Archive for the ‘HGS Principles’ Category

The Stock Market in a Nutshell!

Monday, October 12th, 2009You thought I had forgotten about you…No, just busy. As I am sure you can tell, Ron and I are feverishly working up a storm for the Seminar in less than two weeks time, and we thank you for your support. We still have seats available, so sign up if you want to have three days of intense training and fun at the same time.

I have summarized the Market in one chart and the VIX is the Indicator to Watch. You have seen the chart below several times…and are probably sick to death with it. I tell you this is the one chart that summarizes the impending action in the market in a nutshell:

The messages are on the chart, but I repeat:

Complacency has Set in – Any Knee Jerk Above 28 is a Strong Warning Sign

– Any Move Below 22 we have a Raging Bull Market

I see the gurus are touting Dow 10,000, and why not, it’s about time. A break below 22 to the downside on the VIX will do that and more for us.

If not, the Doom and Gloom Camp will be itching to say “I told you so, this Rally is being manipulated and was moving on fumes.”

Stay “Light on Your Feet”. Best Regards, Ian.

Can the Bull Market Survive?

Saturday, October 3rd, 2009Gene: As I understand, all the conditions of an early warning signal for a correction have been met as specified in Ian’s blog of May 3rd, 2009. Am I correct?

Hi Gene: You are correct about the Early Warning characteristics being met, but now everyone is wondering how severe it might be if confirmed to the downside; nobody knows for sure. However, I can add to your observation and mine from last May as to what to look for, if the market is to go down further:

The Current Status

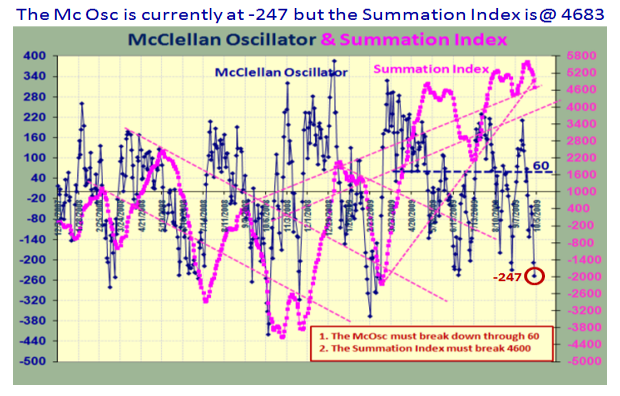

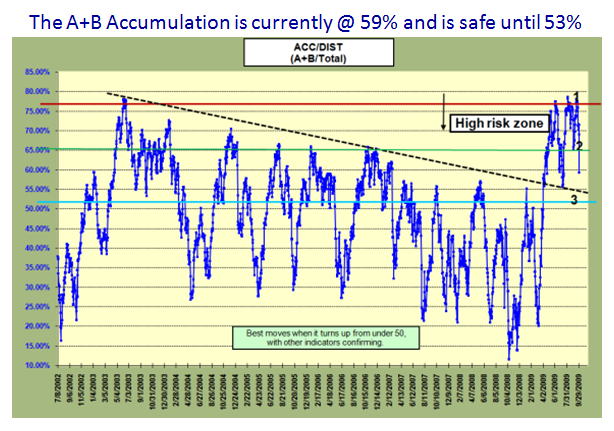

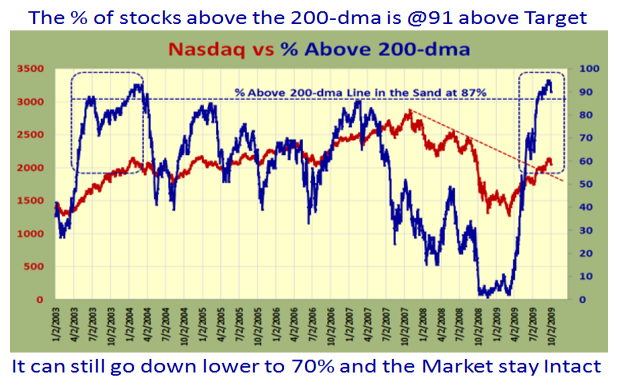

Please understand that the Market Internal Indicators we watch are still intact, though they have deteriorated considerably this past week. Items such as the McClellan Oscillator is in deep negative territory at -247, while the Summation Index is holding at its trendline, the ABCDE statistics have also fallen off sharply, but have not broken down below required levels, and the % of stocks above the 200-dma is still at a healthy 91%, where its Line in the sand is at 87%.

The Immediate Future – Next Week

Given that context:

1. The Phoenix we had on Thursday was THE Major shot across the bow. It signifies that the Bears are gaining Control.

2. We must NOT see a subsequent EUREKA as that would temporarily negate that the Bears are in control. Alternatively, the Bulls are praying for a Eureka to stem the tide one more time.

3. The 50-dma must be broken, but since it is the last vestige of support, the last hope for the Bulls is that the Nasdaq finds support at or near that level.

4. Since the 50-dma is at 2032 and 6.3% below the recent high of 2167.7, we can tolerate a drop of 8% and not have too much damage done. That would put us at 1994, so don’t be too alarmed if there is a slight break down below the 50-dma.

The Deterioration Signposts to Capitulation

5. However, by then, we should expect the %B to breakdown below the Bandwidth.

6. Last but not least, the true sign that things have turned for the worse is that the BONGO Weekly will have given up the ghost and turned from a solid green during this entire rally to RED. At that point the inventors of Bongo, who include Robert Minkowsky, Dave Steckler, Jeffrey Scott, Lou Powers and David Galardi, will be whooping it up and saying “You see it does work and we made a valuable contribution to HGSI.”

7. If we see another Phoenix by then together with a Kahuna (Pink or Red) to the downside, and no immediate response from an Eureka, the Party is really over and the Saw Tooth Plan will have lost a tooth or teeth!

8. By this point in time, it pays to watch the RSI Indicator. It is currently at the 43 level for RSI 14 and it will need to get down to below 30 to signal a Bingo. I need hardly tell you that the Market will be in poor shape if and when that happens. The Indexes will be headed for their 200-dma.

9. The VIX would have shot through 30 to the upside and the Bears will be in full control.

The Upside Scenario:

We get an immediate snap-back Eureka signaling the Bulls see an Oversold opportunity and are not prepared to hand-over control to the Bears just yet. If we get two Eurekas in a row or within a day or two of each other, the Bulls are back in Control!

I repeat again, the Signposts, Stakes in the Ground and Measuring Rods we now have in place keep us on the right side of the market. They tell us what to look for in the expected severity of the decline and the potential steps to recovery.

Thanks to many of you who have responded to my note on the change of venue…please reply immediately if you have not already done so; it does help me to help you.

…And that’s My Story for Today!

Best Regards, Ian.

Important Notice to October Seminar Attendees

Wednesday, September 30th, 2009It is VERY RARE when I make an announcement on this Blog regarding HGS Investor matters, but it is important I get this notice out to our clientele who are attending our next Seminar on October 24 to 26. It has to do with a venue change and if it doesn’t apply to you, please ignore it. I am sure you will understand:

Fellow HGS Investors and attendees at the October Seminar:

The Library was not able to accommodate us for all three days due to other festivities that clashed with our Seminar, but you will be pleased to learn that we have found a very suitable alternative location just 150 yards down below the Library on the same road that most of you are fully familiar with:

1. The spacious and delightful meeting room gives us the ability to spread out

2. It is approximately 1&1/2 times the size of the Library

3. The seats are arm chair padded for far more comfort than before

4. The arrangement will be four seats to each 5 foot round table, so that we don’t feel cramped

5. We will essentially have the place all to ourselves at the weekend

6. There is ample seating outside the meeting room and on the balcony for lunch and relaxation

7. The audio visual provides for either two large screens or a single wall that is huge

8. There is ample parking just above the meeting room and about 150 yards lower down the hill from the usual parking area you are so familiar with at the Library.

9. We already have 60 total people including the HGSI Team and with another three weeks to go we can easily accommodate any late comers. Please hurry and sign up if you intend to come.

10. We will have all the usual amenities including wireless Internet, light dimming, heating/cooling system, sockets for all the laptops, beautiful kitchen, rest rooms, etc.

11. It will be equally convenient to attend the dinner at Georgio’s restaurant on Saturday since we are a stone’s throw away as before.

I show directions below from the Courtyard Marriott, where most of you are staying. One of the maps shows the relationship of this new venue with that of the Library. The usual Landmarks of Silver Spur Road, Deep Valley Drive and Drybank Dr. are on the Map. The location is at the RHCC Community Center, 735 Silver Spur Road. Entrance to the Parking Lot is either on Roxco Dr. or Deep Valley Drive.

Best Regards, Ian.

The High Jump Indicator to the Rescue!

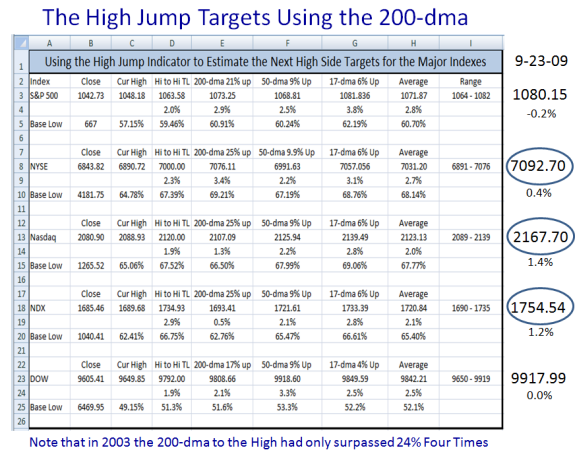

Thursday, September 24th, 2009You can’t say I didn’t give you enough warning in the newsletter and on this blog.

I have repeatedly shown you the value of the High Jump Indicator and once again

it has turned up trumps. I explained in the Newsletter that the Nasdaq had not

exceeded 24% from its 200-dma since 2003 and then only four times at that. I

also said that we were about to break 25% and if it did we would either swoon and

Pause to Refresh, or head into a Climax Run. Well it peaked yesterday, and as the

pundits have said it was a classic reversal day and there is a follow through to the

downside again today.

For Posterity sake, so that you can review the bidding at a future date to know how and when to use this technique, I give you the Targets and Results at the Peak, and you can see it hit them spot on for the DOW and the S&P 500, and overshot less than 1.5% for the Nasdaq, NDX and NYSE:

You might ask “Is that the end of using the High Jump for this round?” The answer

is “No”, but instead of focusing on the 200-dma as the next HIGHER target, you will

need to use the 50-dma and/or the 17-dma to figure out the next levels, should

the Market decide to go higher. I will show you how at the upcoming seminar, so

that is something to look forward to.

The two views of “The News & Plan in a Nutshell” and the “Saw Tooth Game Plan”

from the last blog are still fresh as a daisy, so review them and I won’t repeat them.

For completeness I show what transpired with the VIX today and you need to keep a beady eye on this chart to see if it heads up to 28 like a rocket or subsides back into its shell as the momentary Fear turns into Complacency again.

Understand the action in the last hour yesterday and all of today says this was a

warning shot across the bow and you need to be on guard.

This view of the VIX was taken at 10.20 am Pacific Time.

Best Regards, Ian.

Ian Woodward's Investing Blog

Ian Woodward's Investing Blog