The Rally is Climbing a Wall of Worry

This Rally has confounded most “Quant’s” and for sure all the statistics seem to show

that the majority of the action over the last 38 trading days which has yielded a 38.3% gain is due to Program Trading. Intra-Day Traders are being creamed unless they play in moments. The Rally is long in the tooth as nearly 90% of the S&P 500 Stocks are above their 50-dma on May 1. The question is does the beat go on to reach the next Target of 900 or do we take the expected correction which most Bears are itching to get their hands on.

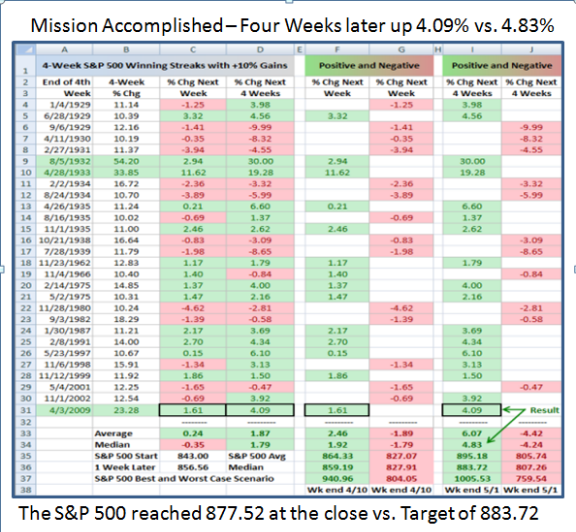

Before I discuss the Low, Middle and High Road Scenarios, let’s look at the happy

results of the past eight weeks. You will recall that four weeks ago, and then again three weeks ago, I displayed the following chart wondering if History repeats itself. It did!

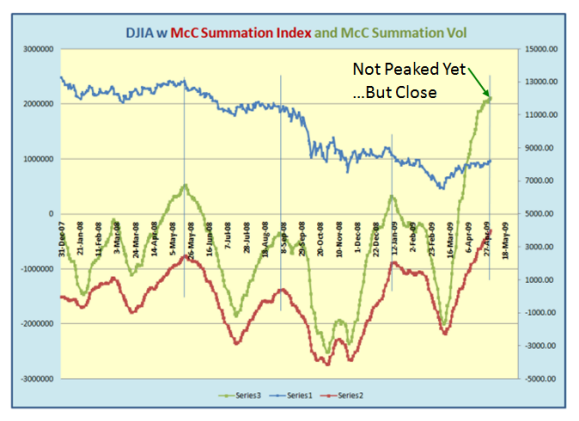

There are several factors we watch that tell us we are in relative “nose bleed” territory, and one of them is the McClellan Summation Index. In the Chart below I show the Summation Index (red line and right scale) to be at 4000, but worse yet is the Summation Index Volume (green line and left scale) which is at a startling 2,000,000…not seen before. We have traipsed from Oversold to Overbought in a short 38 trading days.

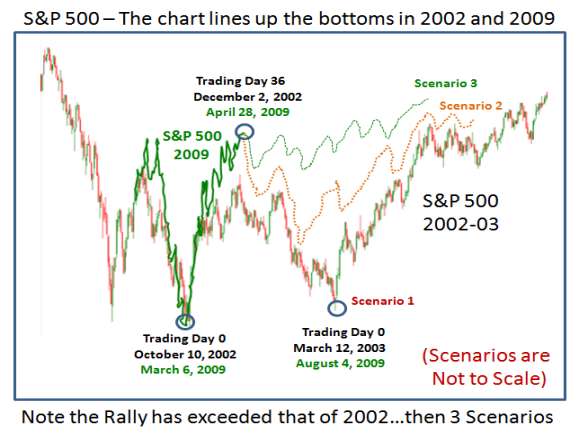

This is a very sharp advance in such a short period of time, and that has occurred three times before, all from the 1930’s! The chart below lines up the bottoms of 2002 and 2009. Note that the current rally has exceeded that of 2002 as shown after 38 trading days. What then are the three obvious Scenarios?

1. The expectation from the majority is that we should see a correction leading to a

double bottom. This is favored by most fundamentalists who immediately point to the fact that the S&P Earnings cannot support anything higher than 900 at present given the overall poor earnings reports especially from the Financial Sector. I show this as retracing to the current low of 667 with the implication that there is heavy bad news to come through the summer months, when the Market traditionally sells off anyway.

2. The second scenario shown in Orange suggests we could see a 50% Fibonacci retracement which would be an Intermediate Correction of about 12% and would take us down to 777.

3. The third Scenario suggests that the worst is behind us with regard to the Economy and that we should not expect more than an 8% correction from where we are now. That would take us down to 807 or just above the psychologically critical 800 mark.

This last Optimistic Scenario would suggest that we could be in the 1932 to 38 Model and, so let’s see what those three occasions could bring us:

a. The Market advances another 63% for another five weeks as it did in 1932

b. The Market advances another 70% for another 12 weeks as it did in 1933

c. The market advances another 6.5% for another two weeks as it did in 1938

It goes without saying that the first two are wishful thinking, so the third would give us 934, which is close enough to the 940 target that I have suggested as a possibility from time to time. Please understand that the Nasdaq 100 which has been the brightest of the main Indexes is right at its 200-dma so is up against resistance, with the Nasdaq close behind.

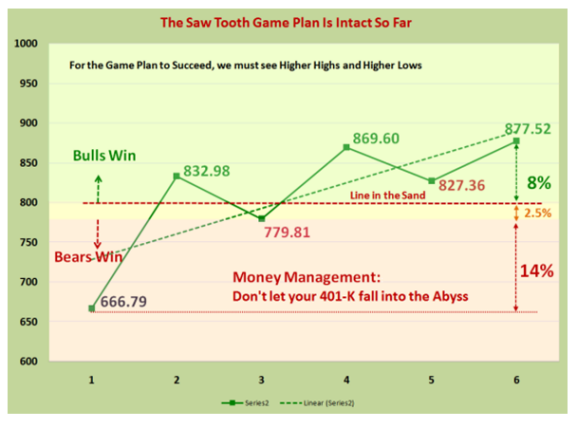

If we stare at these scenarios, anything above 800 on the S&P 500 for a retracement is gravy and would maintain a positive Psychological advantage for the market continuing on the rally. Anything that leads to Scenario 2 and then 1 takes us back to gloom and doom. Longer term holders should seriously watch the 800 mark and make some decisions if it trundles below. Those who have missed this rally had better be on their toes if the correction is no worse than 8% or the market stays above 800.

Here’s the Latest Game Plan:

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog