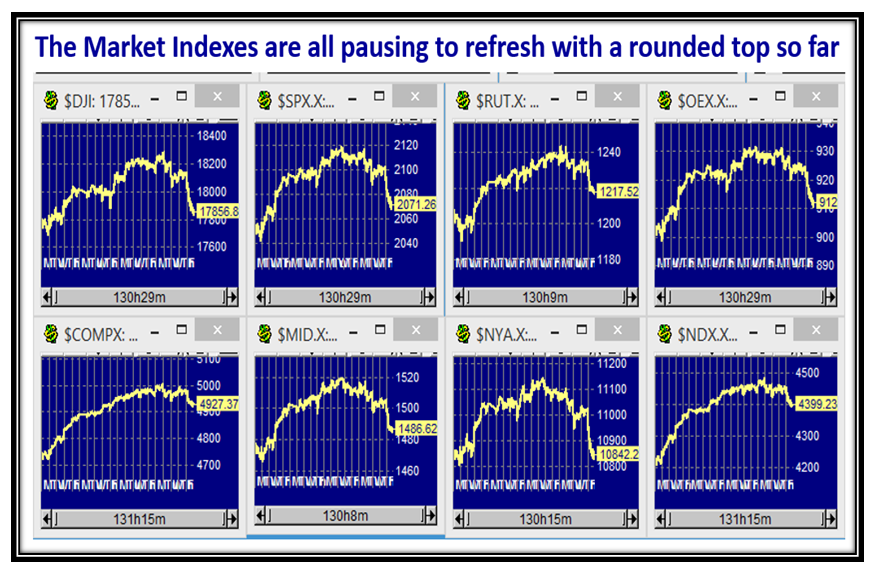

This Market is very similar to that we had back at the Start of the Year in early January…a Rounded Top:

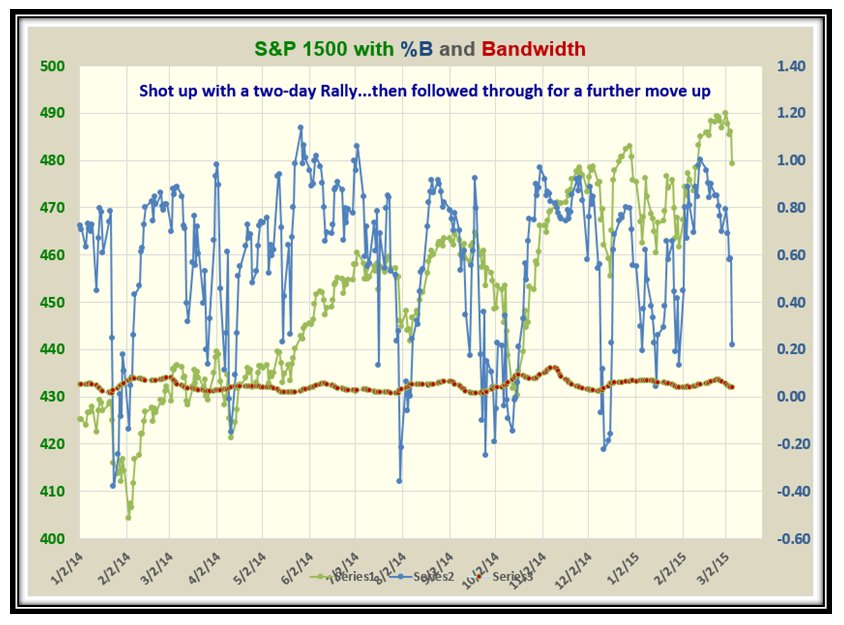

…And here is the picture to prove it:

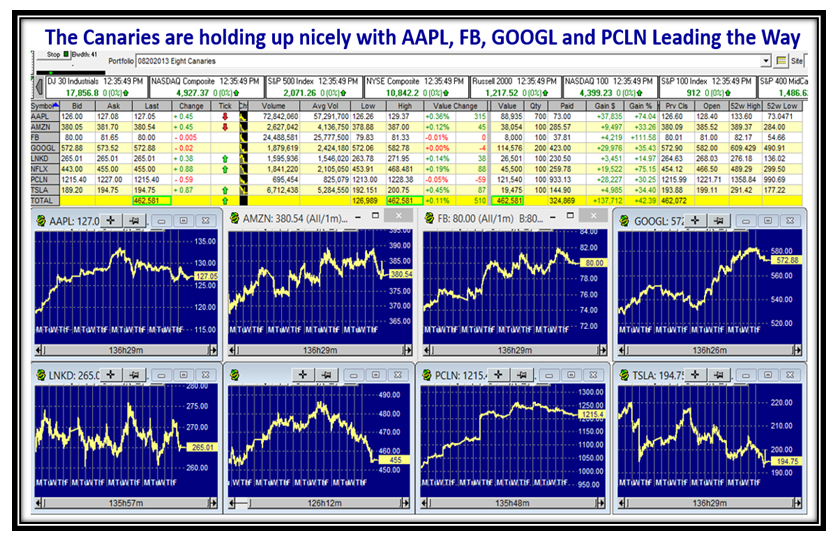

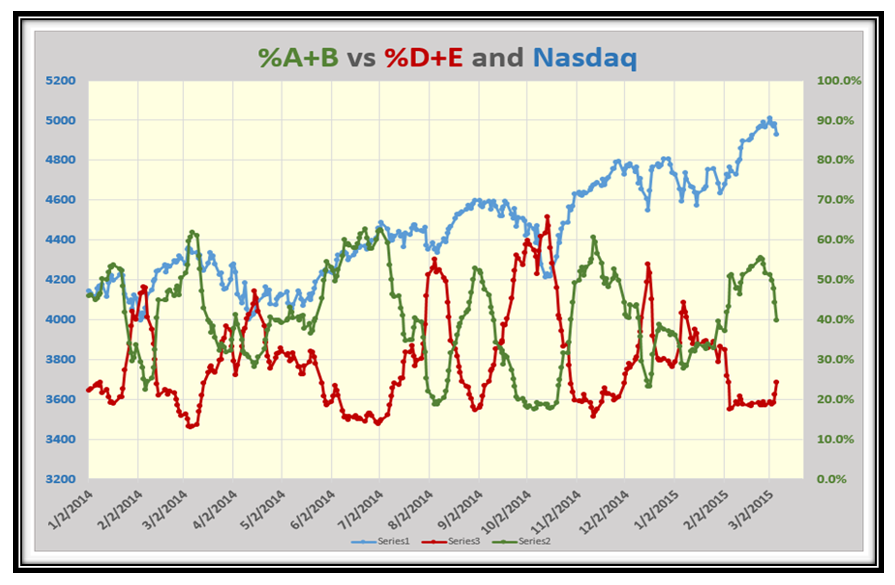

The Canaries are pausing to Refresh, but are holding up nicely with AAPL, FB, GOOGL and PCLN leading the way:

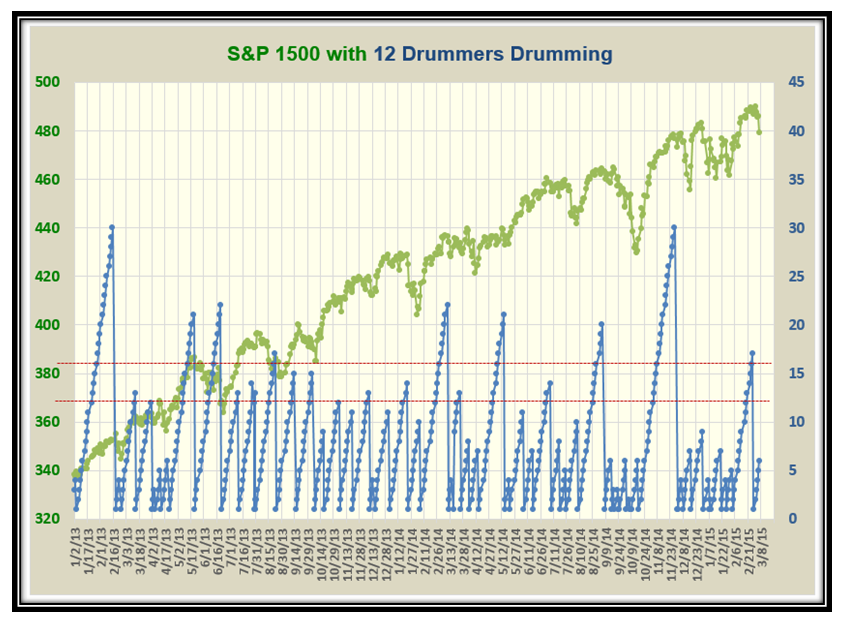

The Drummers Drumming Chart shows that we are 6 Days into a down move, and we should expect the Markets to continue down:

…And this chart shows that the odds are still to the downside for %B to come down through the Bandwidth before going up again:

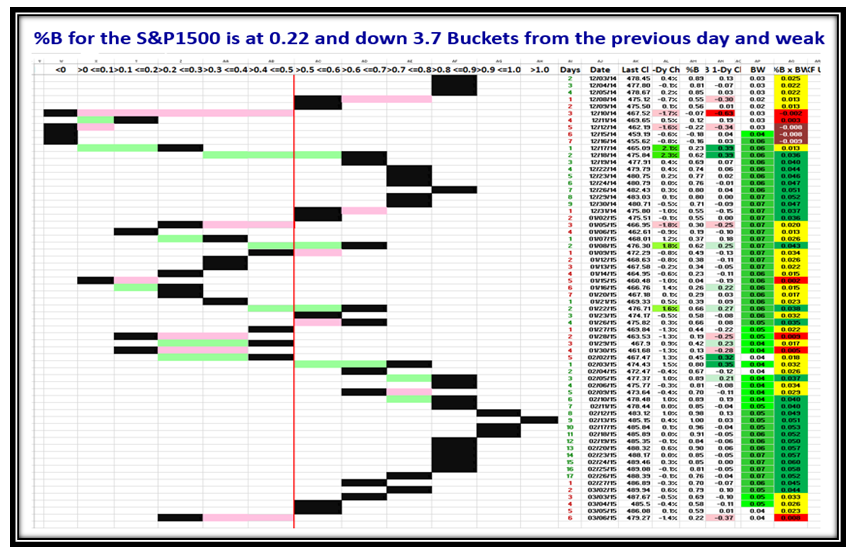

The Market took a Major Hit on Friday with the S&P 1500 down 3.7 buckets and should still head down early next week:

If you didn’t feel the bias for the Markets is downwards, then hopefully this chart will convince you:

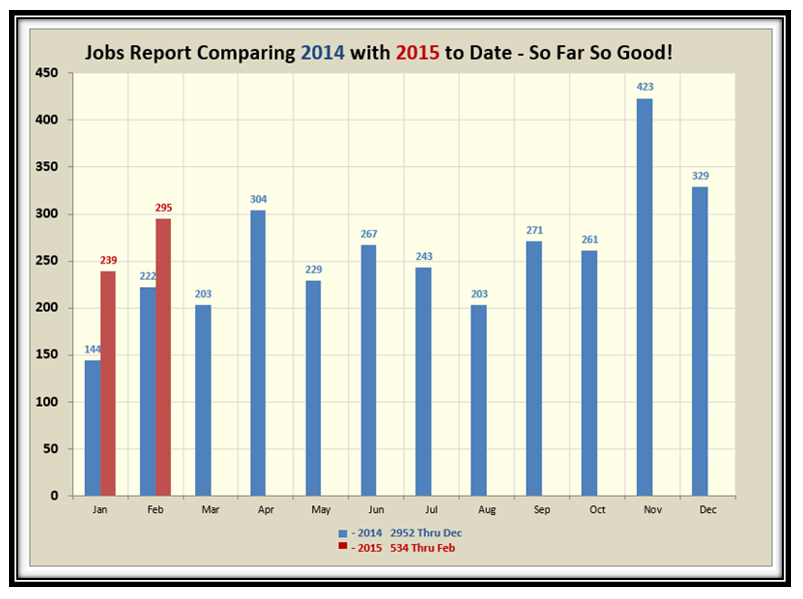

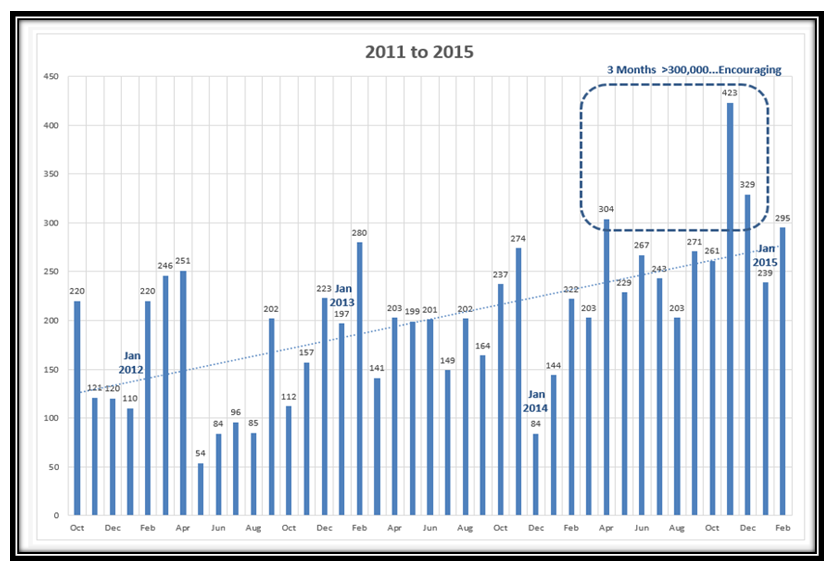

Now for the Jobs Report for February which is still showing improvement at around the 300,000 mark:

Keep your powder dry and have a good week.

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog