The Stock Market was Disappointed with the Rate Cut

Greetings to my friend from Greece, Thrassos, who writes tonight: “Hello again from Greece Ian! Quite a day today and looking forward to hearing what you have to say on the near future. Best wishes for the season”, and so not to disappoint him as Helicopter Ben did to the market today, here is my assessment of today’s events:

A nearly 300 point drop on the Dow told the FOMC Chairman they were more than a little disappointed with the 25 basis point drop in the Fed Funds and Discount Rates. The statement of continuing concern about Inflation exacerbated the flight from stocks to safety in bonds, and the Bears were out in full force for their long awaited taste of some red meat. The feeling is that the Fed is behind the curve and has underestimated the threat to the general economy from the sub-prime loan debacle and of course the housing slump.

As a result no Industry Groups were spared in the downdraft, with the Home Builders, Financials and Retailers hardest hit as one would expect. What looked like a rosy recovery and a bridge to a strong Santa Claus Rally appears to have fizzled unless there is some quick turnaround in the psychology of the market as we head into the last three weeks of the year. Although the Bulls can take some comfort that the Market Indexes had a healthy move these past ten days, sufficient technical and psychological damage has been done that the rally is now reeling on its heels, and the mood must immediately turn to being or staying defensive.

To give you some idea of the quickness of the turnaround, the Ultra Short ETF of the NDX, i.e., Nasdaq 100…the QID went from a paltry 4 Million Shares to nearly 27 Million within 1&3/4 hours. Likewise, the Inverse Chinese Ultra Short ETF, the FXP shot up around 10% in the same time period, so all is not well for the Bulls. Frankly, the Bears have patiently waited their turn to garner some of the spoils and have been thwarted several times in the last few months just when they felt they had the Bulls on the ropes. To rub salt in the wounds, the Volume was very heavy on this distribution day which saw heavy selling of over 2.2 Billion shares on the Nasdaq.

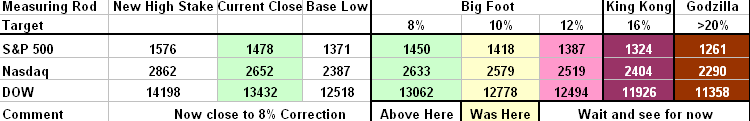

In times like these, return to the basics and rely on the Stakes in the Ground that we have always used as the basis for establishing a bullish or bearish posture. It was only a couple of blogs ago I dusted off the yardsticks and was pleased to show that we were a mere 5% from the highs set in late October. Now we are below the 50 yard line having given up a hefty 2% on all Indexes today and we have cut through the 200 day Moving Average on many of the Indexes. The next week will tell us if this was an over-reaction to a disappointment or whether the downdraft will continue in earnest.

As one can see from the above diagrams, it is not a case of panic stations yet or throwing in the towel, but the only near term help for the bulls is that the correction halts at the natural right shoulder level around the 1446 level which is the 23.6% Fibonacci line as shown on the bottom chart. That would be tantamount to 8% down from the original recent high.

We will soon see if the Bulls have lost the stomach to fight any longer and that lethargy will set in to the point of saying “Let’s get this correction over and done with and have a thorough clean out when we can then start a new bull rally once again.”

One last glimmer of hope for the Bulls is the statistical fact that in the four-year Presidential Cycle Folklore over the past 60 years we have had 3 Bear Market Lows that occurred in Year 1, 10 in Year 2, 1 in Year 3 and NONE in Year 4! I repeat NONE in Year 4. That is a record waiting to be broken. Let’s hope it is not this time in the coming year. Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog