Stock Market: Pause to Refresh or the Real Thing?

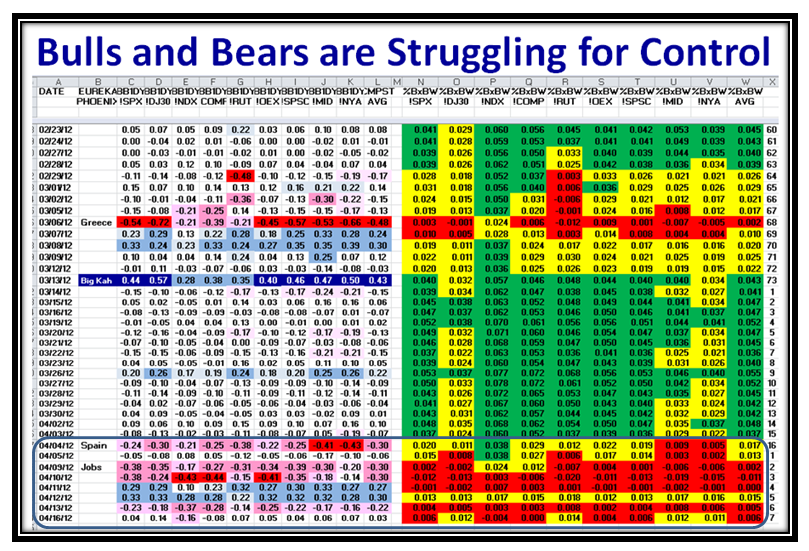

Sunday, April 22nd, 2012The four month Rally is hanging on by a thread, but there are conflicting signals. The general bias is down, but there are pockets of life with some stocks tight as a drum and heading up. We have had rotation in the Leaders over the past month as I will show you, but the Leaders Index we developed at the March Seminar is showing signs of tiredness. In all of this, hopefully the Impulse Indicators I have developed will help you determine whether we are in a Pause to Refresh or the Real Thing! Sing along with me…AyeAyeAyeAye (iiii):

I have a lot of slides for you today, far more than usual, so I will keep the commentary short:

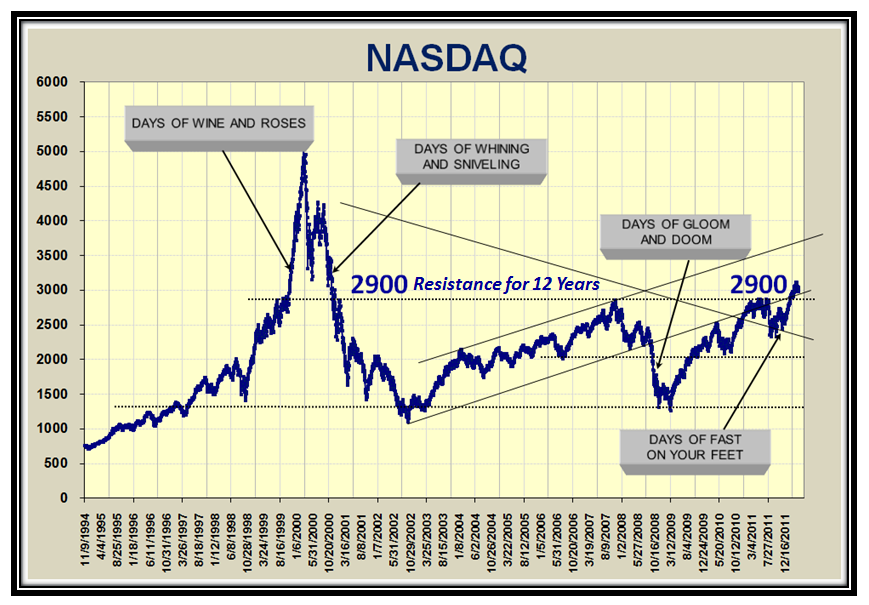

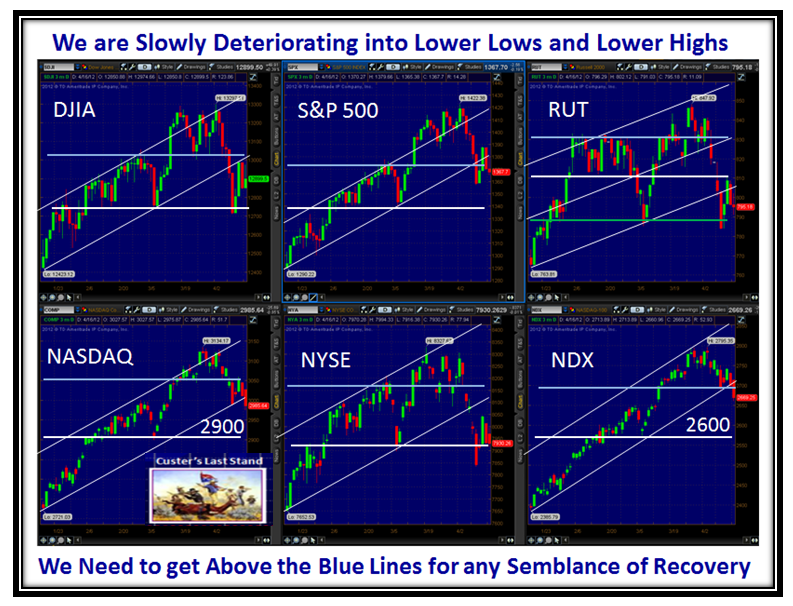

2900 on the Nasdaq has been resistance for 12 Years, and now we must hope it will hold at that level or move up:

The Game Plan is simple, and I have coupled the stages with my favorite Pictures which suggest where we are:

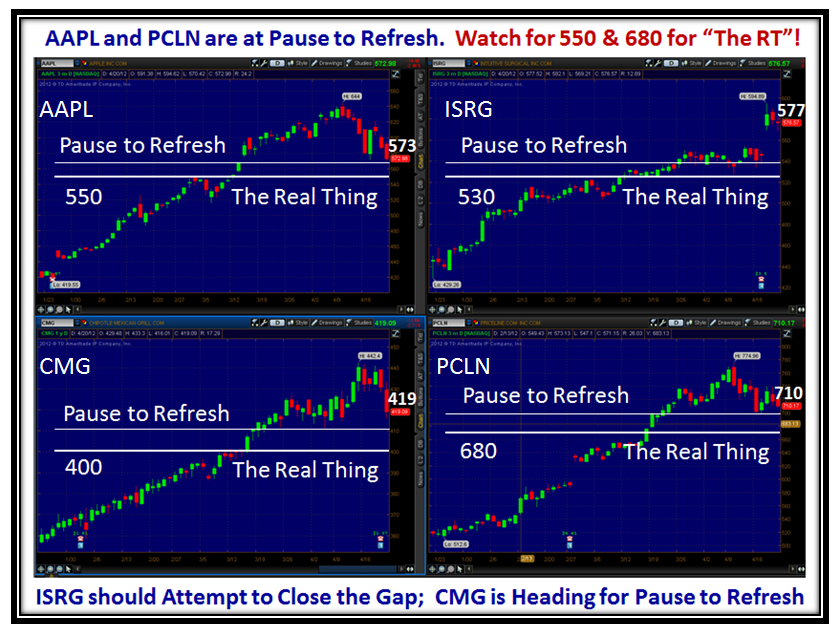

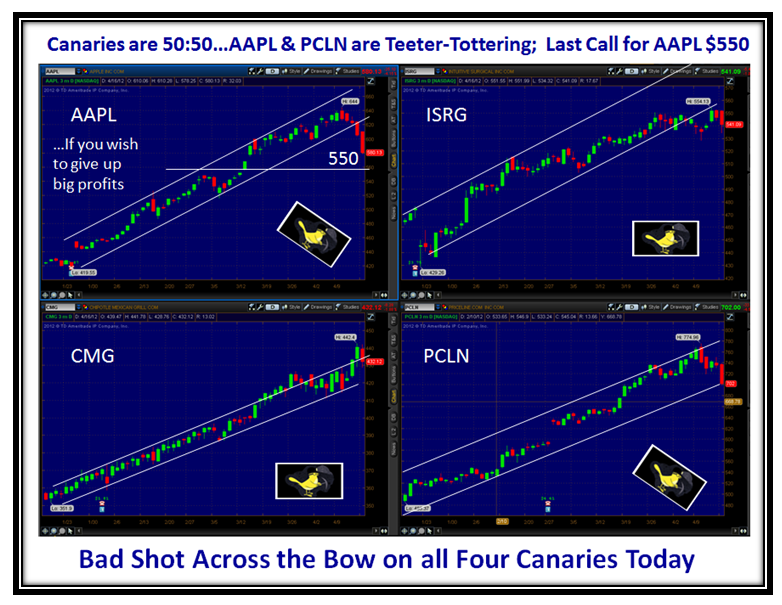

Let’s look at the Canaries; AAPL and PCLN are at Pause to Refresh. I show you the Real Thing Downwards:

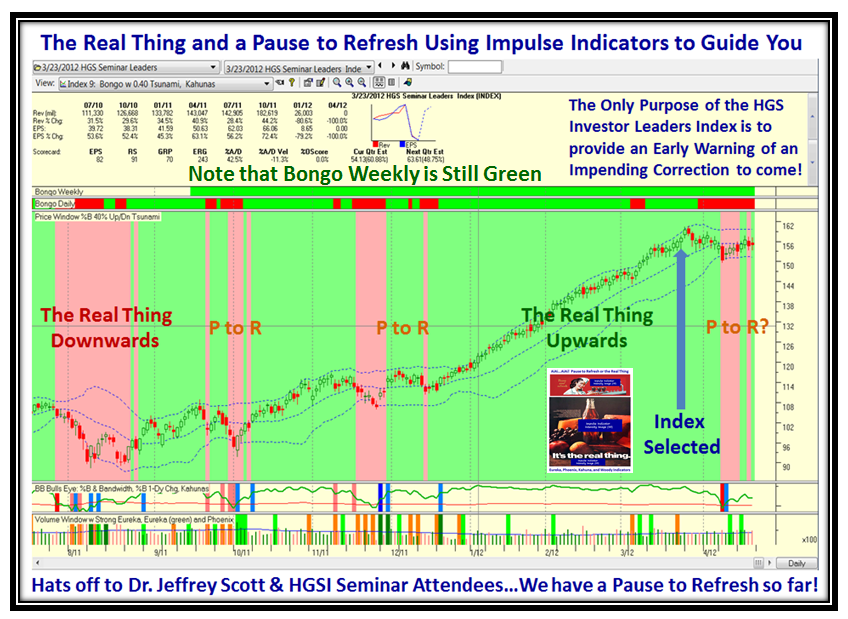

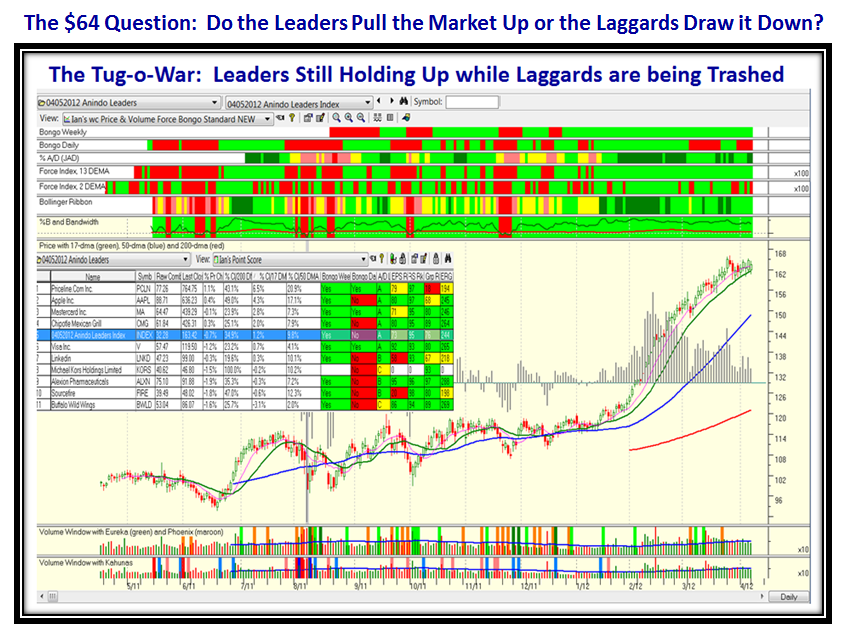

But “The Real Thing” can go either way as I show on this next chart of the Seminar Leaders, with Hats Off to Dr. Jeffrey Scott and the Seminar Attendees. Make sure to sign up for his Webinar tonight for his latest findings.

Space is limited. Reserve your Webinar seat now at: https://www2.gotomeeting.com/register/663790210

We are at Pause to Refresh and could go either way after a month in a churning mode:

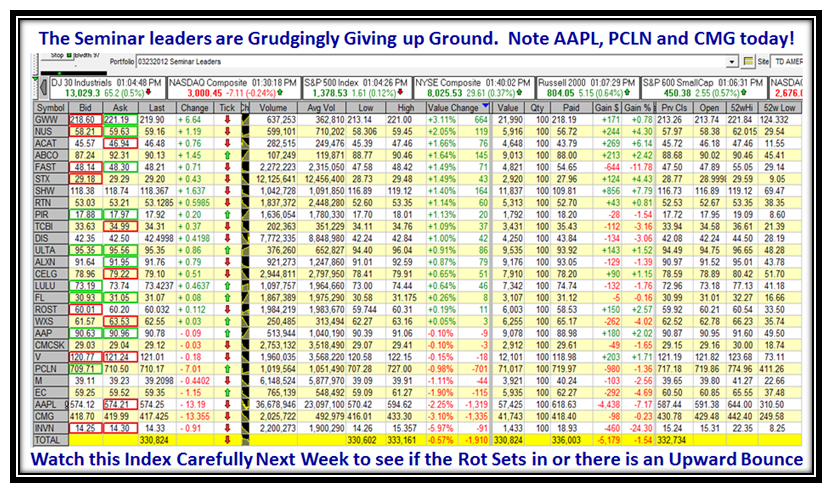

…And here is the list of those stocks and their performance over the past month:

Now let’s take a leaf out of my good friend Ron Brown’s book who has done an excellent Weekly Report on this same subject and you need to make sure to download it. “How to find the leaders to tell which stocks are still strong in this market.” Copy and Paste it into your Browser:

http://www.highgrowthstock.com/WeeklyReports/

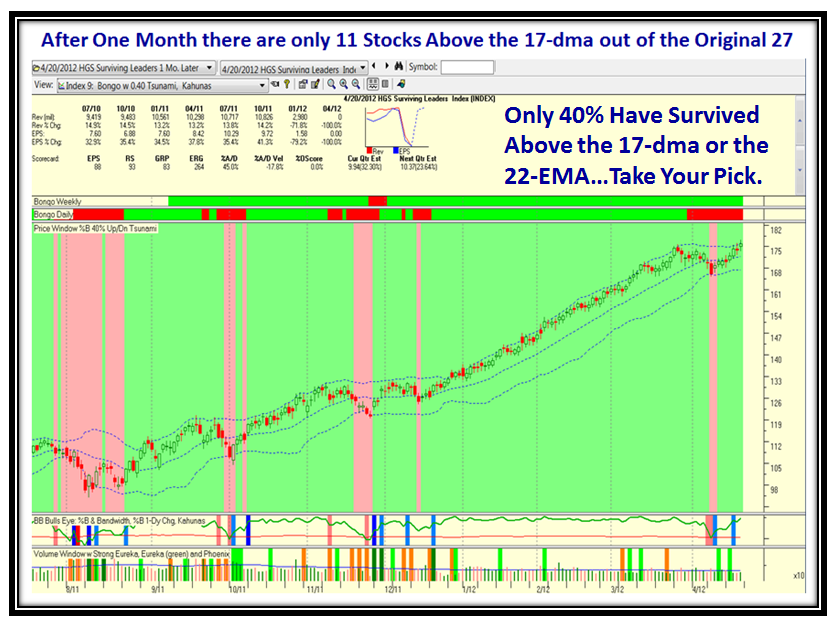

Here is the Index of the stocks that are still above the 17-dma from the list above. We are down to just 11 Stocks:

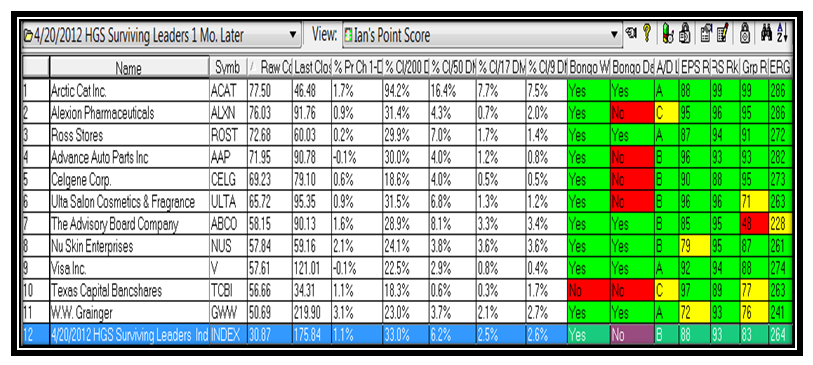

…And here is the list:

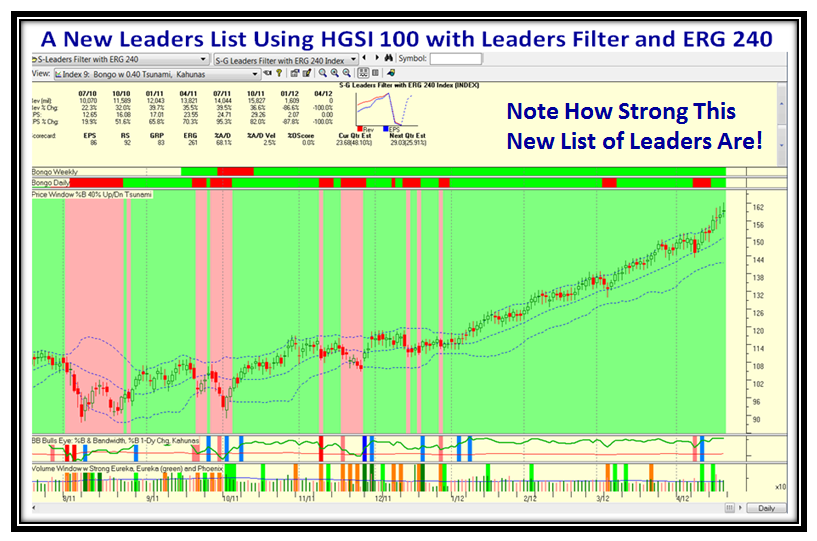

Let’s look at a New Leaders list Index using the HGS 100 as Ron discussed in his Weekly Movie:

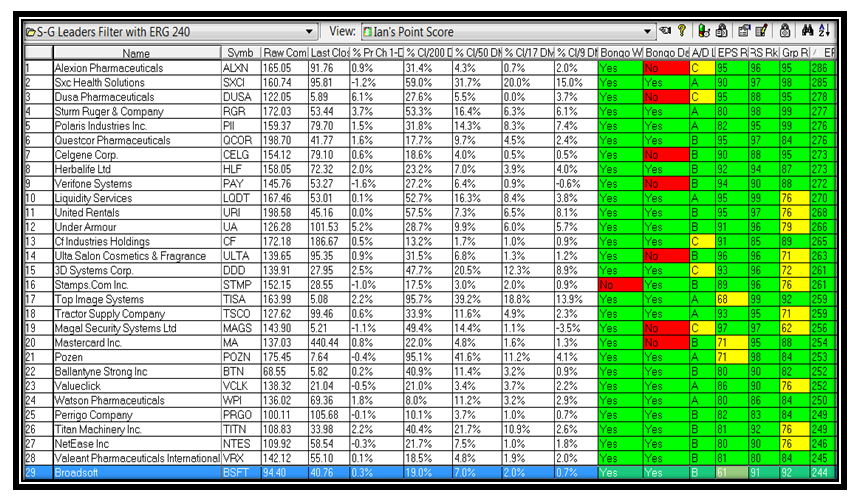

…And here is the List:

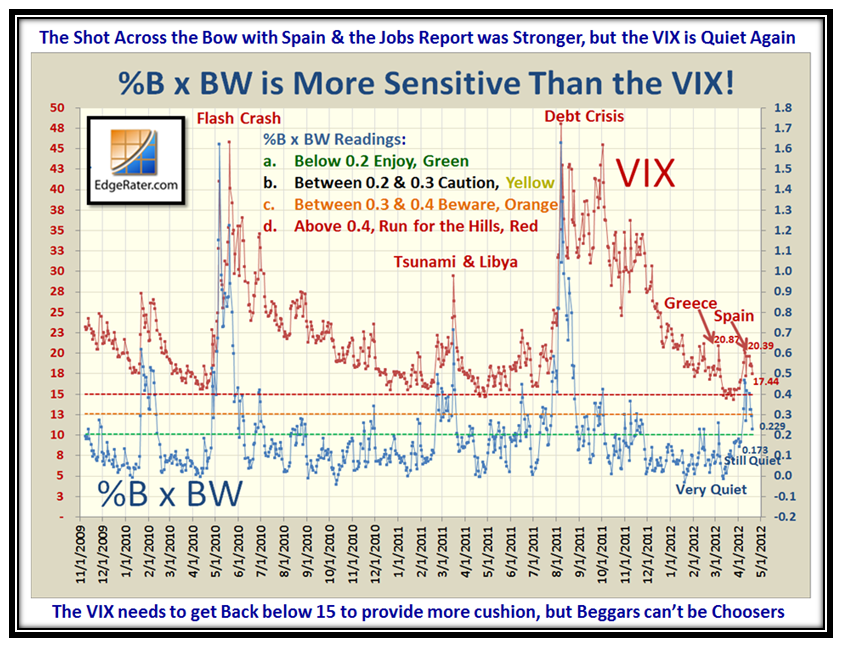

Let’s not get too excited, but the VIX went back into “Quiet Mode” after the recent stirring from Spain and Jobs:

Now for the Gloom and Doom side of the equation, so that we review both points of view:

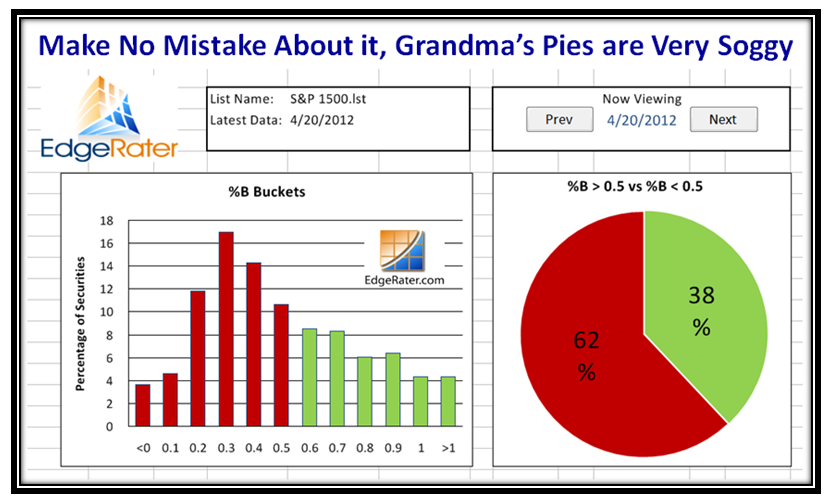

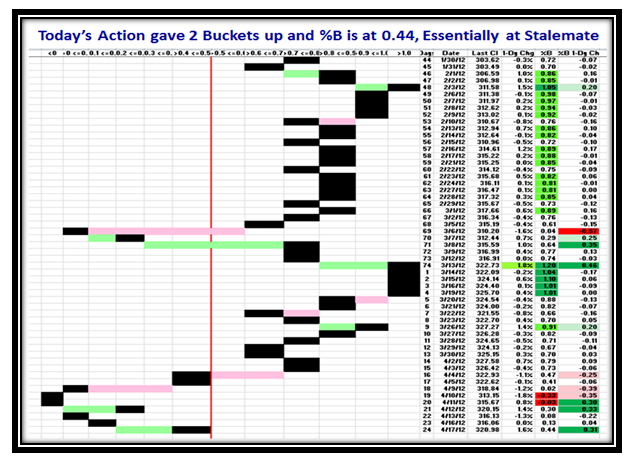

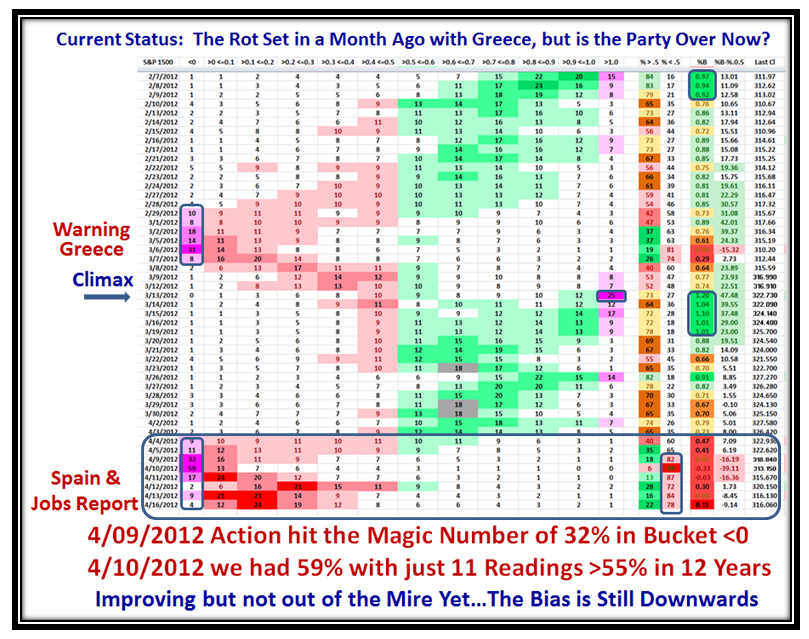

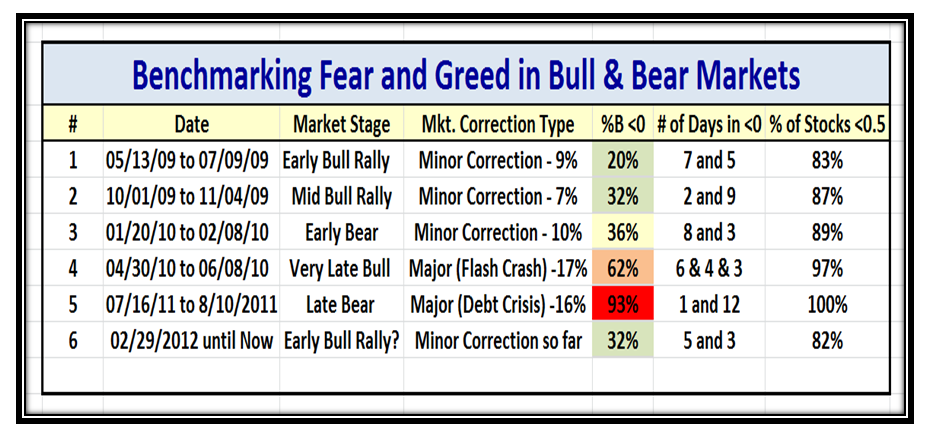

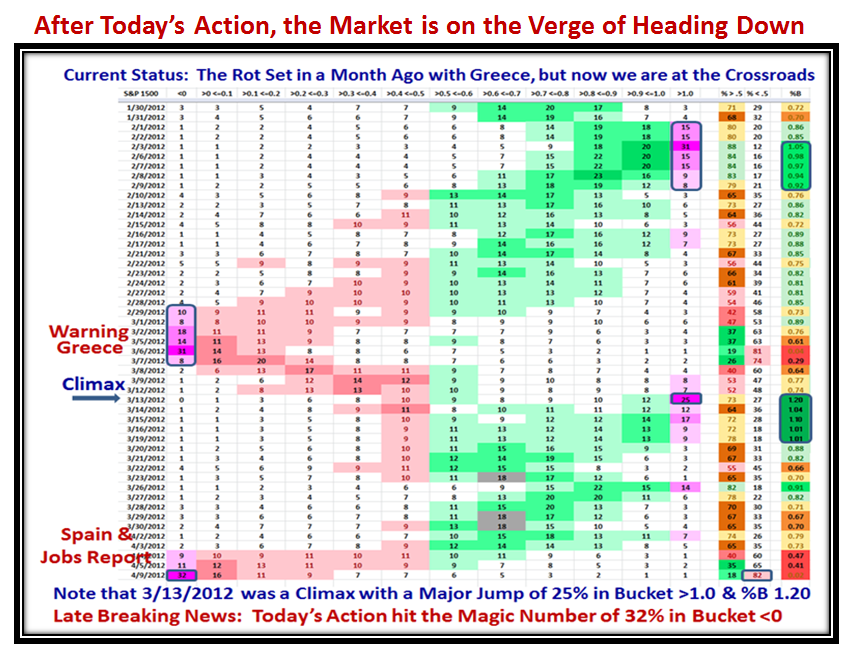

That 59% in Bucket <0 (below the lower BB) has taken its toll, and it seems we currently have “bifurcation”:

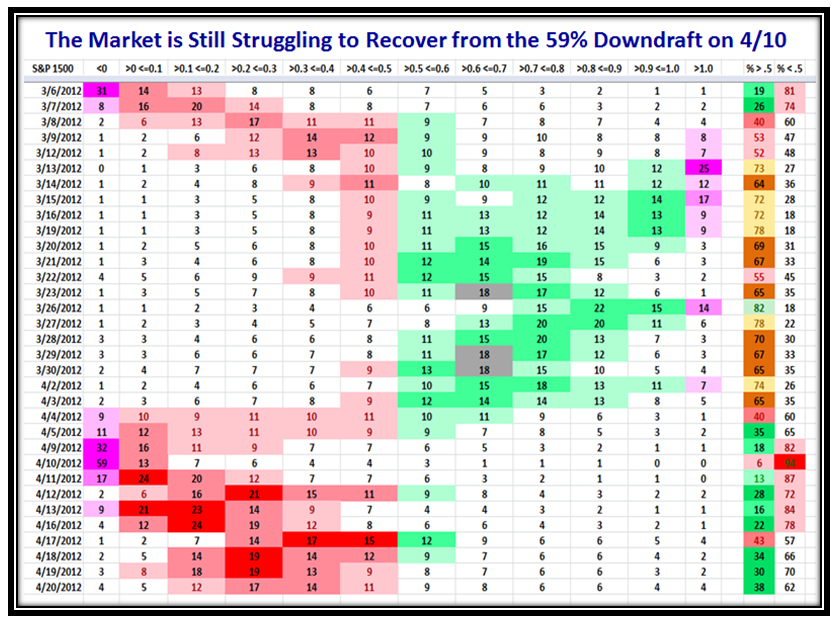

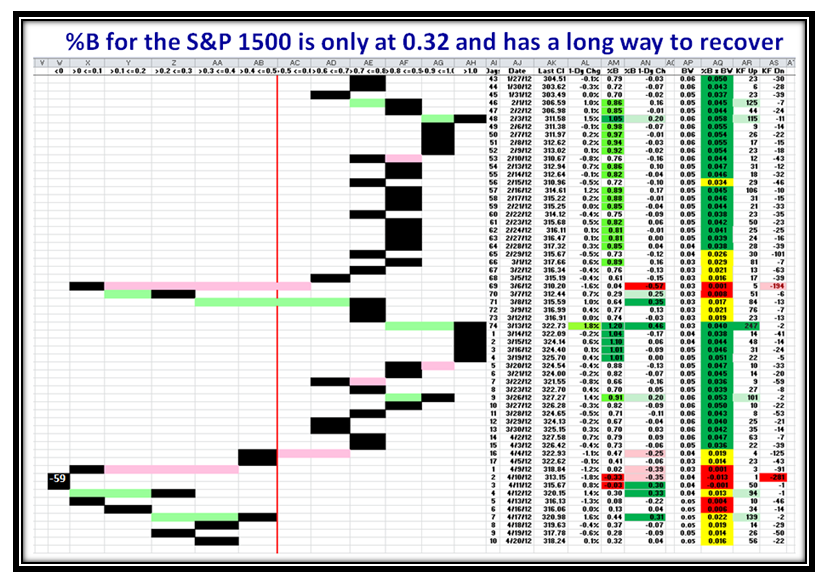

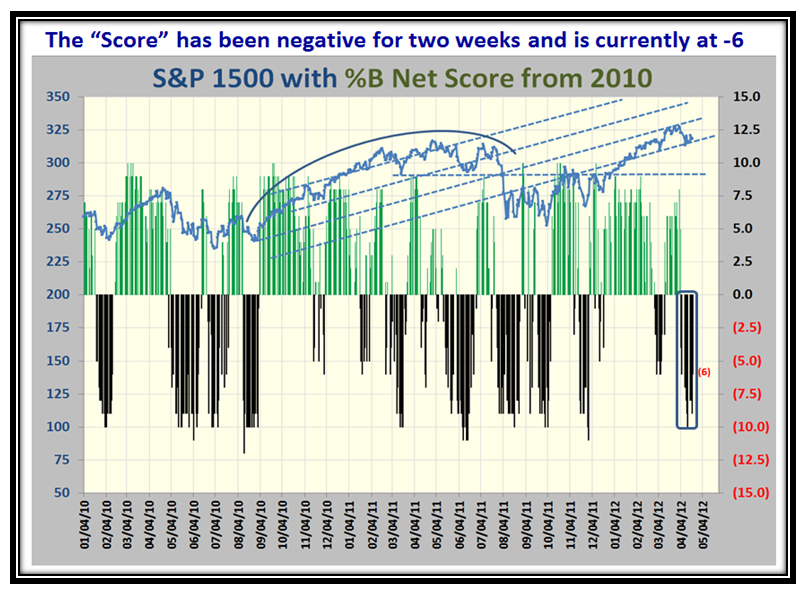

The next chart shows that we are by no means out of the woods, and there is no question the S&P 1500 is weak:

…And the overall Point Score is -6 which means we have to lift the Index a lot higher than it is now:

Each week I say that the next week is critical to getting us out of limbo and either the Market is showing that the Real Thing is either Downwards or Upwards. My thanks to all the people around the world that support my efforts to keep you appraised of the balanced view of the Market. Let’s hear from more of you:

Best Regards,

Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog