Stock Market: Uncertainty & Fork in the Road is Back

Monday, January 17th, 2011We have all had three days to ponder on where next and it would seem that although the Market Factors such as the ABCDE’s are quite robust, the breaking news today is that Steve Jobs is taking a leave of abscence and that could cause a perturbation in the Market. We wish him the very best as he faces new problems with pancreatic cancer.

Steve Job’s medical problems are not new to the Stock Market, but with AAPL being ~21% weighted in the Nasdaq, the market is vulnerable to easy pickings for the market makers to use the opportunity to cause a shake out of the longs and then establish long positions for themselves. Likewise, there is the “Apple Food Chain” where several stocks move on the strength or weakness of AAPL, so it will be interesting to see how this plays out, especially as AAPL’s Earnings Report and Guidance is due after the close tomorrow.

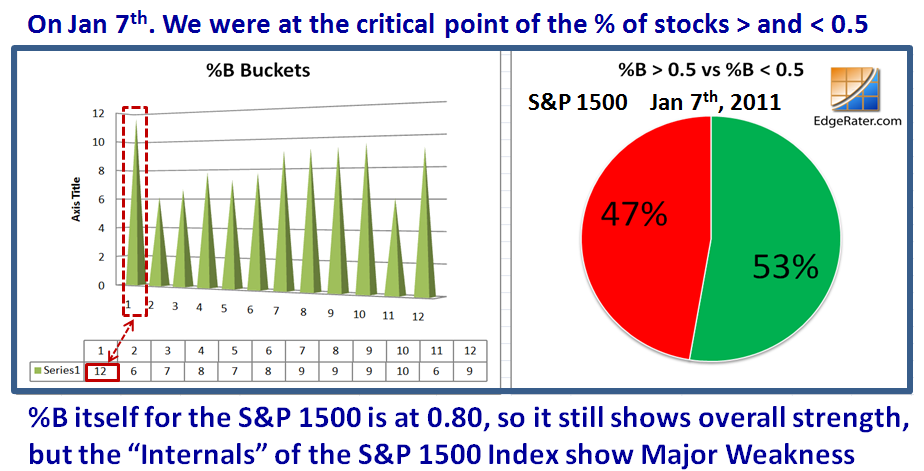

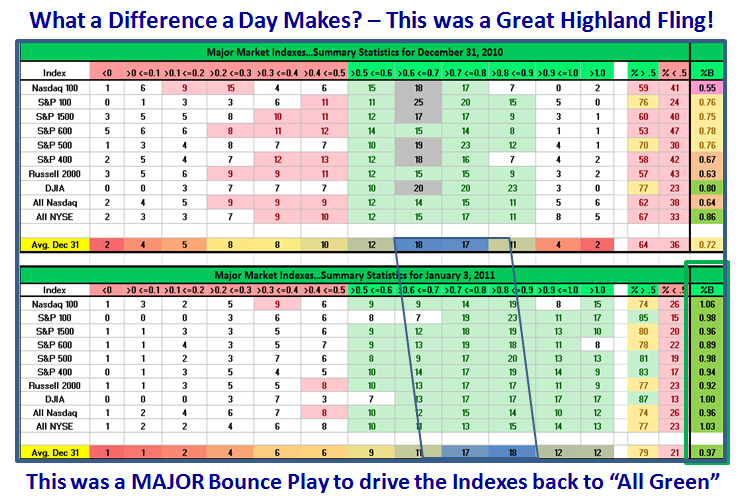

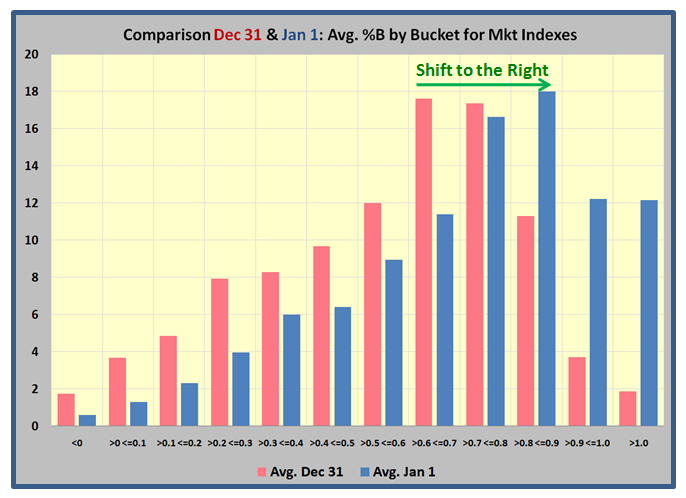

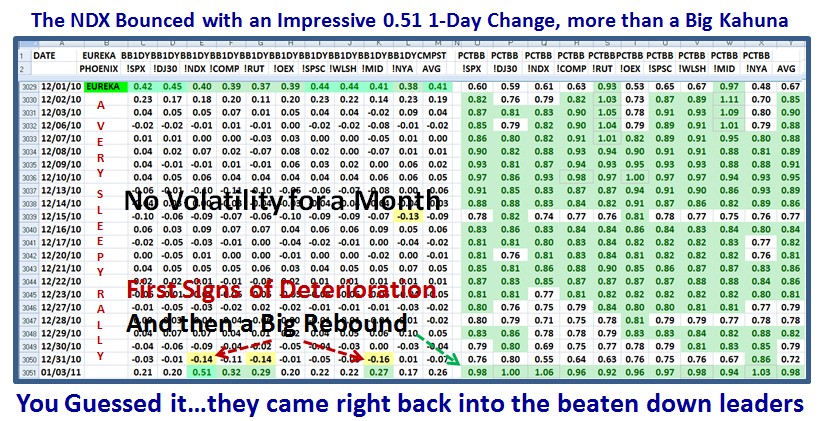

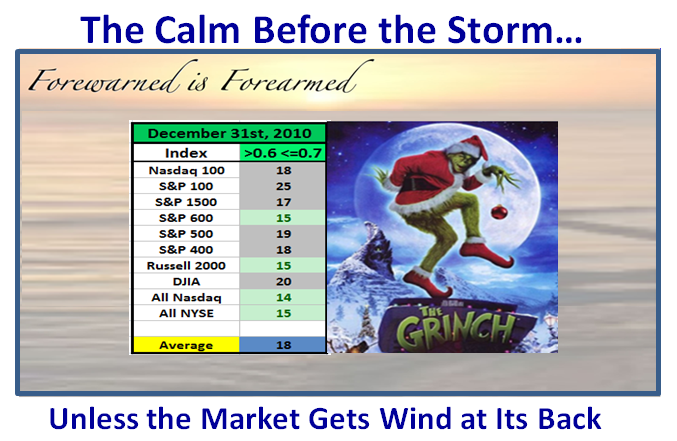

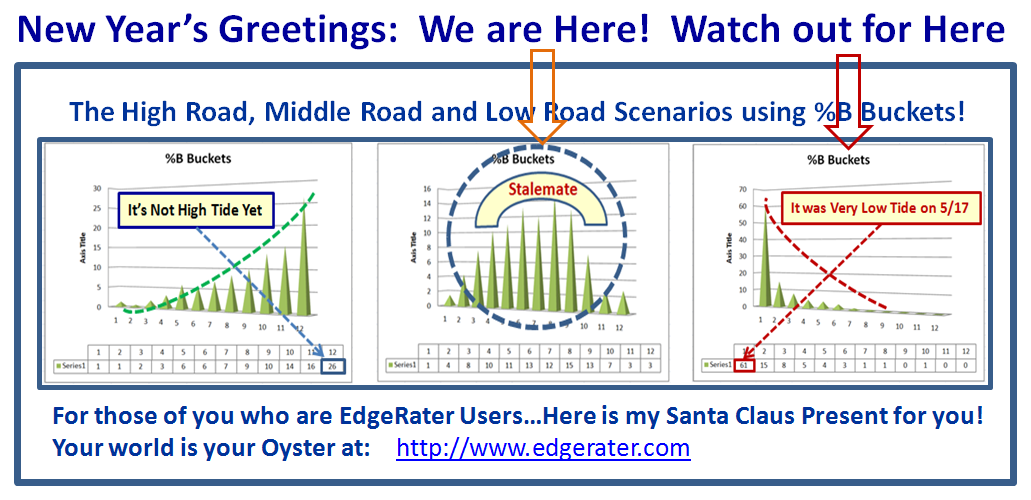

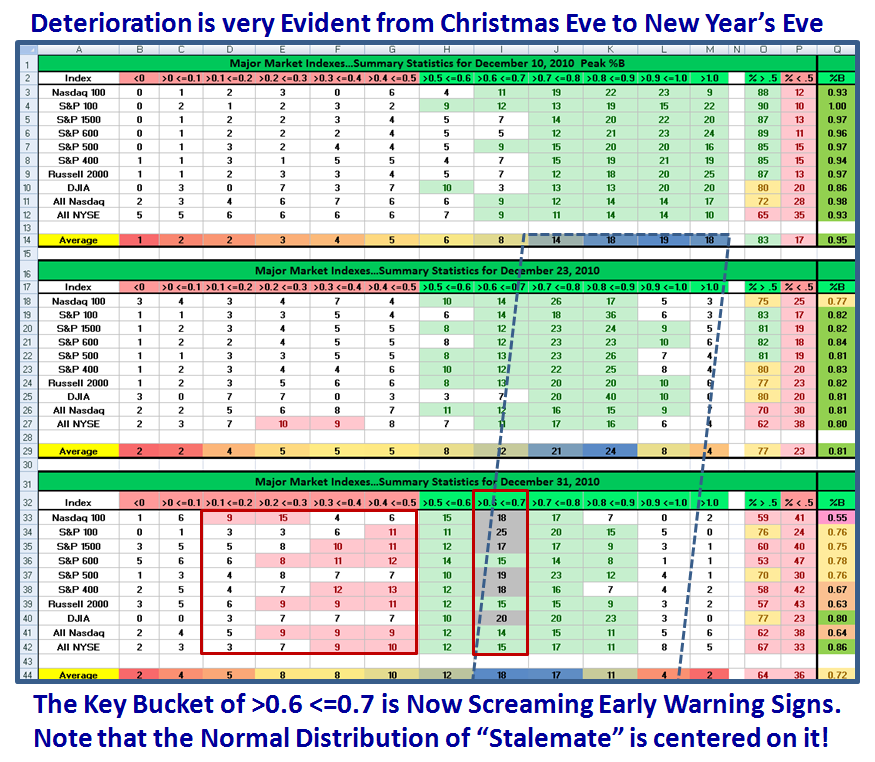

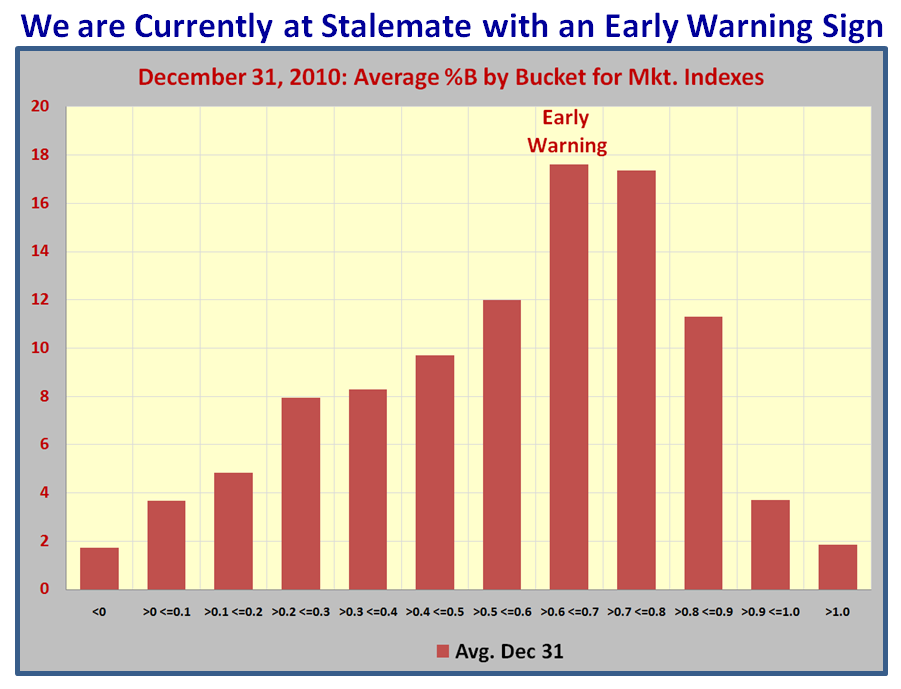

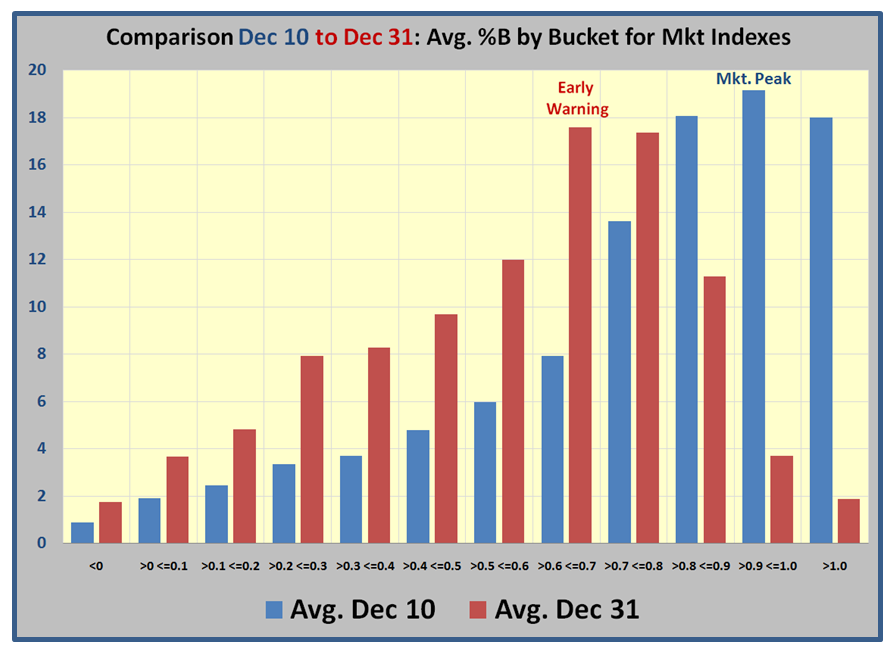

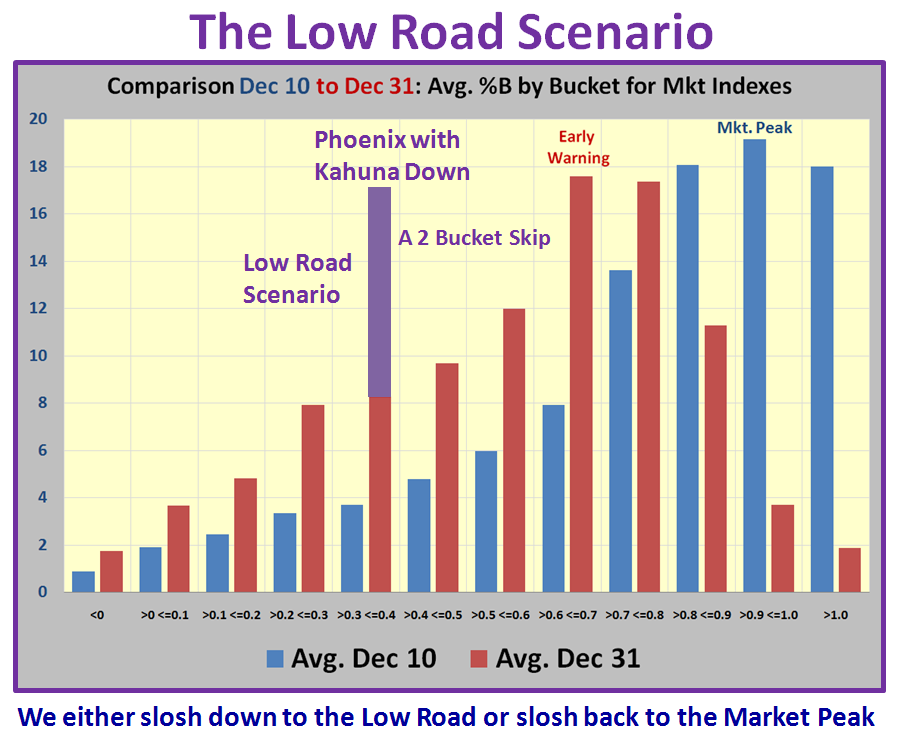

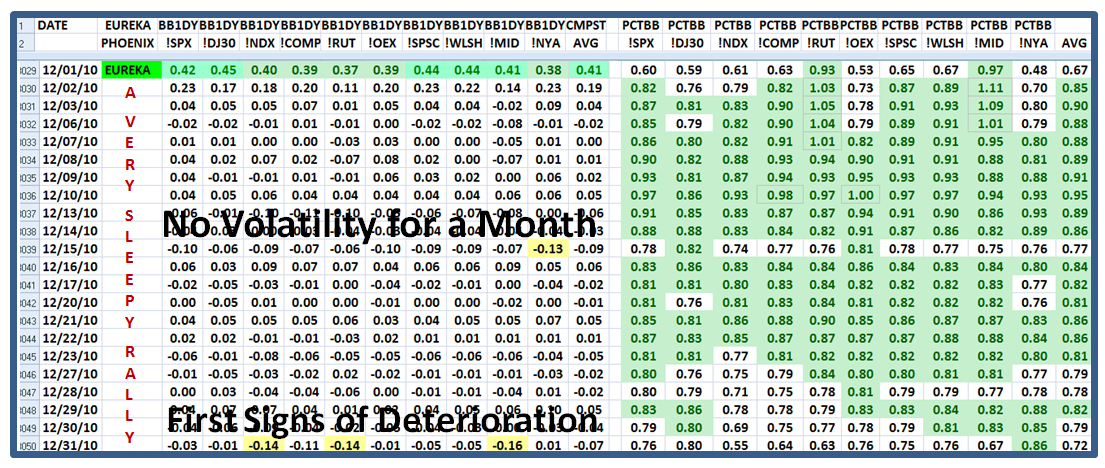

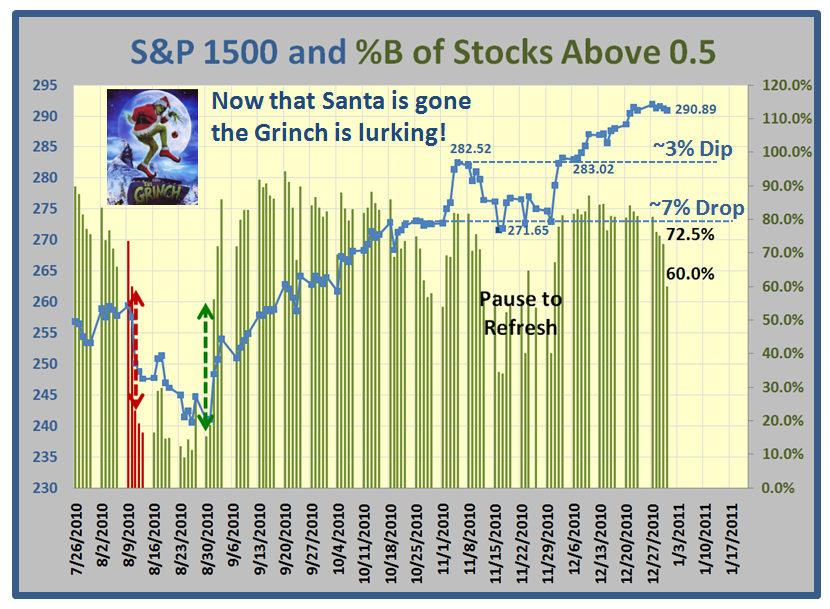

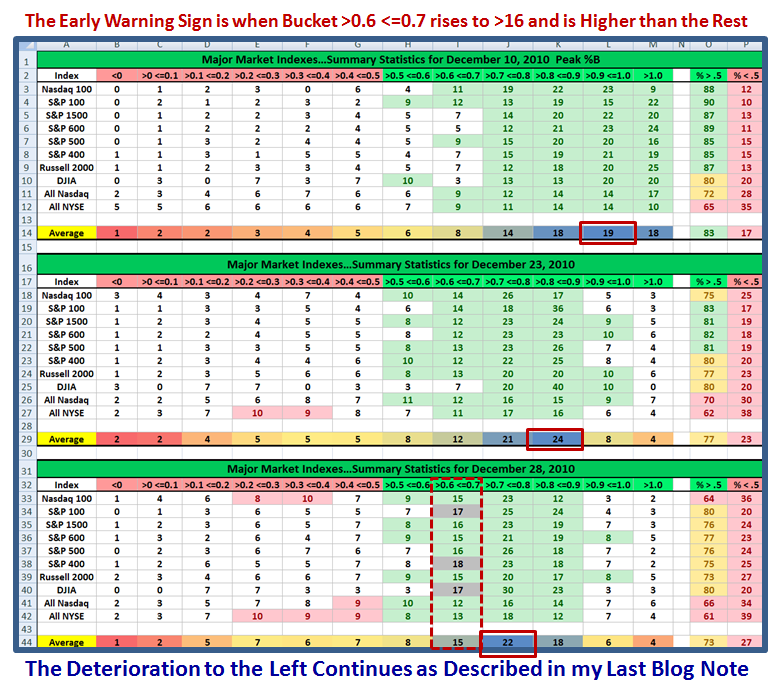

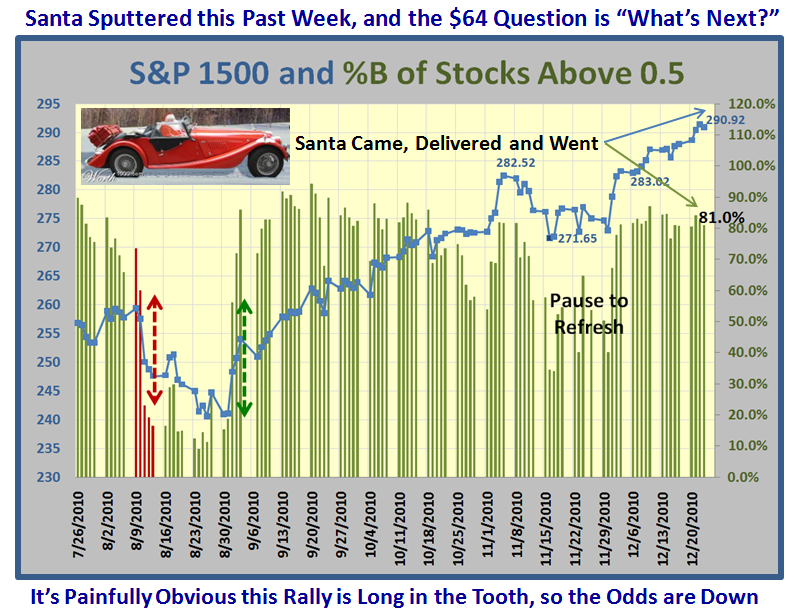

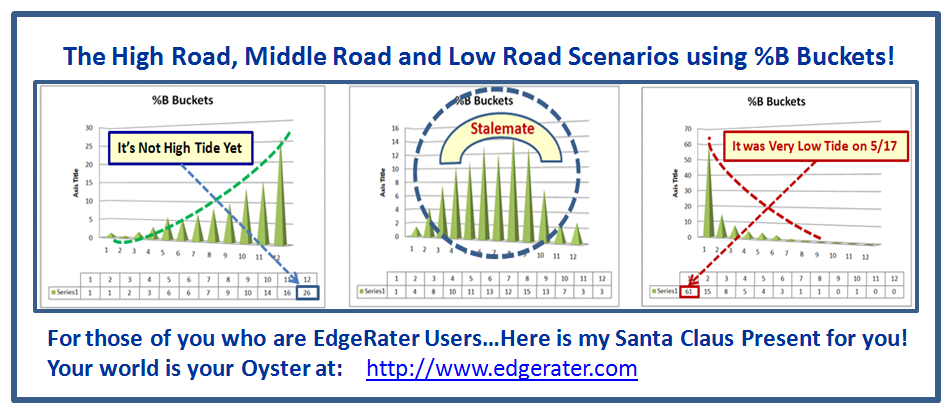

After the shot across the bow on January 7, 2011 when the % of S&P 1500 Stocks with ~12% in %B <0 being the highest bucket, the Market Indexes %B themselves have all recovered nicely to the point where except for the DJIA which is at a healthy 0.96, the rest are all over 1.0! All of this suggests to me that the Fork in the Road is back and both the High Road and Low Road could be in play this week, so we need to be on guard, given all of the above:

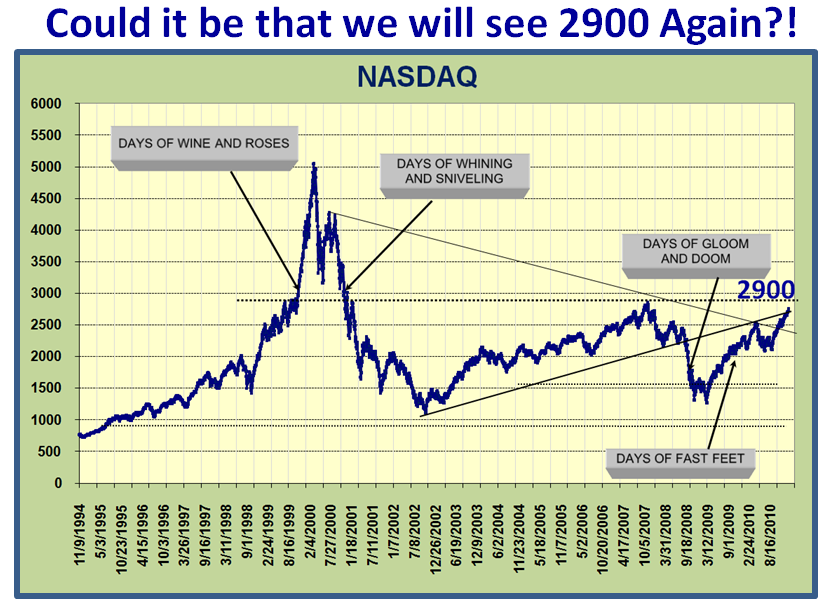

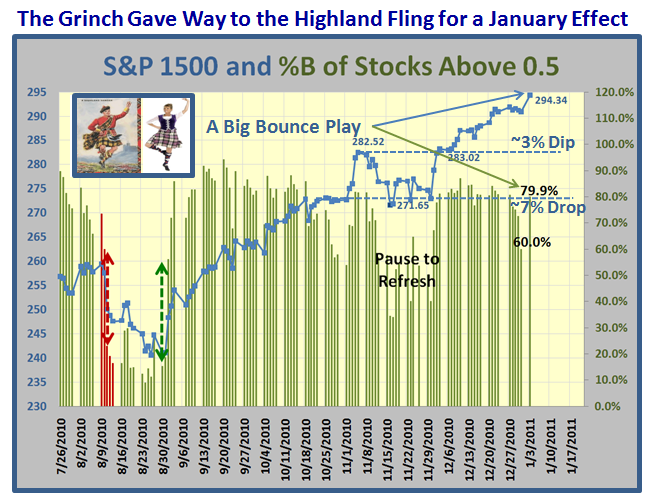

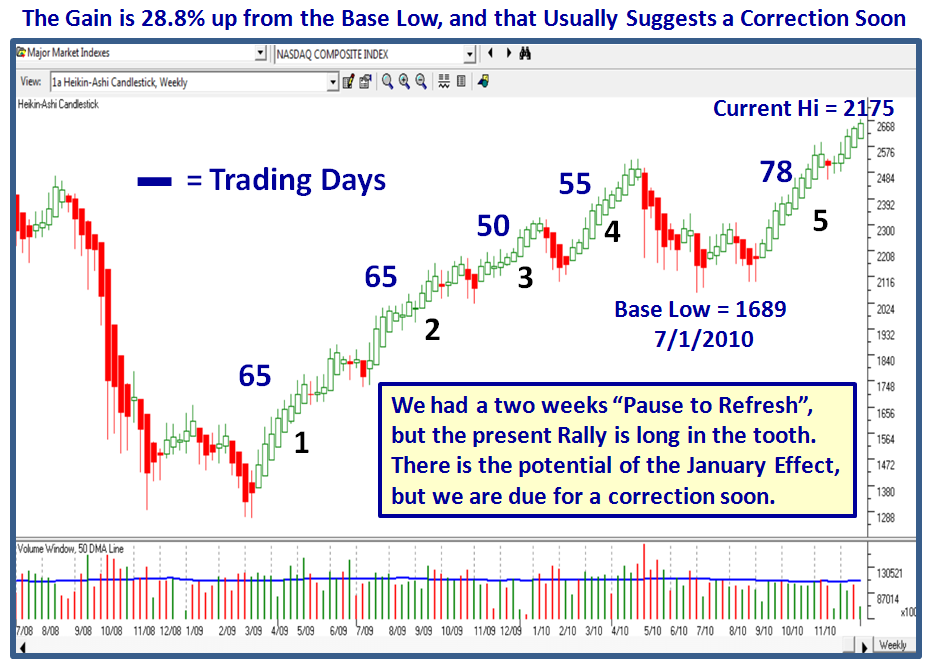

The optimistic longer term view is that we are only a mere 145 points away from that major check point of 2900, and although I am not suggesting that we hit it any time soon, the overall prospects seemed good that we could chip away at half that climb and at least break through 2800 in the near term. My good friend Mike Scott produced this chart moons ago and I have faithfully kept it up to date and added to his musings, so enjoy:

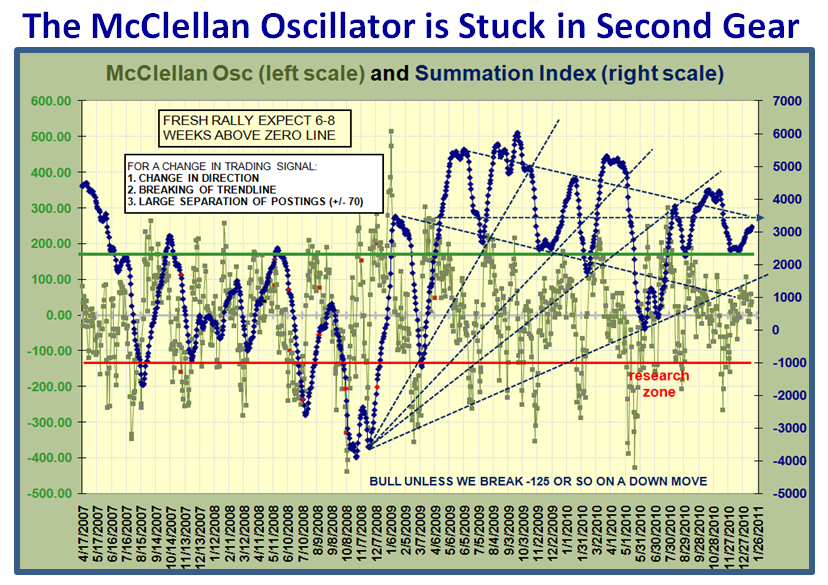

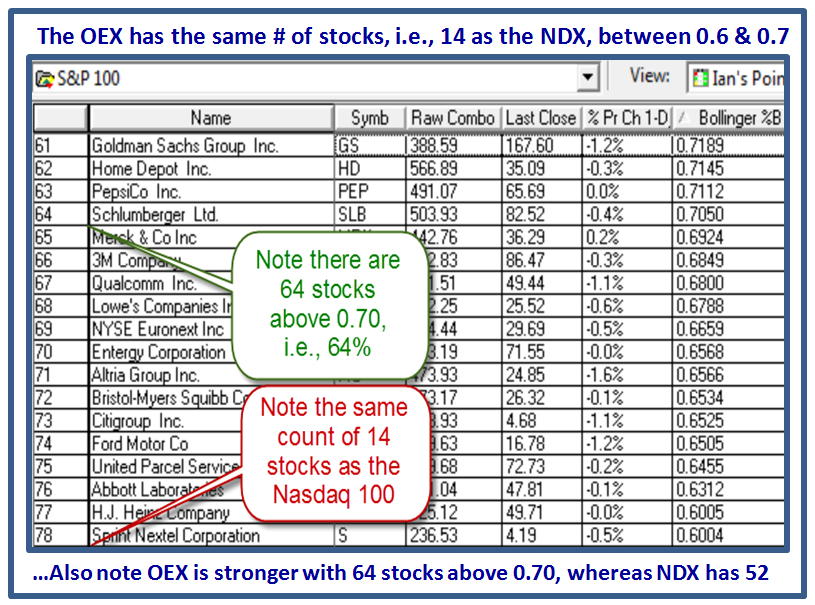

So let’s review the bidding on the usual internal factors that give us a pulse for the Market health, from the McClellan Oscillator, knowing your ABCDE’s, and the % of Nasdaq stocks above the 200-dma:

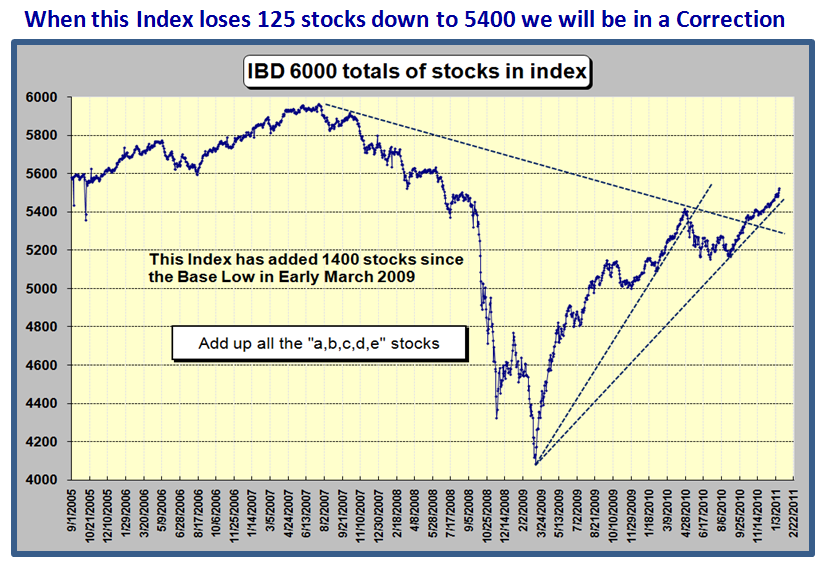

Here’s a picture I haven’t shared with you recently, but it shows how the Market has added over 300 stocks in the last six months and is climbing at a good clip. We can use it to our advantage when the number of stocks in the IBD Index falls below 5400 as that would signal a correction is in progress:

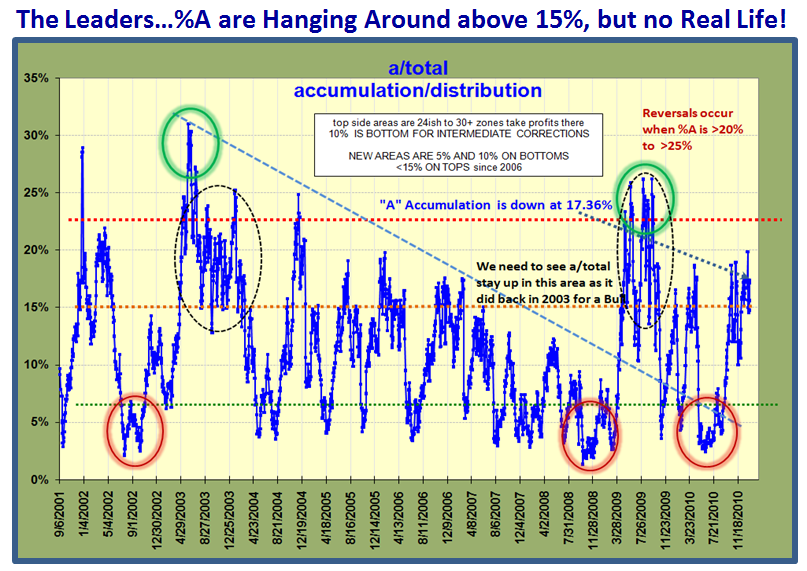

The Leaders with %A Accumulation is at a reasonable 17.36%, but we would prefer to see this above 20 to 23%. Beggars can’t be choosers and we have to be thankful for small mercies since it is at least above 15%:

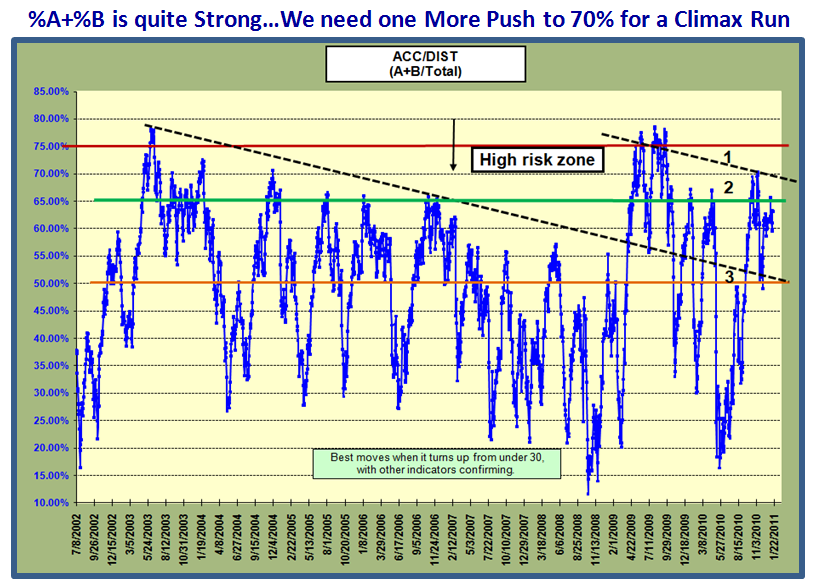

However, the %A + %B Accumulation look a lot stronger at a healthy 63%. We could do with a push to ~70% if we are to see a Climax Run, but we do have a cushion at this stage until it gets below 50%:

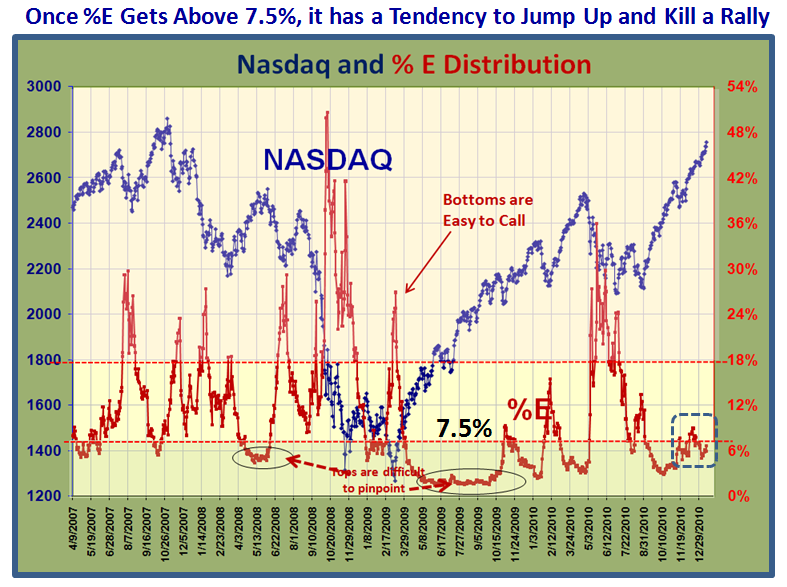

Now for %E, the stocks that are being heavily distributed. The % is close to 7%, but we have seen this rise as the market has risen, whereas it is normally quiet until the market gets long in the tooth. Once above 7% it has a tendency to jump so you need to watch for that as that is a sure sign that the Market will correct:

The % of Nasdaq Stocks above the 200-dma is a very respectable 80%, so the overal breadth of the market is good:

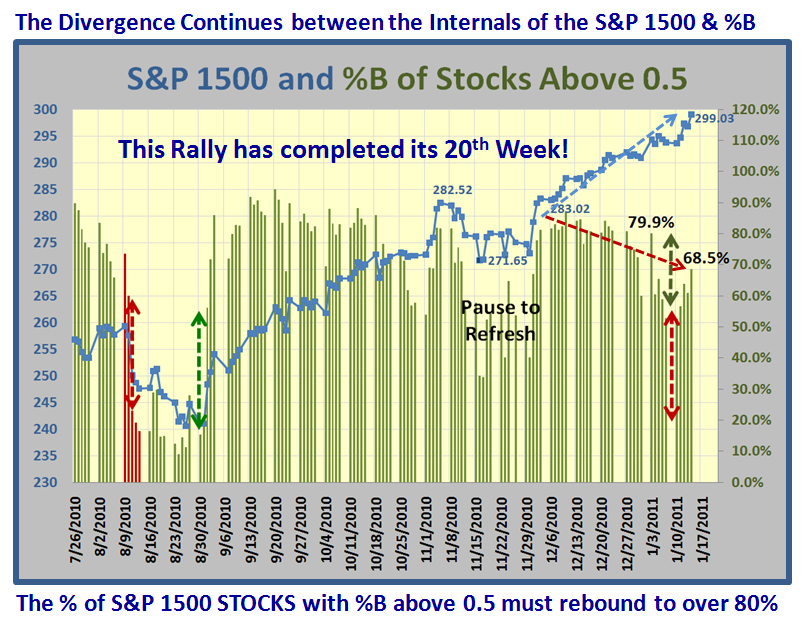

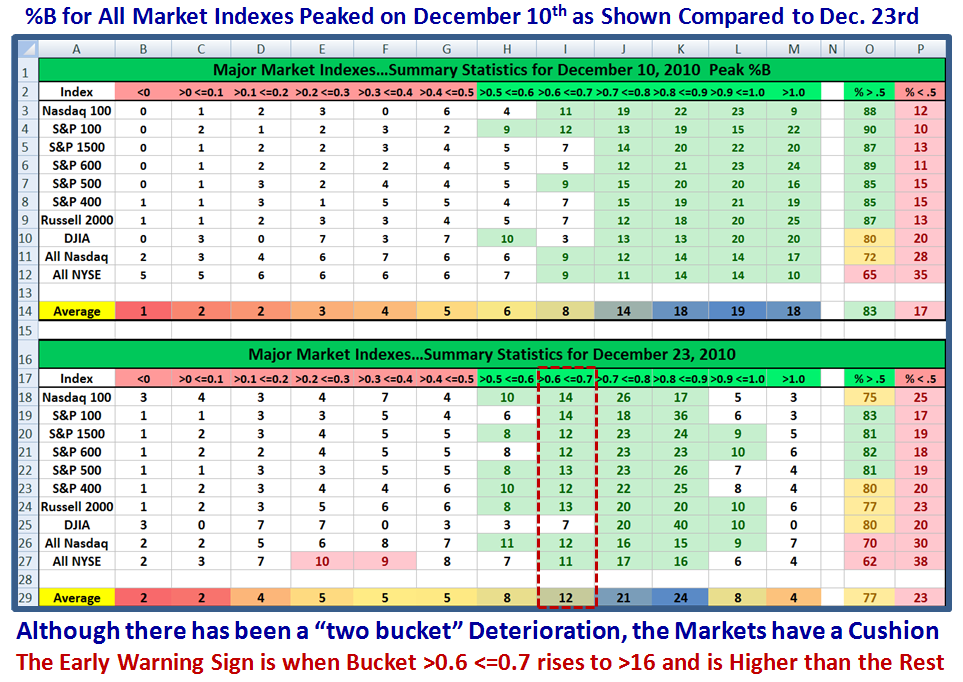

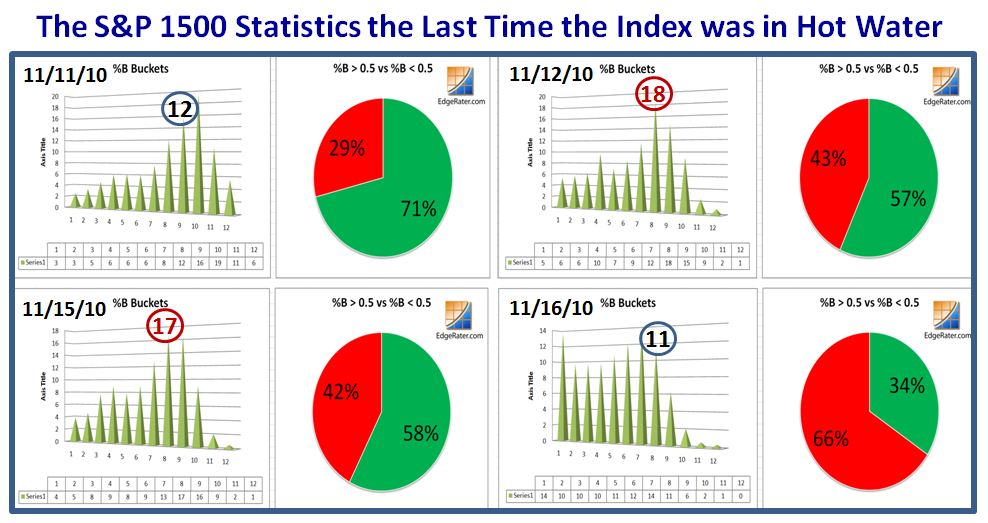

We hit a critical point in this rally on January 7th, but recovered. We are not out of the woods, but at least better off now:

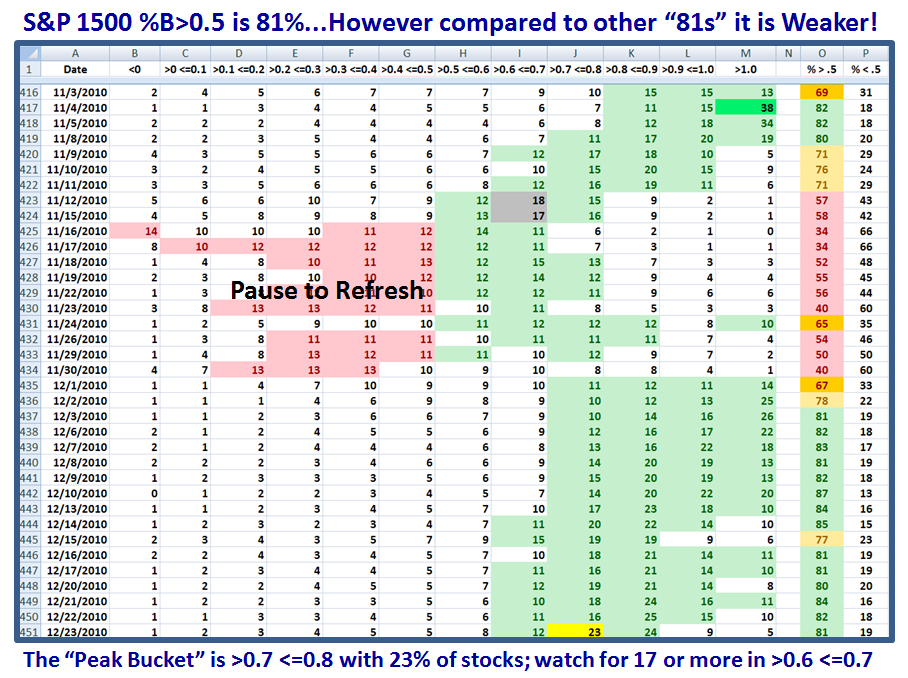

You are familiar with this chart, so it needs no explanation…but it still shows weakness in the %B internals of the S&P 1500:

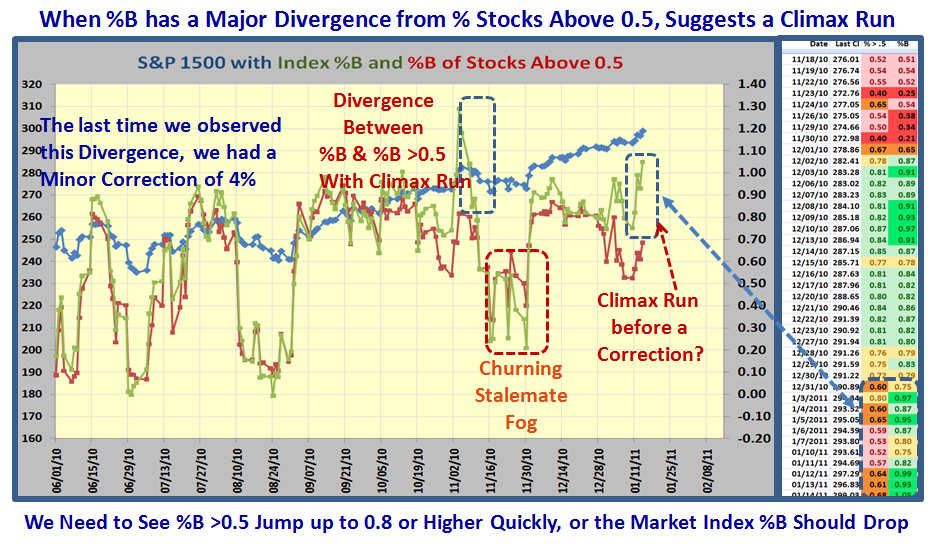

One scenario for this divergence suggests we are again headed into a climax run. It may be cut short as a result of the late breaking news regarding Steve Jobs, but we shall see how this plays out the rest of this week. It’s earnings report due time so be very careful at this time of the year.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog